Travelers Crushes Q4 With $11.13 EPS, Announces $5 Billion Buyback

January 21, 2026 · by Fintool Agent

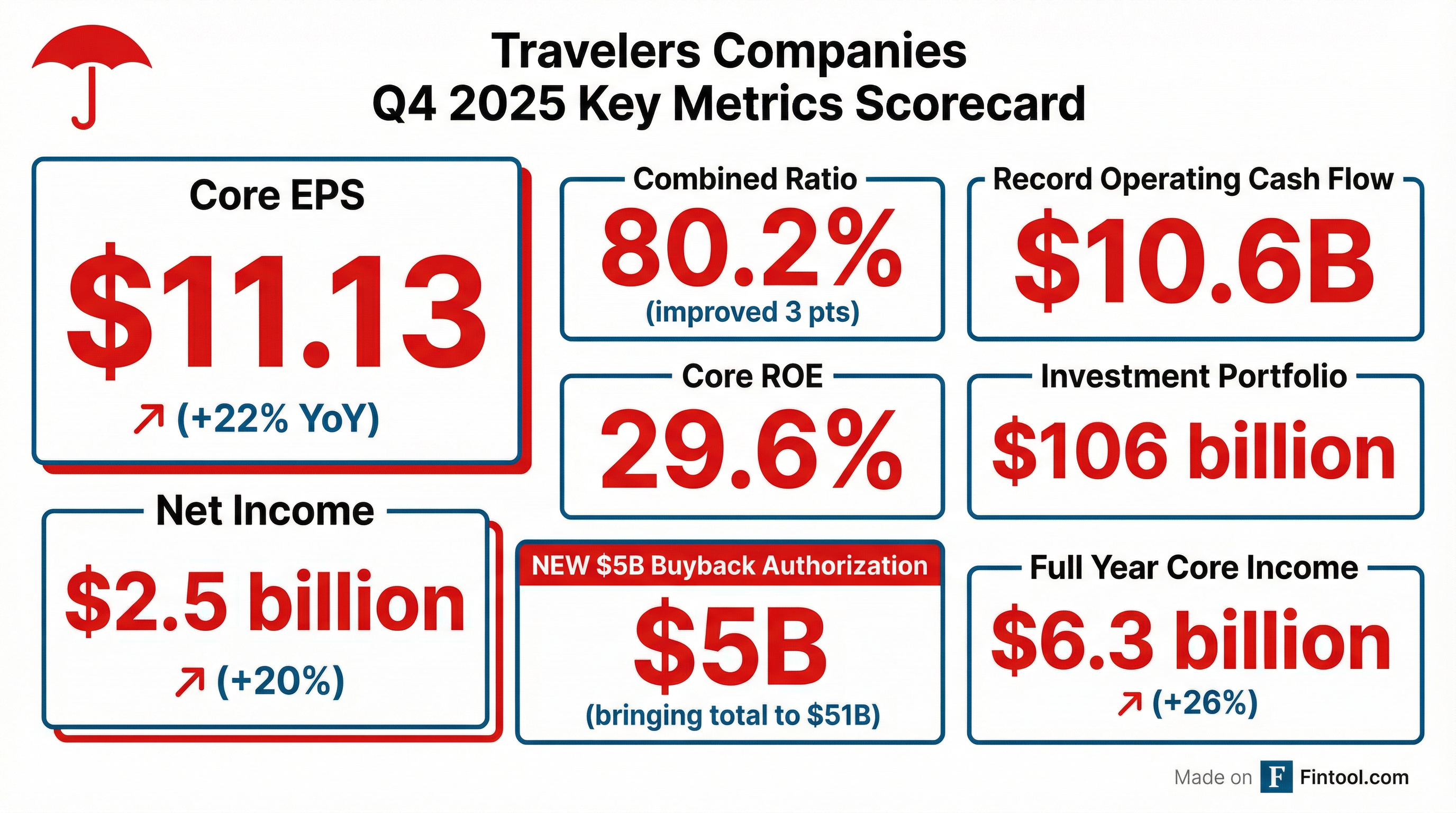

The Travelers Companies delivered a blowout Q4, posting core EPS of $11.13—crushing the Street's $8.45 estimate by 32%—while announcing a massive $5 billion buyback authorization that brings total repurchase capacity to roughly $7 billion.

The Dow component's stock rose 0.5% in pre-market trading to $274 as investors digested results that showcased the P&C insurer's underwriting discipline and growing AI-powered efficiency gains.

