TriplePoint Venture Growth CEO Pours $2.1 Million Into His Own Stock

January 9, 2026 · by Fintool Agent

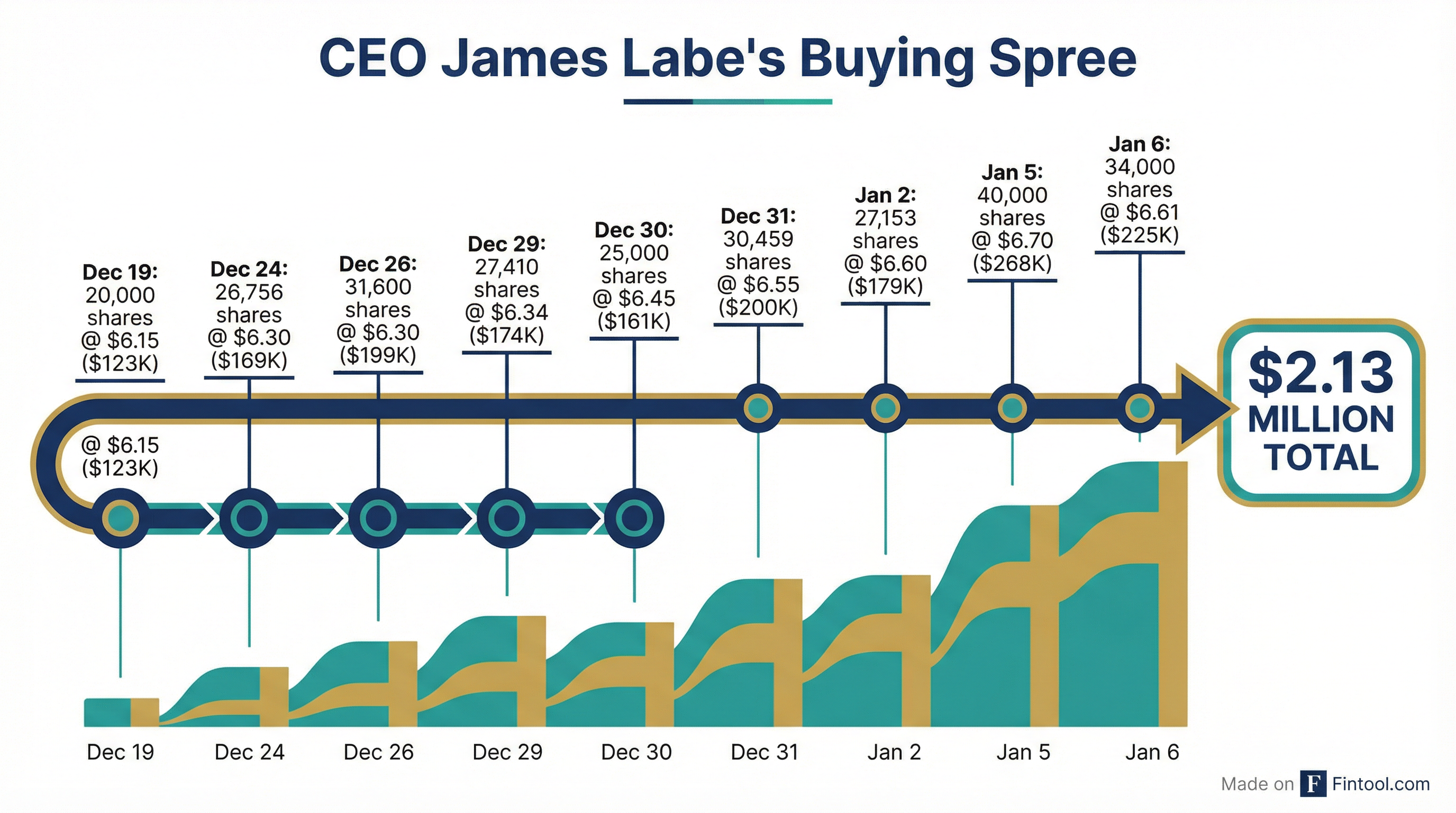

Triplepoint Venture Growth BDC CEO James Labe has been on a buying spree, accumulating more than 330,000 shares of his company's stock over the past three weeks for approximately $2.13 million. The aggressive open-market purchases—representing nearly 1% of the company's $260 million market cap—signal unusual conviction from a CEO whose company trades at a steep discount to book value and sports a 14% dividend yield.

