Earnings summaries and quarterly performance for PayPal Holdings.

Executive leadership at PayPal Holdings.

Alex Chriss

President and Chief Executive Officer

Aaron Webster

Executive Vice President, Global Chief Risk Officer

Diego Scotti

Executive Vice President, General Manager, Consumer Group

Frank Keller

Executive Vice President, General Manager – Large Enterprise & Merchant Platform Group

Jamie Miller

Executive Vice President, Chief Financial and Operating Officer

Michelle Gill

Executive Vice President, General Manager – Small Business & Financial Services Group

Suzan Kereere

President, Global Markets

Board of directors at PayPal Holdings.

Ann Sarnoff

Director

Carmine Di Sibio

Director

David Dorman

Director

David Moffett

Director

Deborah Messemer

Director

Deirdre Stanley

Director

Enrique Lores

Independent Board Chair

Frank Yeary

Director

Gail McGovern

Director

Jonathan Christodoro

Director

Joy Chik

Director

Research analysts who have asked questions during PayPal Holdings earnings calls.

Harshita Rawat

AllianceBernstein

8 questions for PYPL

Tien-tsin Huang

JPMorgan Chase & Co.

8 questions for PYPL

Dan Dolev

Mizuho Financial Group

7 questions for PYPL

Darrin Peller

Wolfe Research, LLC

7 questions for PYPL

Jason Kupferberg

Bank of America

7 questions for PYPL

Ramsey El-Assal

Barclays

6 questions for PYPL

Sanjay Sakhrani

Keefe, Bruyette & Woods (KBW)

6 questions for PYPL

Timothy Chiodo

UBS Group AG

6 questions for PYPL

Andrew Schmidt

Citigroup Inc.

5 questions for PYPL

Trevor Williams

Jefferies LLC

3 questions for PYPL

Colin Sebastian

Baird

2 questions for PYPL

James Faucette

Morgan Stanley

2 questions for PYPL

Will Nance

Goldman Sachs

2 questions for PYPL

Bryan Keane

Deutsche Bank

1 question for PYPL

Daniel Perlin

RBC Capital Markets

1 question for PYPL

Darren Peller

Wolfe Research

1 question for PYPL

Sanjay Sakrani

KBW

1 question for PYPL

William Nance

The Goldman Sachs Group, Inc.

1 question for PYPL

Recent press releases and 8-K filings for PYPL.

- Kirby McInerney LLP has filed a securities fraud class action on behalf of investors who purchased PayPal securities between February 25, 2025 and February 2, 2026, alleging the company misrepresented its revenue outlook and growth prospects.

