Earnings summaries and quarterly performance for Aebi Schmidt Holding.

Research analysts covering Aebi Schmidt Holding.

Recent press releases and 8-K filings for AEBI.

Aebi Schmidt Group announces preliminary Q4 and Full Year 2025 results, provides 2026 guidance, and details Board changes

AEBI

Earnings

Guidance Update

Board Change

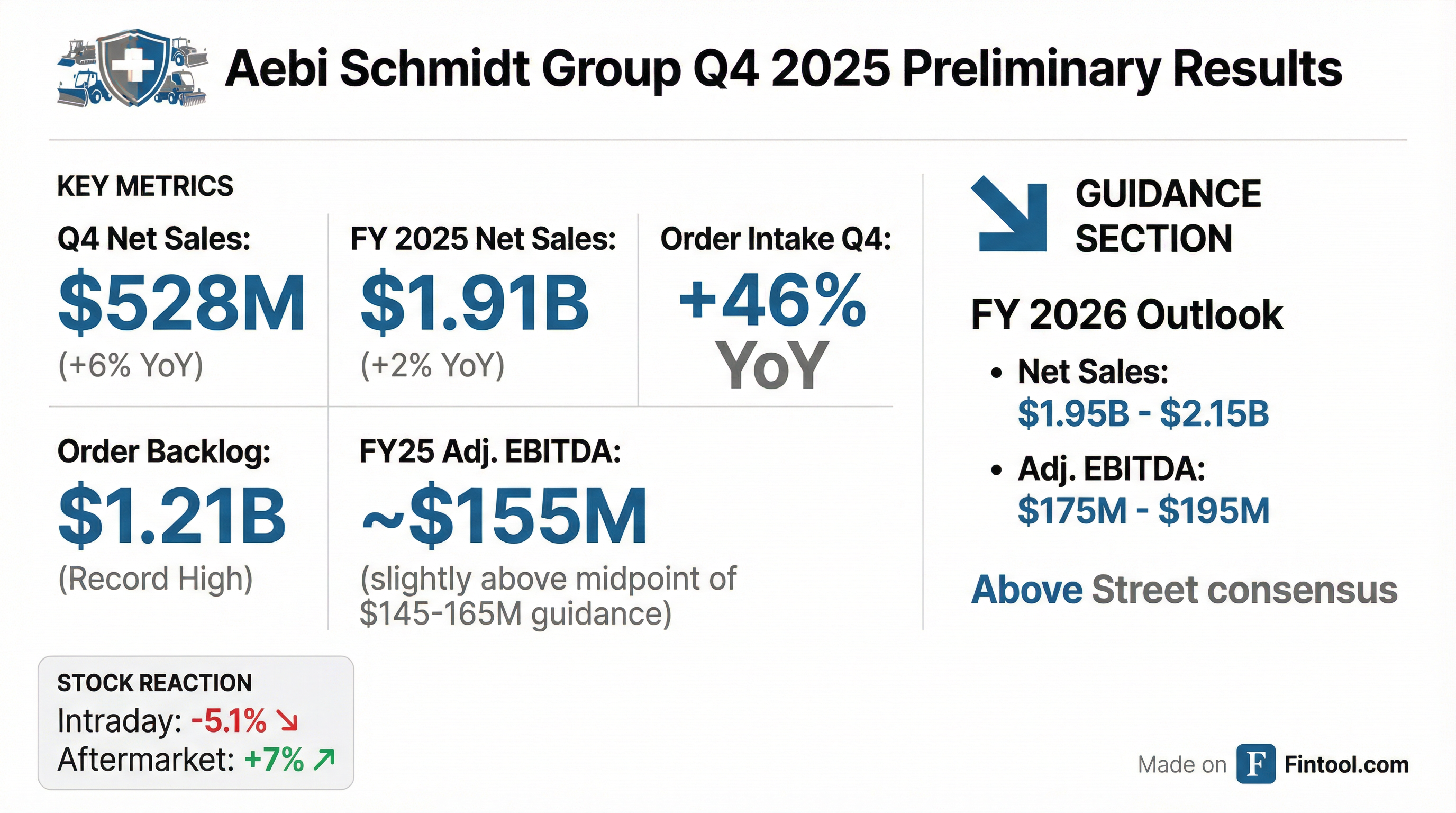

- Aebi Schmidt Group announced preliminary, unaudited Q4 2025 Net Sales of $528 million, up 6% year-over-year, and Full Year 2025 Net Sales of $1,907 million, a 2% increase from Full Year 2024.

- The company reported exceptional order momentum in Q4 2025, with Order Intake increasing 46% and a record Order Backlog exceeding $1.2 billion, supporting 2026 growth.

- Full Year 2025 Adjusted EBITDA is expected to be slightly above the midpoint of the $145 million to $165 million guidance.

- Aebi Schmidt provided 2026 financial guidance, projecting Net Sales of $1.95 billion to $2.15 billion and Adjusted EBITDA of $175 million to $195 million.

- The Board plans to nominate Group CEO Barend Fruithof as Chairman, with current Chairman Jim Sharman and two other members not standing for re-election, leading to a reduction in Board size to eight members.

Feb 24, 2026, 11:00 AM

Aebi Schmidt Group Reports Strong Q3 2025 Profitability and Raises Synergy Target

AEBI

Earnings

Guidance Update

M&A

- Aebi Schmidt Group reported Q3 2025 sales of $471 million, a 3% increase year over year, and a 25% year-over-year increase in adjusted EBITDA to $42.2 million, with North America achieving a 10.2% adjusted EBITDA margin.

- The company confirmed it will reach the upper end of its increased synergy target of $40 million from the Shyft Group acquisition, with half expected by mid-2026 and full realization by mid-2027.

- Order intake grew 33% year over year in Q3 2025, contributing to an order backlog of $1.13 billion that supports ambitious growth targets for 2026.

- For full year 2025, the company expects sales at the midpoint of $1.85 billion-$2 billion and adjusted EBITDA in the upper half of $145 million-$165 million.

- Net debt was $469 million at the end of September, with a target to reduce leverage to 3.0 by year-end 2025 and below 2.0 by year-end 2026.

Nov 13, 2025, 1:30 PM

Aebi Schmidt Reports Strong Q3 2025 Results with Reaffirmed FY2025 Guidance

AEBI

Earnings

Guidance Update

Revenue Acceleration/Inflection

- Aebi Schmidt reported Q3 2025 net sales of $471 million, a 3% increase year-over-year, with significant growth expected in the fourth quarter.

- Adjusted EBITDA reached $42.2 million in Q3 2025, achieving a 9.0% margin, which is a 25% year-over-year increase and a 160 basis-point margin improvement.

- The company demonstrated strong order momentum, with order intake up 33% year-over-year and 17% quarter-over-quarter to $518 million, leading to an order backlog of $1,127 million.

- FY2025 guidance was reaffirmed, projecting sales at the mid-point of $1.85 to $2.0 billion and adjusted EBITDA at the upper half of $145 to $165 million.

- Net Debt stood at $469 million in Q3 2025, with expectations for strong positive cash flow in Q4 and leverage below 3.0x by year-end 2025 and below 2.0x by year-end 2026.

Nov 13, 2025, 1:30 PM

Aebi Schmidt Group Reports Significant Profitability Step-Up and Strong Order Momentum in Q3 2025

AEBI

Earnings

M&A

Guidance Update

- Aebi Schmidt Group reported a significant step-up in profitability for Q3 2025, with Adjusted EBITDA increasing 25.2% year-over-year to $42.2 million and an adjusted EBITDA margin of 9.0%.

- The company achieved strong order momentum, with order intake up 33% year-over-year in Q3 2025, and the order backlog grew 6% since June 2025 to $1,127 million.

- Net sales for Q3 2025 reached $471.3 million, a 3.2% increase year-over-year, while net income was $1.2 million, affected by non-recurring transaction and restructuring costs.

- Synergies from the integration of the Shyft Group are accelerating, supporting the upper end of the increased target of $40 million.

- Aebi Schmidt Group reaffirmed its 2025 financial outlook, projecting sales between $1.85 and $2.0 billion and Adjusted EBITDA between $145 and $165 million.

Nov 13, 2025, 12:00 PM

Quarterly earnings call transcripts for Aebi Schmidt Holding.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more