Earnings summaries and quarterly performance for PayPal Holdings.

Executive leadership at PayPal Holdings.

Alex Chriss

President and Chief Executive Officer

Aaron Webster

Executive Vice President, Global Chief Risk Officer

Diego Scotti

Executive Vice President, General Manager, Consumer Group

Frank Keller

Executive Vice President, General Manager – Large Enterprise & Merchant Platform Group

Jamie Miller

Executive Vice President, Chief Financial and Operating Officer

Michelle Gill

Executive Vice President, General Manager – Small Business & Financial Services Group

Suzan Kereere

President, Global Markets

Board of directors at PayPal Holdings.

Ann Sarnoff

Director

Carmine Di Sibio

Director

David Dorman

Director

David Moffett

Director

Deborah Messemer

Director

Deirdre Stanley

Director

Enrique Lores

Independent Board Chair

Frank Yeary

Director

Gail McGovern

Director

Jonathan Christodoro

Director

Joy Chik

Director

Research analysts who have asked questions during PayPal Holdings earnings calls.

Harshita Rawat

AllianceBernstein

8 questions for PYPL

Tien-tsin Huang

JPMorgan Chase & Co.

8 questions for PYPL

Dan Dolev

Mizuho Financial Group

7 questions for PYPL

Darrin Peller

Wolfe Research, LLC

7 questions for PYPL

Jason Kupferberg

Bank of America

7 questions for PYPL

Ramsey El-Assal

Barclays

6 questions for PYPL

Sanjay Sakhrani

Keefe, Bruyette & Woods (KBW)

6 questions for PYPL

Timothy Chiodo

UBS Group AG

6 questions for PYPL

Andrew Schmidt

Citigroup Inc.

5 questions for PYPL

Trevor Williams

Jefferies LLC

3 questions for PYPL

Colin Sebastian

Baird

2 questions for PYPL

James Faucette

Morgan Stanley

2 questions for PYPL

Will Nance

Goldman Sachs

2 questions for PYPL

Bryan Keane

Deutsche Bank

1 question for PYPL

Daniel Perlin

RBC Capital Markets

1 question for PYPL

Darren Peller

Wolfe Research

1 question for PYPL

Sanjay Sakrani

KBW

1 question for PYPL

William Nance

The Goldman Sachs Group, Inc.

1 question for PYPL

Recent press releases and 8-K filings for PYPL.

- Levi & Korsinsky, LLP is probing PayPal for a notable gap between its prior outlook and actual fourth quarter 2025 results.

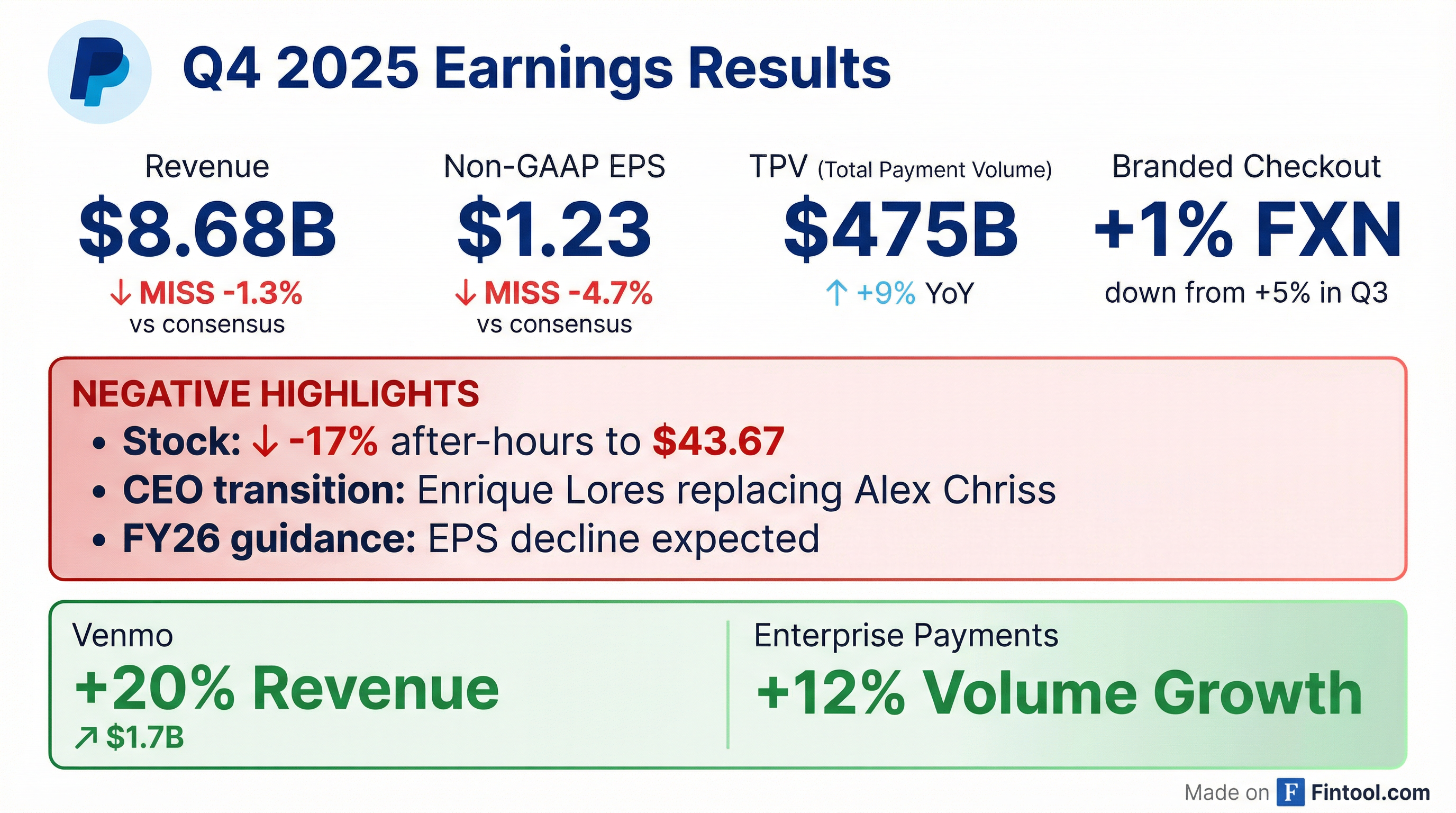

- Q4 2025 revenue was $8.68 billion, missing estimates by $120 million (~1.4%), and adjusted EPS of $1.23 fell short of the $1.30–$1.33 consensus (5.4–7.5% miss).

- The company’s 2026 guidance forecasts a decline in transaction margin dollars and adjusted EPS ranging from a low-single-digit fall to a modest gain, below analyst models.

- Shares plunged 19–20% to about $42, establishing a new 52-week low after the announcement.

- Report projects the Poland BNPL market will grow by 24.7% in 2026 to US$4.09 billion.

- The sector recorded a 27.7% CAGR from 2022–2025 and is forecast to sustain a 21.3% CAGR through 2026–2031.

- Market size is expected to expand from US$3.28 billion in 2025 to US$10.72 billion by 2031.

- Analysis is underpinned by 90+ KPIs, including market size, segment breakdowns, and consumer behaviour, with competitive insights on PayPo, Klarna, Twisto, PayPal, and PayU.

- Forecast period covers 2026–2031, offering strategic inputs for investment and expansion in Poland’s BNPL landscape.

- PayPal’s Board has appointed Enrique Lores as President and Chief Executive Officer, effective March 1, 2026, succeeding Alex Chriss, with Jamie Miller serving as Interim CEO until Lores assumes the role.

- David W. Dorman has been named Independent Board Chair, effective immediately, and Enrique Lores relinquishes the Board Chair position while remaining a director.

- The leadership changes follow a strategic board evaluation aimed at accelerating execution, innovation, and PayPal’s competitive position in a rapidly evolving AI-driven payments landscape.

- Law Offices of Frank R. Cruz launched an investigation into PayPal for possible federal securities law violations, urging shareholders who lost money to contact the firm.

- On February 3, 2026, PayPal replaced CEO Alex Chriss, citing execution and pace of change below the Board’s expectations.

- In its Q4 and FY 2025 results, PayPal reported adjusted EPS of $1.23 (vs. $1.29 expected) and revenue of $8.68 billion (vs. $8.79 billion expected), and admitted branded checkout execution issues.

- PayPal’s stock fell as much as 20% intraday on the news, leading to investor losses.

- PayPal reported Q4 revenue of $8.68 billion and adjusted EPS of $1.23, missing Street estimates; total payment volume rose 6% to $475.1 billion, while branded-checkout growth slowed to 1%.

- The board announced CEO Alex Chriss will be replaced by Enrique Lores (former HP CEO) on March 1, with CFO Jamie Miller serving as interim until then.

- Issued a full-year 2026 adjusted profit outlook calling for a low-single-digit decline or slight growth, below Wall Street’s ~8% growth expectation, and warned Q1 earnings may fall mid-single-digits.

- Shares plunged 15–17% in premarket trading, hitting as low as $43.26, amid concerns over execution, softer U.S. retail demand and intensifying competition.

- The board appointed Enrique Lores as President and CEO effective March 1, with Jamie Miller serving as interim CEO during the transition and David Dorman named Board Chair.

- Full-year 2025 revenue was $33.2 billion, up 4% on a spot and currency-neutral basis; Q4 total payment volume reached $475 billion (-9% spot, +6% FX-neutral), driving FY TPV of $1.8 trillion (+7% spot).

- Non-GAAP EPS grew 14% to $5.31 for 2025, with Q4 revenue up 4% spot (3% FX-neutral); adjusted free cash flow was $6.4 billion for the full year.

- Key growth drivers included Venmo revenue of $1.7 billion (+20%), Q4 Venmo TPV +13%, Buy Now, Pay Later TPV >$40 billion (+20%), and seven consecutive quarters of profitable growth in enterprise payments, while online branded checkout volume grew just 1%.

- Underperformance in online branded checkout prompted increased investment in experience, presentment, and rewards; 2026 guidance assumes flat TM dollars, non-GAAP EPS down low single digits to slightly positive, ~$6 billion in share repurchases, and ≥$6 billion in adjusted free cash flow.

- PayPal appointed Enrique Lores as President and CEO effective March 1 and named David Dorman as Board Chair, with Steve serving as interim CEO during the transition.

- In 2025, Venmo revenue grew approximately 20% to $1.7 billion with active accounts surpassing 100 million and 14% ARPA growth; enterprise payments delivered seven consecutive quarters of profitable growth; and BNPL TPV exceeded $40 billion, up over 20% YoY. Transaction margin dollars ex-interest rose 6% for the year; non-GAAP operating income was $6.4 billion, up 9%; full-year share repurchases totaled $6 billion and PayPal initiated a $0.14 quarterly dividend.

- Online branded checkout underperformed in Q4, with TPV growth slowing to 1% (from 5% in Q3) due to U.S. retail weakness, international headwinds (notably Germany), and decelerating high-growth verticals, compounded by deployment and integration challenges.

- For 2026, PayPal plans approximately 3 points of transaction margin headwind from targeted investments, guiding to low single-digit revenue growth in Q1, roughly flat to slightly down TM dollars ex-interest, and mid-single-digit non-GAAP EPS decline.

- Online branded checkout TPV grew 1% in Q4, down from 5% in Q3, due to U.S. retail weakness, German macro headwinds, vertical slowdowns, and integration challenges.

- 2026 priorities focus on experience (biometric/passkey adoption), presentment (upstream BNPL messaging), and selection (rewards programs) to accelerate branded checkout growth.

- Venmo TPV +13% and MAAs +7%, U.S. debit card TPV +50% and MAAs +35%, and enterprise PSP margins doubled net processing yield in Q4.

- Capital allocation: completed $6 B share repurchases and launched $0.14/share dividend in 2025; 2026 guidance assumes low single-digit branded checkout growth and mid-single-digit non-GAAP EPS decline, reflecting a ~3-point headwind from targeted investments.

- Management change: Board appointed Enrique Ortiz as next CEO to drive faster execution and clear prioritization in 2026.

- PayPal named Enrique Lores President and CEO effective March 1, 2026, with CFO/COO Jamie Miller serving as interim CEO and David W. Dorman appointed independent board chair.

- Q4 adjusted EPS of $1.23 missed consensus of $1.29; revenue of $8.68 billion versus $8.79 billion expected; total payment volume rose 9% to $475.1 billion.

- Fiscal 2026 EPS guidance set at $5.75, slightly above consensus, and warned of a mid-single-digit decline in Q1 earnings; declared a $0.14 quarterly dividend.

- Shares tumbled about 15–16% in premarket trading following the results and modest guidance.

- In Q4’25, net revenues grew 4% to $8.7 bn and in FY’25 to $33.2 bn, both +4% FXN.

- Q4 GAAP EPS was $1.53, up 38% YoY; non-GAAP EPS was $1.23, up 3%; FY’25 GAAP EPS $5.41 (+35%), non-GAAP EPS $5.31 (+14%).

- Q4 total payment volume reached $475.1 bn, up 9% YoY (6% FXN); active accounts were 439 m, up 1.1% YoY.

- The Board appointed Enrique Lores as the next President and CEO to strengthen execution and innovation.

- For 1Q’26, PayPal sees GAAP EPS declining mid-single digits and non-GAAP EPS declining mid-single digits; FY’26 GAAP EPS also mid-single digit decline and non-GAAP EPS down low-single digits to slightly positive.

Fintool News

In-depth analysis and coverage of PayPal Holdings.

Quarterly earnings call transcripts for PayPal Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more