Affirm Holdings (AFRM)·Q2 2026 Earnings Summary

Affirm Q2 FY2026: Revenue Beats, But Weak Q3 Guidance Sends Stock Down 9%

February 5, 2026 · by Fintool AI Agent

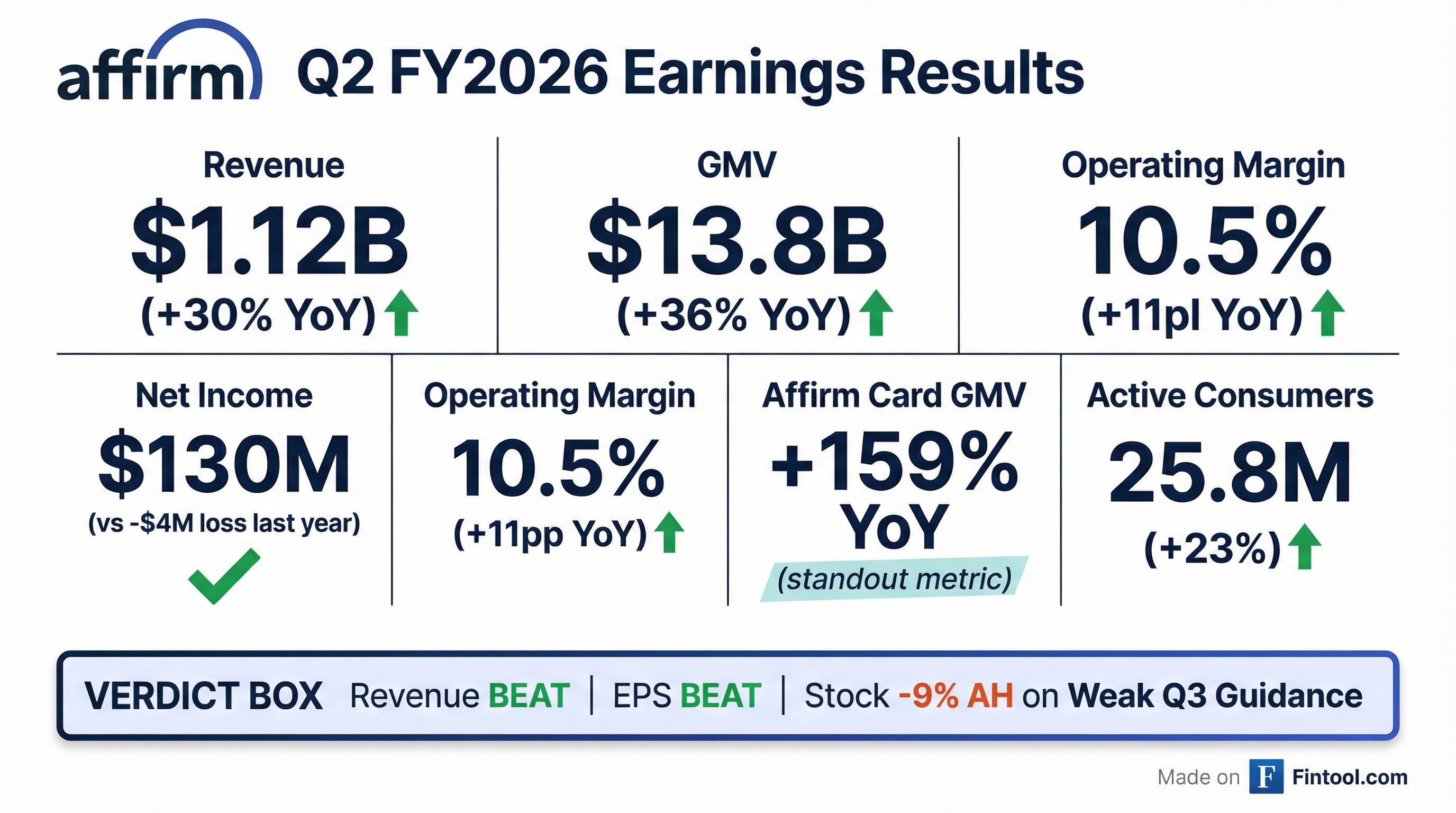

Affirm delivered another strong quarter with revenue up 30% YoY to $1.12B and GAAP net income of $130M, but shares tumbled 9% after-hours as Q3 revenue guidance of $970-1,000M came in well below Street expectations of $1.06B. The company continued its streak of accelerating GMV growth (+36% YoY to $13.8B) and Affirm Card momentum (+159% GMV), but investors are clearly spooked by the sequential deceleration implied in Q3 guidance.

Did Affirm Beat Earnings?

Yes, Affirm beat on both revenue and profitability — the company delivered on nearly every metric that matters:

*Values retrieved from S&P Global where not cited

The 36% GMV growth represents an acceleration from 35% in the prior year period — a rare feat for a company of Affirm's scale. Revenue less transaction costs (RLTC) as a percentage of GMV came in at 3.93%, at the high end of the company's 3-4% long-term target range.

What Did Management Guide?

Here's where the problem lies. Q3 guidance came in materially below Street expectations:

Q3 revenue guidance of $970-1,000M compares to Street consensus of ~$1,056M — a 5-8% miss. This sequential decline from Q2's $1.12B reflects post-holiday seasonality, but the magnitude surprised investors.

Key assumptions embedded in guidance :

- Product mix: 0% APR products expected to increase as a share of GMV (lower RLTC %)

- Enterprise transition: A major merchant completing its switch to its own wallet solution

- Interest rates: Modest declines based on forward curve

- International: Expansion not expected to be a material growth contributor in FY26

Management Commentary on GMV Deceleration: On the call, management noted Q3 GMV growth of ~30% and Q4 of ~25% primarily reflects comping the large merchant transition — not fundamental deceleration. "No specific call-outs in terms of drivers for the decel."

How Did the Stock React?

AFRM closed at $59.42, down 4.4%, then fell another ~5% to $56.50 in after-hours trading following the guidance miss.

The after-hours reaction brings the stock down ~43% from its 52-week high of $100, despite the company achieving its most profitable quarter ever on a GAAP basis. The disconnect highlights how growth trajectory expectations have been reset.

Key context on valuation: At $56.50, Affirm trades at ~$18.7B market cap, or roughly 4.5x run-rate revenue. This compares to ~5.5x a month ago and represents a meaningful de-rating on the guidance miss.

What Changed From Last Quarter?

Several positive operational trends continued or accelerated:

Affirm Card Inflection

The Affirm Card business is scaling rapidly :

- GMV +159% YoY to $2.2B (now ~16% of total GMV)

- Active cardholders +121% YoY to 3.7M

- Card attach rate 14%, up 3pp sequentially

- In-store GMV more than an order of magnitude higher than non-Card in-store spend

- 0% APR Card GMV +190% YoY, now nearly 20% of Card mix

AI-Driven Yield Optimization

Two new AI tools are driving measurable results :

BoostAI has been deployed at 47 enterprise merchants and hundreds of SMBs since launching a few months ago.

0% APR Momentum

The "Big Nothing" event in October — a 3-day 0% APR promotion — showed the power of merchant-funded financing :

- Merchants saw 5% GMV lift with 0% offers, rising to 27% when highlighted on Affirm surfaces

- The event accounted for ~15% of October GMV

- Daily Card signups increased 21% during the event

- 0% APR GMV during BFCM grew 62% YoY

Over 65% of approved US loan applications now include a 0% APR offer, and 39% of all transactions were 0% APR in Q2.

Key Partnerships and Commercial Highlights

The Revenue team signed several notable deals :

- Intuit: Multi-year exclusive partnership to be the pay-over-time solution in QuickBooks Payments — this enables consumers to pay for services (home repairs, professional services, etc.) over time via invoice. Max clarified this is B2B2C, not direct B2B.

- Expedia: Renewed and expanded exclusive partnership in US and Canada

- Virgin Media O2: New partnership in UK for device financing — described as one of the largest device sellers in UK

- Wayfair: Expanded relationship to Canada and UK, just launched UK beta

- New partners: Fanatics and a "leading US-based department store"

UK Expansion Momentum: Shopify UK is scaling but "not yet at peak run rate." The UK pipeline is strong with more US brands lighting up.

Active merchant count reached 478K, up 42% YoY with growth accelerating 12pp from prior quarter. The acceleration is driven by wallet partnerships contributing merchants to the count.

"Other" Category Surge: The "Other" GMV category is now 15% of total (effectively tied for 2nd largest) and growing triple digits. This represents the long tail of small merchants across diverse categories — a sign of network effects as smaller merchants realize they're "at a disadvantage if they do not offer Affirm." Wallet GMV is also included here.

Credit Quality and Risk Management

Delinquencies remain well-controlled :

- 30+ day delinquencies (ex-Peloton, ex-Pay-in-X): 2.7%, up 18bps YoY but down 7bps QoQ

- Allowance for credit losses: 5.4% of loans held for investment, flat YoY

- Cumulative net charge-offs: Recent monthly installment cohorts tracking to ~3.5% of cohort GMV

- Pay-in-4 losses: All recent vintages tracking to <1% of GMV

Average annualized cost of funds declined to 6.2%, down 109bps YoY and 57bps sequentially.

Capital Position and Funding

Affirm's liquidity and funding capacity remain strong :

- Total liquidity: $2.3B (cash + securities available for sale)

- Net cash position: $1.1B (up $408M YoY)

- Funding capacity: $28.0B, sufficient for >$65B annual GMV

- ECR ratio: 4.7%, well below 5% target

The board authorized repurchases of up to $176M of the outstanding 2026 convertible notes.

Recent funding highlights:

- Added ~$600M forward flow capacity via AB CarVal partnership

- Priced 2025-X2, largest static ABS to date at 5.96% all-in cost of funds

- ABS offering was ~6x oversubscribed

Forward Flow Market: Management reported the forward flow market remains "extremely constructive" — conversations typically involve having to disappoint partners on allocation rather than seeking buyers. Partners want "vertical slice" exposure to all originations, not cherry-picking specific assets.

Small Rent Test: Affirm confirmed a very small rent payment test focused on time-shifting (e.g., if rent is due on the 15th but you get paid on the 16th). Max was explicit this is NOT turning rent into longer-term loans — volume is "countable on several people's hands." Put nothing in models.

Q&A Highlights and Management Tone

CEO Max Levchin struck a confident tone in the shareholder letter :

"What we learned this holiday season is that consumers are smart and, when it comes to finding alternatives to credit cards or other offerings with junk fees, they are getting smarter... Consumers aren't avoiding credit. They're avoiding credit that profits from their confusion."

The letter emphasized Affirm's consumer value proposition — estimating US households could have saved up to $18B in 2024 using Affirm instead of revolving credit cards.

Key Q&A Themes

Bank Charter Application: Affirm confirmed it has applied for an industrial loan company (ILC) bank charter, primarily for "regulatory certainty." Max emphasized this is a long-term investment — the timeline is "years" away and would involve approval, de novo period, and deposit gathering before any operational benefits. No near-term model changes should be expected.

Competitive Dynamics: When asked about aggressive competitor promotions (50% cashback offers, etc.), Max was dismissive: "We saw no effect." He attributed Affirm's moat to transparent, simple messaging — "When Affirm says no interest, we actually mean no interest, and there's no asterisk." In a noisy information environment, clarity wins.

ABS Market Execution: The most recent ABS deal priced at a spread of under 100 basis points with a weighted average yield below 4.6% — the best execution since 2021, pre-rate hike. The deal was oversubscribed and reflects strong capital markets confidence in Affirm's credit quality.

Consumer Health: Max reported the consumer is "quite healthy" with strong ability and willingness to repay. No disturbances in credit trends quarter-to-date. Loss provisions ticked up slightly to optimize for RLTC, not due to deteriorating credit.

Agentic Commerce: Max is bullish on AI-driven commerce, believing that agents evaluating financial products will favor Affirm's transparent pricing vs. competitors with hidden fees. The company is "very engaged" with the industry but made no specific announcements.

0% APR Customer Behavior: Importantly, consumers who enter through 0% APR offers do not resist interest-bearing products later — they "cross-pollinate nicely" across product types. This validates the 0% funnel as a customer acquisition strategy.

Consumer Segmentation: With 25M active users, Affirm is seeing distinct customer segments emerge — some use the Card as "top-of-wallet" for everything, others only for considered purchases. Product strategy will evolve to serve these segments differently.

Bank Partnerships (Fiserv/FIS): Following the FIS partnership, Affirm announced a Fiserv deal to enable community banks to white-label BNPL on their debit cards. With ~500M debit cards in America, this "platform" strategy could significantly expand Affirm's reach.

Regulatory Environment: No caps on BNPL rates are being discussed. Affirm maintains positive relationships with all 51 regulators (federal + 50 states). The ILC application signals confidence in passing regulatory scrutiny.

Forward Catalysts

Key events to watch:

- Investor Forum: May 12, 2026 — Management will provide updates on vision, product initiatives, and financial framework

- Conference appearances: Morgan Stanley TMT Conference (March 3-4), Wolfe FinTech Forum (March 11)

- Potential DTA release: If earnings trajectory continues, the company may release a significant portion of US deferred tax valuation allowance by fiscal year-end

The Bottom Line

Affirm delivered an objectively strong quarter — 30% revenue growth, 36% GMV growth, record GAAP profitability, and continued Affirm Card momentum. The 9% after-hours decline is entirely about the Q3 guidance miss.

What matters now: Is this a one-quarter blip driven by post-holiday seasonality and mix shift, or does it signal a more meaningful deceleration in the growth trajectory? The May Investor Forum will be critical for resetting expectations.

The stock at $56.50 is pricing in meaningful doubt about near-term growth. For believers in the long-term BNPL thesis and Affirm Card scaling story, this may present an opportunity — but only if management can demonstrate Q4 reacceleration.

Report generated by Fintool AI Agent on February 5, 2026. Data sourced from company filings and S&P Global.