Earnings summaries and quarterly performance for AMERICAN BATTERY TECHNOLOGY.

Executive leadership at AMERICAN BATTERY TECHNOLOGY.

Board of directors at AMERICAN BATTERY TECHNOLOGY.

Research analysts who have asked questions during AMERICAN BATTERY TECHNOLOGY earnings calls.

Recent press releases and 8-K filings for ABAT.

American Battery Technology Company Reports Record Q2 FY26 Revenue and Key Cash Flow Milestone

ABAT

Earnings

Revenue Acceleration/Inflection

New Projects/Investments

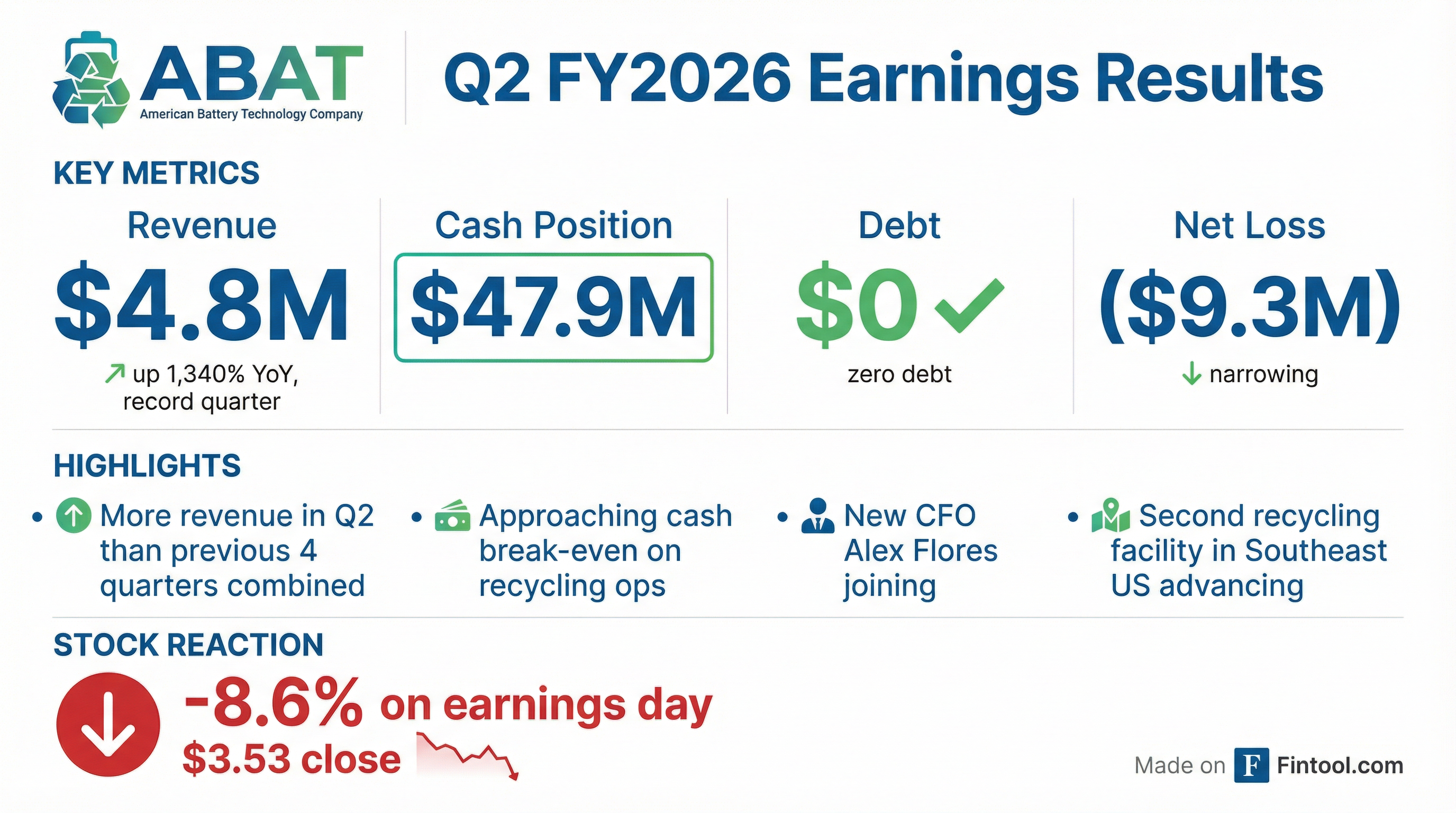

- American Battery Technology Company (ABAT) reported record-breaking revenue for Q2 Fiscal Year 2026, with revenue from operations reaching $4.8 million for the quarter ended December 31, 2025, representing an increase of over 1,300% year-over-year, while total operating expenses decreased 24% year-over-year.

- For the first time, the company's combined revenue and interest income of $5.1 million exceeded its cash cost of goods sold of $4.9 million for the quarter. ABAT maintains a strong financial position with a cash balance of $48.7 million and zero debt as of December 31, 2025.

- The company is advancing its Tonopah Flats Lithium Project, which has an after-tax Net Present Value (NPV) of $2.57 billion and 2.73 million tonnes of proven and probable lithium hydroxide monohydrate (LHM) reserves, and is also accelerating the design of a second battery recycling facility with approximately five-fold the capacity of its first facility.

Feb 9, 2026, 9:45 PM

ABTC announces Q2 FY26 results and strategic project advancements

ABAT

Earnings

New Projects/Investments

CFO Change

- American Battery Technology Company (ABTC) reported $5.1 million in revenue and interest income for Q2 FY26, with $4.8 million from operations, and maintained a strong financial position with $48.7 million in cash and zero debt at quarter-end.

- The company's battery recycling operations achieved record-breaking revenue growth and are accelerating plans for a second facility in the Southeast US with approximately five-fold the capacity of its first facility.

- ABTC's Tonopah Flats Lithium Project (TFLP) advanced to the Definitive Feasibility Study phase, with its October 2025 Pre-Feasibility Study projecting 30,000 tonnes per year of lithium hydroxide monohydrate (LHM) production, an after-tax NPV of $2.57 billion, and an IRR of 21.8%.

- Alex Flores was appointed as the new Chief Financial Officer, bringing over 20 years of financial leadership experience in the battery and automotive sectors.

Feb 5, 2026, 9:30 PM

American Battery Technology Company Enters Lithium-Ion Battery Recycling Agreement with Veolia

ABAT

New Projects/Investments

- American Battery Technology Company (ABAT) entered into the Moss Landing Amendment 2 to its Recycling/Reclamation Services Agreement with Veolia ES Technical Solutions, L.L.C. on November 5, 2025.

- Under this amendment, ABAT will provide recycling services for lithium-ion battery products originating from the Moss Landing Battery Energy Storage System in Monterey County, California.

- Veolia controls a minimum of 35,156 accessible modules, totaling 6,892,340 pounds or 3,126 metric tons, of LG Lithium-Ion battery products (NMC chemistries) at the Moss Landing Phase 1 Project, which ABAT will acquire and recycle.

- The amendment, effective October 9, 2025, stipulates that title to the recyclable material transfers to ABAT upon delivery, and Veolia will compensate ABAT for the services provided.

Nov 6, 2025, 1:30 PM

American Battery Technology Company Faces Investor Investigation Following Grant Termination

ABAT

Legal Proceedings

New Projects/Investments

- Pomerantz LLP is investigating American Battery Technology Company (ABAT) for potential securities fraud or other unlawful business practices.

- The investigation stems from the company's disclosure on October 15, 2025, that the U.S. Department of Energy (DoE) terminated a $57.7 million grant for the construction of a battery cathode grade lithium hydroxide manufacturing facility.

- Following this news, American Battery's stock price fell $6.48 per share, or 57.19%, over three trading sessions, closing at $1.85 per share on October 17, 2025.

Oct 28, 2025, 2:00 PM

American Battery Technology Company Publishes Tonopah Flats Lithium Project Pre-Feasibility Study

ABAT

New Projects/Investments

Guidance Update

- American Battery Technology Company (ABAT) published a Pre-Feasibility Study (PFS) for its Tonopah Flats Lithium Project, highlighting an after-tax NPV@8% of $2.57 billion, an IRR of 21.8%, and a 7.5-year payback from initial investment.

- The project is designed for a 45-year life-of-mine, producing 30,000 tonnes/year of lithium hydroxide monohydrate (LHM), with a production cost of $4,307/tonne LHM and total operating costs of $6,994/t produced LHM.

- The PFS established 2.73 million tonnes of LHM proven and probable reserves and reported a 53% increase in Measured and Indicated Resources compared to the April 2024 Initial Assessment.

- The project received initial approval for $900 million in low-cost debt financing from the US Export-Import Bank and was designated a full Covered Project by the FAST-41 Permitting Council for streamlined permitting.

Oct 16, 2025, 6:58 PM

American Battery Technology Company Completes NEPA Baseline Studies for Tonopah Flats Lithium Project

ABAT

New Projects/Investments

Debt Issuance

- American Battery Technology Company (ABAT) announced on October 13, 2025, the completion and submission of all required National Environmental Policy Act (NEPA) baseline studies for its Tonopah Flats Lithium Project (TFLP) to the U.S. Bureau of Land Management (BLM).

- This achievement, which involved over two years of dedicated effort, represents a major milestone in the federal permitting process for the TFLP, identified as one of the largest critical mineral lithium projects in the U.S..

- ABTC has also submitted a comprehensive Mine Plan of Operations (MPO) for the TFLP, which is currently under review by the BLM.

