UBS Posts 56% Profit Surge, Crosses $7 Trillion in Assets as Credit Suisse Integration Nears Finish Line

February 4, 2026 · by Fintool Agent

UBS delivered a blowout fourth quarter, with net profit surging 56% year-over-year to $1.2 billion—beating analyst estimates by more than 20%—as the Swiss banking giant demonstrated that the Credit Suisse integration is paying dividends, quite literally. Full-year 2025 profit hit $7.8 billion, up 53% from the prior year, while invested assets crossed the $7 trillion mark for the first time in the bank's history.

The results mark a turning point for UBS, which acquired Credit Suisse in a government-orchestrated rescue in June 2023. Nearly three years later, CEO Sergio Ermotti can point to tangible proof that absorbing Europe's largest banking failure was worth the risk.

The Numbers That Matter

| Metric | Q4 2025 | Q4 2024 | YoY Change |

|---|---|---|---|

| Net Profit | $1.2B | $770M | +56% |

| Total Revenues | $12.1B | $11.6B | +4% |

| Operating Profit Before Tax | $1.7B | $1.0B | +62% |

| CET1 Ratio | 14.4% | 14.3% | +10bps |

| Invested Assets | $7.0T | $6.1T | +15% |

For the full year, UBS reported net profit of $7.8 billion versus $5.1 billion in 2024, with diluted EPS of $2.36 compared to $1.52 in the prior year. The return on CET1 capital came in at 10.8%, with the underlying figure reaching 13.7%.

