TransDigm CEO Puts $1.2 Million of His Own Money Into Stock After Post-Earnings Drop

February 10, 2026 · by Fintool Agent

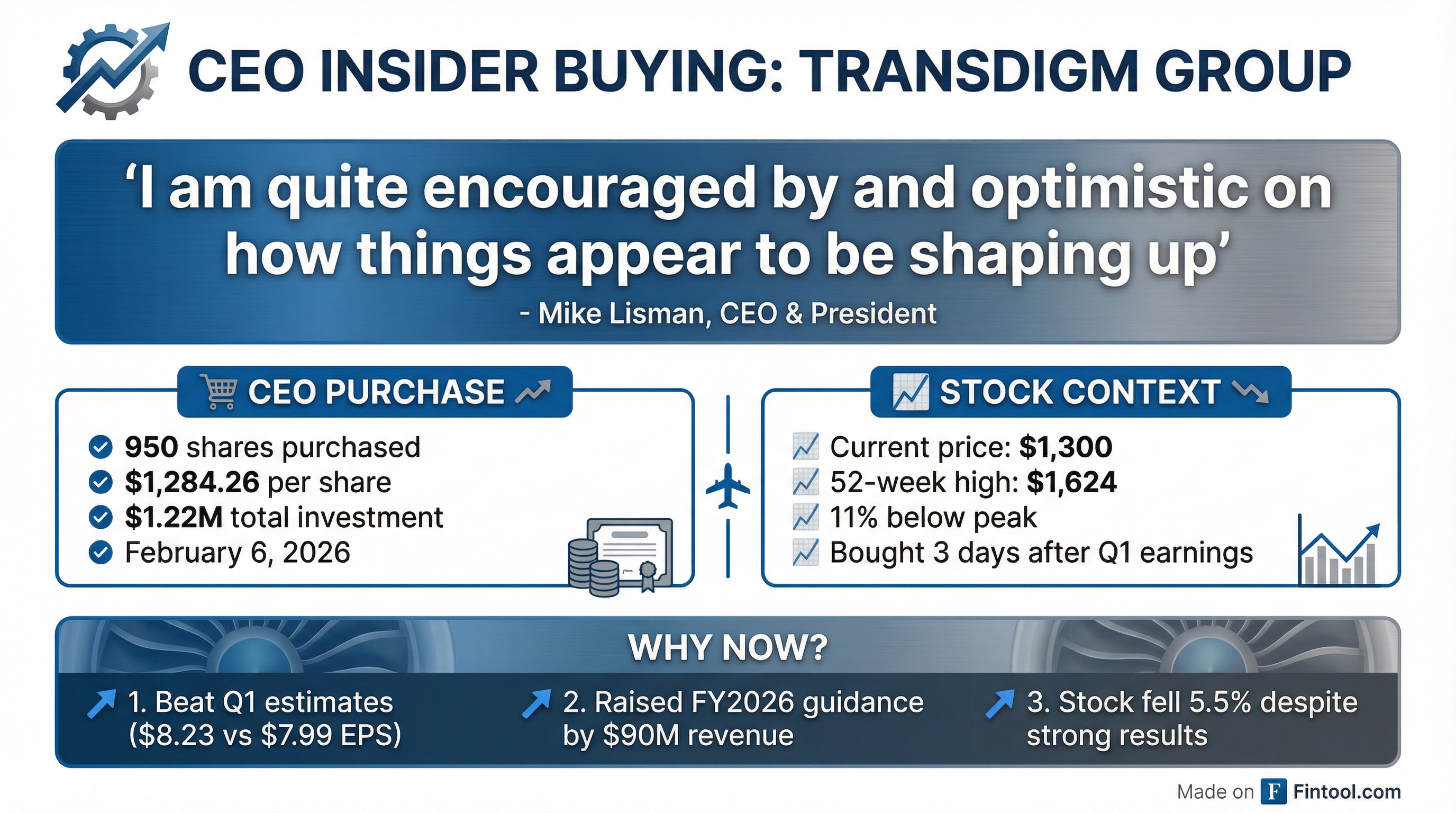

Transdigm Group CEO Michael Lisman just bought $1.22 million of his company's stock—three days after shares cratered 5.5% despite the aerospace supplier beating quarterly estimates and raising full-year guidance.