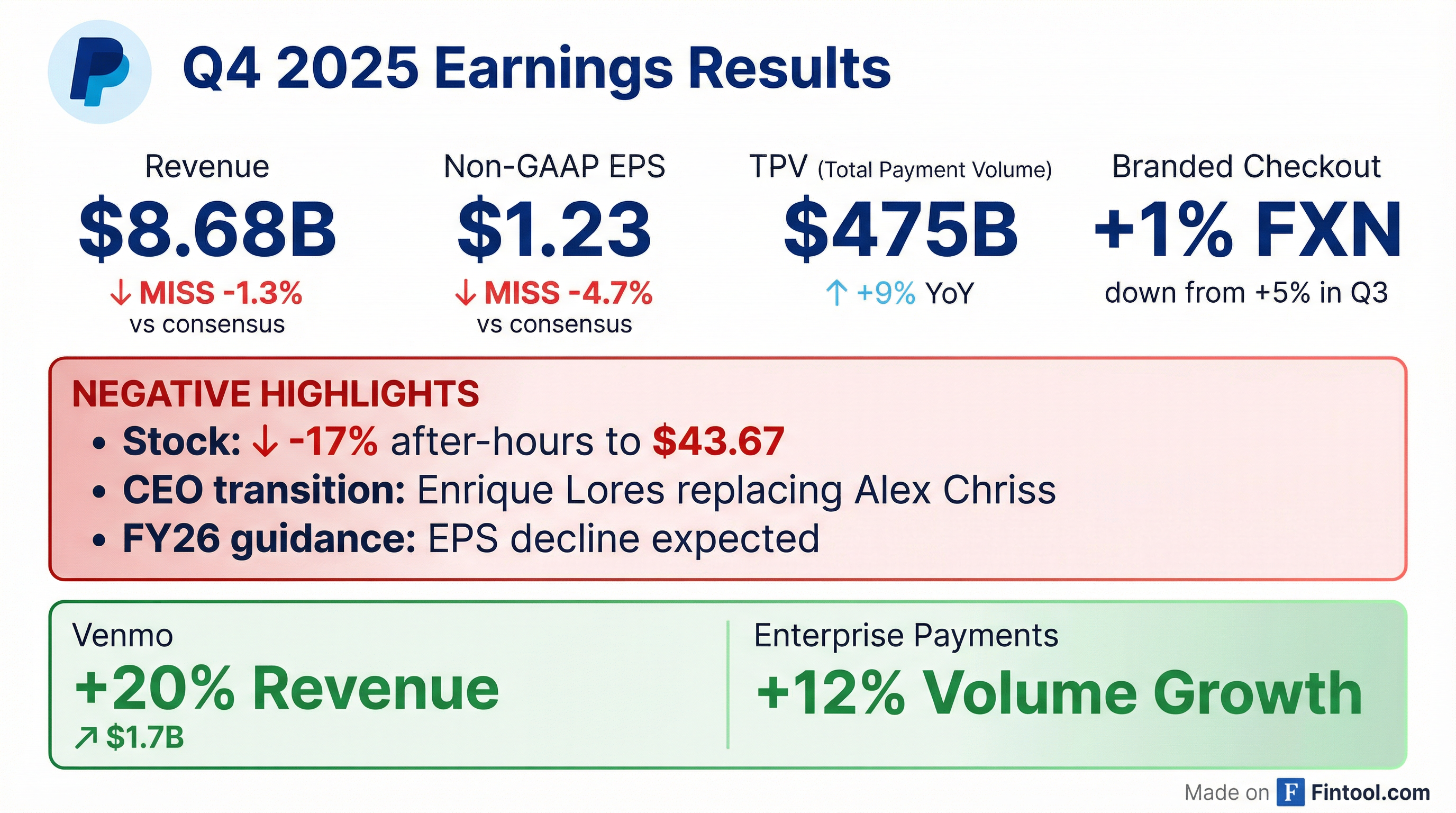

- On February 3, 2026, PayPal announced its Q4 and full-year 2025 results, withdrew its 2027 financial targets, and cited macroeconomic and “operational and deployment issues” for underperformance in Branded Checkout.

- The lawsuit notes the transition of CEO James Alexander Chriss concurrent with these disclosures.

- Investors who suffered losses have until April 20, 2026 to seek lead plaintiff appointment and can contact Kirby McInerney LLP at [email protected] at no cost.

- Levi & Korsinsky, LLP is investigating PayPal for potential disclosure issues around its key operating metrics and their timing, in light of SEC guidance on GAAP vs. non-GAAP prominence.

- In its Feb. 3, 2026 release, PayPal reported adjusted EPS of $1.23, missing analyst expectations of $1.30–$1.33.

- Q4 revenue was $8.68 billion versus estimates of $8.80 billion, with management attributing the shortfall to weaker checkout growth and macroeconomic headwinds.

- The company announced CEO Dan Schulman’s departure, naming HP’s Enrique Lores as his successor.

- Shares plunged 19–20% to a 12-month low of ~$42 on Feb. 3, accompanied by a surge in trading volume.

- Stripe is in early-stage discussions to acquire all or parts of PayPal, lifting PayPal shares by about 6–7% on the news.

- The contemplated transaction could exceed $60 billion, with Stripe considering either a full buyout or selective asset purchase.

- Stripe’s recent tender offer values the company at roughly $159 billion, and its platform processed $1.9 trillion in volume (up 34% from 2024); its Link wallet serves over 200 million users.

- PayPal’s share price closed at $47.01, up 6.7%, implying a market cap near $43.3 billion following the report.

- PayPal shares plunged 46–50% over the past year, reducing its market value to $38 billion and prompting takeover interest.

