Tyson Foods Posts $14.3B Quarter as Chicken Powers Through Beef Headwinds

February 2, 2026 · by Fintool Agent

Tyson Foods delivered a beat-and-raise quarter on Monday as its chicken business hit all-time record volumes, helping offset ongoing losses in beef that forced management to shutter one plant and scale back another. Shares rose 2.5% to hit a 52-week high of $66.12 before settling around $65.50.

The nation's largest meat processor reported fiscal Q1 2026 revenue of $14.31 billion, up 5.1% year-over-year and topping analyst estimates of roughly $14 billion . Adjusted EPS came in at $0.97, narrowly beating the $0.95 consensus, though GAAP net income plummeted 76.7% to $85 million due to restructuring charges and beef segment losses .

"Our Q1 results, with sales increasing to more than $14 billion, demonstrate our initiatives and our strategy are clearly working," CEO Donnie King said on the earnings call . "We're driving operational excellence daily, and the team is energized for what's ahead."

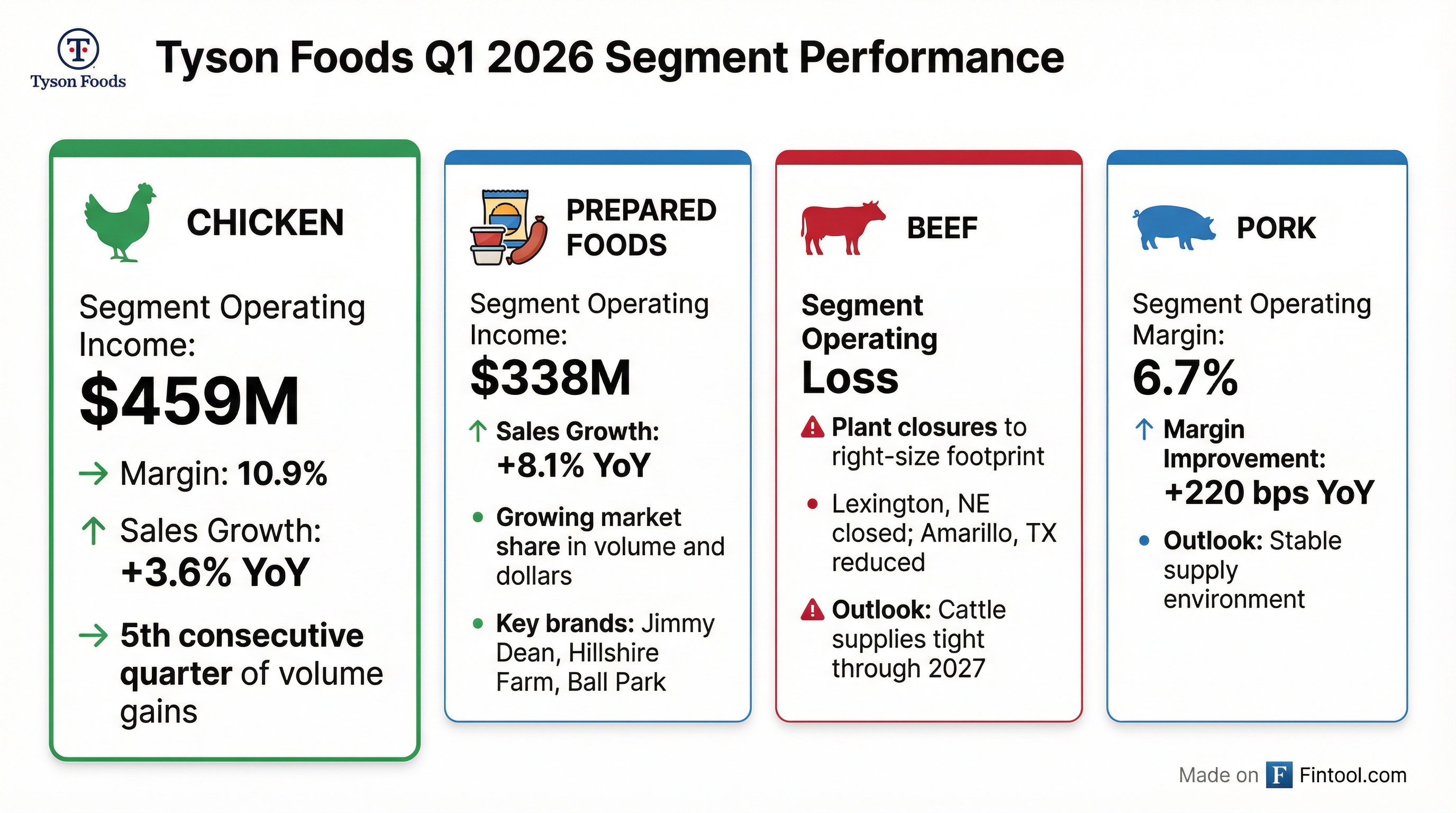

Chicken: The Profit Engine

The chicken segment delivered $459 million in segment operating income with a 10.9% margin—its fifth consecutive quarter of year-over-year volume gains . Volume in Q1 hit an all-time company record, with branded fresh chicken up 10.7% and branded frozen up 12.2% .

"There's never been a better time to be in protein," King emphasized, noting that USDA research projects chicken will account for 50% of all U.S. animal protein consumption by 2030 .

