Andy Cecere to Retire from U.S. Bancorp Board After 40 Years; Gunjan Kedia to Become Chairman

January 28, 2026 · by Fintool Agent

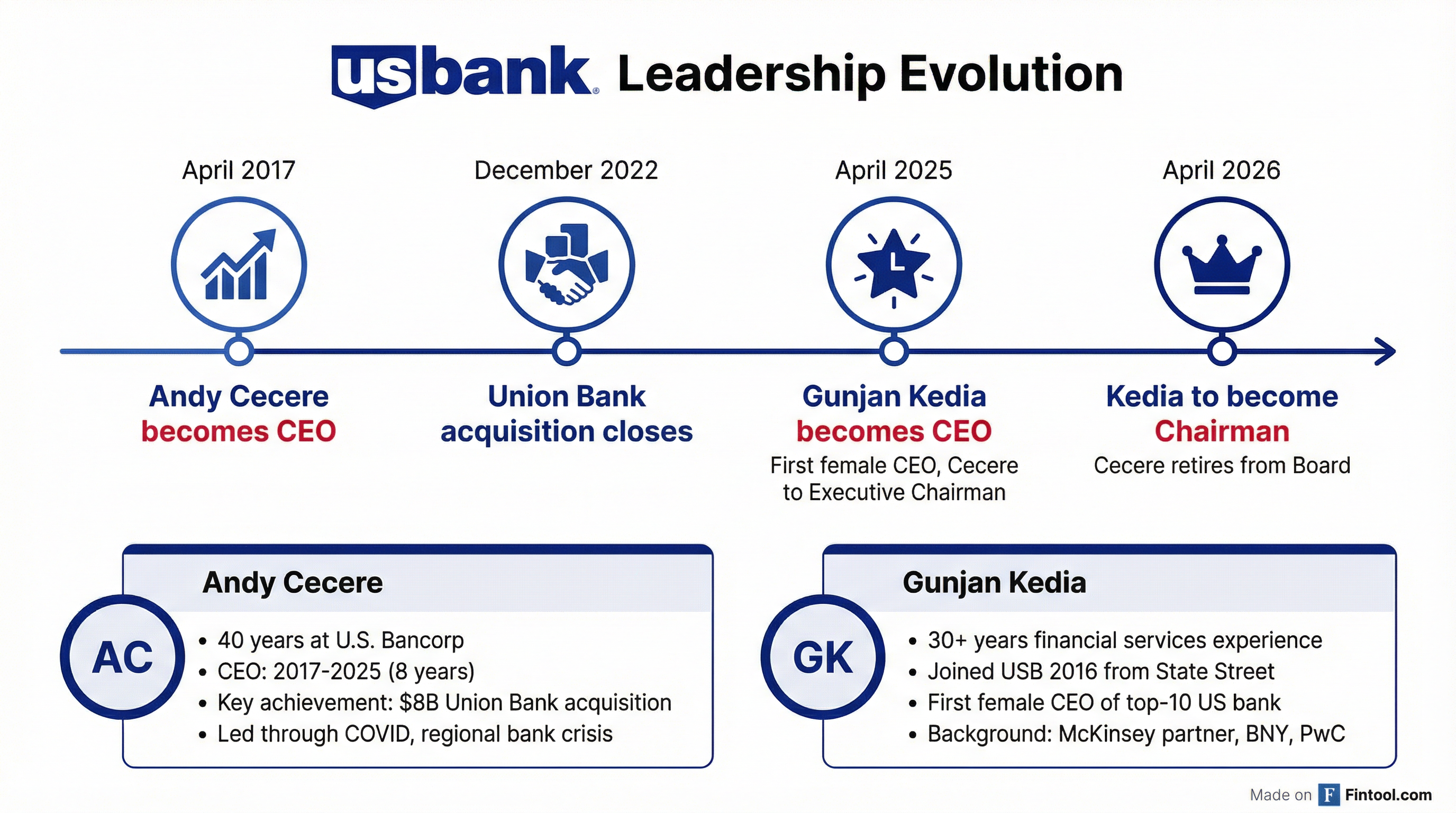

U.s. Bancorp announced Tuesday that Executive Chairman Andy Cecere will not stand for re-election to the board of directors, ending a 40-year career at the Minneapolis-based bank. CEO Gunjan Kedia will add the Chairman title when Cecere steps down following the annual meeting on April 21, 2026.

The transition completes a succession plan that began a year ago when Kedia was named to succeed Cecere as CEO. She will become the first woman to serve as both CEO and Chairman of a top-10 U.S. bank by assets.

USB shares rose 1.3% to $56.53 on the news, touching a 52-week high of $56.70 and extending a rally that has seen the stock gain 60% from its 2023 regional banking crisis low of $27.27.

The Cecere Era: 40 Years, One Bank

Cecere's departure marks the end of an era at the nation's fifth-largest commercial bank. He joined U.S. Bancorp in 1985 and held virtually every senior role—CFO, COO, President—before becoming CEO in April 2017.