- Preliminary talks with banks suggest potential suitors are considering either a full-company acquisition or purchases of specific units like Venmo.

- Fourth-quarter profit and revenue missed analyst expectations, and payment volume growth continued to slow.

- Enrique Lores is set to become CEO on March 1 after Alex Chriss’s removal following disappointing results.

- Q4 2025 revenue of $8.68 billion missed the $8.80 billion consensus; adjusted EPS of $1.23 fell short of the $1.30–$1.33 estimate

- Warned that 2026 EPS will decline year-over-year, well below prior Wall Street forecasts

- CEO Dan Schulman will depart and be replaced by HP veteran Enrique Lores

- Shares tumbled 16–17% to a 12-month low near $53, with trading volume 3–4× the 30-day average

- Class action lawsuit filed in the U.S. District Court for the Northern District of California alleging PayPal made misleading statements about its 2027 financial targets and Branded Checkout growth while concealing salesforce readiness issues.

- Lawsuit follows PayPal’s disappointing Q4 and FY2025 results announced Feb 3, 2026, a sudden CEO transition, withdrawal of its 2027 guidance, and a 20.31% stock decline from $52.33 to $41.70 in one day.

- Investors who acquired PayPal shares between Feb 25, 2025 and Feb 2, 2026 have until April 20, 2026 to seek appointment as lead plaintiff.

- Pomerantz LLP is investigating claims on behalf of investors that PayPal and certain officers/directors engaged in securities fraud or other unlawful business practices.

- On February 3, 2026, PayPal reported weaker-than-expected Q4 and FY2025 earnings and revenue.

- PayPal announced the departure of CEO Alex Chriss alongside its Q4 results announcement.

- Following the announcement, PayPal’s share price plunged 20.31% to $41.70 on February 3, 2026.

- Levi & Korsinsky, LLP is probing PayPal for a notable gap between its prior outlook and actual fourth quarter 2025 results.

- Q4 2025 revenue was $8.68 billion, missing estimates by $120 million (~1.4%), and adjusted EPS of $1.23 fell short of the $1.30–$1.33 consensus (5.4–7.5% miss).

- The company’s 2026 guidance forecasts a decline in transaction margin dollars and adjusted EPS ranging from a low-single-digit fall to a modest gain, below analyst models.

- Shares plunged 19–20% to about $42, establishing a new 52-week low after the announcement.

- Report projects the Poland BNPL market will grow by 24.7% in 2026 to US$4.09 billion.

- The sector recorded a 27.7% CAGR from 2022–2025 and is forecast to sustain a 21.3% CAGR through 2026–2031.

- Market size is expected to expand from US$3.28 billion in 2025 to US$10.72 billion by 2031.

- Analysis is underpinned by 90+ KPIs, including market size, segment breakdowns, and consumer behaviour, with competitive insights on PayPo, Klarna, Twisto, PayPal, and PayU.

- Forecast period covers 2026–2031, offering strategic inputs for investment and expansion in Poland’s BNPL landscape.

- PayPal’s Board has appointed Enrique Lores as President and Chief Executive Officer, effective March 1, 2026, succeeding Alex Chriss, with Jamie Miller serving as Interim CEO until Lores assumes the role.

- David W. Dorman has been named Independent Board Chair, effective immediately, and Enrique Lores relinquishes the Board Chair position while remaining a director.

- The leadership changes follow a strategic board evaluation aimed at accelerating execution, innovation, and PayPal’s competitive position in a rapidly evolving AI-driven payments landscape.

Fintool News

In-depth analysis and coverage of PayPal Holdings.

Stripe Explores Acquisition of PayPal: A $200 Billion Fintech Earthquake?

Stripe Hits $159 Billion Valuation, Surpasses 2021 Peak as AI Payments Boom

PayPal Attracts Takeover Interest After Stock Collapses 87% From Highs

PayPal Fires CEO Alex Chriss After 2.5 Years, Taps HP's Enrique Lores

PayPal Acquires Cymbio to Power AI Shopping as Agentic Commerce Wars Heat Up

Quarterly earnings call transcripts for PayPal Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more