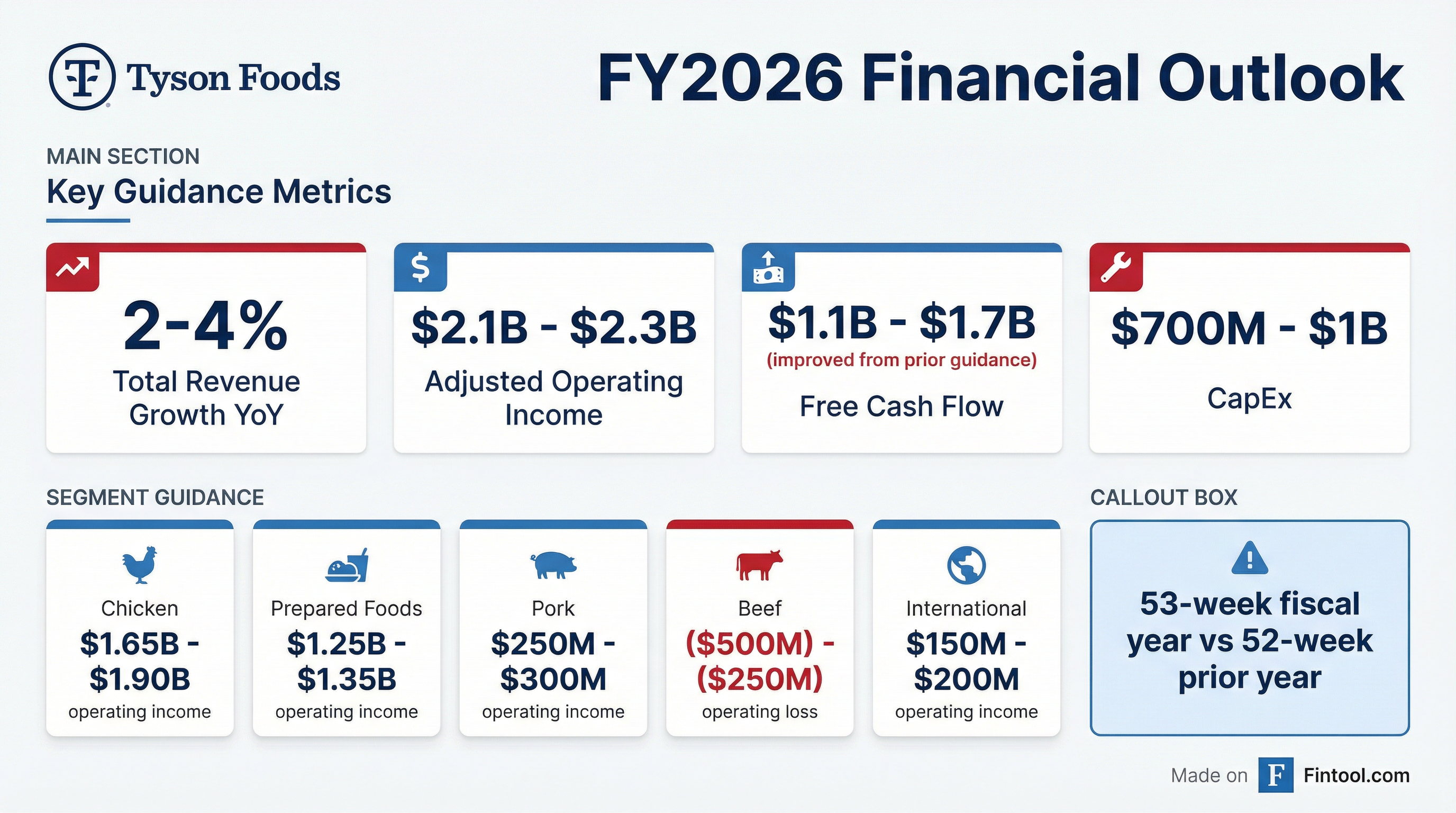

Management raised its FY2026 chicken segment operating income guidance to $1.65-1.90 billion, citing strong demand fundamentals and disciplined execution across the supply chain .

| Metric | Q1 2024 | Q1 2025 | Q1 2026 | YoY Change |

|---|---|---|---|---|

| Revenue ($B) | $13.07 | $13.62 | $14.31 | +5.1% |

| Net Income ($M) | $145 | $359 | $85 | -76.3% |

Beef: Right-Sizing for a Shrinking Herd

The stark contrast came from beef, where Tyson continues to battle the tightest cattle supplies since 1951. In January, the company announced the closure of its Lexington, Nebraska facility and reduced its Amarillo, Texas plant to a single shift .

"Continuing to absorb losses like we have been seeing for the past two years is simply unacceptable," King stated bluntly .

COO Devin Cole provided context on the USDA's latest cattle inventory report: "It is the smallest herd since 1951... 9% lower than it was in 2019" . While there are early signs of herd rebuilding—replacement heifers increased 1% and beef cow slaughter declined 17.7% in 2025—Cole warned that "cattle are going to remain extremely tight for the foreseeable future" .

Management widened the FY2026 beef operating loss guidance range to $500 million to $250 million, acknowledging the volatile environment while expecting benefits from the plant rationalization in coming quarters .

Prepared Foods and Pork: Steady Contributors

Prepared Foods posted $338 million in segment operating income on 8.1% sales growth, driven by volume, channel mix, and formula-based pass-through pricing . The segment's brand portfolio—including Jimmy Dean, Hillshire Farm, and Ball Park—outpaced category volume and dollar growth, marking the fifth consecutive quarter of sequential improvement .

"Tyson was the only food company in consumer staples growing volume and dollar share in the most recent report," King noted. "The only other one was P&G, which is not in the food space" .

