Activist Director Bets $573K on UNFI Turnaround—Stock Gaps Higher

January 7, 2026 · by Fintool Agent

United Natural Foods Director James Pappas purchased $573,000 worth of UNFI stock across two open-market transactions this week, according to SEC filings—his first significant buy since joining the board in September 2023 as part of a cooperation agreement with his activist firm, JCP Investment Management.

The market took notice. UNFI shares gapped up over 3.5% Tuesday, touching $34.99 intraday as traders parsed the signal from an insider who built his career spotting turnarounds in the food and restaurant sector.

The Trade Details

Pappas bought 17,000 shares in two tranches:

| Date | Shares | Price | Total Value |

|---|---|---|---|

| January 2, 2026 | 15,000 | $33.76 | $506,400 |

| January 5, 2026 | 2,000 | $33.30 | $66,600 |

| Total | 17,000 | $33.71 avg | $573,000 |

Following the transactions, Pappas and affiliated JCP entities now hold roughly 538,000 shares—including 293,144 shares through JCP Investment Partnership and 194,178 shares through managed accounts at JCP Investment Management.

This marks the largest insider purchase at UNFI in the past year and comes at an interesting moment in the company's turnaround trajectory.

Why It Matters: The Activist's Track Record

James Pappas isn't a passive board member. The former Goldman Sachs investment banker founded JCP Investment Management in 2009 and has built a career pushing for value creation at food and retail companies. His resume includes board seats at Jamba, The Pantry, Morgan's Foods, and Panera Brands—many of which were ultimately sold at premiums.

When Pappas joined UNFI's board in September 2023, the stock was trading in the low teens. The company was struggling with elevated leverage, margin pressure, and skepticism about its ability to execute a turnaround. The cooperation agreement with JCP included a commitment to a board-led financial review and strategic transformation.

Now, with the stock around $34 and the turnaround showing tangible results, Pappas is putting his own capital behind the thesis.

