Earnings summaries and quarterly performance for Mastercard.

Executive leadership at Mastercard.

Michael Miebach

President and Chief Executive Officer

Ari Sarker

President, Asia Pacific

Craig Vosburg

Chief Services Officer

Edward McLaughlin

President & Chief Technology Officer, Mastercard Technology

George Maddaloni

Chief Technology Officer, Operations

Greg Ulrich

Chief AI and Data Officer

Jorn Lambert

Chief Product Officer

Karen Griffin

Chief Risk Officer

Ken Moore

Chief Innovation Officer

Linda Kirkpatrick

President, Americas

Ling Hai

President, Asia Pacific, Europe, Middle East & Africa

Mark Barnett

President, Europe

Michael Lashlee

Chief Security Officer

Raj Seshadri

Chief Commercial Payments Officer

Raja Rajamannar

Chief Marketing & Communications Officer

Richard Verma

Chief Administrative Officer

Sachin Mehra

Chief Financial Officer

Susan Muigai

Chief People Officer

Tiffany Hall

General Counsel

Timothy Murphy

Vice Chair

Board of directors at Mastercard.

Candido Bracher

Director

Choon Phong Goh

Director

Gabrielle Sulzberger

Director

Harit Talwar

Director

Julius Genachowski

Director

Lance Uggla

Director

Merit E. Janow

Board Chair

Oki Matsumoto

Director

Richard K. Davis

Director

Rima Qureshi

Director

Youngme Moon

Director

Research analysts who have asked questions during Mastercard earnings calls.

Harshita Rawat

AllianceBernstein

8 questions for MA

Tien-tsin Huang

JPMorgan Chase & Co.

8 questions for MA

Darrin Peller

Wolfe Research, LLC

6 questions for MA

Sanjay Sakhrani

Keefe, Bruyette & Woods (KBW)

6 questions for MA

Trevor Williams

Jefferies LLC

6 questions for MA

Craig Maurer

FT Partners

5 questions for MA

Timothy Chiodo

UBS Group AG

5 questions for MA

Bryan Keane

Deutsche Bank

4 questions for MA

Ramsey El-Assal

Barclays

4 questions for MA

Adam Frisch

Evercore ISI

3 questions for MA

Andrew Schmidt

Citigroup Inc.

3 questions for MA

Bryan Bergin

TD Cowen

3 questions for MA

James Faucette

Morgan Stanley

3 questions for MA

Rayna Kumar

Oppenheimer & Co. Inc.

3 questions for MA

Will Nance

Goldman Sachs

3 questions for MA

Brian Keane

Citi

2 questions for MA

Darren Peller

Wolfe Research

2 questions for MA

David Koning

Robert W. Baird & Co.

2 questions for MA

Fahed Kunwar

Redburn Atlantic

2 questions for MA

Jason Kupferberg

Bank of America

2 questions for MA

Sanjay Sakrani

KBW

2 questions for MA

William Nance

The Goldman Sachs Group, Inc.

2 questions for MA

Andrew Jeffrey

William Blair & Company

1 question for MA

James Friedman

Susquehanna Financial Group, LLLP

1 question for MA

Ken Suchoski

Autonomous Research

1 question for MA

Nate Svensson

Deutsche Bank

1 question for MA

Paul Golding

Macquarie Capital

1 question for MA

Recent press releases and 8-K filings for MA.

- Mastercard and SoFi have partnered to enable SoFiUSD as a settlement option across Mastercard’s global payments network, aiming to offer faster, 24/7 transaction settlement.

- SoFiUSD is a fully reserved U.S. dollar stablecoin issued 1:1 by cash on a public, permissionless blockchain—the first by a U.S. nationally chartered bank.

- The integration leverages the Mastercard Multi-Token Network and SoFi’s Galileo platform to support interoperability among fiat currencies, stablecoins, and tokenized deposits.

- SoFi Bank, N.A. will settle its Mastercard credit and debit transactions in SoFiUSD, with both companies exploring additional use cases including cross-border remittances, B2B transfers, and programmable treasury applications.

- Phase 1 migration completed, creating an end-to-end independent network using Mavenir’s cloud-native OSS and BSS for full control of network operations and digital service platforms

- Tune Talk deployed new digital services—MyDigital ID integration, Mastercard identity-theft protection, free personal accidental insurance, foodpanda promotions and in-app streaming—enabled by its cloud-native environment

- Phase 2 will introduce advanced AI-driven orchestration and next-generation BSS to further enhance network performance, accelerate service delivery and unlock new revenue streams

- The partnership positions Tune Talk as ASEAN’s first fully cloud-native MNO and serves as a reference for modern OSS/BSS architectures, highlighted at MWC26

- Conductor closed FY2026 with record growth, securing 50+ new enterprise logos as 98% of CMOs shift budgets to AI search.

