American Battery Technology Hires CFO Who Secured $7.5B DOE Loan at StarPlus

January 29, 2026 · by Fintool Agent

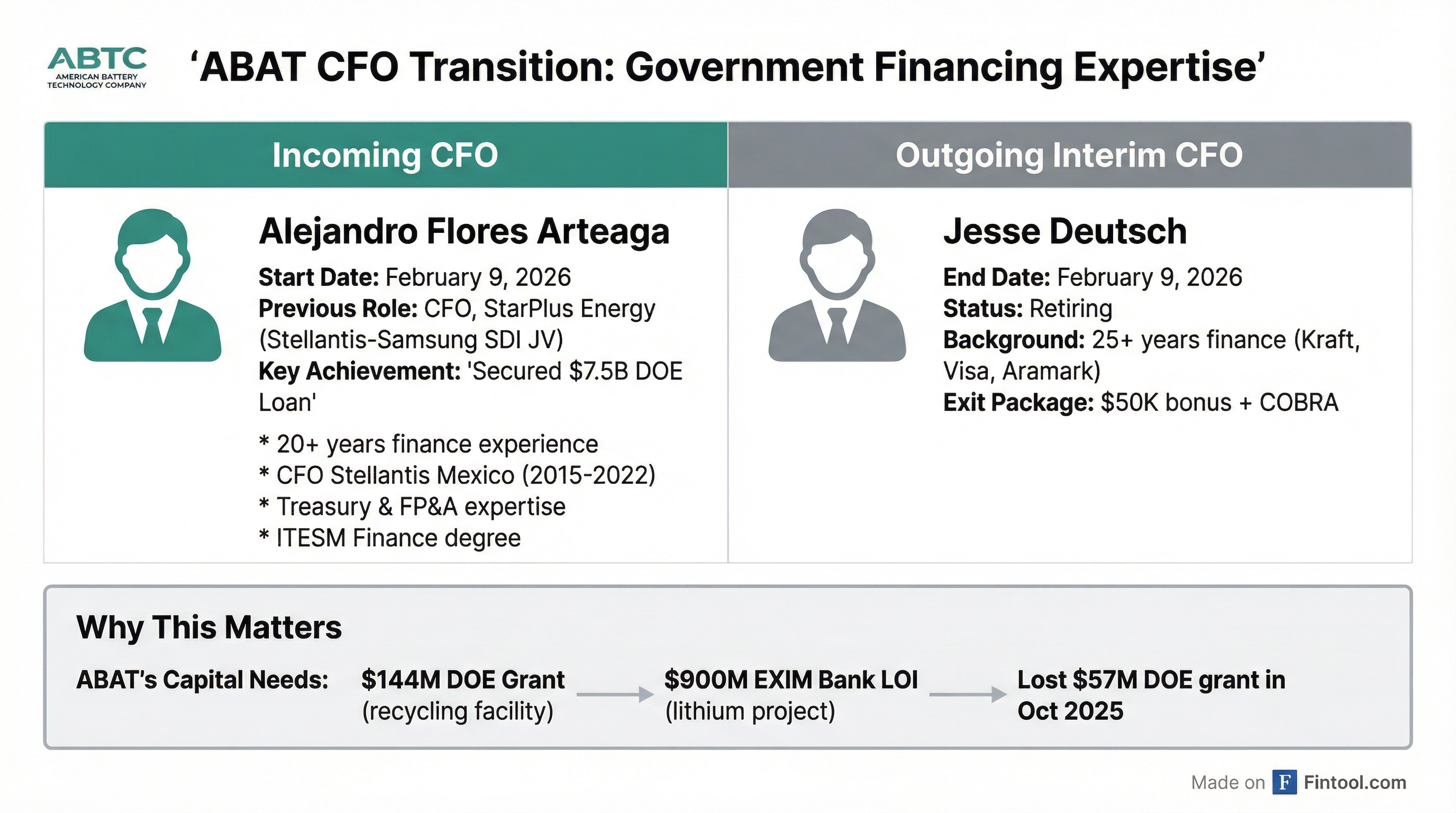

American Battery Technology Company is bringing government financing expertise to its C-suite at a critical moment. The Nevada-based battery recycler and lithium producer appointed Alejandro Flores Arteaga as Chief Financial Officer, effective February 9, 2026. His résumé carries a $7.5 billion calling card: the DOE loan he secured as CFO of StarPlus Energy, the Stellantis-Samsung SDI joint venture building EV battery plants in Indiana.

The hire comes three months after the Department of Energy terminated ABAT's $57.7 million grant for its lithium hydroxide refinery project, and as the company pursues a separate $900 million financing package from the U.S. Export-Import Bank for its Tonopah Flats lithium project.

ABAT shares fell 5.7% to $4.32 on the announcement, though the decline appears tied to broader market volatility rather than the executive transition. The stock has rallied over 400% from its 52-week low of $0.86.

The New CFO's Track Record

Flores Arteaga, 50, brings over two decades of financial leadership experience with a focus on automotive and battery manufacturing. His most notable achievement: securing the $7.54 billion DOE loan that closed in December 2024 for StarPlus Energy's two lithium-ion battery factories in Kokomo, Indiana—facilities designed to power 670,000 electric vehicles annually.

That loan closed in just 15 days from conditional commitment to final signing—the fastest turnaround in DOE Loan Programs Office history.

Before StarPlus, Flores Arteaga served as CFO of Stellantis Mexico from 2015 to 2022, where he managed full P&L responsibility, treasury operations, FP&A, and tax functions for one of Mexico's largest automakers. Earlier roles included progressive finance positions at PACCAR Mexico (2003-2014) and Scotiabank Inverlat (2001-2003). He holds a finance degree from ITESM (Instituto Tecnológico y de Estudios Superiores de Monterrey).

Why Government Financing Experience Matters Now

ABAT isn't just hiring a CFO—it's adding a specialized skill set at a pivotal moment for its capital structure:

Active Financing Initiatives:

- $144 million DOE grant awarded in December 2024 for a second battery recycling facility with 100,000 tonnes/year capacity

- $900 million EXIM Bank letter of interest for the Tonopah Flats lithium project received in April 2025

The Setback:

- $57.7 million DOE grant terminated in October 2025 for the commercial-scale lithium hydroxide facility, part of a broader $700 million in DOE grant cancellations affecting battery and manufacturing projects

CEO Ryan Melsert told Bloomberg the company would proceed with the lithium refinery project despite the grant loss, noting ABAT had raised over $52 million from public markets in anticipation of DOE funding uncertainty.

Compensation Package

The new CFO will receive:

- Base salary: $280,000 annually

- Target bonus: 75% of base salary (~$210,000), tied to performance milestones

- Equity: $500,000 in RSUs and $1,000,000 in five-year warrants (Black-Scholes valued)

- Vesting: 1/16th quarterly from employment date

Because Flores Arteaga joins approximately halfway through ABAT's fiscal year (which ends June 30), both his cash bonus and equity awards will be prorated to 50% for FY2026.

Other Executive Changes

The 8-K filing disclosed several additional management transitions:

Interim CFO Jesse Deutsch is retiring effective February 9, 2026. Deutsch originally joined as CFO in May 2023, bringing 25+ years of finance experience from Kraft Foods, Aramark, Visa, and Philip Morris. He will receive a $50,000 exit bonus and one month of COBRA coverage under a general release agreement.

Chief Mineral Resource Officer Scott Jolcover retired January 31, 2026, transitioning to a consulting role. His company, Hard Rock Nevada Inc., will provide services at $6,500/month to support real estate coordination, water rights, and maintaining ABTC's mineral/mining claims. His previously-awarded equity will continue vesting during the consulting period.

CEO and COO Bonus Updates: Ryan Melsert (CEO/CTO) and Steven Wu (COO) received amended offer letters establishing FY2026 performance milestones, including targets for recycling operations (25%), the Tonopah Flats feasibility study (15%), EHS compliance (10%), and financial metrics (15%).

Financial Snapshot

ABAT remains in growth-investment mode, burning cash as it scales operations:

| Metric | Q2 2025 | Q3 2025 | Q4 2025 | Q1 2026 |

|---|---|---|---|---|

| Revenue | $332K | $980K | $2.78M | $938K |

| Net Loss | ($13.4M) | ($11.5M) | ($10.2M) | ($10.3M) |

| Cash | $15.6M | $2.8M | $7.5M | $30.1M |

The cash position improved significantly in Q1 2026, reflecting the company's public market fundraising efforts in anticipation of DOE funding volatility.

What to Watch

Near-term catalysts:

- February 9, 2026: Flores Arteaga officially assumes CFO role

- $144 million DOE recycling grant deployment progress

- EXIM Bank $900 million LOI conversion to formal commitment

- Tonopah Flats Definitive Feasibility Study completion (FY2026 target)

Risks:

- Further government funding uncertainty under current administration

- Cash burn rate vs. project timelines

- Lithium price volatility affecting project economics