The Numbers

| Metric | Q4 2025 | Q4 2024 | Change |

|---|---|---|---|

| Core EPS | $11.13 | $9.15 | +22% |

| Net Income | $2.5B | $2.1B | +20% |

| Combined Ratio | 80.2% | 83.2% | -3.0 pts |

| Underlying Combined Ratio | 82.2% | 84.0% | -1.8 pts |

| Core ROE | 29.6% | 27.7% | +1.9 pts |

| Net Written Premiums | $10.9B | $10.7B | +1% |

Source: Travelers earnings release

The 31.7% EPS surprise marks Travelers' fourth consecutive quarter of beating expectations, with the company averaging a 35%+ beat over that stretch.

Underwriting Engine Firing on All Cylinders

Travelers' Q4 combined ratio of 80.2% represents exceptional underwriting performance. The improvement was driven by three factors:

-

Underlying profitability: The underlying combined ratio of 82.2% improved 1.8 points, marking the fifth consecutive quarter below 85%.

-

Lower catastrophe losses: CAT losses of just $95 million—primarily winter storms—compared to $175 million a year ago.

-

Favorable reserve development: $321 million of favorable prior year reserve development, driven by workers' compensation performance.

All three segments delivered excellent results:

| Segment | Q4 Segment Income | Combined Ratio | YoY Change |

|---|---|---|---|

| Business Insurance | $1.29B | 84.4% | -0.8 pts |

| Bond & Specialty | $236M | 83.0% | +0.3 pts |

| Personal Insurance | $1.09B | 74.0% | -6.7 pts |

*Source: Travelers earnings release *

Personal Insurance was the standout, with its 74.0% combined ratio improving nearly 7 points year-over-year. "The strength of our 2025 results reflects years of disciplined execution and strategic investment," said Personal Insurance President Michael Klein.

$5 Billion Buyback: A Confidence Signal

The board's $5 billion buyback authorization is one of the largest in Travelers' history, bringing total capacity to approximately $7 billion when combined with the $2 billion remaining from prior programs.

Management wasted no time putting capital to work—the company repurchased 5.8 million shares in Q4 at an average price of $285.04 for $1.65 billion. CFO Dan Frey guided to roughly $1.8 billion of repurchases in Q1 2026, even after the elevated Q4 pace.

"Given the strong finish to the 2025 year, we now expect repurchases of around $1.8 billion in Q1," Frey said on the call. "When we have excess [capital], it's not ours, and we're going to give it back to the shareholders."

The buyback is supported by record operating cash flows of $10.6 billion in 2025—up from roughly $4 billion annually in the decade prior—and an investment portfolio that has grown to $106 billion.

AI: From Strategy to Operating Leverage

Perhaps the most notable development was management's detailed commentary on AI deployment across the enterprise.

