Earnings summaries and quarterly performance for Affirm Holdings.

Executive leadership at Affirm Holdings.

Board of directors at Affirm Holdings.

Research analysts who have asked questions during Affirm Holdings earnings calls.

Dan Dolev

Mizuho Financial Group

10 questions for AFRM

Robert Wildhack

Autonomous Research

10 questions for AFRM

James Faucette

Morgan Stanley

8 questions for AFRM

Adam Frisch

Evercore ISI

7 questions for AFRM

John Hecht

Jefferies

7 questions for AFRM

Moshe Orenbuch

TD Cowen

7 questions for AFRM

Reginald Smith

JPMorgan Chase & Co.

7 questions for AFRM

Ramsey El-Assal

Barclays

6 questions for AFRM

Andrew Bauch

Wells Fargo & Company

5 questions for AFRM

Daniel Perlin

RBC Capital Markets

5 questions for AFRM

Kyle Peterson

Needham & Company

5 questions for AFRM

Nate Svensson

Deutsche Bank

5 questions for AFRM

Andrew Jeffrey

William Blair & Company

4 questions for AFRM

Jason Kupferberg

Bank of America

4 questions for AFRM

Jeff Cantwell

Seaport Research Partners

4 questions for AFRM

Matthew O'Neill

Financial Technology Partners

4 questions for AFRM

Timothy Chiodo

UBS Group AG

4 questions for AFRM

Vincent Caintic

Stephens Inc.

4 questions for AFRM

William Nance

The Goldman Sachs Group, Inc.

4 questions for AFRM

Harry Bartlett

Rothschild & Co Redburn

3 questions for AFRM

Jamie Friedman

Susquehanna International Group

3 questions for AFRM

Matt Coad

Truist Securities

3 questions for AFRM

Reggie Smith

JPMorgan Chase & Co.

3 questions for AFRM

Will Nance

Goldman Sachs

3 questions for AFRM

Bryan Keane

Deutsche Bank

2 questions for AFRM

Darrin Peller

Wolfe Research, LLC

2 questions for AFRM

David Scharf

Citizens Capital Markets and Advisory

2 questions for AFRM

Giuliano Anderes-Bologna

Compass Point

2 questions for AFRM

James Fawcett

Morgan Stanley

2 questions for AFRM

Joel Rykers

William Blair

2 questions for AFRM

Kathy Chan

Wells Fargo Securities

2 questions for AFRM

Kyle Joseph

Jefferies

2 questions for AFRM

Mihir Bhatia

Bank of America

2 questions for AFRM

Rayna Kumar

Oppenheimer & Co. Inc.

2 questions for AFRM

Zachary Gunn

Financial Technology Partners

2 questions for AFRM

Adib Choudhury

William Blair

1 question for AFRM

Andrew Jeffery

William Blair

1 question for AFRM

Giuliano Bologna

Compass Point Research & Trading LLC

1 question for AFRM

James Friedman

Susquehanna Financial Group, LLLP

1 question for AFRM

Jill Glaser Shea

UBS

1 question for AFRM

Recent press releases and 8-K filings for AFRM.

- Affirm anticipates some deceleration in GMV growth in the second half of the year due to lapping strong prior-year performance and the roll-off of Walmart volume, though Q2 2026 showed accelerated year-over-year growth.

- The company reports healthy consumer demand and repayment data, noting the environment is "surprisingly and positively boring" with no concerning trends, and no changes are being made to its credit box.

- Affirm successfully completed an ABS deal in January 2026 with the tightest spread (under 100 basis points), which was significantly oversubscribed, demonstrating strong access to capital and a "flight to quality" from partners.

- Strategic growth initiatives include net-accretive 0% promotions, expansion into high-ticket services, and increasing offline penetration via card and wallet integrations, which is currently nascent but growing faster than e-commerce.

- Affirm differentiates itself through its advanced underwriting capabilities, allowing for longer duration and bigger ticket size financing, supported by vertical integration and continuous model evolution.

- Affirm anticipates some deceleration in Gross Merchandise Volume (GMV) growth in the second half of the year, primarily due to lapping a strong prior-year quarter (40%-45% year-over-year growth) and the conclusion of the Walmart partnership.

- The company reports healthy and stable consumer demand and repayment data, with no concerning trends observed in its credit portfolio.

- Affirm's funding market remains robust, highlighted by an oversubscribed ABS deal in January 2026 with a spread under 100 basis points, indicating strong investor confidence and access to capital.

- The Buy Now, Pay Later (BNPL) market is expected to continue gaining share, with current US e-commerce penetration at 8%-9% compared to over 20% in other markets, and Affirm sees potential to replace $1.1-$1.2 trillion in revolving debt.

- Affirm's President, Lior, addressed the market's reaction to the outlook, explaining that the anticipated GMV growth deceleration in the second half of the year is primarily due to lapping the previous year's 40%-45% year-over-year growth and the rolling off of Walmart volume.