- In Q4, the company exceeded goals with 147% ARR attainment, 214% upsell attainment, and 125% gross new bookings attainment.

- Launched the Model Context Protocol (MCP) for seamless integration with AI systems and was named a verified app in OpenAI’s enterprise App Directory.

- Formed new global agency partnerships with Havas, Publicis, Overdrive, and Clutch to broaden enterprise go-to-market reach.

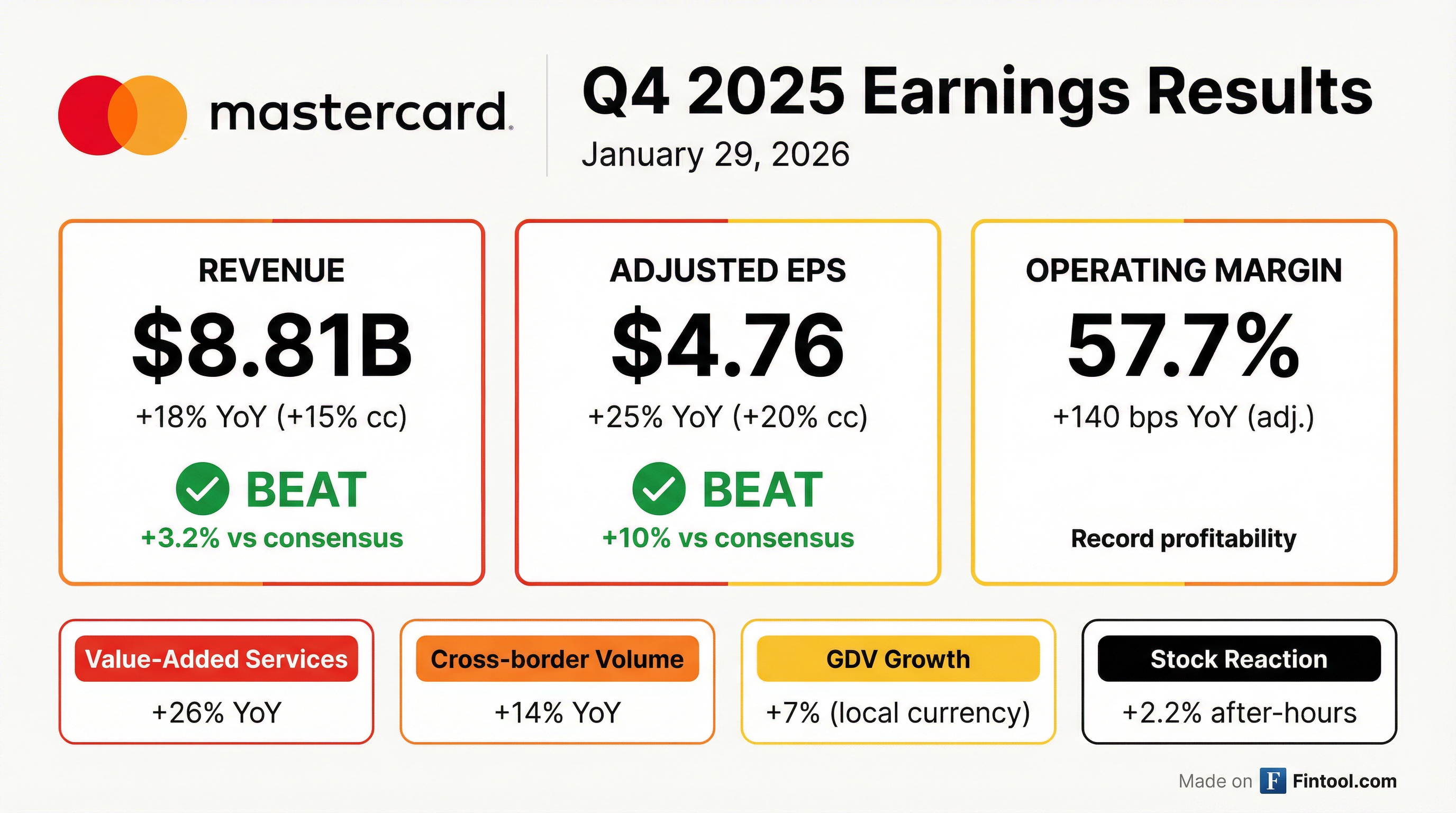

- Mastercard reported Q4 2025 net income of $4.06 billion ($4.52 per share), adjusted EPS of $4.76, and revenue of $8.81 billion, up ~17–18% YoY

- Transaction volumes grew robustly: gross dollar volume +7%, cross-border volumes +14%, and switched transactions +9–10% to ~46.5 billion

- Value-added services revenue increased ~26% YoY to $3.9 billion, driven by security, digital authentication, and recent acquisitions

- CEO Michael Miebach highlighted healthy consumer spending and investments in tokenization and stablecoins, while warning of regulatory risks like the Credit Card Competition Act

- Mastercard delivered net revenue +15%, net income +17% and non-GAAP EPS of $4.76, up 20% y/y.

- Payment network revenue rose 9%, while value-added services jumped 22%, with acquisitions contributing ~3 ppt to VAS growth.

- Q4 volumes: worldwide GDV +7%, cross-border volume +14%; global branded cards reached 3.7 billion and switched transactions grew 10%.

- Returned capital via $3.6 billion of share buybacks in Q4 and an additional $715 million through January 26, 2026.

- 2026 guidance: net revenues to grow at the high end of a low double-digit range (currency-neutral), with a one-time $200 million restructuring charge in Q1 impacting ~4% of staff.

- In Q4 2025, net revenue rose 15%, operating income increased 17%, net income grew 17%, and EPS was $4.76 (+20%, including $0.10 from share repurchases); the company repurchased $3.6 billion of stock ($715 million through Jan 26).

- Transaction volumes were strong: worldwide gross dollar volume was up 7%, cross-border volume rose 14%, switch transactions grew 10%, contactless penetration reached 77%, and 3.7 billion cards were in circulation.

- By business segment, payment network net revenue increased 9%, while value-added services and solutions net revenue climbed 22% (organic ~19 ppt).

- For fiscal 2026, Mastercard expects net revenues to grow at the high end of low-double-digit rates (currency-neutral, ~1–1.5 ppt FX tailwind), operating expenses at the low end of low-double-digit growth (FX headwind of 0.5–1 ppt), and Q1 net revenue growth at the low end of low-double-digit (FX tailwind 3.5–4 ppt) with a one-time $200 million restructuring charge.

- Mastercard reported Q4 2025 net revenue of $8,806 million, up 18% YoY (15% currency-neutral).

- Adjusted operating income was $5,085 million, up 21% YoY, yielding a 57.7% adjusted operating margin, up 1.4 pp.

- Adjusted net income reached $4,278 million and adjusted diluted EPS was $4.76, up 22% and 25% YoY, respectively.

- Fourth-quarter gross dollar volume grew to $1.301 trillion in credit and $1.518 trillion in debit/prepaid, up from $1.194 T and $1.374 T in Q4 2024.

- 2026 guidance calls for non-GAAP net revenue growth at the high end of low double digits and operating expenses growth in the low double digits.

- Net revenue +15% with Payment Network net revenue +9% and Value-added Services net revenue +22% on a currency-neutral basis

- Gross dollar volume +7% globally (U.S. +4%, ex-U.S. +9%) and cross-border volume +14% in Q4 2025

- Operating income +17%, EPS $4.76 up 20% (incl. $0.10 from buybacks); repurchased $3.6 B in Q4 and $715 M through Jan 26, 2026

- Secured key deal renewals and migrations: extended Capital One credit partnership, migrated ~10 M Yapı Kredi cards, and won co-brand deals (Apple Card, Walmart/Sam’s Mexico, Amazon/Emirates Islamic UAE)

- Fourth quarter net revenue of $8.8 billion (up 18% YoY, 15% currency-neutral) and diluted EPS of $4.52; adjusted diluted EPS was $4.76.

- Q4 payment network drivers: gross dollar volume rose 7%, cross-border volume 14%, and switched transactions 10% on a local currency basis.

- Full-year 2025 net revenue reached $32.8 billion (up 16% YoY, 15% currency-neutral) with diluted EPS of $16.52.

- In Q4, Mastercard repurchased 6.4 million shares for $3.6 billion and paid $684 million in dividends.

- Mastercard is expanding its Start Path accelerator to scout smaller agentic AI innovators and broaden its partner pipeline.

- It will launch the Mastercard Agent Suite in Q2 to help banks, fintechs, and merchants build, test and deploy customizable AI agents across payments, customer engagement and operational workflows.

- The Agent Suite combines customizable agents with Mastercard’s payments data, fraud and identity infrastructure, proprietary platforms and advisory services to support use cases like product recommendations, conversational shopping, inventory/pricing and transaction decisioning.

- The firm processed nearly $10 trillion in volume in 2024, operates in over 200 countries, and has a market capitalization of $473.6 billion, reflecting its scale to back AI initiatives.

Quarterly earnings call transcripts for Mastercard.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more