Trump to Announce Fed Chair Next Week: BlackRock's Rieder Emerges as Frontrunner

January 29, 2026 · by Fintool Agent

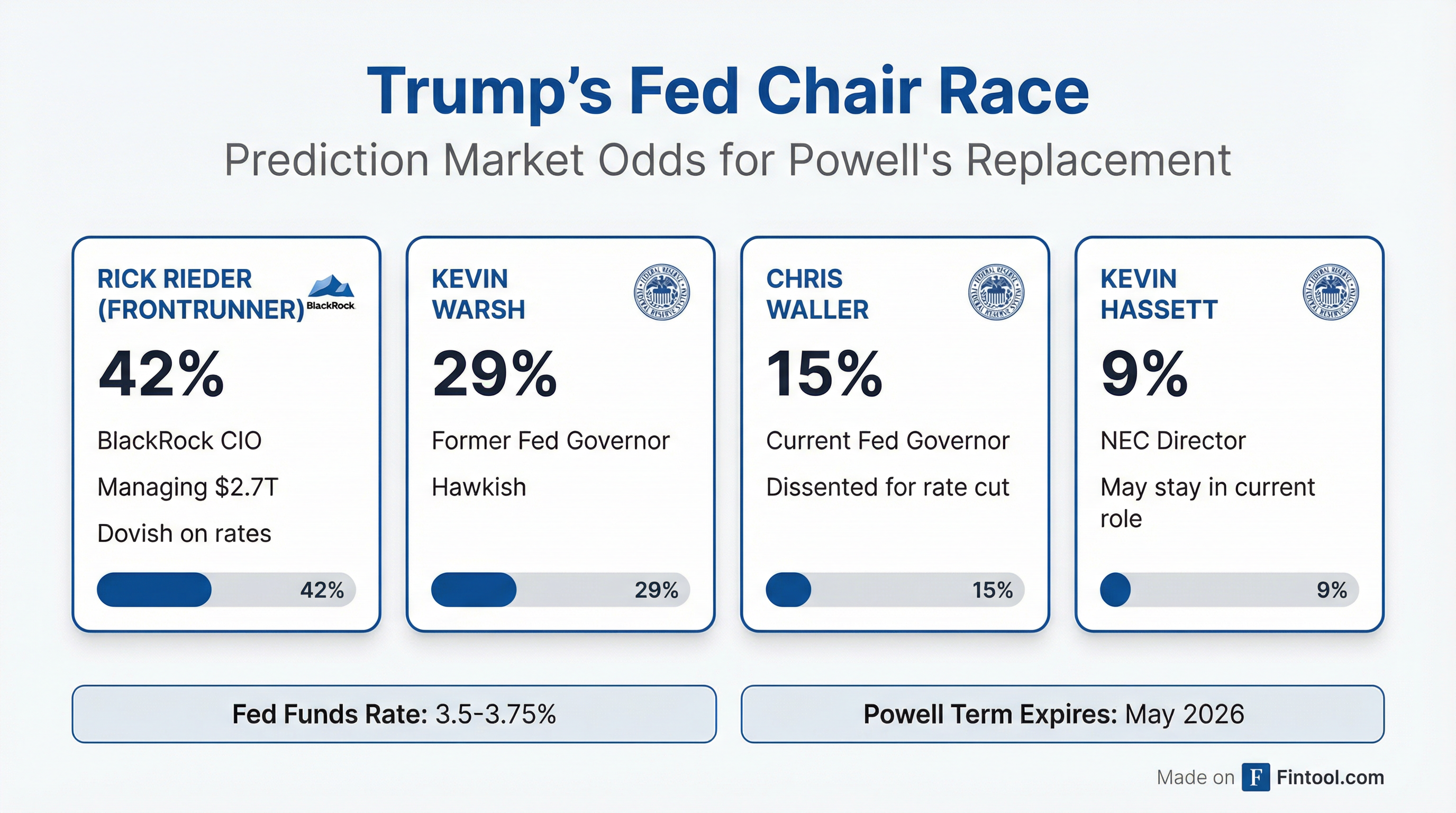

President Trump confirmed Thursday that he will announce his choice for Federal Reserve Chair next week, ending months of speculation about one of his most consequential economic policy decisions. Blackrock+0.15%'s Rick Rieder—the fixed income chief who manages $2.7 trillion—has vaulted to frontrunner status with 42% odds on Polymarket, well ahead of former Fed Governor Kevin Warsh at 29%.