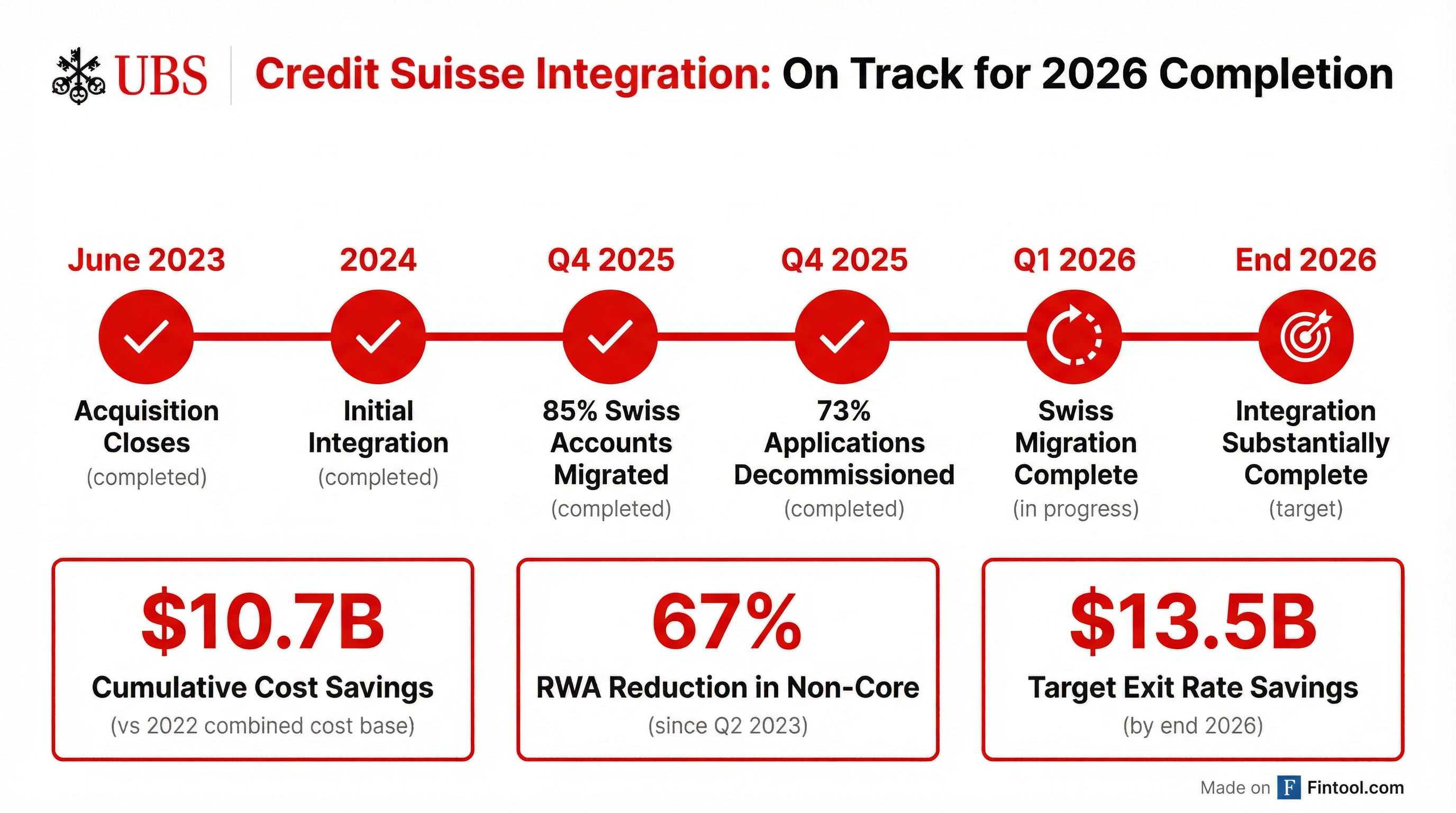

Integration: The Home Stretch

The Credit Suisse integration—described by CFO Todd Tuckner as "one of the most complex integrations in banking history"—is now 85% complete on the Swiss client account migration, with Personal & Corporate Banking substantially finished.

Key integration milestones achieved:

- $10.7 billion in cumulative gross cost savings realized versus the 2022 combined cost base

- 85% of Swiss-booked accounts migrated to UBS systems

- 73% of Non-core and Legacy applications decommissioned

- 67% reduction in Non-core and Legacy RWA since Q2 2023

UBS has increased its cost savings target to $13.5 billion in annualized exit rate savings by end of 2026, up from the previous $13 billion target. Management expects cumulative integration-related expenses to total around $15 billion by year-end 2026.

"We made great progress in one of the most complex integrations in banking history, while regulatory uncertainty continues in Switzerland," CEO Ermotti said on the earnings call.

Capital Returns: $3 Billion Buyback on Deck

UBS is rewarding shareholders handsomely. The Board of Directors plans to propose a dividend of $1.10 per share for 2025—a 22% increase from $0.90 in 2024. The bank also completed $3 billion in share repurchases during 2025 and intends to repurchase another $3 billion in 2026, "with the aim to do more."

The caveat: management noted that additional buybacks beyond the $3 billion are subject to regulatory clarity in Switzerland, where policymakers are still debating new capital requirements following the Credit Suisse failure.

"It's very important to remember that this kind of upstream [capital] was always part of our planning process," Ermotti clarified. "This is not new discovered capital."

Wealth Management Momentum

Global Wealth Management, UBS's crown jewel, posted pretax profit of $1.29 billion in Q4, up 49% year-over-year. The division attracted $100.8 billion in net new assets for the full year, with fee-generating assets reaching $2.1 trillion.

Looking ahead, management expects net new assets of around $125 billion in 2026, building toward the goal of $200 billion per annum by 2028.

UBS shares have nearly doubled over the past year, rising from $25.75 to $47.67, reflecting investor confidence in the integration execution. The stock is trading near its 52-week high of $49.36.

2026 Outlook and Targets

UBS reiterated its exit-rate targets for end of 2026:

| Target | 2026 Exit Rate | 2028 Ambition |

|---|---|---|

| Underlying RoCET1 | 15% | 18% (reported) |

| Cost/Income Ratio | <70% | 67% (reported) |

| CET1 Capital Ratio | 14% | 14% |

| Invested Assets (GWM) | - | >$5.5T |

CFO Tuckner offered a measured outlook for 2026: "As we entered the year... we felt like the markets were broadly constructive... But as we also highlight in our statement, there's a lot of potential for event-driven volatility and spikes in volatility is high."

What to Watch

- Q1 2026 Swiss migration completion: UBS expects to finish Swiss client account migrations by end of Q1

- Swiss regulatory framework: New capital requirements could impact buyback capacity

- Investment Bank buildout: Management targets doubling Global Banking revenues from 2022 levels

- U.S. national bank charter: UBS received conditional approval and expects final authorization during 2026

Related Companies: UBS