Anthropic Partnership

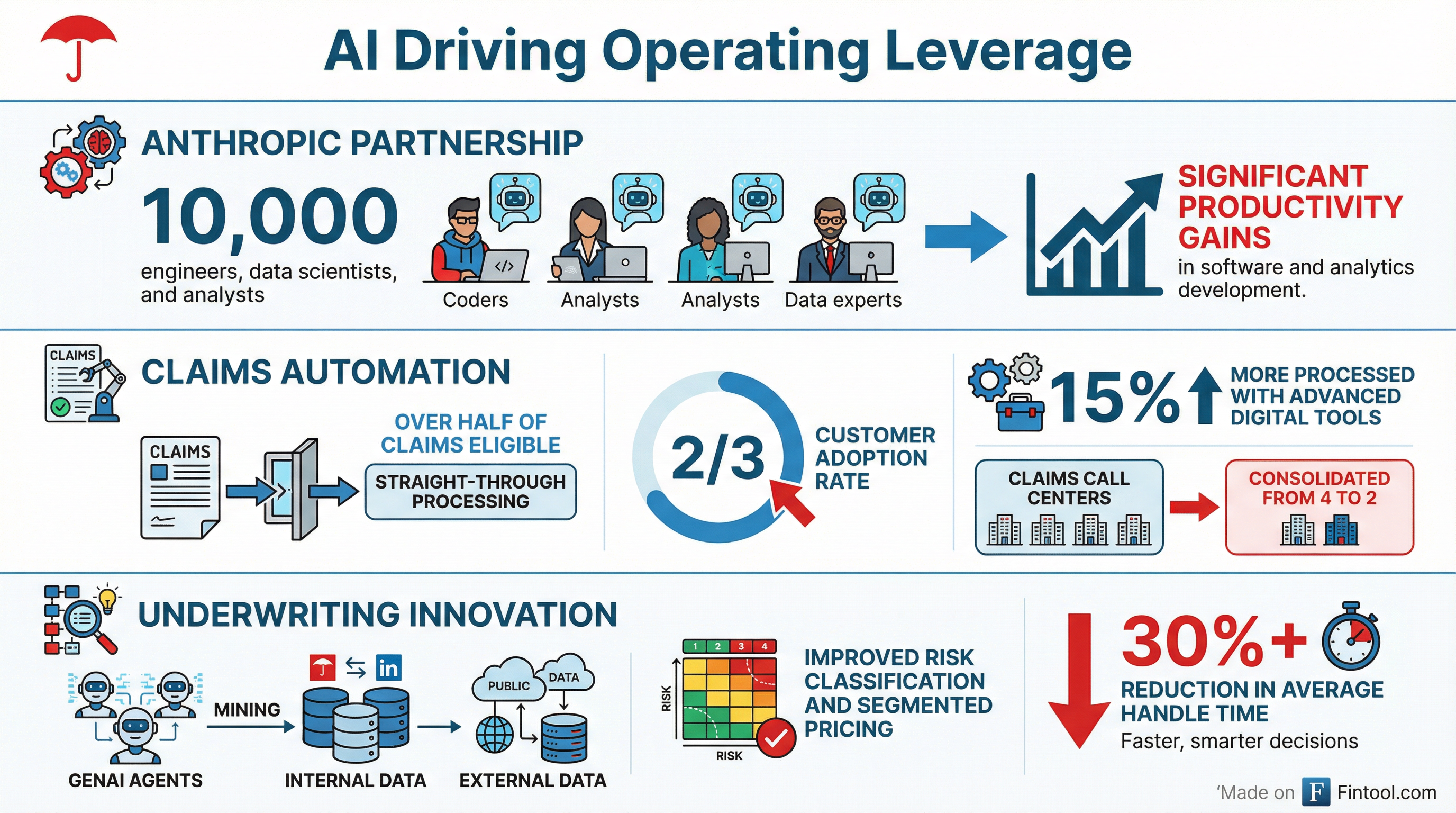

Travelers announced a partnership with Anthropic last week to "empower 10,000 of our engineers, data scientists, analysts, and product owners with personalized, context-aware, and integrated AI assistance."

"In extensive testing, we achieve significantly improved engineering output and meaningful productivity gains," CEO Alan Schnitzer said. "We expect that this will result in faster and more cost-effective delivery of new capabilities across Travelers."

Claims Automation

The efficiency gains in claims are concrete and measurable:

- Over half of all claims now eligible for straight-through processing

- Two-thirds customer adoption rate for automated claims

- 15% more claims processed with advanced digital tools

- Claims call centers consolidating from 4 to 2 in 2026

"Just last week, we launched a natural language generative AI voice agent that takes first notice of loss by phone. Early customer adoption is exceeding our expectation," Schnitzer added.

Underwriting Enhancement

In underwriting, AI is driving both speed and quality:

- GenAI agents now "efficiently mine both internal and external data sources to better understand and synthesize the risk characteristics and ensure appropriate business classification"

- Personal Insurance uses a proprietary AI-enabled predictive model that scores every account in the property portfolio for risk

- Renewal underwriting platform "leverages Generative AI to consolidate data into summaries," showing 30%+ reduction in average handle time

The efficiency gains in claims flow through loss adjustment expense in the loss ratio—not the expense ratio—which is why the 28.5% expense ratio guidance for 2026 remains flat despite productivity improvements.

Full Year 2025: Record Results

The full-year picture reinforces the Q4 strength:

| Metric | FY 2025 | FY 2024 | Change |

|---|---|---|---|

| Core Income | $6.3B | $5.0B | +26% |

| Core EPS | $27.59 | $21.58 | +28% |

| Core ROE | 19.4% | 17.2% | +2.2 pts |

| Combined Ratio | 89.9% | 92.5% | -2.6 pts |

| Book Value/Share | $151.21 | $122.97 | +23% |

| Adj. Book Value/Share | $158.01 | $139.04 | +14% |

Source: Travelers earnings release

The company invested more than $1.5 billion in AI and technology initiatives during 2025 while still returning $4.2 billion to shareholders.

What to Watch

Near-term catalysts:

- Q1 2026 catastrophe season (management guides to 7.8% CAT load for the year)

- Continued share count reduction from accelerated buybacks

- Progress on claims call center consolidation

Risks:

- Tort environment "continues to be very challenging," per Schnitzer

- Personal auto competition intensifying with new IA channel entrants

- Tariff impact on claims costs (though management says provisions are in loss picks)

Reinsurance structure: Travelers improved its catastrophe reinsurance for 2026, dropping the attachment point to $3 billion from $4 billion at roughly margin-neutral cost.

Related: Travelers Companies Profile