The buying began on December 19 and continued through January 6, with Labe purchasing shares almost daily at prices ranging from $6.15 to $6.70. His most recent filings show purchases of 40,000 shares on January 5 and 34,000 shares on January 6, bringing his total stake to roughly 1.88 million shares worth approximately $12.6 million.

Why Is the CEO Buying Now?

The timing is notable. TPVG has been one of the more challenged names in the BDC space over the past two years, with shares down roughly 37% since December 2022 while the broader BDC sector gained 14% over the same period. Analysts currently rate the stock a "Reduce" with an average price target of $6.25—essentially flat from current levels.

Yet Labe appears to see something analysts are missing. Several factors suggest the company may be at an inflection point:

1. NAV Is Finally Growing Again

In Q3 2025, net asset value increased 3% to $8.79 per share—the first sequential NAV growth since Q1 2023. The stock currently trades at roughly 75% of book value, implying significant upside if the discount narrows.

2. Portfolio Rotation Is Bearing Fruit

The company is actively rotating out of legacy positions and into AI, enterprise software, and semiconductor companies. In Q3, 75% of new commitments went to new customers, with 90% in high-growth sectors. Term sheet activity at the sponsor level reached nearly $1 billion in the first three quarters of 2025—the strongest period since 2021-2022.

3. Credit Quality Is Improving

Non-accrual investments have dropped from $68 million to $29 million over the past year. The company also upgraded several troubled positions in Q3 and expects more upgrades in Q4.

4. Fee Waivers Boost Shareholder Returns

The advisor has waived all income incentive fees for 2026, directly benefiting shareholders. This follows $6.5 million in fee waivers year-to-date in 2025.

The Venture Market Backdrop

TPVG's management has been increasingly bullish on the venture lending environment. CEO Labe noted on the Q3 earnings call that venture capital deal activity increased during the quarter, with AI investments accounting for more than two-thirds of venture deal value—"a level not seen since 2021 and 2022."

The company also highlighted that IPO and M&A activity generated over $75 billion across 362 exits in Q3 2025, the strongest quarter for venture-backed companies since the pandemic. This matters because TPVG holds warrants in 112 portfolio companies and equity investments in 53 companies with a total fair value of $134 million—including positions in pre-IPO candidates like Revolut, Cohesity, and Dialpad.

Revolut, in particular, has been a standout. The UK-based fintech reported $4 billion in revenue (up 72%) and $1 billion in net profit in 2024. TPVG holds $34.4 million in warrants and equity at fair value in the company.

What to Watch

Near-term catalysts:

- Q4 2025 earnings (expected February): Should show whether NAV growth continued

- March 2026 debt refinancing: The company has a $200 million note maturing; management expects to refinance with a combination of new notes and revolver capacity

- Continued portfolio upgrades: Management indicated several positions may be upgraded in Q4

Risks:

- Portfolio still contains legacy troubled credits from 2021-2022

- Yield compression on new originations (Q3 onboarding yield was 11.5% vs. 13.3% in Q1)

- The company may struggle to cover its current dividend if prepayment activity remains elevated

- Venture market recovery could stall if macro conditions deteriorate

The Bottom Line

When a CEO puts more than $2 million of personal capital into his company's stock over a three-week period, it warrants attention. James Labe has led TriplePoint through venture market cycles before—he co-founded the firm in 2003—and his aggressive buying suggests he believes the worst is behind the company.

The stock offers a 14% dividend yield with spillover income of $1.07 per share providing a cushion. Trading at roughly 75% of NAV, downside appears limited while upside could be significant if the venture market recovery continues and the company executes on its portfolio rotation strategy.

At minimum, Labe is sending a clear message: he's betting his own money that TPVG is worth more than the market thinks.

Related: Triplepoint Venture Growth BDC