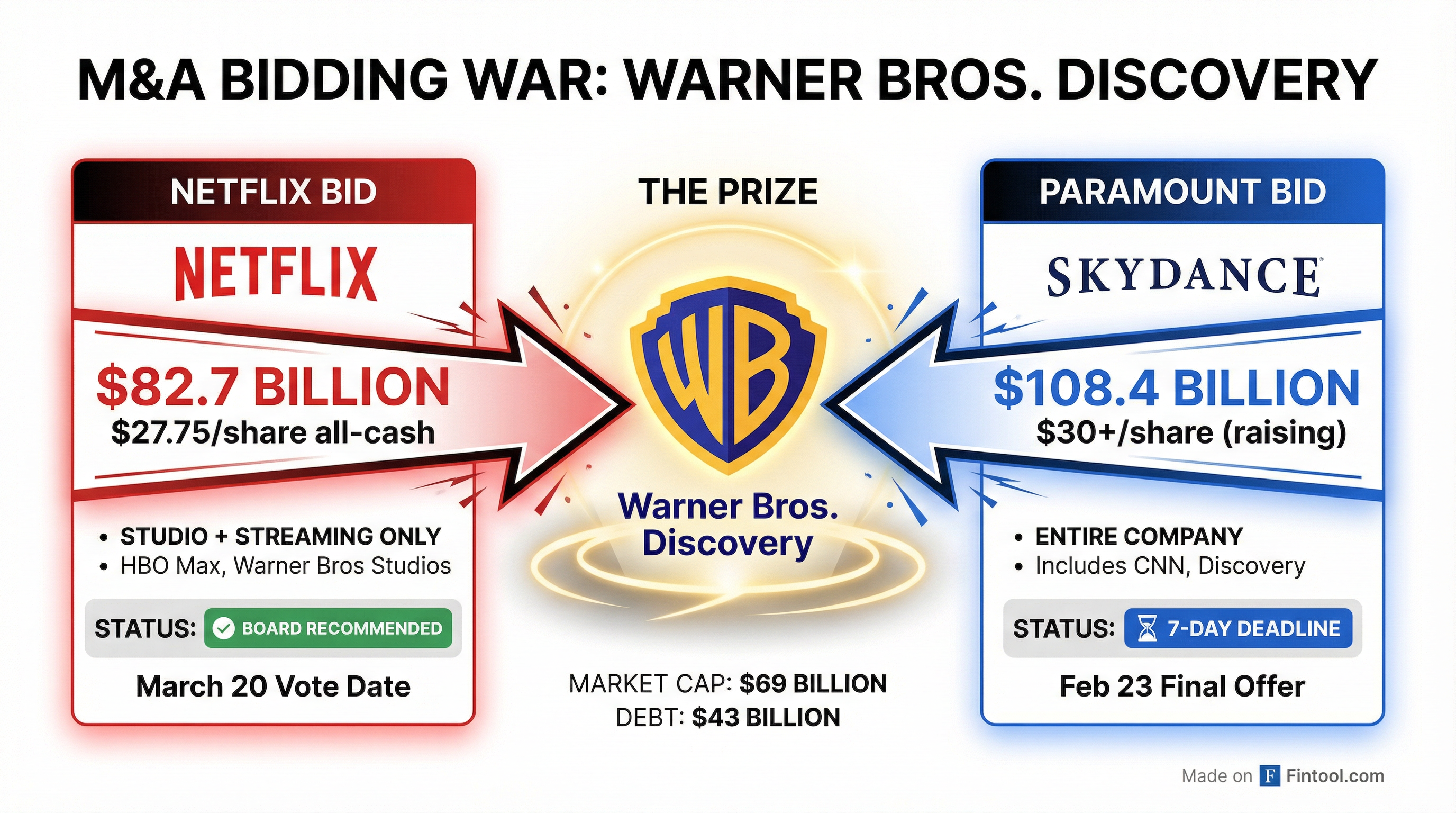

Warner Bros. Discovery Cracks Open Door to Paramount: 7 Days to Beat Netflix's $82.7 Billion Offer

February 17, 2026 · by Fintool Agent

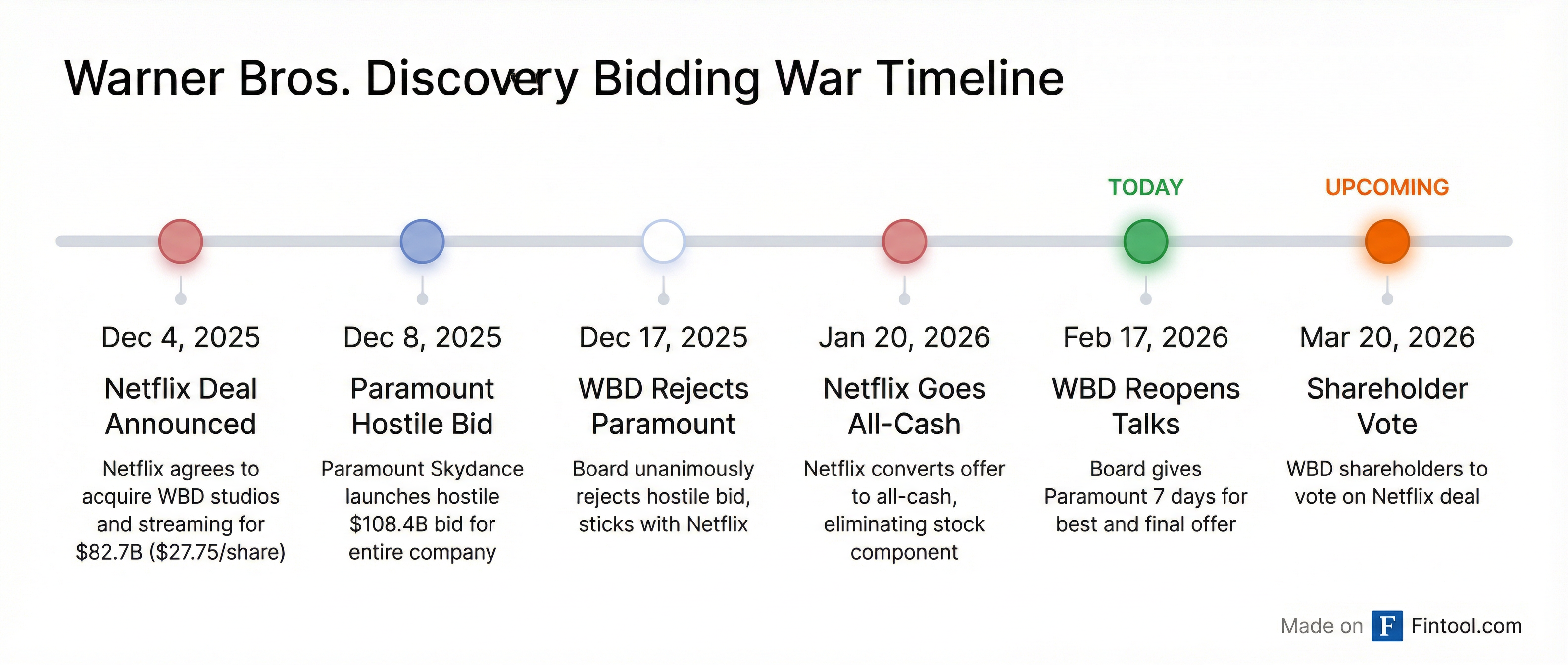

After months of rejecting Paramount Skydance's overtures, Warner Bros. Discovery is finally cracking open the door. The studio giant announced Tuesday it will give David Ellison's company seven days to present a "best and final" offer that could upend its $82.7 billion deal with Netflix.

WBD shares surged 2.7% to $28.75 on the news, while Paramount Skydance jumped nearly 5% to $10.83. Netflix held steady at $77, showing investors remain confident in its position.

The move marks a dramatic shift for WBD's board, which has steadfastly backed Netflix since December and rejected six separate Paramount offers. The deadline: February 23.

The Competing Offers

The bidding war comes down to a fundamental choice: take Netflix's cleaner deal for less, or bet on Paramount's higher price with more complexity.

| Metric | Netflix Offer | Paramount Offer |

|---|---|---|

| Total Value | $82.7 billion | $108.4 billion |

| Per Share | $27.75 (all cash) | $30.00+ (willing to raise) |

| What's Acquired | Studios + Streaming only | Entire company |

| Cash Component | 100% cash | Cash + rollover equity |

| CNN Included? | No (stays with spinoff) | Yes |

| Breakup Fee | $2.8 billion | Covers Netflix fee |

| Expected Close | 12-18 months | TBD |

Netflix's revised all-cash structure, announced January 20, "provides greater certainty of value for WBD stockholders" and eliminated the market-based variability of a stock component.

Paramount has verbally indicated it would pay $31 per share if talks reopen—and that wouldn't be its best offer.

"It's about time the actual headline price bidding heated up in what has to be one of the most inactive corporate bidding wars in history," said Eric Talley, a business professor at Columbia Law School.

The Math Behind the Bids

The gap between offers is narrower than headlines suggest. Netflix's $27.75/share comes with an additional stake in Discovery Global, WBD's cable spinoff that includes CNN, TLC, HGTV, and Food Network. WBD estimates that stake is worth between $1.33 and $6.86 per share—a wide range reflecting deep uncertainty about linear TV's future.

At the midpoint, Netflix's effective offer is roughly $31.85/share. But Paramount's willingness to pay $31+ in cash provides certainty Netflix's structure can't match.

WBD's board acknowledged Paramount's latest modifications "address some of the concerns that WBD had identified several months ago."

