AbbVie (ABBV)·Q4 2025 Earnings Summary

AbbVie Beats Q4 But Stock Tanks 7%: Skyrizi Hits $5B, Guidance Only Slightly Above Consensus

February 4, 2026 · by Fintool AI Agent

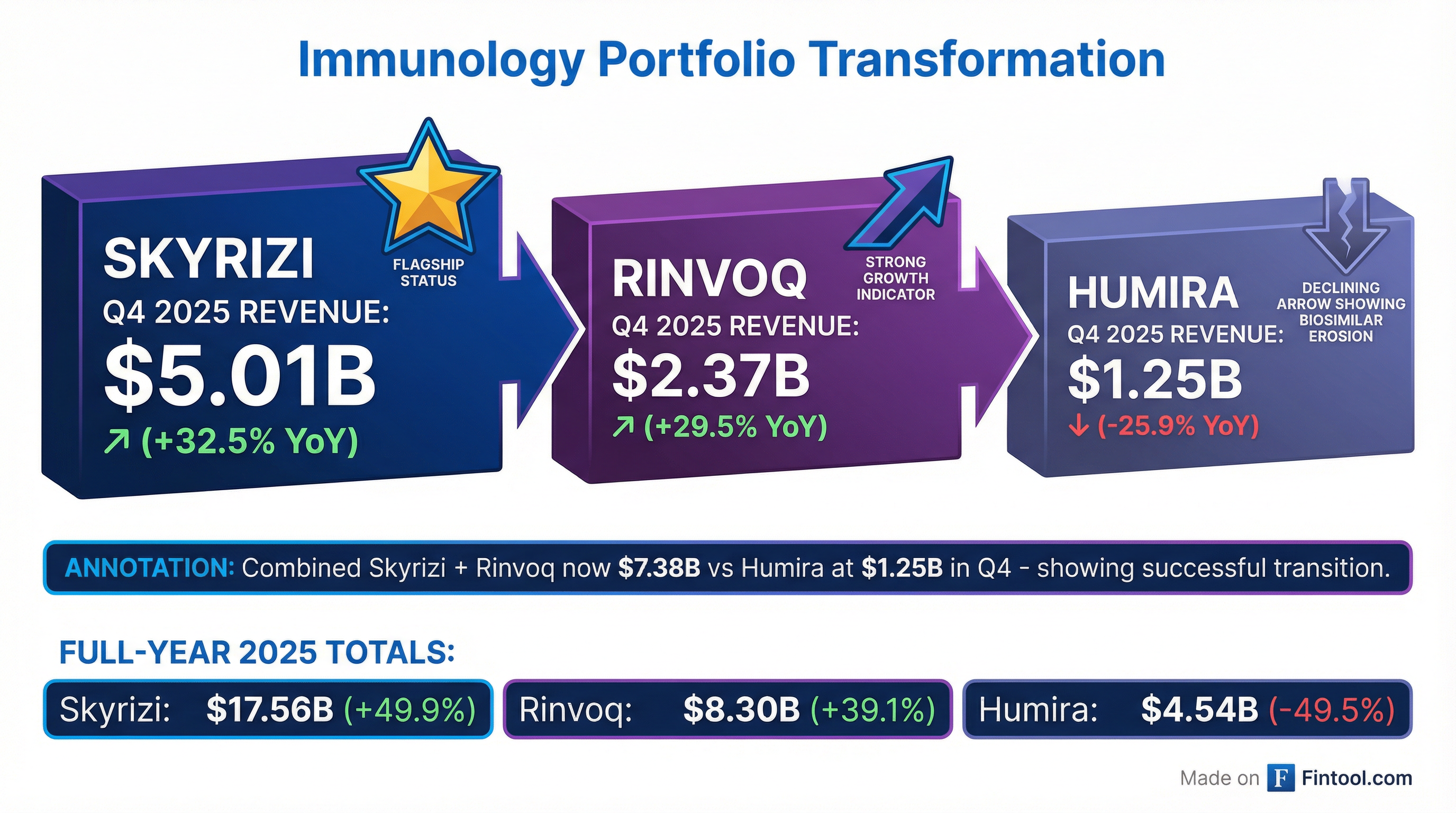

AbbVie delivered a double beat in Q4 2025, posting revenue of $16.6B (+10% YoY) and adjusted EPS of $2.71 (+2.3% vs consensus), capping a record year with $61.2B in total sales despite $16B of cumulative Humira erosion . Skyrizi crossed $5B quarterly revenue for the first time (+31.9% YoY), cementing the immunology transition thesis. But investors weren't impressed — shares plunged 7% to $209.69, erasing $28B in market cap, as 2026 EPS guidance of $14.37-$14.57 came in only marginally above the $14.32 consensus .

Did AbbVie Beat Earnings?

Yes — both revenue and EPS exceeded expectations, but guidance disappointed.

Full-Year 2025 Summary:

CEO Rob Michael: "We delivered full-year adjusted earnings per share of $10, which is $0.54 above our initial guidance midpoint, excluding the impact of IPRD expense. Total net revenues were $61.2 billion, beating our initial guidance by more than $2 billion."

What Did Management Guide?

AbbVie issued FY 2026 adjusted diluted EPS guidance of $14.37-$14.57, only modestly above the $14.32 consensus .

Detailed 2026 Product Guidance

Key guidance notes:

- Guidance excludes any acquired IPR&D and milestones expense

- Skyrizi + Rinvoq combined at $31.6B exceeds 2027 long-term guidance by $500M

- Vyalev expected to achieve blockbuster status ($1B+) in its first full year

- Low single-digit pricing headwinds expected for Skyrizi and Rinvoq

CEO Rob Michael stated: "We are entering 2026 with substantial momentum and remain well-positioned to deliver another year of strong growth... We are also forecasting a substantial sales ramp for Vyalev, achieving blockbuster status this year."

What Changed This Quarter?

The Humira Transition is Complete

AbbVie's immunology franchise has fundamentally transformed. In Q4 2025:

Skyrizi and Rinvoq now generate 6x Humira's quarterly revenue. The combined FY 2025 revenue of $25.9B increased by more than $8B YoY , and AbbVie has already exceeded its 2027 combined guidance by $500M .

Pipeline & Business Development

AbbVie increased adjusted R&D expense by nearly $1B in 2025, fully funding 90 clinical programs . Key 2025 milestones:

New approvals:

- Rinvoq for GCA (giant cell arteritis)

- Emrelis for non-squamous non-small cell lung cancer

- Epkinly for second-line follicular lymphoma

Recent acquisitions ($5B+ invested in 2025):

- Capstan Therapeutics: In vivo CAR-T platform in immunology

- Bretisilocin: Next-generation psychedelic for depression

- ISB 2001: Novel trispecific antibody for multiple myeloma

- ABBV-295: Long-acting amylin analog for obesity

- ADARx: Next-generation siRNA platform

- RemeGen: PD-1/VEGF bispecific for solid tumors

Trump Administration Deal

AbbVie announced a three-year voluntary agreement with the Trump administration :

AbbVie receives:

- Exemption from tariffs during the term

- Exemption from future pricing mandates (including demonstration projects)

AbbVie commits to:

- Low prices in Medicaid

- Expanded direct-to-patient cash pay options for select products

- $100 billion in U.S. R&D and capital investments over the next decade

How Did Each Segment Perform?

Standout performers:

- Qulipta (migraine): $288M

- Ubrelvy (migraine): $339M

- Vyalev (Parkinson's): $183M (+33% sequentially)

- Vraylar (psychiatry): $1.0B

Full-Year 2025 Neuroscience: $10.7B (+$1.8B YoY, nearly 20% growth)

How Did the Stock React?

Despite the double beat, ABBV shares plunged 7.1% to $209.69 on the day, erasing approximately $28 billion in market cap.

Why the selloff on a beat?

- Guidance of $14.37-$14.57 was only marginally above $14.32 consensus — no upside surprise

- Oncology (-2.5% YoY) and Aesthetics (-1.2% YoY) remain weak spots

- Acquired IPR&D spend of $0.71/share in Q4 alone weighed on reported earnings

- Stock had rallied ~37% over 12 months heading into earnings (52-week high: $244.81)

- Imbruvica IRA pricing headwinds expected to unfavorably impact oncology in 2026

Stock context:

- 52-week high: $244.81

- 52-week low: $164.39

- Current: $209.69 (-14% from 52-week high)

Key Financial Metrics

Margins (Q4 2025)

Note: Q4 operating margin includes 7.6% unfavorable impact from acquired IPR&D expense .

2026 Margin Guidance

Operating margin expected to expand meaningfully vs 2025 .

Q&A Highlights: What Analysts Asked

On Skyrizi/Rinvoq Upside Potential

Chris Schott (J.P. Morgan) asked whether the street now fully understands Skyrizi/Rinvoq potential. CEO Rob Michael pushed back:

"I see numerous sources of upside across the enterprise... Obviously, the combined guidance for this year is already $500 million higher than our 2027 estimate. And we do expect both Skyrizi and Rinvoq to grow robustly into the 2030s."

On IBD competition specifically, Jeff Stewart noted Skyrizi maintains a 75% capture rate in frontline IBD overall, with 80% in Crohn's disease specifically .

On Neuroscience Underappreciation

Rob Michael highlighted neuroscience as undervalued by the street:

"Neuroscience clearly overperforming. We delivered nearly 20% growth last year. We expect to deliver mid-teens growth this year. It'll put us in the number one position in the industry."

He outlined three $5B+ peak franchises in neuroscience:

- Parkinson's (Vyalev + Duopa + Tavapadon): >$5B peak potential

- Migraine (Ubrelvy + Qulipta): >$5B peak (vs prior $3B guidance)

- Psychiatry: $5B from next-gen assets to replace Vraylar post-LOE (2030)

On Bretisilocin (Psychedelic for Depression)

David Risinger (Leerink) asked about the psychedelic pipeline. Roopal Thakkar explained:

"This has potential to be highly differentiated. We see very high levels of efficacy... almost led to a remission-like state in the majority of patients."

Key differentiators: Short-acting hallucinogen (~2.5-3 weeks duration), rapid efficacy, patients can leave clinic quickly. Phase 3 plans after two more readouts expected by Q3 2026 .

On BD Strategy and Late-Stage Deals

Terence Flynn (Morgan Stanley) asked about business development. Rob Michael:

"We're clearly focused on early-stage opportunities... That's also why we utilize BD to enter into another growth area in obesity... To the extent we see a differentiated asset in any of our core areas, whether early or late stage... We are willing to invest in late-stage assets."

AbbVie has invested $8B+ in external innovation over the past two years with 30+ deals .

On Aesthetics Recovery and Trenibot E

Asad Haider (Goldman Sachs) asked about Trenibot E (short-acting toxin). Jeff Stewart:

"We believe when we look at the patient funnel that at peak, we could potentially up to double the inflow of patients... The real commercial impact goes to your conversion rate... we have a much higher conversion rate than our existing share."

Trenibot approval expected later in 2026, with sales impact gating heavily into 2027-2028 .

Forward Catalysts

Regulatory Decisions (2026)

Key Data Readouts (2026)

Strategic Catalysts

- Skyrizi vs Entyvio head-to-head — Results expected shortly; major competitive catalyst in IBD

- Venclexta + Calquence combo approvals — Global approvals in CLL expected 2026

- Migraine market expansion — Ubrelvy menstrual migraine filing expected 2027, Qulipta in 2H 2026

- $100B U.S. investment commitment — Part of Trump administration deal

Bottom Line

AbbVie delivered another beat, but the 7% stock selloff signals expectations have outpaced execution. The Humira-to-Skyrizi/Rinvoq transition is complete — the newer drugs now generate 6x Humira's quarterly revenue and 2026 guidance of $31.6B combined exceeds 2027 long-term targets by $500M .

The fundamental story remains intact:

- Record sales: $61.2B in FY 2025, guiding to $67B in 2026 (+9.5%)

- Expanding margins: Adjusted operating margin expected at 48.5% in 2026

- Deep pipeline: 90 clinical programs with multiple 2026 catalysts

- Capital return: $18.5B free cash flow, 330%+ dividend increase since inception

Key questions for 2026:

- Can Skyrizi maintain 30%+ growth as it scales past $20B annually?

- Will Vyalev's blockbuster trajectory ($1B+ guided) validate the Parkinson's franchise thesis?

- Can Aesthetics and Oncology return to growth, or will weakness persist?

- How will Botox IRA pricing (2028) affect long-term Botox Therapeutic margins?

For bulls, today's 7% drop may offer an entry point at 14% below the 52-week high with intact fundamentals. For bears, the lack of meaningful upside to guidance suggests expectations have normalized.

Data sources: AbbVie Q4 2025 earnings call transcript (February 4, 2026); S&P Global