The Turnaround in Context

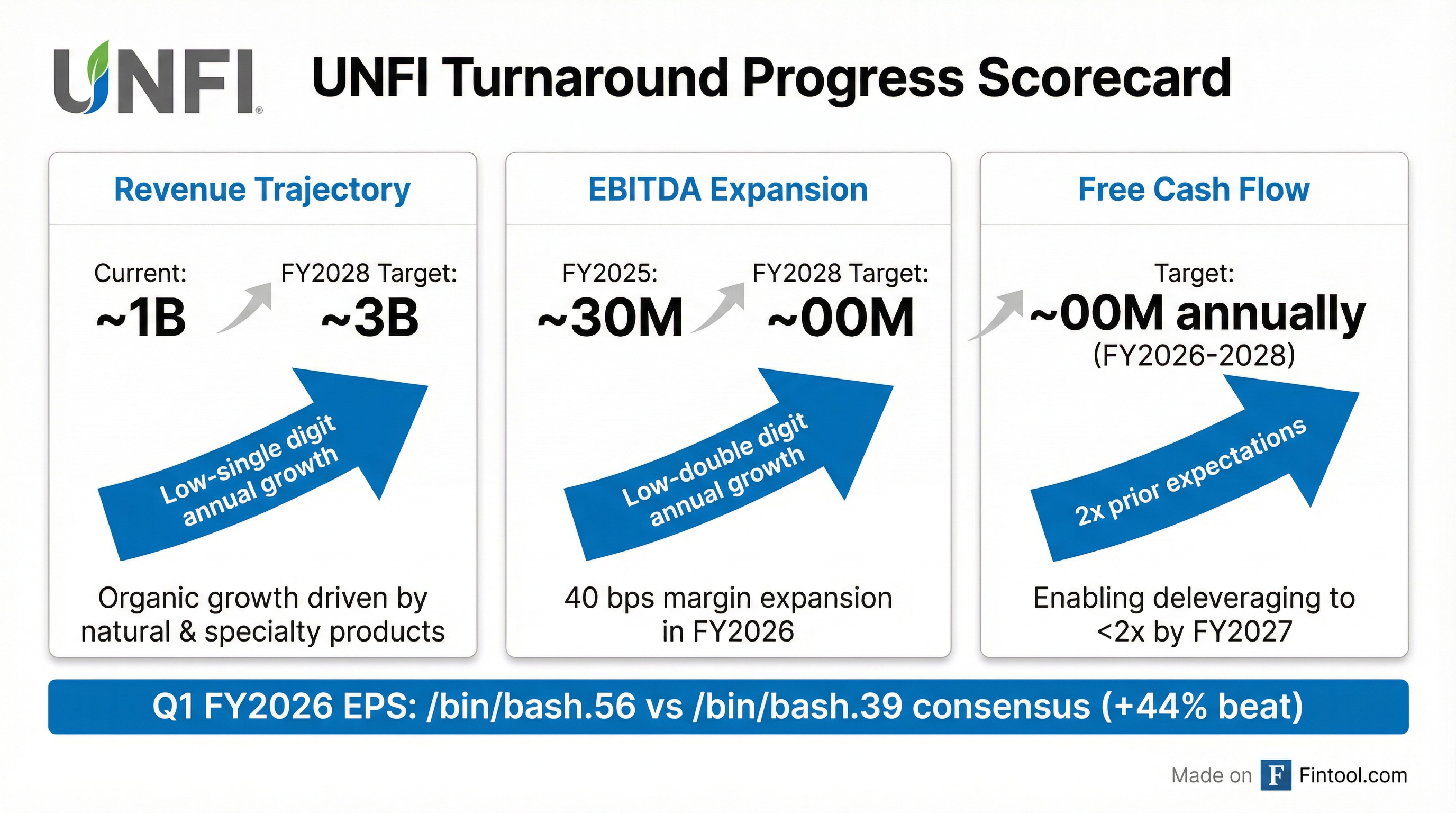

UNFI's transformation has been quietly impressive. At the December 2025 Investor Day, management raised its multi-year financial targets and outlined a path to significantly higher profitability.

The updated FY2025–FY2028 value creation framework includes:

| Metric | Target |

|---|---|

| Net Sales | Low-single digit CAGR → $33B by FY2028 |

| Adjusted EBITDA | Low-double digit CAGR → $800M by FY2028 |

| Free Cash Flow | $300M annually (FY2026–2028) |

| Net Leverage | <2.0x by end of FY2027 |

This represents a substantial upgrade from the targets UNFI communicated just one year ago—when free cash flow expectations were roughly half their current level.

CEO Sandy Douglas framed it succinctly on the Q4 2025 earnings call: "We still believe our future value creation opportunities far exceed what we've achieved so far."

Recent Financial Performance

The Q1 FY2026 results validated the strategy. UNFI beat earnings by 44%, posting $0.56 adjusted EPS versus the $0.39 consensus.

| Metric | Q2 2025 | Q3 2025 | Q4 2025 | Q1 2026 |

|---|---|---|---|---|

| Revenue | $8.16B | $8.06B | $7.70B | $7.84B |

| Gross Margin | 13.1% | 13.4% | 13.6% | 13.6%* |

| EBITDA | $135M | $152M | $96M | $142M* |

*Values retrieved from S&P Global

The margin improvement reflects several ongoing initiatives: network optimization (consolidating four distribution centers into more efficient facilities), lean management deployment across 28 of 52 DCs, and working capital improvements that brought inventory days back to pre-COVID levels.

FY2026 guidance calls for $1.50–$2.30 EPS and approximately $300 million in free cash flow.

What Analysts Are Saying

Wall Street remains cautious, with a consensus "Hold" rating and an average price target of $37—implying roughly 10% upside from current levels. The range spans from approximately $29 to $42.

The bull case centers on the turnaround momentum and the runway for margin expansion as network optimizations and cost initiatives fully roll through. UNFI's 12-month range of $20.78 to $43.29 illustrates the stock's volatility—and the potential for significant moves as the market reassesses the turnaround narrative.

One recent bull thesis highlighted by Insider Monkey noted: "The presence of activist investor James Pappas from JCP Investment Management on the board signals continued strategic discipline and a focus on shareholder value creation... Given these multiple self-help catalysts, United Natural Foods offers an attractive asymmetric risk/reward setup."

The Bigger Picture

Insider buying alone doesn't guarantee outperformance. But when an experienced activist investor—one who's seen dozens of turnarounds in his target sector—puts over half a million dollars of personal capital into a stock after a year of strategic work, it warrants attention.

Pappas now has meaningful skin in the game. His purchase comes after UNFI raised targets, beat earnings, and began generating the free cash flow necessary to deleverage. The stock is trading at roughly 11x FY2026 midpoint EPS guidance ($1.90), a modest multiple for a company guiding to low-double-digit EBITDA growth.

What to Watch

Key catalysts on the horizon include:

- Q2 FY2026 earnings (expected late March 2026): Will the margin expansion continue?

- Free cash flow trajectory: Management is targeting $300M—tracking toward that number will be critical for debt reduction

- Further insider activity: Will other directors or executives follow Pappas's lead?

- Strategic initiatives: Progress on merchandising capabilities, technology investments, and supplier programs outlined at Investor Day

Related: