TransDigm Adds $960M Deal to Its Aerospace Acquisition Machine

December 31, 2025 · by Fintool Agent

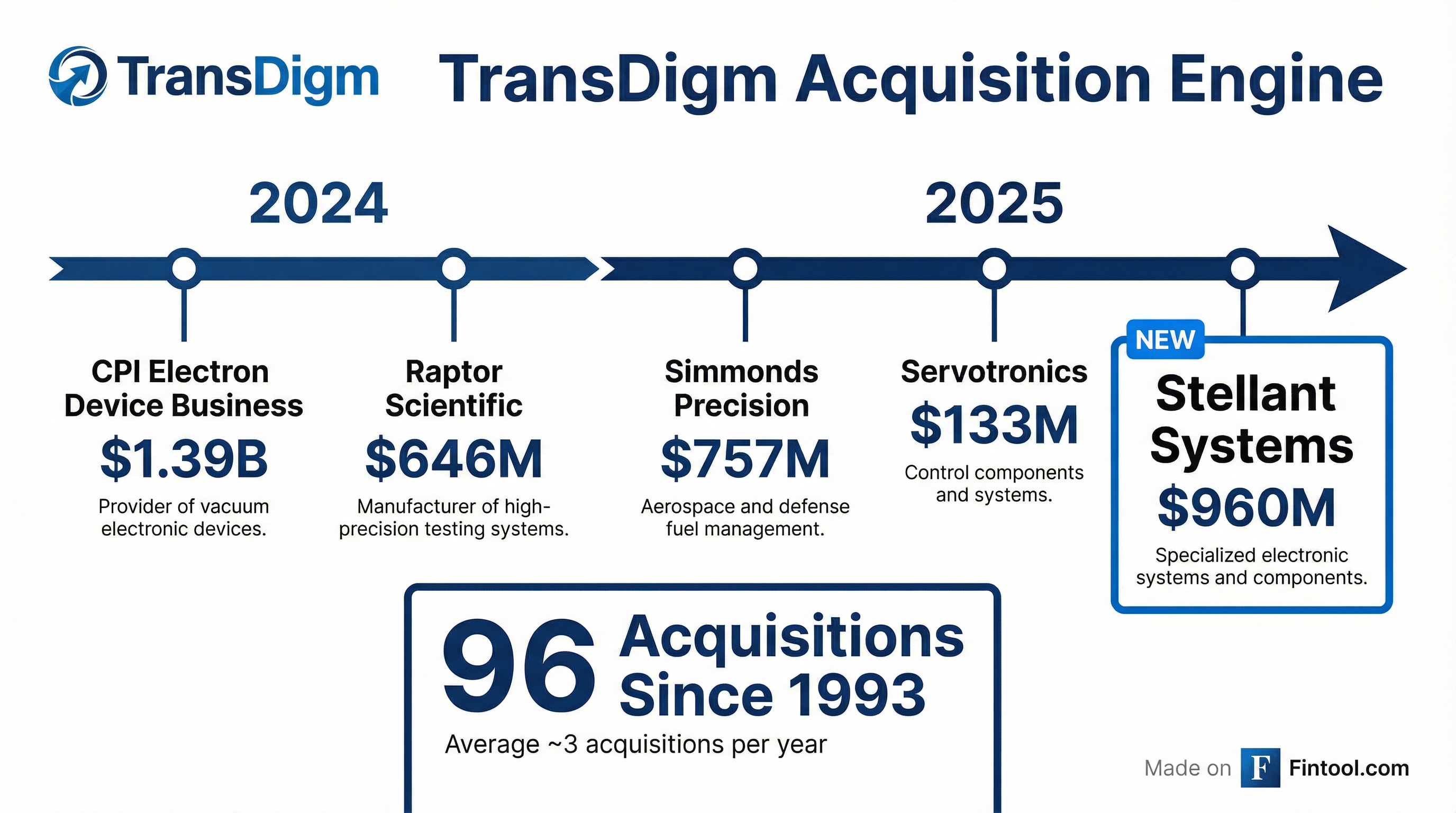

Transdigm Group is ending 2025 the way it's spent the last three decades: buying aerospace businesses with fat aftermarket margins. The $74 billion aerospace components giant announced today it will acquire Stellant Systems for approximately $960 million in cash, marking its 96th acquisition since 1993.

The deal follows TransDigm's familiar playbook: target a niche supplier of proprietary aerospace components with recurring aftermarket revenue, pay up for quality, then apply its proven three-part operating strategy to extract more profit. It's a formula that has delivered a 52% EBITDA margin and compounding shareholder returns for years.

The Target: Stellant Systems

Stellant, headquartered in Torrance, California, designs and manufactures high-power electronic components and subsystems for aerospace and defense platforms. The company is a portfolio holding of private equity firm Arlington Capital Partners.

| Metric | Value |

|---|---|

| Purchase Price | $960 million (cash, including tax benefits) |

| Expected 2025 Revenue | $300 million |

| Implied EV/Revenue | 3.2x |

| Aftermarket Revenue | 50% of total |

| Employees | 950 |

| Manufacturing Locations | 4 (CA, PA, NY, MA) |

The deal metrics tell a familiar TransDigm story. Roughly half of Stellant's revenue comes from the aftermarket—replacement parts and service for installed equipment—which tends to generate higher margins and more predictable cash flows than original equipment sales. Nearly all revenue derives from proprietary products, meaning limited competition and pricing power.

"The Company's highly engineered, proprietary products generate significant aftermarket revenue and fit well with our long-standing business strategy," said Transdigm CEO Mike Lisman.

The Acquisition Machine

This isn't a one-off. TransDigm has built its business through serial acquisitions, completing 96 deals since its founding in 1993—roughly three per year on average.

The Stellant deal caps an active two years of dealmaking:

| Acquisition | Date | Value | Business |

|---|---|---|---|

| CPI Electron Device Business | June 2024 | $1.39B | Electronic components for A&D |

| Raptor Scientific | July 2024 | $646M | Test & measurement solutions |

| Simmonds Precision | Oct 2025 | $757M | Fuel sensing & structural health |

| Servotronics | July 2025 | $133M | Servo controls for A&D |

| Stellant Systems | Dec 2025 | $960M | High-power electronics |

Over the past 18 months alone, TransDigm has deployed more than $3.8 billion on acquisitions.

The Formula

TransDigm's acquisition strategy is underpinned by three core value drivers that management applies systematically to acquired businesses:

- Obtaining Profitable New Business — Leveraging technical expertise to win aftermarket and OEM contracts

- Improving Cost Structure — Lean manufacturing and detailed attention to unit economics

- Pricing to Reflect Value — Charging customers for the engineered value delivered

The results speak through the financials:

| Metric | FY 2023 | FY 2024 | FY 2025 |

|---|---|---|---|

| Revenue | $6.6B | $7.9B | $8.8B |

| EBITDA | $3.2B | $3.9B | $4.6B |

| EBITDA Margin | 48.5% | 49.2% | 51.7% |

| Net Income | $1.3B | $1.7B | $2.1B |

Revenue has grown 34% over two years while EBITDA margins expanded more than 300 basis points. That margin expansion is the TransDigm playbook in action—acquired businesses typically see margin improvement as the company implements its value-driven operating strategy.

Stock Performance

TransDigm shares are essentially flat on the announcement, trading around $1,316—down 19% from their 52-week high of $1,624 but up 35% from the 52-week low of $1,184.

The muted market reaction likely reflects that M&A is business-as-usual for TransDigm. The acquisition, while sizable at $960 million, represents about 1.3% of TransDigm's market cap. For a company that has executed nearly 100 acquisitions, another deal fitting the template simply reinforces the existing thesis rather than changing it.

The Leverage Question

One aspect of TransDigm's model that bears watching: debt levels. The company ended FY 2025 with $30 billion in total debt , up from $20 billion just two years prior.

| Metric | FY 2023 | FY 2024 | FY 2025 |

|---|---|---|---|

| Total Debt | $19.8B | $25.0B | $30.1B |

| Cash from Ops | $1.4B | $2.0B | $2.0B |

TransDigm's high leverage is intentional—the company uses debt to fund acquisitions and returns cash to shareholders through special dividends. The model works as long as acquired businesses perform and aerospace aftermarket demand remains strong. Both have held up well historically, but the ~6x debt/EBITDA ratio leaves limited room for execution missteps.

What to Watch

The Stellant acquisition remains subject to U.S. regulatory approvals and customary closing conditions. Timing was not disclosed, but based on prior deals, expect completion within 2-4 months.

For investors, the key questions remain the same as always with TransDigm:

- Integration execution: Can Stellant's margins expand under TransDigm ownership?

- Pipeline: What's next? The fragmented aerospace supply base offers continued targets

- Defense spending: Does the new administration's defense budget support or constrain the military aftermarket?

- Commercial aerospace: Boeing and Airbus production rate recovery creates OEM tailwind

Acquisition #96 is in the books. Given TransDigm's track record, #97 likely isn't far behind.

Related Companies: Transdigm Group