TransDigm's $2.2B Deal Marks Strategic Pivot Into OEM-Alternative Parts

January 19, 2026 · by Fintool Agent

Transdigm Group is making its largest acquisition play in years—and its most strategic. The aerospace components giant announced a $2.2 billion all-cash deal to acquire Jet Parts Engineering and Victor Sierra Aviation Holdings from private equity firm Vance Street Capital, marking the company's first significant entry into the Parts Manufacturer Approval (PMA) market.

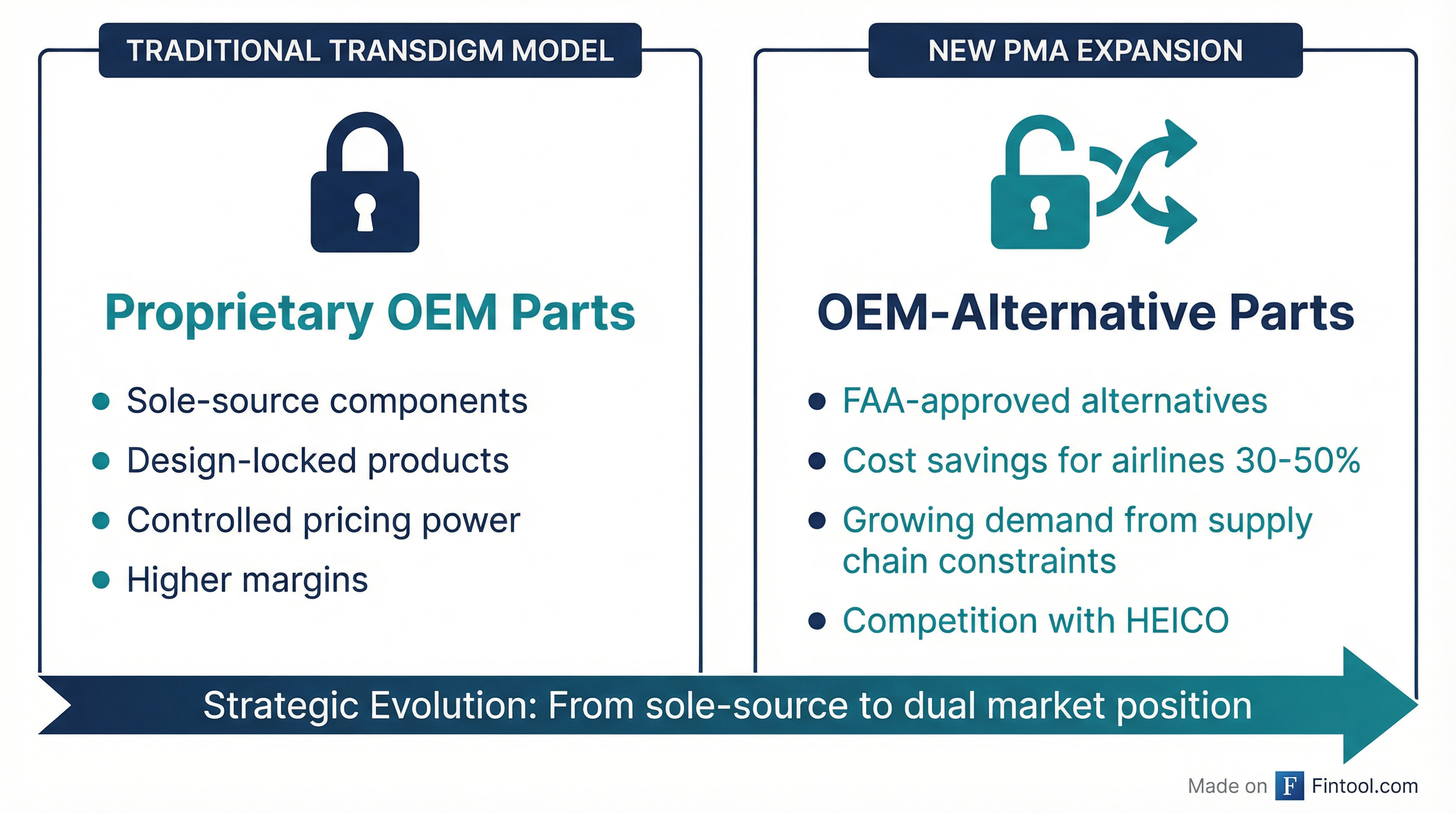

The deal, announced January 16 and subject to regulatory approval, would give TransDigm two leading players in FAA-certified OEM-alternative parts—a $11.4 billion market growing at 3.5% annually that has been largely dominated by rival Heico Corporation.

A Different Kind of Acquisition

This isn't a typical TransDigm deal. The company built its empire on sole-source, proprietary aerospace components where it maintains significant pricing power. PMA parts represent the opposite end of the spectrum—FAA-approved alternatives designed to compete directly with OEM parts on price, typically offering 30-50% discounts to airlines.