- The TFLP was designated a FAST-41 Covered Priority Project in 2025 and received a $900 million Letter of Interest from the Export-Import Bank of the United States (EXIM) for a low-interest loan to support its expansion.

Oct 14, 2025, 9:00 PM

American Battery Technology Company Reports Strong Q4 and FY 2025 Revenue Growth and Operational Progress

ABAT

Earnings

Revenue Acceleration/Inflection

New Projects/Investments

- American Battery Technology Company (ABAT) reported a substantial increase in revenue for both Q4 2025 and fiscal year 2025, with Q4 revenue nearly tripling compared to the quarter ending March, and full-year revenue reaching approximately $4.3 million compared to $0.3 million in the prior year.

- The company's cash balance rose to just over $25 million as of September 15, 2025, driven by financing activities and the exercising of warrants, further supported by its inclusion in the Russell 2000 and 3000 indices in June.

- Operational progress includes a 70% increase in throughput at its first battery recycling plant in the quarter ending June versus March, and the initiation of a second battery recycling plant project in January 2025, supported by a $144 million U.S. Department of Energy grant.

- The Tonopah Flats lithium project advanced significantly, completing its demonstration-scale facility and being designated a "covered project" in August, which accelerates federal permitting, and is also being facilitated for a $900 million low-interest loan from the U.S. Export-Import Bank.

Sep 22, 2025, 8:30 PM

AMERICAN BATTERY TECHNOLOGY reports FY25 financial results and details mineral resource assessments

ABAT

Earnings

New Projects/Investments

Revenue Acceleration/Inflection

- AMERICAN BATTERY TECHNOLOGY (ABAT) reported FY25 revenue of $4.3 million, a significant increase from $0.3 million in FY24, primarily driven by the ramp-up of its recycling facility.

- The company secured substantial government funding, with $5.8 million from grants in FY25 and a balance of $203.8 million on contracted government grants, including a new grant for its second recycling facility.

- ABAT's liquidity position improved, with a cash balance of $25.4 million as of September 15, 2025, and it was awarded $60.1 million in Investment Tax Credits to be monetized.

- The documents also provide detailed information regarding mineral resource estimates and classifications, including Initial Assessment, Inferred, Indicated, and Measured Resources, and Pre-Feasibility Studies, which were performed by third-party qualified person RESPEC, LLC.

Sep 22, 2025, 8:30 PM

ABAT Reports Substantial Revenue Growth and Key Project Advancements in Q4 2025

ABAT

Earnings

Revenue Acceleration/Inflection

New Projects/Investments

- American Battery Technology Company (ABAT) reported a substantial increase in revenue for fiscal year 2025, reaching approximately $4.3 million compared to $0.3 million in the prior year, with Q4 2025 revenue nearly tripling compared to the previous quarter. The company's cash balance also increased to over $25 million as of September 15, 2025.

- The company achieved a 70% increase in throughput at its first battery recycling plant in Q4 2025 and secured a $144 million grant from the U.S. Department of Energy to construct a second battery recycling plant, with the project commencing in January 2025.

- ABAT completed its multi-ton-per-day integrated pilot facility for claystone to lithium hydroxide and had its Tonopah Flats Lithium Project designated as a "covered project" for streamlined federal permitting, supported by a letter of interest for a $900 million low-interest loan from the U.S. Export-Import Bank.

- The company was listed on the Russell 2000 and 3000 indices in June, leading to a significant increase in trading volume and institutional ownership.

Sep 22, 2025, 8:30 PM

American Battery Technology Company Reports Strong Q4 2025 Revenue Growth and Key Project Advancements

ABAT

Earnings

New Projects/Investments

Revenue Acceleration/Inflection

- American Battery Technology Company reported a significant increase in revenue for Q4 2025, nearly tripling compared to the previous quarter, and full-year revenue grew to approximately $4,300,000 from $300,000 the prior year, with a smaller relative increase in costs leading to improved gross margins.

- The company's first battery recycling plant increased throughput by approximately 70% in the quarter ending June versus March. ABAT was awarded a $144,000,000 grant from the U.S. Department of Energy for a second battery recycling plant, with construction commencing in January 2025.

- The Tonopah Flats Lithium project achieved "covered project" status with the Fast 41 Permitting Council, streamlining federal permitting, and received a letter of interest for a $900,000,000 low-interest loan from the US Export Import Bank.

- The cash balance increased to just over $25,000,000 as of September 15, 2025, supported by financing activities and the company's inclusion in the Russell 2000 and 3000 indices in June, which boosted trading volume and institutional ownership.

Sep 22, 2025, 8:30 PM

Fintool News

In-depth analysis and coverage of AMERICAN BATTERY TECHNOLOGY.

Quarterly earnings call transcripts for AMERICAN BATTERY TECHNOLOGY.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more