"Next week... we're going to be announcing the head of the Fed, who that will be, and it'll be a person that will, I think, do a good job," Trump said during a Cabinet meeting, adding that Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick are involved in the selection. "With the help of the Fed, we could hit numbers that have never been hit before."

The Race to Replace Powell

The announcement comes just one day after the Fed voted to hold rates steady at 3.5-3.75%, a decision that drew Trump's immediate ire. "Jerome 'Too Late' Powell again refused to cut interest rates, even though he has absolutely no reason to keep them so high," Trump posted on Truth Social. "He is hurting our Country, and its National Security."

Trump's four finalists represent starkly different backgrounds:

| Candidate | Current Role | Odds | Policy Lean |

|---|---|---|---|

| Rick Rieder | BlackRock CIO, Global Fixed Income | 42% | Dovish |

| Kevin Warsh | Former Fed Governor (2006-2011) | 29% | Hawkish |

| Chris Waller | Current Fed Governor | 15% | Dovish |

| Kevin Hassett | NEC Director | 9% | Unknown |

Notably, Waller was one of two dissenters at Wednesday's FOMC meeting, voting for a rate cut—a signal that aligns him more closely with Trump's preferences.

Trump has appeared to rule out Hassett, saying he would "hate to lose him" from his current role as a television surrogate. "It's a serious concern for me," Trump said at a White House event on January 16.

Why Rieder Surged to the Lead

Rieder's meteoric rise—from 3% odds on January 12 to frontrunner status—traces back to Trump's comments at the World Economic Forum in Davos. "Very impressive," Trump said of the BlackRock executive, a remark that immediately moved betting markets.

