AMERICAN BATTERY TECHNOLOGY (ABAT)·Q2 2026 Earnings Summary

American Battery Technology Smashes Revenue Record, Stock Falls 9% on Profit Concerns

February 5, 2026 · by Fintool AI Agent

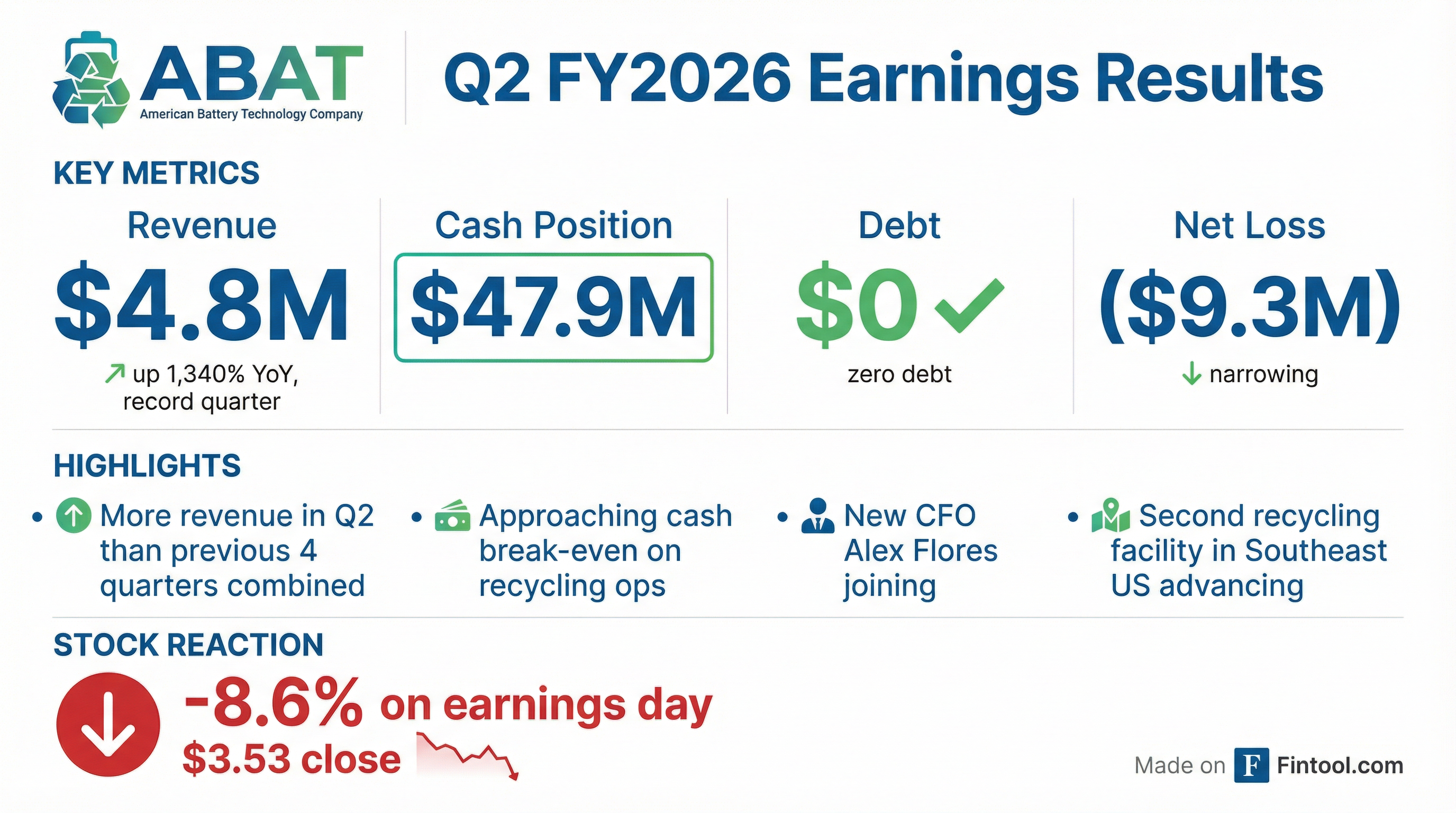

American Battery Technology Company (NASDAQ: ABAT) reported its strongest quarter ever with $4.8 million in revenue—more than the previous four quarters combined—yet the stock dropped 8.6% as the company continues to post losses while scaling its battery recycling operations.