- The company confirmed that 0% promotions are dollar accretive and drive both consumer and merchant engagement, leading to increased user retention and subsequent transactions, with a recent "zero percent days" event demonstrating net accretive volume rather than just pulled-forward sales.

- Affirm reports healthy consumer demand and repayment data in line with expectations, with no current changes to its origination or credit box.

- The company sees significant and persistent BNPL market share gains, noting US e-commerce penetration at 8%-9% compared to over 20% in other markets, and views the total addressable market as a replacement for $1.1 trillion-$1.2 trillion in revolving credit.

- Affirm recently completed an ABS deal in January 2026 with the tightest spread (under 100 basis points), which was well oversubscribed, indicating strong access to efficient funding sources and benefiting from a "flight to quality" in the private credit space.

- Affirm is expanding its partnership with Stripe to support Shared Payment Tokens (SPT), enabling AI agents to initiate purchases using a shopper's permission and preferred payment method without exposing sensitive credentials.

- This collaboration will integrate Affirm's pay-over-time options into AI-driven commerce experiences, allowing shoppers to see the total cost upfront and select a clear repayment plan with AI assistance.

- Merchants will be able to accept these payments through Stripe, and any merchant offering Affirm can opt in to accept these transactions in agentic flows.

- Affirm has partnered with Stripe since 2021 to bring transparent pay-over-time options to various shopping environments.

- Affirm and Virgin Media O2 have announced a new partnership to provide flexible hardware financing options to O2 customers in the UK.

- This partnership will offer financing for mobile phones, headphones, and games consoles, with monthly payment plans that include no late or hidden fees and no compound interest.

- The collaboration is expected to be available to Virgin Media O2 customers later this summer, pending regulatory approval.

- The partnership enables Virgin Media O2 to expand its offering to the SIM-free market.

- Affirm Holdings reported excellent results for Q2 2026, with CEO Max Levchin stating the consumer is "quite healthy" and able to repay.

- The company expects RLTC take rates to be slightly above 4% in Q3 and Q4, driven by benefits from lower funding costs, despite a softening in revenue take rates due to increased 0% loan mix.

- The Affirm Card is a significant growth driver, with GMV up 160% year-over-year, active cardholders up 121%, and 0% deals on the card up 190% year-over-year for the quarter.

- Affirm has applied for an industrial loan company bank charter, primarily for regulatory certainty, noting the timeline is "certainly years".

- The company projects a slowdown in GMV growth to 30% in Q3 and 25% in Q4, attributed partly to comping a transition with a large retail partner.

- Affirm Holdings expects RLTC take rates to be slightly above 4% in Q3 and Q4 2026, benefiting from lower funding costs in the ABS market, with the latest ABS deal priced with a spread under 100 basis points and a weighted average yield below 4.6%.

- The Affirm Card demonstrated significant growth in Q2 2026, with GMV up nearly 160%, active cardholders increasing by 121%, and 0% deals rising by 190% year-over-year, making it a material part of the business.

- Affirm is expanding its market reach through new strategic partnerships, including with Intuit to offer buy now, pay later for services billed through QuickBooks, and with Fiserv to enable financial institutions to provide BNPL capabilities to their debit card users.

- The company's application for a bank charter is a long-term investment primarily focused on regulatory certainty, with a timeline of "certainly years," and is not expected to provide short-term reductions in the cost of funds.

- Affirm Holdings expects RLTC take rates slightly above 4% for Q3 and Q4 2026, benefiting from lower funding costs, as evidenced by a recent ABS deal priced with a spread under 100 basis points and a weighted average yield below 4.6%.

- The company projects a slowdown in GMV growth to 30% in Q3 and 25% in Q4 2026, but anticipates continued operating leverage and improved FY 2026 margin expansion.

- Growth is significantly driven by the Affirm Card, with GMV up nearly 160% and active cardholders up 121% year-over-year, alongside international expansion into markets like the U.K..

- Active merchant growth increased by 42%, boosted by wallet partnerships, and Affirm is expanding its platform to banks through new partnerships such as with Fiserv.

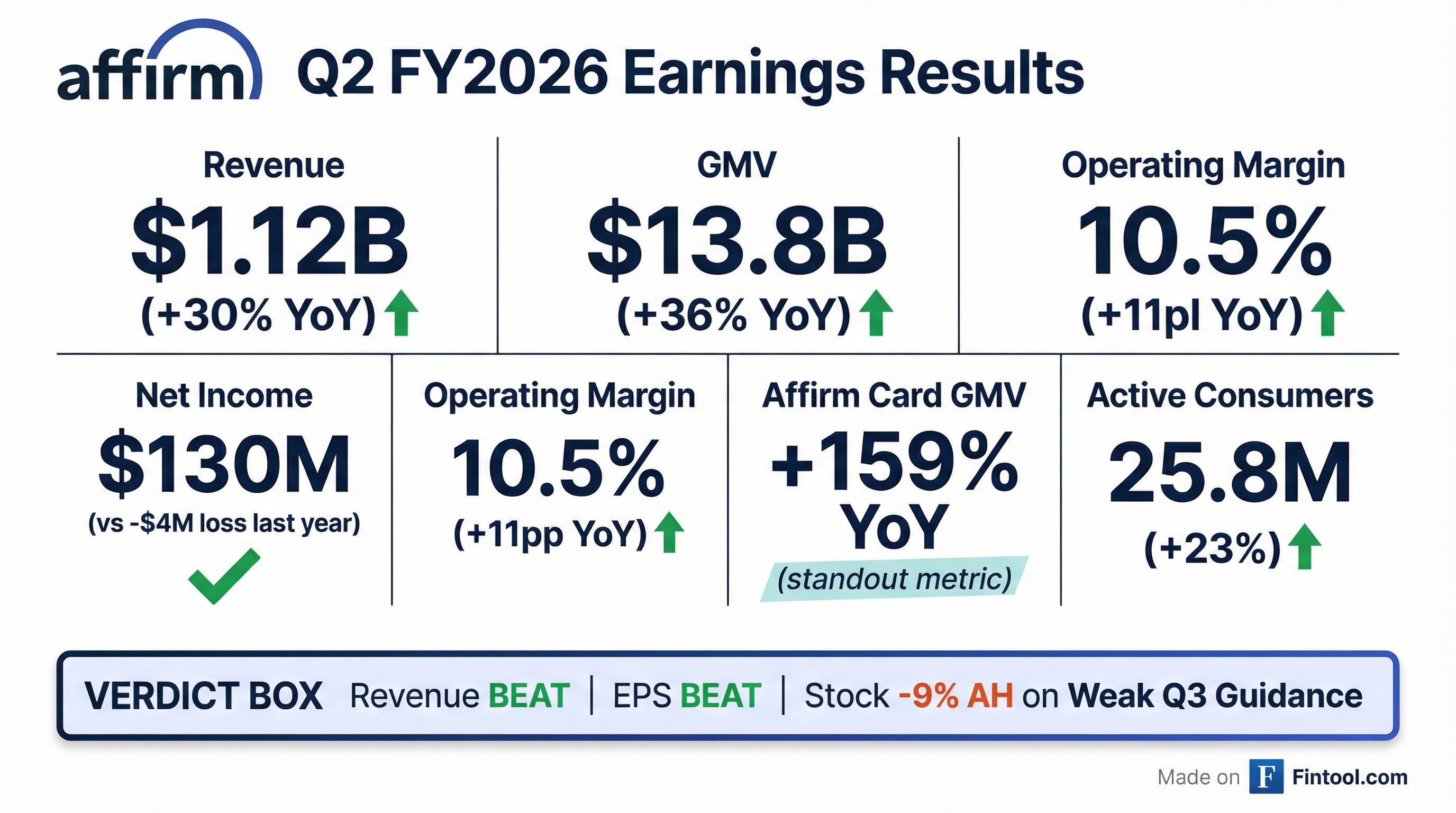

- Affirm Holdings reported revenue of $1,123 million and Gross Merchandise Volume (GMV) of $13.8 billion for FY Q2 2026.

- The company achieved an Adjusted Operating Income of $337 million and an Adjusted Operating Margin of 30% in FY Q2 2026.

- Key operating metrics showed significant growth, with Active Consumers increasing by 23% and Total Transactions growing by 44% year-over-year in FY Q2 2026.

- For FY Q3 2026, Affirm projects revenue between $970 million and $1,000 million and GMV between $11.00 billion and $11.25 billion, alongside an Adjusted Operating Margin of 24.5% to 25.5%.

- Affirm Holdings, Inc. reported strong Q2 2026 financial results, with revenue increasing 30% year-over-year to $1,123 million and Gross Merchandise Volume (GMV) growing 36% to $13.8 billion.

- The company achieved net income of $129.6 million and saw Adjusted Operating Income rise 42% to $337 million, leading to an Adjusted Operating Margin of 30.0%.

- Operational growth was robust, with active consumers increasing 23% to 25.8 million and active merchants growing 42% to 478 thousand as of December 31, 2025.

- Strategic partnerships expanded, including a multi-year agreement with Intuit and renewals with Expedia, while funding capacity increased to $28.0 billion.

- For Q3 2026, Affirm provided guidance projecting GMV between $11.00 billion and $11.25 billion and revenue between $970 million and $1,000 million.

Fintool News

In-depth analysis and coverage of Affirm Holdings.

Affirm Hits $1.12B Revenue, 30% Margins as BNPL Model Proves Profitable

Affirm Wins Exclusive BNPL Rights to QuickBooks' $2 Trillion Invoice Platform

Affirm Seeks FDIC Bank Charter, Joining Fintech Rush for Banking Licenses

Kerrisdale Capital Shorts Affirm, Calls BNPL Leader 'Subprime Lender in Fintech Clothing'

Quarterly earnings call transcripts for Affirm Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more