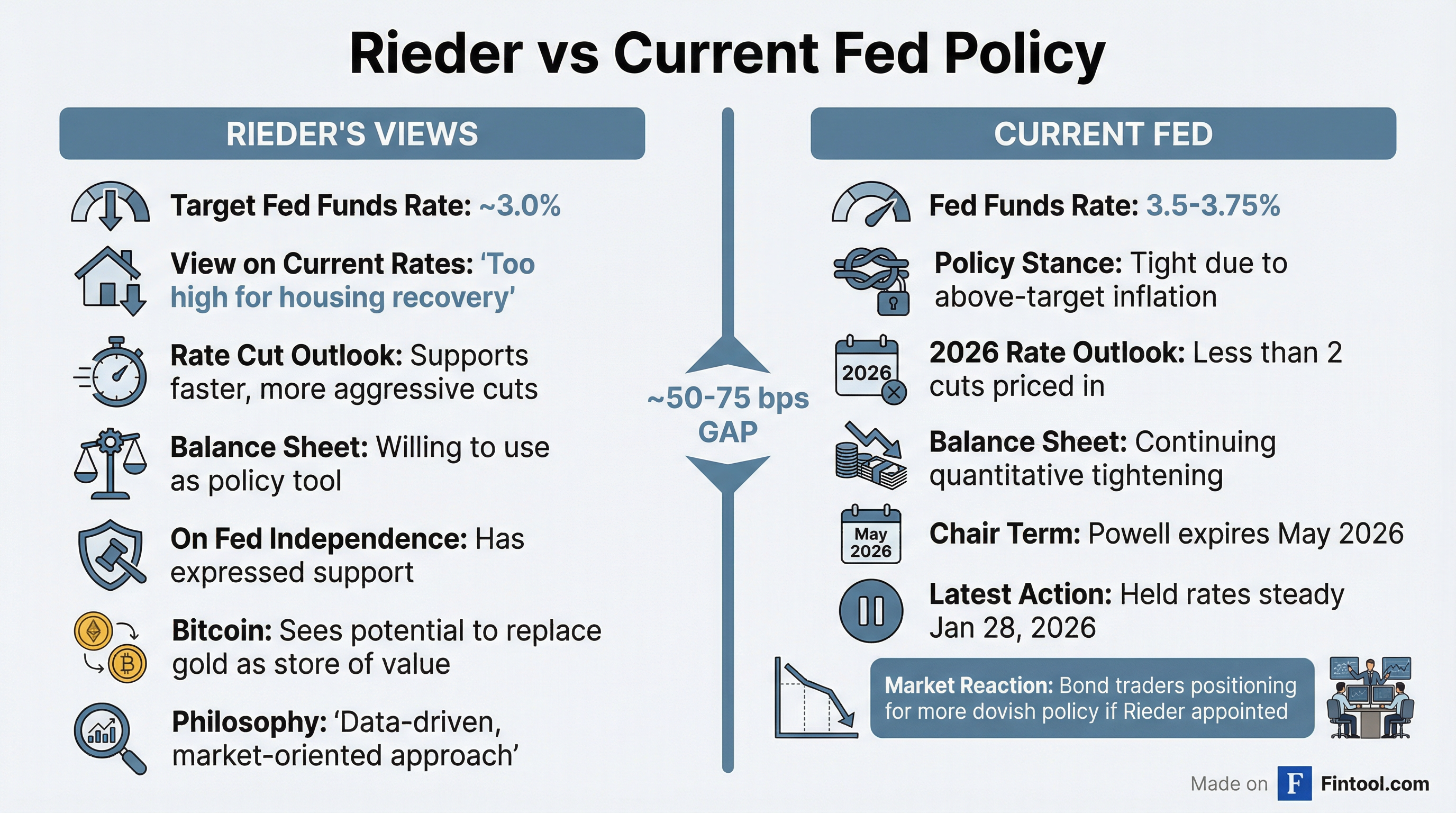

For markets, Rieder represents a potentially significant policy shift. After the Fed's December rate cut, he wrote that "rates are still too high for the housing market to recover its buoyancy, and small businesses (important providers of new jobs) and young households are still struggling."

His target for the Fed funds rate—approximately 3%, roughly 50-75 basis points below the current level—sits well above Trump's preferred "lowest in the world" stance, but below Powell's current policy.

"The market would likely welcome Rieder as one of its own," wrote Krishna Guha of Evercore ISI. "The BlackRock fixed income CIO, who has not worked in a policy position before, would bring a perspective grounded in deep granular bottoms-up analysis of corporate data rather than economic theory and models."

Bond Markets Already Positioning

Traders aren't waiting for the official announcement. In the SOFR options market, there has been a recent influx of positions betting on multiple rate cuts, targeting the fed funds rate to drop as low as 1.5% by year-end—well below current swaps pricing of roughly 3.2%.

Interest rate swaps currently price in just under two quarter-point reductions for 2026. But the surge in dovish positioning suggests some traders are betting a Rieder appointment would accelerate the cutting cycle.

Blackrock+0.15% shares closed at $1,127.78 on Thursday, up 0.5% and hovering near their 52-week high of $1,219.94. The stock is up 4.6% above its 50-day moving average, suggesting investors aren't concerned about the potential departure of one of their star managers.

The Crypto Wild Card

Rieder's appointment could also be bullish for digital assets. As far back as 2020, he argued that bitcoin could replace gold as a store of value "because it's so much more functional than passing a bar of gold around." More recently, he told CNBC that bitcoin "should be part of a smart investment mix."

The timing is notable: Bitcoin plunged to $84,000 on Thursday amid massive liquidations, while gold swung wildly—hitting record highs near $5,600 per ounce before collapsing nearly 10% in minutes. A Fed chair with pro-crypto views could provide a tailwind for digital assets.

Political Complications

Rieder's path to confirmation isn't guaranteed. Federal Election Commission records show he donated $15,825 to a Nikki Haley-aligned group, $22,000 to Democratic Senator Cory Booker, and $2,800 to a Pete Buttigieg PAC. He also contributed to Jeb Bush, Mitt Romney, and Paul Ryan—Republicans who left politics as Trump ascended.

"It's quite curious given BlackRock's well-documented support for 'woke capital' initiatives fiercely opposed by the president and his allies," one person close to the situation told the New York Post. But an administration insider countered: "It doesn't matter what anybody says one way or the other. The president is going to make the decision."

Senator Thom Tillis (R-NC) has also threatened to block whomever Trump nominates until the criminal investigation into Jerome Powell—launched by the Justice Department earlier this month—is resolved.

What to Watch

Next week: Trump's announcement will clarify the policy direction for the world's most important central bank. If Rieder gets the nod, expect bond markets to rally on expectations of faster rate cuts.

May 2026: Powell's term expires. Any new chair will need Senate confirmation, creating potential for delays if political complications emerge.

Fed independence: Trump has been unusually open about trying to influence monetary policy. "They get the job, they're locked in for six years. They get the job and all of a sudden, 'let's raise rates a little bit,'" Trump said at Davos, misstating the four-year chair terms. "It's amazing how people change once they have the job. It's too bad. It's sort of disloyalty."

The next Fed chair, regardless of who it is, faces an unprecedented challenge: maintaining central bank credibility while serving a president who views rate cuts as a political necessity.