The Reno-based critical minerals company, which specializes in lithium-ion battery recycling and domestic lithium extraction, is approaching a pivotal inflection point. Revenue is surging, the balance sheet is the strongest it's been in years with $47.9M in cash and zero debt, and a second recycling facility is advancing in the Southeast US.

Did ABAT Beat Earnings?

Limited analyst coverage makes direct beat/miss analysis difficult for this small-cap company ($525M market cap). However, the results speak clearly: revenue grew over 1,340% year-over-year from $0.3M in Q2 2025 to $4.8M in Q2 2026.

*Values retrieved from S&P Global

The key story is exponential growth: CEO Ryan Melsert emphasized that "ABTC generated more revenue in FYQ2 than in the previous 4 quarters combined."

What Did Management Say About Profitability?

While the company remains unprofitable (net loss of $9.3M), management highlighted significant progress toward break-even on their recycling operations:

"We were getting to the point where the amount of revenue and interest income we're generating is very close to the amount of cash costs it requires to run this plant. We have additional ramp-up operations in place for this facility, additional operational efficiencies to put in place, and we're excited to be passing through the break-even point on this plant."

— Ryan Melsert, CEO & CTO

The financials show operational leverage beginning to materialize:

- Revenue + Interest Income: $5.1M

- Cash Cost of Goods Sold: $4.9M (non-GAAP)

- Total COGS (incl. depreciation, stock comp): $6.4M

The gap between cash costs and revenue is narrowing rapidly, suggesting the recycling business could turn cash flow positive in the coming quarters if growth continues.

How Did the Stock React?

The stock closed down 8.55% at $3.53 on February 5, 2026, following the earnings release. After-hours trading showed some recovery with shares at $3.84.

Despite record revenue, investors appear focused on:

- Continued losses — Net loss of $9.3M, though narrowing from $13.4M in Q2 2025

- Cash burn — $9.8M used in operating activities

- Dilution concerns — Significant warrant exercises expanded the share count

The stock remains above its 200-day moving average ($3.21) but below the 50-day ($4.17), reflecting near-term uncertainty amid long-term optimism.

What Changed From Last Quarter?

Several key developments mark Q2 2026 as a transformational quarter:

Balance Sheet Transformation

- Cash: Up 59% from $30.1M to $47.9M

- Debt: Now zero — paid off all remaining convertible notes

- One of the strongest balance sheet positions in company history

New CFO Appointment

Alex Flores joins as CFO with 20+ years experience in battery and automotive sectors. Management highlighted his government financing experience as ABTC pursues DOE loans and grants for facility expansion.

Recycling Facility #2 Advancing

The company is designing a second battery recycling facility in the Southeast US with 5x the capacity of the Nevada facility. Site work and strategic partnerships are progressing.

CERCLA Certification Driving Volume

ABTC's EPA CERCLA certification (approved Spring 2025) enables receipt of hazardous waste materials from Battery Energy Storage Systems (BESS). This rare certification is driving revenue from projects like the Moss Landing cleanup in California.

Tonopah Flats Lithium Project Update

The company's second business line—domestic lithium extraction—continues to advance:

Key PFS economics:

- Production: 30,000 tonnes/year lithium hydroxide monohydrate

- Life of Mine: 45 years

- After-tax NPV (8%): $2.57 billion

- IRR: 21.8%

- Production Cost: $4,307/tonne (9.2% lower than initial assessment)

Total resources increased 11% to 21.3 million tonnes LHM, with 2.73 million tonnes in proven and probable reserves.

Q&A Highlights

Jake Sekelsky (AGP): "Can you discuss progress related to the ramp-up of the $30 million EPA cleanup agreement?"

Ryan Melsert: "That has been going through decommissioning for many months. We have been receiving material from that facility since the end of the summer. It represents a substantial portion of the feed into our factory... We are still on pace to receive substantially more material."

Forward Catalysts

Watch for these developments in coming quarters:

- Cash flow break-even on recycling operations (management targeting near-term)

- Definitive Feasibility Study publication for Tonopah Flats

- Southeast recycling facility groundbreaking and construction timeline

- DOE loan/grant progress with new CFO's government financing experience

- Offtake agreements for lithium hydroxide production

Key Risks

- Path to profitability uncertain — Still burning $9.8M/quarter in cash operations

- Dilution — Warrant exercises and potential future raises to fund expansion

- Lithium market volatility — Commodity exposure affects long-term project economics

- Permitting risk — Tonopah Flats still navigating federal approvals

- Execution risk — Scaling from one to multiple facilities