Windtree's COO Exits as Company Abandons Biotech Identity for Crypto and Fintech

January 7, 2026 · by Fintool Agent

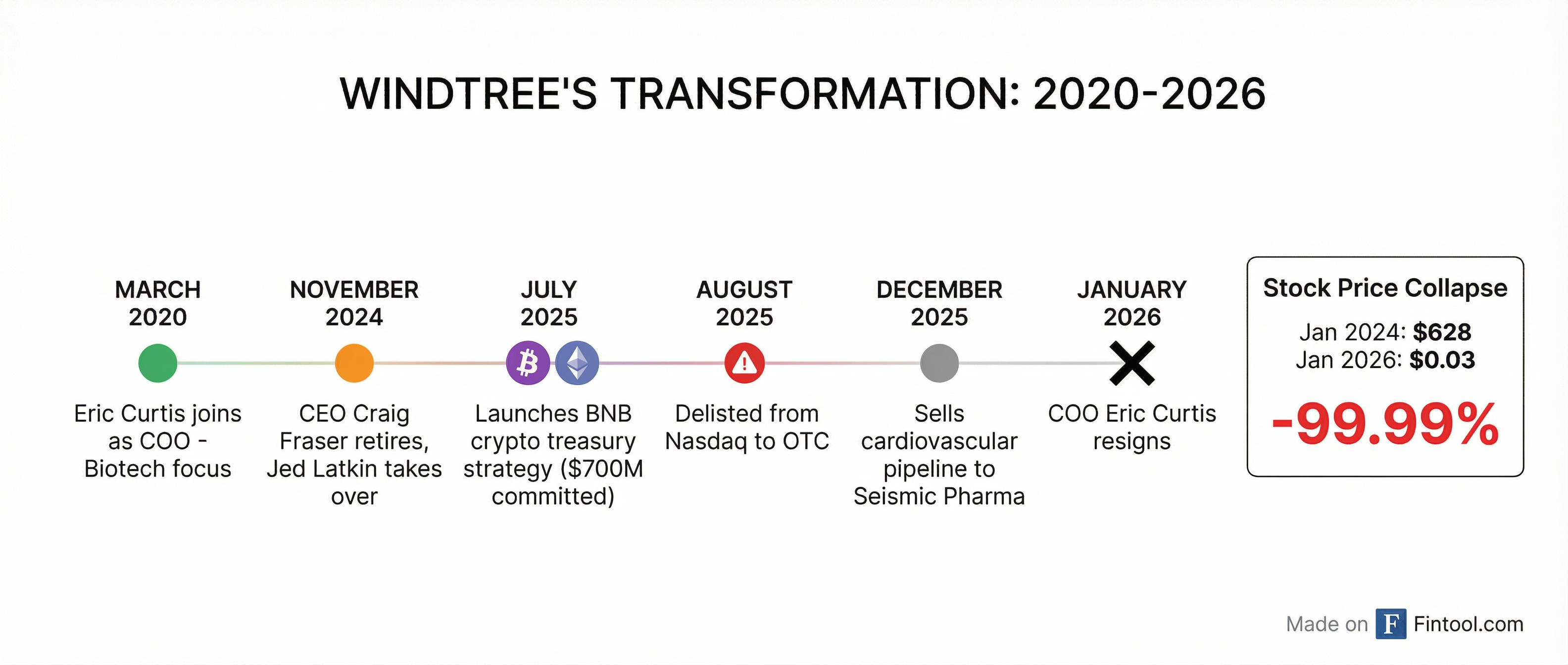

Eric L. Curtis, the President and Chief Operating Officer of Windtree Therapeutics+9.89%, has resigned effective immediately—the final act in a transformation that has seen the once-promising biotech company abandon drug development entirely for cryptocurrency speculation and fintech acquisitions. The departure, disclosed in an 8-K filing today, comes just two weeks after Windtree sold off its cardiovascular drug pipeline, leaving nothing for a biotech executive to oversee.

The stock, which traded near $628 in January 2024, now changes hands at roughly $0.03—a 99.99% collapse that has destroyed virtually all shareholder value as the company pivoted from developing life-saving heart failure treatments to accumulating Binance Coin.

The Last Biotech Executive Walks Out

Curtis joined Windtree in March 2020 with deep pharmaceutical industry credentials: former CEO of Centurion BioPharma, President and COO of CytRx Corporation, and President of U.S. Commercial at Aegerion Pharmaceuticals. His mandate was clear—execute the company's pipeline strategy and drive clinical development of istaroxime, a promising treatment for acute heart failure.

