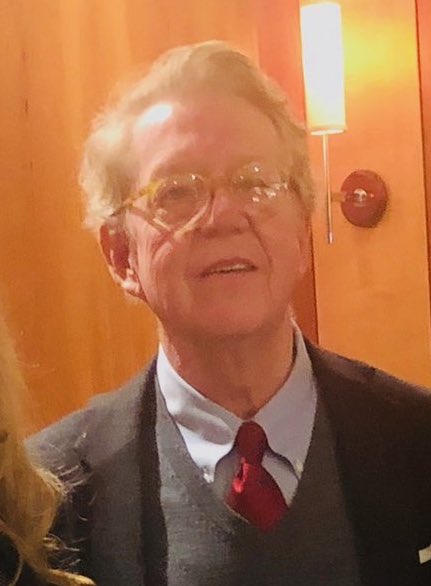

Daniel Amos

About Daniel Amos

Daniel P. Amos (age 73) is Chairman and Chief Executive Officer of Aflac Incorporated and Aflac, serving as CEO since 1990 and Chairman since 2001; he served as President of Aflac (2017–2018) and President of Aflac Incorporated (Jan 2024–Jan 2025; Feb 2018–Dec 2019) and has spent 51 years in various roles at Aflac . He holds a bachelor’s degree in risk management from the University of Georgia . Under his tenure, total shareholder return (TSR) from August 1990 to December 31, 2024 was 19,812% vs. 3,541% for the S&P 500; 3‑year TSR was +90.0% . 2024 highlights include net earnings of $5.4B ($9.63 diluted EPS), adjusted EPS ex‑FX $7.39 (+18.6% YoY), and $2.8B share repurchases .

Past Roles

| Organization | Role | Years | Strategic Impact |

|---|---|---|---|

| Aflac Incorporated | Chief Executive Officer | 1990–present | Led multi-decade value creation; TSR 19,812% since Aug 1990; strengthened capital returns . |

| Aflac Incorporated | Chairman | 2001–present | Board leadership; works with Lead Non‑Management Director structure for independent oversight . |

| Aflac | President | Jul 2017–May 2018 | Executive leadership continuity . |

| Aflac Incorporated | President | Feb 2018–Dec 2019; Jan 2024–Jan 2025 | Oversaw corporate functions and strategy execution . |

External Roles

| Organization | Role | Years | Notes |

|---|---|---|---|

| Synovus Financial Corp. | Director | 2001–2011 | Public company board experience . |

| Southern Company | Director | 2000–2006 | Public company board experience . |

Fixed Compensation

| Metric ($) | 2022 | 2023 | 2024 |

|---|---|---|---|

| Base Salary | 1,441,100 | 1,441,100 | 1,441,100 |

| All Other Compensation | 291,943 | 474,889 | 1,606,042 |

| — of which: Perquisites | — | 461,689 | 489,091 |

| — of which: Company 401(k) | — | 13,200 | 27,600 |

| — of which: Company EDCP contribution | — | — | 1,089,351 |

| Total Compensation | 15,776,291 | 20,703,253 | 19,268,254 |

Notes:

- 2024 perqs included personal aircraft ($193,173) and security services ($261,864) .

- Daniel Amos defers $441,100 of salary within the nonqualified plan (noted in SCT footnote) .

Performance Compensation

Annual Incentive (MIP) – Structure and 2024 Outcomes

- Metrics: corporate Adjusted EPS ex‑FX; U.S.: new annualized premium, net earned premium, total adjusted expense ratio, pretax adjusted earnings; Japan: new annualized premium, net earned premium; Global Investments: net investment income and credit losses/impairments; ±5% sustainability modifier .

- 2024 MIP Target/Max for Amos and Actual Paid: | Item | 2024 Amount | |---|---:| | Target MIP ($) | 3,602,750 | | Maximum MIP ($) | 7,205,500 | | Actual MIP Paid ($) | 5,821,241 |

(Implied target bonus ≈ 250% of base salary, computed from target $3.60M vs. $1.44M base using cited figures) .

Long‑Term Incentive (PBRS) – Design, Grants, and Vesting

- 100% performance‑based restricted stock (PBRS), 3‑year performance period; metrics: AROE ex‑FX, RBC, SMR/ESR; payout subject to relative TSR modifier ±20% .

- 2024 grant (2/15/2024): target 131,744 PBRS; threshold 65,872; max 263,488; grant‑date fair value $10,399,871 .

- Outstanding and vesting: | Grant | Cycle | Shares/Status at 12/31/24 | Vest Result/Date | |---|---|---:|---| | 2/10/2022 | 2022–2024 | 294,981 unvested; $30,512,835 MV | Vested at 200% of target on Feb 10, 2025 (per Committee certification Feb 11, 2025) . | | 2/9/2023 | 2023–2025 | 299,713 unvested; $31,002,313 MV (shown at max as of YE given over‑target performance) | Pays in Q1 2026 subject to final certification . | | 2/15/2024 | 2024–2026 | 269,013 unvested; $27,826,705 MV | Pays in 2027 subject to performance and TSR modifier . |

Equity Ownership & Alignment

| Item | Detail |

|---|---|

| Beneficial Ownership (as of Feb 25, 2025) | 2,988,878 shares; 0.5% of outstanding; voting rights on 17,483,108 votes (1.3% of available votes) . |

| Included Restricted Shares | 391,401 restricted shares included in beneficial ownership . |

| Indirect Holdings | Includes 5,060 shares owned by spouse; 941,326 by a partnership; 908,632 by trusts where he is trustee . |

| Pledging/Hedging | Pledging prohibited for officers/directors; hedging prohibited; 10b5‑1 plans require Compensation Committee approval . No Director has any pledged shares . |

| Ownership Guidelines | CEO must hold 8x base salary; all NEOs/Directors meet or are on track within compliance periods . |

Vested vs. unvested: At 12/31/24, unvested PBRS totaled 294,981 (2022), 299,713 (2023), and 269,013 (2024) with aggregate market value ~$89.3M using $103.44 close; 2022 tranche vested at 200% on Feb 10, 2025 .

Employment Terms

-

Agreements and Severance: Mr. Amos has an employment agreement but has voluntarily waived all golden parachute and other severance components; no excise tax gross‑ups; employment agreements are double‑trigger for change‑in‑control . Upon Company termination without “good cause” or any NEO’s (including Mr. Amos) termination for “good reason,” all outstanding equity becomes fully vested (performance‑based awards remain subject to performance) .

-

Potential Payments (as of 12/31/24, illustrative): | Scenario | Salary | Non‑Equity Incentive | Retirement Benefits | Health & Welfare | Equity Awards | Total | |---|---:|---:|---:|---:|---:|---:| | Death | 4,323,300 | 15,153,896 | 26,127,107 | 239,618 | 61,515,354 | 107,359,275 | | Disability | 2,161,650 | 5,821,241 | 48,620,944 | 1,516,801 | 61,515,354 | 119,635,990 | | CIC Termination (w/out cause or for good reason) | — | — | 48,579,544 | 1,483,631 | 61,515,354 | 111,578,529 | Notes: CIC severance cash waived by Mr. Amos; equity accelerates per plan terms; amounts reflect assumptions in proxy’s methodology .

-

Retirement Plan for Senior Officers (RPSO): CEO is sole active participant; after first 12 months of full‑comp pay at retirement, lifetime annual benefit equals 60% of final compensation (or 54% with 50% survivor benefit); fully vested with 51 years of credited service; plan frozen to new participants and further accruals frozen as of Dec 31, 2023; 2024 PV of accumulated benefit $47,490,193 .

Compensation Structure Analysis

- Strong pay‑for‑performance orientation: CEO target mix ~9% base, 23% MIP, 68% LTI (all performance‑based equity) for 2024 . Metrics tie to adjusted EPS ex‑FX and capital/solvency ratios with a TSR modifier; 2022–2024 PBRS vested at 200% for Mr. Amos, aligning payouts with multi‑year outperformance .

- Governance safeguards: Clawback policy since 2007; no CIC tax gross‑ups; double‑trigger CIC; anti‑hedging and anti‑pledging policies; 10b5‑1 plans require approval .

- Perquisites are meaningful but disclosed and security‑rationale based: 2024 aircraft ($193k) and security ($262k) services; no tax gross‑ups on perqs .

Director & Board Governance

- Board Service and Committees: Director since 1983; serves on Executive and Finance & Investment Committees .

- Dual‑role implications and mitigants: The Board combines Chairman and CEO roles but appoints a Lead Non‑Management Director with authority over agendas, executive sessions (without management), liaison duties, and independent Director meetings; Audit & Risk, Compensation, and Corporate Governance Committees are fully independent . 91% of nominees are independent .

Director/Shareholder Say‑on‑Pay and Feedback

- Say‑on‑Pay approval: 96.4% support in 2024; five‑year average 96.6% .

- Independent compensation oversight with an independent consultant; Committee reviews alignment of CEO pay and performance; methodology references Mercer in goal setting .

Related Party Transactions (historical context)

- In 2017, Mr. Paul S. Amos II (son of Daniel P. Amos) entered into a separation agreement totaling $3.4M over the agreement term; payments in 2018–2019 were reviewed/ratified by the Audit & Risk Committee .

Performance & Track Record

| Metric | Result |

|---|---|

| TSR since Aug 1990 (to 12/31/24) | 19,812% (vs. DJIA 3,551%; S&P 500 3,541%; S&P 500 Life & Health 1,790%) . |

| 3‑Year TSR | +90.0% . |

| 2024 Net Earnings / EPS | $5.4B; $9.63 diluted EPS (+23.8% YoY) . |

| 2024 Adjusted EPS ex‑FX | $7.39 (+18.6% YoY) . |

| Capital Returns | $2.8B share repurchases; 42nd consecutive year of dividend increases; 1Q25 dividend raised 16% to $0.58 . |

Director/Executive Perquisites (2024 detail)

| Category | Amount ($) |

|---|---|

| Personal Use of Company Aircraft | 193,173 |

| Security Services | 261,864 |

| Other (guest travel, etc.) | 34,054 |

| Total Perquisites | 489,091 |

Investment Implications

- Alignment: High at‑risk mix (68% LTI; 100% PBRS) tied to AROE, RBC/SMR and relative TSR, plus currency‑neutral MIP metrics, supports performance alignment; large 2022–2024 PBRS vest at 200% reflects outperformance and can drive insider share supply around vest dates .

- Retention/Transition: Substantial RPSO value ($47.5M PV) and ongoing equity cycles provide strong retention but also imply sizable retirement economics; Mr. Amos’ waiver of severance reduces CIC cash risk and mitigates golden parachute optics .

- Trading signals: Watch for vesting‑related liquidity events (e.g., Feb 2025 vest) and upcoming 2026/2027 award settlements; per anti‑pledge policy and lack of pledged shares, forced‑sale risk from collateral is low .

- Governance: Dual Chairman/CEO role is offset by a robust Lead Non‑Management Director framework and highly independent committees; consistently strong say‑on‑pay support (>96%) reduces compensation‑related governance overhang .