Pork delivered a 6.7% segment operating margin, up 220 basis points year-over-year, benefiting from adequate hog supplies and operational efficiencies . Management expects the stable supply environment to persist, guiding to $250-300 million in segment operating income for FY2026.

Updated Guidance and Capital Returns

CFO Curt Calaway maintained the FY2026 adjusted operating income guidance of $2.1-2.3 billion while improving the free cash flow outlook to $1.1-1.7 billion, up from prior expectations due to working capital improvements .

The company returned $224 million to shareholders in Q1 through $177 million in dividends and $47 million in share repurchases . Net leverage improved to 2.0x, with gross debt reduced by $1.4 billion over the trailing twelve months .

Tyson also introduced a new segment reporting structure, separating corporate expenses and amortization from individual business units. King explained the rationale: "Before we make the first sale every week, before we turn on the first machine... we're sitting with something on the order of $1 billion of amortization and corporate expenses" . The change gives business leaders clearer accountability and sets up the company for volume-driven growth.

What to Watch

The new U.S. dietary guidelines advocating increased animal protein consumption provide a tailwind for Tyson's core business . The company has proactively removed petroleum-based dyes and high-fructose corn syrup from its branded portfolio, positioning it ahead of regulatory trends .

Key catalysts ahead include:

- Beef plant rationalization impact: Q2 should reflect the first full quarter of the reduced footprint

- Cattle cycle signals: Continued monitoring of heifer retention and herd rebuilding indicators

- Chicken demand sustainability: Whether record volumes can persist as pricing normalizes

For a 90-year-old American food company navigating a protein renaissance, Tyson's message is clear: chicken is king, but patience on beef is required.