"Andy helped guide the company through some of the most formidable years in its history," said Lead Independent Director Roland Hernandez, who will continue in that role. "His drive to invest in digital capabilities, build needed scale, and instill a focus on prudent financial and risk management will serve as a strong foundation for the future."

The filing explicitly noted Cecere's decision was "for personal reasons" and "not due to any disagreement with the Company on any matter relating to the Company's operations, policies or practices"—standard language that in this case appears to reflect reality rather than legal boilerplate.

Legacy: Union Bank and the Crisis Test

Cecere's defining move was the $8 billion acquisition of MUFG Union Bank, which closed in December 2022 and expanded U.S. Bank's California presence from 10th to 5th in deposit market share.

The deal's timing proved challenging. Just three months after closing, Silicon Valley Bank collapsed, triggering a regional banking crisis that sent USB shares plunging to $27.27—a 50% decline from pre-crisis levels. Cecere navigated the storm without the deposit flight that felled smaller rivals, though the stock took years to recover.

"2024 was a pivotal year for the company in many ways and it marked a very important inflection point in our story," Cecere said on the Q4 2024 earnings call, his last as CEO. "We effectively managed through the changes and most importantly executed on our strategic objectives."

Financial Performance Under Cecere (CEO: 2017-2025)

| Metric | Q1 2024 | Q4 2025 | Change |

|---|---|---|---|

| Revenue | $2.70B | $3.05B | +13% |

| Net Income | $1.32B | $2.05B | +55% |

| ROE | 9.5% | 12.7% | +320 bps |

| Total Assets | $684B | $692B | +1% |

The numbers tell a story of profitability recovery rather than growth. Net income expanded meaningfully as the bank absorbed Union Bank integration costs and benefited from higher rates, while the asset base remained relatively flat—a deliberate choice as management prioritized returns over scale.

Kedia: From McKinsey to Making History

Kedia, 55, brings a distinctly different profile to the chairman role. Born in Delhi, she earned engineering and MBA degrees with distinction from Delhi Technological University and Carnegie Mellon before building a career across consulting and banking.

Her path included partnership at McKinsey, where she led financial services work; executive roles at BNY Mellon and State Street; and ultimately U.S. Bancorp, which she joined in 2016 to lead wealth management. She was promoted to President in 2024 and became CEO last April.

"Gunjan is a remarkable leader who is well-respected by the Board, her team and our stakeholders for her strategic acumen, client focus and ability to drive business performance," Hernandez said.

Her ascension makes her the second woman to lead a top-10 U.S. bank by assets, joining Citi's Jane Fraser. But Kedia will be the first to hold both CEO and Chairman titles simultaneously—a concentration of power that some governance advocates question but that U.S. Bancorp's board has clearly endorsed.

Strategic Direction: Organic Over M&A

The leadership transition comes as U.S. Bancorp charts a path focused on organic growth rather than acquisitions. On his final earnings call as CEO, Cecere was explicit: "Large bank M&A is just not a priority for us right now."

Kedia has emphasized executing on existing opportunities—deepening client relationships, enhancing digital capabilities, and connecting the bank's payment, wealth, and commercial businesses.

"While the regulatory environment is very attractive for our organic growth opportunities too, we saw a very significant acceleration of our trust and investment fees and our capital markets fees because investor confidence and consumer confidence is very high," Kedia said in January 2025.

The bank has maintained five consecutive quarters of flat expenses while investing in technology—what management calls "bending the cost curve" on digital spending after years of elevated investment.

Forward Estimates

| Metric | Q1 2026E | Q2 2026E | Q3 2026E | Q4 2026E |

|---|---|---|---|---|

| Revenue | $7.26B | $7.54B | $7.71B | $7.78B |

| EPS | $1.13 | $1.25 | $1.31 | $1.33 |

| Target Price | $62.43 | $62.43 | $62.43 | $62.43 |

Values retrieved from S&P Global

Analysts expect continued revenue growth in the 3-5% range, with the consensus target price of $62.43 implying roughly 10% upside from current levels.

What to Watch

The smoothness of this transition stands out in a banking industry where CEO departures often signal trouble. There's no activist pressure, no performance crisis, no scandal—just a 64-year-old executive choosing retirement after four decades.

For investors, the key questions are execution-focused:

- Profitability targets: U.S. Bancorp has set ROA targets of 1.15-1.35% and ROE in the high teens. The bank is close but not there yet.

- Capital deployment: With Basel III clarity emerging, expect more aggressive buybacks. The bank has $5 billion in repurchase authorization.

- M&A optionality: While Kedia has downplayed deals, her consulting background and stated openness to strategic opportunities suggest the door isn't closed.

Roland Hernandez continuing as Lead Independent Director provides governance continuity and a counterbalance to Kedia's dual role.

The annual meeting on April 21 will formalize the transition. Until then, Cecere remains on the board—presumably passing along four decades of institutional knowledge to his successor.