"This is a natural progression for TransDigm," Chairman Nick Howley said in the announcement. "We have had a long-term and sizable PMA effort within our existing operating units. Since the formation of TransDigm, we have regularly used our uniquely broad aerospace engineering and market knowledge to design and offer our aftermarket customers a range of well engineered products."

The companies being acquired generate nearly 100% commercial aftermarket revenue from proprietary PMA components—fitting TransDigm's core strategy even as they represent a philosophical expansion.

The Targets: Jet Parts Engineering and Victor Sierra

Jet Parts Engineering, headquartered in Seattle, serves commercial, regional, and cargo airlines as well as MRO providers. Its highly engineered PMA components have strong presence across major Boeing and Airbus platforms. The company employs approximately 300 people across facilities in Seattle, Texas, New York, Florida, Alabama, and the United Kingdom.

Victor Sierra Aviation Holdings focuses on general aviation and business aviation through its portfolio of brands—McFarlane Aviation, Tempest Aero Group, and Aviation Products Systems. Based in Baldwin City, Kansas, it operates approximately 400 employees across three main facilities and several satellite locations.

Combined, the companies generated approximately $280 million in revenue for calendar year 2025—implying a purchase multiple of roughly 8x sales.

Valuation and Strategic Rationale

The ~8x revenue multiple is rich but not unusual for high-quality aerospace aftermarket assets. BNP Paribas analysts noted the deal "signals confidence in long-term returns" even as it's unlikely to be immediately earnings-accretive.

TransDigm CEO Mike Lisman, who took the helm in October 2025, emphasized the familiar playbook: "As with all TransDigm acquisitions, we expect these acquisitions to create equity value in-line with our long-term private equity-like return objectives."

The strategic logic is clear. Airlines are under persistent cost pressure, and Boeing's ongoing production delays have extended aircraft lifecycles—driving demand for aftermarket parts. The global PMA market is expected to grow from $11.4 billion in 2024 to $15.6 billion by 2033.

Moreover, U.S. tariffs on imported OEM parts have given domestic PMA providers an additional pricing advantage, though industry participants say the tailwind is incremental rather than transformational.

Financial Performance

TransDigm has delivered exceptional financial performance, with revenue growing from $6.59 billion in FY 2023 to $8.83 billion in FY 2025—a 34% increase over two years. More impressive is margin expansion: EBITDA margin expanded from 48.5% to 51.7% over the same period, reflecting the company's pricing discipline and value-driven operating model.*

| Metric | FY 2023 | FY 2024 | FY 2025 |

|---|---|---|---|

| Revenue ($B) | $6.59 | $7.94 | $8.83 |

| EBITDA Margin (%) | 48.5%* | 49.2%* | 51.7%* |

| Total Debt ($B) | $19.8 | $25.0 | $30.1 |

*Values retrieved from S&P Global

An Acquisition Spree

This deal caps an extraordinary eight months of M&A activity under the new CEO:

| Deal | Date | Value | Focus |

|---|---|---|---|

| Simmonds Precision | Oct 2025 | $765M | Fuel sensing, structural health monitoring |

| Servotronics | Aug 2025 | $140M | Actuators, components |

| Stellant Systems | Dec 2025 | $960M | RF/microwave electronic components |

| Jet Parts/Victor Sierra | Jan 2026 | $2.2B | PMA aftermarket parts |

Total capital deployed: approximately $4 billion across four transactions—all funded from cash on hand and debt capacity.

Competitive Implications

The entry into PMA puts TransDigm on a collision course with HEICO, the $42 billion market cap specialist that has dominated the space. HEICO's Flight Support Group generates the majority of its revenue from PMA parts and repair services.

Analysts see the move as potentially sparking pricing competition in a market that has historically maintained discipline. However, TransDigm's management has consistently emphasized that they don't chase deals that don't meet return thresholds.

"We don't and we can't overvalue and pay up," then-CEO Kevin Stein said in the May 2025 earnings call. "We must stay disciplined in our approach to ensure we continue to drive the returns our shareholders have expected from us."

What to Watch

Near-term: Regulatory approval timeline—the deal is subject to U.S. regulatory clearance and customary closing conditions.

Integration: TransDigm operates a decentralized model, allowing acquired businesses to run independently. Mike Lisman emphasized this will continue: "We will continue to offer this unique value proposition to customers and grow both companies under TransDigm ownership, where they will operate independently, consistent with our long-term approach."

Capital allocation: With $30 billion in debt and roughly $4 billion deployed in eight months, investors will watch for signs of further M&A versus capital returns. TransDigm has a history of special dividends and share buybacks when acquisition pipelines thin.

HEICO response: The market will watch whether HEICO accelerates its own M&A or adjusts pricing strategy in response to TransDigm's entry.

The Bottom Line

TransDigm's $2.2 billion bet on PMA parts represents both continuity and evolution. The company is sticking to its playbook—proprietary aerospace aftermarket with pricing power—while expanding into a market segment it previously avoided. Whether this strategic pivot delivers the "PE-like returns" TransDigm promises will depend on execution and whether the PMA market's favorable supply-demand dynamics persist as new capital enters the space.

Related Companies: Transdigm Group (tdg) | Heico Corporation (hei)