For nearly six years, Curtis served as the company's operational backbone. He was promoted to President in January 2025, adding the title to his COO responsibilities. As recently as December 23, 2025, he was listed as the media contact on the company's press releases—including, ironically, the announcement that Windtree was selling off its entire cardiovascular pipeline.

That sale, to an obscure North Carolina investment group called Seismic Pharmaceutical Holdings, netted Windtree no upfront cash—just a 20% royalty stake in potential future proceeds and a contingent $700,000 payment tied to a financing milestone that may never occur.

A Company Transformed Beyond Recognition

The company Curtis joined no longer exists. Windtree has reinvented itself multiple times in the past 18 months:

November 2024: Former CEO Craig Fraser retired after nine years, replaced by board member Jed Latkin who had no drug development background.

July 2025: Windtree shocked investors by announcing a $700 million BNB cryptocurrency treasury strategy—committing to convert 99% of future capital raises into Binance Coin.

August 2025: The company was delisted from Nasdaq and now trades on the OTC markets after failing to maintain minimum bid price requirements.

November 2025: A planned acquisition of Titan Environmental Services collapsed, with Windtree receiving a $7.5 million breakup payment.

December 2025: The company announced plans to acquire CommLoan, a commercial real estate lending fintech platform, and sold its cardiovascular drug candidates for essentially no upfront consideration.

Today's "About Us" description tells the story: Windtree Therapeutics now calls itself "a diversified company with several divisions and focused on becoming a revenue generating company with future profitability"—a far cry from its former identity as "a biotechnology company focused on advancing early and late-stage innovative therapies for critical conditions."

The Stock Price Collapse

The destruction of shareholder value has been staggering:

| Date | Stock Price | Event |

|---|---|---|

| January 2024 | $628.50 | — |

| November 2024 | $24.74 | CEO retirement announced |

| July 2025 | $1.05 | Crypto strategy announced |

| August 2025 | $0.11 | Nasdaq delisting |

| December 2025 | $0.04 | Pipeline sold |

| January 7, 2026 | $0.029 | COO resignation filed |

The company's market capitalization has shrunk to approximately $1.1 million—a rounding error in the biotech world.

What's Left at Windtree?

With Curtis's departure, Windtree's remaining executive team consists of:

- Jed Latkin - CEO (appointed December 2024), remains a board member

- Jamie McAndrew - CFO (appointed September 2024), previously the company's controller

The company's current "assets" include:

- BNB cryptocurrency holdings - Value fluctuates with crypto markets

- CommLoan acquisition (pending) - A commercial real estate fintech platform

- 20% royalty rights on cardiovascular assets sold to Seismic Pharmaceutical

- License agreement milestones - Up to $78.9 million potential payments from an Asian licensee for pulmonary treatments, though these are highly contingent

- A residential apartment complex in Houston, Texas—rights acquired through an assignment agreement in May 2025

None of these involve drug development. The transformation from biotech to speculative holding company is complete.

The Context: Why Curtis Stayed This Long

Curtis's nearly six-year tenure through this chaos raises questions about why he remained as long as he did. Former colleagues describe him as deeply committed to the company's original mission—advancing treatments for acute heart failure, a condition affecting millions with limited treatment options.

Istaroxime, the company's lead asset, had shown promising Phase 2 results. As late as Q3 2025, Windtree was still enrolling patients in a cardiogenic shock trial, with plans for interim data in late 2025 and potential Phase 3 readiness discussions with regulators in early 2026.

But the company's pivot to cryptocurrency and repeated strategic pivots made continued drug development untenable. The December sale of the cardiovascular portfolio—Curtis's primary responsibility—left him with nothing to manage.

The 8-K filing offers no reason for Curtis's departure, simply stating he "resigned as President and Chief Operating Officer of Windtree Therapeutics, Inc., effective immediately." The terseness speaks volumes.

What Comes Next?

Windtree's new direction requires fundamentally different skills than drug development. CEO Jed Latkin has touted the CommLoan acquisition as providing "a unique advantage to seize on the growing trend in using software and AI to streamline the lending process."

Whether a tiny OTC-traded shell company with a cryptocurrency treasury and a pending fintech acquisition can create shareholder value remains to be seen. The pipeline of promising heart failure treatments is now in the hands of an unknown investment group with no track record in drug development.

For Curtis, the departure marks the end of an effort to advance treatments that might have helped millions of heart failure patients. For Windtree shareholders who bought into the biotech story, it marks the final confirmation that that story is over.

The stock traded at $0.029 at the close on January 7, 2026—down 4.25% on the day of the filing. With a market cap barely exceeding $1 million, even that movement involved just a few hundred thousand dollars changing hands.

Related: