Earnings summaries and quarterly performance for Adaptive Biotechnologies.

Executive leadership at Adaptive Biotechnologies.

Chad Robins

Chief Executive Officer

Francis Lo

Chief People Officer

Harlan Robins

Chief Scientific Officer

Julie Rubinstein

President and Chief Operating Officer

Kyle Piskel

Chief Financial Officer

Sharon Benzeno

Chief Commercial Officer, Immune Medicine

Susan Bobulsky

Chief Commercial Officer, MRD

Board of directors at Adaptive Biotechnologies.

Research analysts who have asked questions during Adaptive Biotechnologies earnings calls.

Mark Massaro

BTIG, LLC

6 questions for ADPT

David Westenberg

Piper Sandler

4 questions for ADPT

Sebastian Sandler

JPMorgan Chase & Co.

4 questions for ADPT

Andrew Brackmann

William Blair & Company, L.L.C.

3 questions for ADPT

Daniel Brennan

TD Cowen

3 questions for ADPT

Bill Bonello

Craig-Hallum Capital Group LLC

2 questions for ADPT

Dan Brennan

UBS

2 questions for ADPT

Subbu Nambi

Guggenheim Securities

2 questions for ADPT

Sung Ji Nam

Scotiabank

2 questions for ADPT

Tejas Savant

Morgan Stanley

2 questions for ADPT

Yuko Oku

Morgan Stanley

2 questions for ADPT

Corey Rosenbaum

Scotiabank

1 question for ADPT

Margarate Boeye

Raymond James

1 question for ADPT

Matthew Sykes

Goldman Sachs Group Inc.

1 question for ADPT

Rachel Vatnsdal Olson

JPMorgan

1 question for ADPT

Thomas Stevens

TD Cowen

1 question for ADPT

Recent press releases and 8-K filings for ADPT.

- Adaptive Biotechnologies reported total company revenue of $277 million for full-year 2025, a 55% year-over-year growth, and achieved positive adjusted EBITDA of $12.2 million for the full year, compared to a loss of $80.4 million in 2024.

- The MRD business was a key driver, with full-year revenue growing 46% year-over-year and achieving profitability ahead of expectations. clonoSEQ clinical testing revenue grew 64% for the full year, with Q4 2025 test volumes reaching a record 30,038 tests.

- In Immune Medicine, the company scaled its TCR antigen data and modeling capabilities, securing its first two data partnerships with Pfizer, while strategically deciding to stop further investment in its lead TCR-depleting antibody program to prioritize data generation and AI modeling.

- For 2026, Adaptive Biotechnologies expects full-year MRD revenue between $255 million and $265 million and anticipates achieving positive adjusted EBITDA and positive free cash flow for the entire company by the end of the year.

- Adaptive Biotechnologies reported strong Q4 2025 results, with total company revenue (excluding Genentech amortization) reaching $71.7 million, a 63% year-over-year increase, and full-year 2025 revenue of $235.7 million, up 42% year-over-year.

- The MRD business achieved profitability in 2025, with full-year revenue growing 46% and clonoSEQ test volumes increasing 43% year-over-year to 30,038 tests in Q4 2025, contributing to a full-year average ASP of $1,307 per test.

- The company achieved positive adjusted EBITDA of $4.1 million in Q4 2025 and $12.2 million for the full year, significantly improving from prior-year losses, and maintained a strong cash balance of $227 million at year-end.

- For 2026, Adaptive Biotechnologies projects full-year MRD business revenue between $255-$265 million, representing 22% year-over-year growth at the midpoint, with clonoSEQ test volumes expected to grow by more than 30% and an average ASP of approximately $1,400 per test. The company also expects to achieve positive adjusted EBITDA and positive free cash flow for the entire company by the end of 2026.

- Adaptive Biotechnologies reported Q4 2025 total revenue of $71.7 million, a 63% increase year-over-year, and full-year 2025 total revenue of $235.7 million, up 42% year-over-year (excluding Genentech amortization).

- The MRD business achieved profitability in 2025 with $15.2 million in adjusted EBITDA and saw its revenue grow 46% year-over-year to $212.12 million for the full year. clonoSEQ test volumes reached a record 30,038 tests in Q4 2025, up 43% year-over-year.

- The Immune Medicine business generated $23.4 million in revenue for the full year 2025, a 17% increase, and the company ended 2025 with a strong cash balance of $227 million.

- For full-year 2026, the company expects MRD business revenue between $255-$265 million and anticipates achieving positive adjusted EBITDA and positive free cash flow for the entire company by the end of 2026.

- Adaptive Biotechnologies reported FY 2025 revenue of $277M, a 55% year-over-year increase, with $212M from MRD and $65M from Immune Medicine.

- The MRD segment achieved positive adjusted EBITDA and positive cash flow in FY 2025, with clinical testing revenue growing 64% year-over-year.

- For FY 2026, the company expects MRD revenue between $255M and $265M and operating expenses between $350M and $360M.

- Adaptive Biotechnologies aims to achieve positive adjusted EBITDA and positive free cash flow for the entire company by the end of 2026.

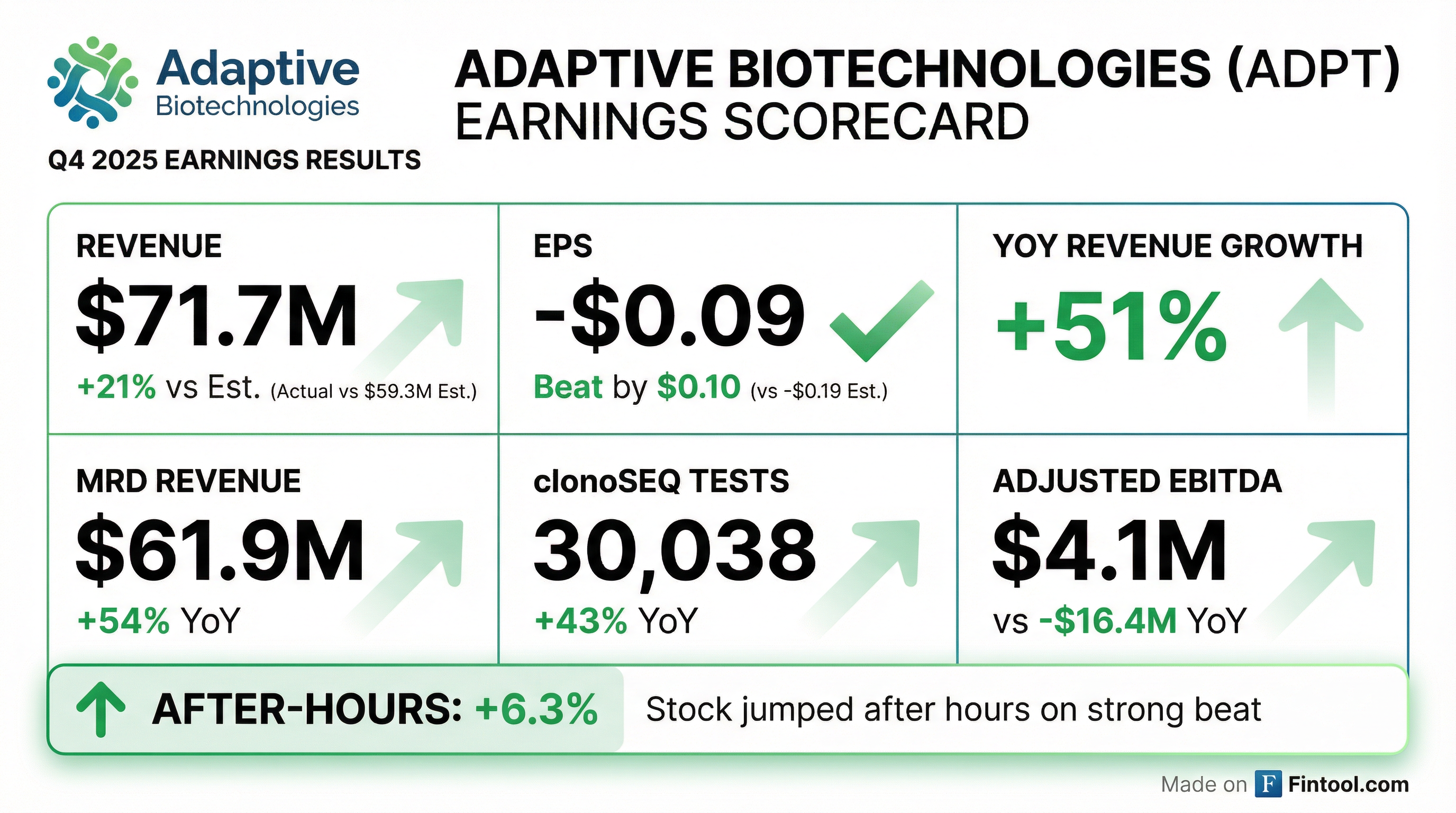

- Adaptive Biotechnologies reported total revenue of $71.7 million for Q4 2025, a 51% increase from the prior year, and $277.0 million for full year 2025, a 55% increase from the prior year.

- The company achieved positive Adjusted EBITDA of $4.1 million for Q4 2025 and $12.2 million for full year 2025, a significant improvement from losses in the prior year.

- The MRD business generated $61.9 million in revenue for Q4 2025 and $212.3 million for full year 2025, growing 54% and 46% respectively, and achieved positive Adjusted EBITDA and positive cash flow for the full year.

- clonoSEQ® test volume increased 43% to 30,038 tests in Q4 2025 and 39% to 105,587 tests for the full year 2025 compared to 2024.

- For full year 2026, Adaptive Biotechnologies expects MRD business revenue to be between $255 million and $265 million, and total company operating expenses between $350 million and $360 million.

- Adaptive Biotechnologies reported strong financial performance for Q4 and full year 2025, with total revenue reaching $71.7 million in Q4 (up 51% year-over-year) and $277.0 million for the full year (up 55% year-over-year). The MRD business was a key driver, contributing 86% of Q4 revenue and 77% of full year revenue, growing 54% and 46% respectively.

- The company achieved positive Adjusted EBITDA of $4.1 million for Q4 2025 and $12.2 million for full year 2025, a significant improvement from losses in the prior year. Notably, the MRD business achieved positive Adjusted EBITDA and positive cash flow in 2025.

- Operational highlights include a 43% increase in clonoSEQ test volume in Q4 2025 and expanded Medicare coverage for clonoSEQ. For 2026, the company forecasts MRD business revenue between $255 million and $265 million.

- Adaptin Bio has received the first Institutional Review Board (IRB) approval from the Preston Robert Tisch Brain Tumor Center for its Phase 1 clinical trial of APTN-101 for glioblastoma multiforme (GBM), enabling patient recruitment.

- APTN-101, the company's Brain Bispecific T cell Engager (BRiTE), is designed to redirect T cells to destroy cancer cells in the brain and demonstrated compelling anti-tumor activity and a favorable safety profile in preclinical studies.

- This advancement addresses an urgent unmet medical need for GBM, an aggressive brain tumor with over 12,000 new cases diagnosed annually in the United States and a global glioma treatment market projected to reach approximately $4.4 billion.

- Adaptive reports over $275 million in revenue and a cash position of approximately $227 million as of January 13, 2026.

- The minimal residual disease (MRD) business achieved positive adjusted EBITDA in 2025 and its revenue surpassed $200 million with a 34% cumulative average growth rate from 2021 to 2025.

- For fiscal year 2026, the company expects MRD clinical testing volume to grow by more than 30% year-over-year, with an average selling price (ASP) of approximately $1,400, and sequencing gross margins to reach over 70%.

- The Immune Medicine (IM) business is projected to have a lower cash burn of between $15 million and $20 million in 2026, down from approximately $30 million in 2025.

- Adaptive anticipates achieving positive adjusted EBITDA and positive free cash flow for the entire company in 2026.

- Adaptive (ADPT) expects to achieve positive adjusted EBITDA and positive free cash flow for the entire company in 2026.

- The minimal residual disease (MRD) business is projected to grow clinical testing volume by more than 30% year-over-year in fiscal year 2026, with an anticipated Average Selling Price (ASP) of approximately $1,400 and sequencing gross margins expected to exceed 70%.

- The MRD business achieved positive adjusted EBITDA in 2025 and saw its revenue scale consistently with a 34% cumulative average growth rate from 2021 to 2025, now surpassing $200 million.

- The Immune Medicine business has scaled its TCR antigen dataset to 5 million paired T-cell receptors and executed two data agreements with Pfizer, while expecting a lower cash burn of between $15 and $20 million in 2026.

- Adaptive's Minimal Residual Disease (MRD) business achieved positive adjusted EBITDA and positive cash flow in 2025, with revenue surpassing $200 million and growing at a 34% cumulative average growth rate from 2021-2025.

- For fiscal year 2026, the company expects clinical testing volume to grow by more than 30% year-over-year and an average selling price (ASP) of approximately $1,400.

- Adaptive anticipates achieving positive adjusted EBITDA and positive free cash flow for the entire company in 2026, supported by a projected reduction in the Immune Medicine business's cash burn from approximately $30 million in 2025 to between $15 million and $20 million in 2026.

- The clonoSEQ ASP reached approximately $1,310 in 2025, a 17% year-over-year increase, with a long-term target of $1,700-$1,800 by 2029.

- In Q4 2025, clonoSEQ volumes were around 30,000 tests, driven by an 18% quarter-over-quarter growth in community settings and blood-based testing increasing to 47% of total tests.

Quarterly earnings call transcripts for Adaptive Biotechnologies.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more