The February 6 purchase—950 shares at $1,284.26 each—came as TransDigm traded 11% below its 52-week high of $1,624. When the CEO who just told analysts he's "quite encouraged by and optimistic" about the year ahead reaches into his own pocket for seven figures, it's worth understanding why.

The Trade

Lisman's Form 4 filing shows a straightforward open-market purchase:

| Detail | Value |

|---|---|

| Shares Purchased | 950 |

| Price Per Share | $1,284.26 |

| Total Investment | $1,219,847 |

| Transaction Date | February 6, 2026 |

| Shares Owned After | 3,259 |

This brings Lisman's direct holdings to 3,259 shares worth roughly $4.2 million at current prices. The purchase was executed at the day's volume-weighted average price of $1,282.35.

Why the Stock Fell

TransDigm's Q1 FY2026 results released February 3 looked solid by any measure :

| Metric | Q1 FY2026 | Consensus | Beat/Miss |

|---|---|---|---|

| Revenue | $2.29B | $2.26B | Beat |

| Adjusted EPS | $8.23 | $7.99 | Beat |

| EBITDA Margin | 52.4% | — | Solid |

| YoY Revenue Growth | +14% | — | Strong |

Management raised full-year guidance at the midpoint:

- Revenue: +$90 million to $9.94 billion

- EBITDA: +$60 million to $5.21 billion

"We are pleased with our team's performance and operating results for the first quarter. This is a solid start to the 2026 fiscal year," Lisman said on the call. "Total revenue ran ahead of our expectations. Additionally, bookings were strong in all three of our major market channels."

Yet the stock dropped 5.5% that day, falling from $1,436 to $1,302. The culprit appears to be valuation concerns and a timely downgrade: KeyCorp cut TransDigm from "overweight" to "sector weight" on February 6, citing the stock's premium multiple.

At roughly 35x forward earnings, TransDigm trades at a significant premium to aerospace peers—but the company argues its 50%+ EBITDA margins and proprietary aftermarket position justify the valuation.

The Bull Case Lisman Is Backing

Lisman's purchase comes as TransDigm executes an aggressive M&A strategy. In the past two months, the company has announced $3.2 billion in acquisitions:

- Stellant Systems ($960M) — high-power electronic components for aerospace and defense

- Jet Parts Engineering + Victor Sierra Aviation ($2.2B) — PMA and aftermarket parts specialists

"Pro forma for the announced acquisitions, we have significant M&A firepower and capacity remaining, approaching $10 billion," Lisman told analysts.

The company also opportunistically bought back over $100 million of its own stock during Q1 "when the share price dipped," CFO Sarah Wynne noted.

Market Channel Outlook for FY2026

| Segment | Expected Growth |

|---|---|

| Commercial OEM | High single to mid-teens % |

| Commercial Aftermarket | High single-digit % |

| Defense | Mid to high single-digit % |

TransDigm's defense bookings are "ahead of expectations, outpacing our sales," with lead times extending—suggesting potential upside to guidance if momentum continues.

What to Watch

Near-term catalysts:

- Closing of the Stellant, Jet Parts, and Victor Sierra acquisitions (excluded from current guidance)

- Q2 FY2026 earnings (expected May 2026)

- Boeing and Airbus production ramp progress

- Defense budget developments and backlog conversion

Risks:

- Valuation compression if growth decelerates

- OEM production delays at Boeing or Airbus

- Integration challenges from rapid M&A pace

- Interest expense rising with $30 billion gross debt load

TransDigm's negative return on equity (-29% per recent disclosures) reflects its leveraged capital structure—the company operates at 5.7x net debt/EBITDA, though this remains within its stated 5-7x target range.

The Bottom Line

CEO insider purchases over $1 million are relatively rare—and when they come three days after strong results that the market punished, they merit attention. Lisman is betting that TransDigm's:

- 50%+ EBITDA margins

- $10 billion M&A capacity

- Strong aftermarket franchise

- Defense tailwinds

...will eventually be rewarded at current prices. The market may have concerns about valuation, but the CEO just voted with his wallet.

Related: Transdigm Group Company Profile