WBD: The Crown Jewel at Stake

Warner Bros. Discovery controls one of entertainment's most valuable content libraries: Harry Potter, Batman, Superman, Game of Thrones, and a century of Warner Bros. film and television.

| Metric | FY 2024 | FY 2023 |

|---|---|---|

| Revenue | $27.8B | $28.9B |

| Net Income | -$11.3B | -$3.1B |

| EBITDA | $7.7B | $7.4B |

| Total Debt | $43.0B | $47.3B |

| Total Assets | $104.6B | $122.8B |

| Cash | $5.3B | $3.8B |

The company's balance sheet tells a story of aggressive debt paydown—$4.3 billion reduced in 2024 alone—but also massive losses as it absorbed goodwill impairments from the ill-fated WarnerMedia-Discovery merger.

Netflix: The Streaming Colossus

Netflix enters this fight from a position of overwhelming strength. With $45.2 billion in revenue and $11 billion in net income for fiscal 2025, it dwarfs both competitors.

| Netflix Financials | FY 2025 | FY 2024 | FY 2023 |

|---|---|---|---|

| Revenue | $45.2B | $39.0B | $33.7B |

| Net Income | $11.0B | $8.7B | $5.4B |

| EBITDA | $13.7B | $10.7B | $7.3B |

| Cash | $9.0B | $7.8B | $7.1B |

Netflix co-CEO Ted Sarandos framed the WBD acquisition as "defining the next century of storytelling" and emphasized that the all-cash structure "demonstrates our commitment to the transaction."

Paramount: The Underdog With Deep Pockets

Paramount Skydance enters this fight backed by the Ellisons—tech billionaire Larry and his son David, who took control last August. The company reported $29.2 billion in revenue for fiscal 2024, but a $6.2 billion net loss reflects the brutal economics of the streaming transition.

The Ellisons' personal wealth provides a backstop. Larry Ellison's $40 billion personal guarantee reportedly backs the bid, giving Paramount firepower most media companies can't match.

The Regulatory Wildcard

Both deals face significant regulatory scrutiny, but the concerns differ.

Netflix Deal:

- DOJ antitrust review underway

- European Commission engaged

- Not subject to CFIUS (foreign investment) review

- Writers Guild of America has called for the merger to be blocked, arguing "the world's largest streaming company swallowing one of its biggest competitors is what antitrust laws were designed to prevent"

Paramount Deal:

- Would combine CNN with CBS News under one owner

- FCC concerns about media consolidation

- Rep. Sam Liccardo (D-CA) has raised concerns about "foreign funding behind PSKY's bid," citing Saudi Arabia's Public Investment Fund

- David Ellison allegedly promised President Trump "sweeping changes" to CNN

"What I am seeing lost in the excitement around this bidding war is that all of the parties seem to be vastly underestimating the regulatory risk," said Lee Hepner, senior legal counsel at the American Economic Liberties Project.

Stock Performance in the Bidding War

The market's verdict so far: WBD shareholders have been the winners.

| Stock | Today's Close | Change | 52-Week Range | YTD Change |

|---|---|---|---|---|

| WBD | $28.75 | +2.7% | $7.52 - $30.00 | +59% |

| NFLX | $77.00 | +0.2% | $75.23 - $134.12 | -31% |

| PSKY | $10.83 | +4.9% | $9.95 - $20.86 | -13% |

Netflix shares have declined 31% from their 52-week high as investors weigh the $82.7 billion price tag and antitrust risks. WBD has surged from under $8 in mid-2025 to nearly $30, rewarding shareholders who held through the turmoil.

What Happens Next

February 23: Paramount's deadline for its "best and final" offer

If Paramount raises its bid: Netflix has matching rights under its merger agreement. The streaming giant can improve its own offer to counter Paramount.

If WBD switches to Paramount: WBD must pay Netflix a $2.8 billion termination fee. Paramount's latest proposal includes provisions to cover this cost.

March 20: WBD shareholder vote on the Netflix transaction

"Our Board has not determined that your proposal is reasonably likely to result in a transaction that is superior to the Netflix merger," WBD chairman Samuel DiPiazza Jr. and CEO David Zaslav wrote to Paramount. "We continue to recommend and remain fully committed to our transaction with Netflix."

Netflix said it "granted WBD a narrow seven-day waiver of certain obligations under our merger agreement to allow them to engage with PSKY to fully and finally resolve this matter."

The Bottom Line

Warner Bros. Discovery's decision to reopen talks represents the board's fiduciary obligation to maximize shareholder value—not a change in preference. The language in their letter makes clear: they still believe Netflix offers the better path.

But with Paramount signaling willingness to pay $31 or more—and potentially higher—the board had no choice but to engage. A $3-4 premium over Netflix's effective offer for the entire company, with the Ellisons' deep pockets backing it, deserves consideration.

The next seven days will determine whether Hollywood's biggest merger drama ends with Netflix's streaming empire or Larry Ellison's media ambitions.

"Time is running out for Paramount with this saga wrangling on, for way too long, which is in no one's interest," said PP Foresight analyst Paolo Pescatore.

Related Companies: