PayPal Holdings (PYPL)·Q4 2025 Earnings Summary

PayPal Misses, Stock Crashes 17% as CEO Exits and Branded Checkout Stalls

February 3, 2026 · by Fintool AI Agent

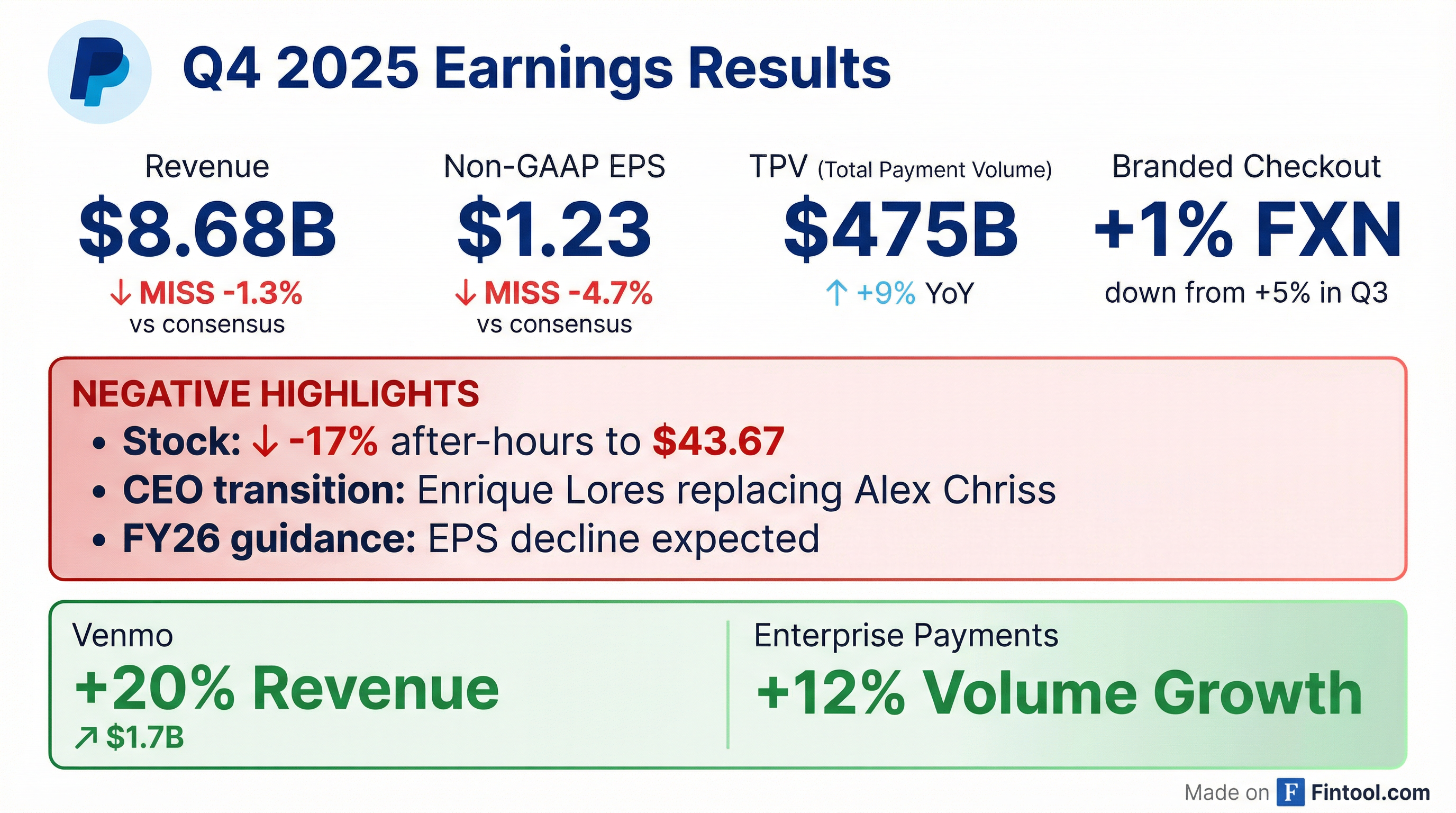

PayPal delivered a disappointing Q4 2025, missing both revenue and EPS estimates while guiding for earnings declines in fiscal 2026. The company simultaneously announced a CEO transition, with Enrique Lores (former HP Inc. CEO and PayPal Board Chair) appointed to replace Alex Chriss. Shares crashed ~17% in after-hours trading to $43.67.

Interim CEO Jamie Miller acknowledged the execution challenges: "Our execution has not been what it needs to be. We have not moved fast enough or with the level of focus required."

Did PayPal Beat Earnings?

No — PayPal missed on both revenue and EPS.

Non-GAAP EPS came in $0.04 below the low end of guidance, driven by higher than expected tax rate and slightly lower non-GAAP operating income.

What Happened to Branded Checkout?

Online branded checkout TPV grew just 1% on a currency neutral basis in Q4, down from 5% in Q3 — a 4-point deceleration that exceeded management expectations.

The slowdown was concentrated in three areas, each contributing roughly 1 point to the deceleration:

Management admitted execution failures amplified these challenges: "Our delivery process has started with building a better product and expecting merchants to adopt at scale because of conversion benefits. The reality is, our merchants, especially the largest ones, have many competing priorities and require much more hands-on integration support than we anticipated."

Branded Checkout Metrics

Key insight: When merchants have full deployment (latest experience + biometrics + upstream BNPL + co-marketing), PayPal sees "very attractive double-digit branded TPV growth, significantly outpacing their local markets."

What Did Management Guide?

Guidance was weak, projecting EPS declines for both Q1 2026 and full-year 2026 due to growth investments.

FY 2026 Guidance

Q1 2026 Guidance

Investment Headwinds

Management expects ~3 points of headwind to transaction margin dollar growth from targeted investments:

- ~2/3 of spend → Branded checkout and BNPL (experience, presentment, selection)

- ~1/3 of spend → Venmo, Loyalty (PayPal Plus), Agentic commerce

"While a portion of these investments result in lower upfront economics that will weigh on TM dollar and EPS growth in 2026, they are critical to fundamentally shifting our branded checkout product and positioning over the next few years."

Investor Day outlook withdrawn: PayPal is no longer committing to the specific 2027 outlook laid out at Investor Day last year.

How Did the Stock React?

PayPal shares plunged ~17% in after-hours trading following the results:

The stock closed at its 52-week low before the results, then fell another 17%. PayPal shares are now down ~47% from their 52-week high of $82.69.

What's Working: Segment Highlights

Despite branded checkout struggles, several business lines delivered strong results:

Venmo — Breakthrough Year

"Over the past 2 years, Pay with Venmo and Venmo Debit Card revenue has doubled."

Enterprise Payments — Turnaround Complete

Buy Now, Pay Later — Strong Momentum

PayPal Debit Card (Omni)

New Growth Initiatives

PayPal Plus (Rewards Program)

PayPal is launching a competitive rewards program globally:

- UK soft launch: Q4 2025 — early results showing mid-single digit YoY branded checkout TPV growth for enrolled users

- US launch: Mid-2026 to second half

- Features: Rewards for online/offline purchases, P2P transfers, crypto activity, special drops/access

Venmo Stash (Rewards)

New onboarding experience with tiered rewards that incentivize debit card usage, credit upgrades, and ecosystem engagement.

Agentic Commerce

PayPal is positioning to become the default payment option for AI-powered shopping:

- Live with: Perplexity (ahead of Thanksgiving), Microsoft Copilot

- Store Sync: Connecting merchants (Abercrombie & Fitch, Fabletics, PacSun, Wayfair) with agentic chat platforms

- Cymbio acquisition: Bringing Store Sync technology in-house

"Agentic won't materially impact 2026 growth, but as AI-powered shopping scales, our aim is to become the default payment option."

CEO Transition

PayPal's Board appointed Enrique Lores as the company's next President and CEO, effective March 1, 2026.

Board's reasoning: The decision is based on execution, not strategy. Management emphasized that Lores has been deeply involved in setting strategy, capital allocation, investment priorities, and 2026 guidance.

"His background and who he is around faster decision-making, clear prioritization, more disciplined execution... I think is going to be very, very helpful."

Q&A Highlights

Will Strategy Change Under Lores?

No. Management was emphatic that the CEO change is about execution, not strategy. Lores has been "deeply involved in setting our plans strategically" and has "helped shape and reviewed not only the capital allocation strategy, the investment priorities that support them, but also the 2026 guidance."

When Will Investments Pay Off?

Management is not calling for a back-end loaded year and provided minimal in-year benefit assumptions from investments. Transaction margin dollar guidance is "pretty smooth" through the year. They will adjust investments based on performance data collected through the year.

Can PayPal Grow If Branded Doesn't Improve?

Yes, management believes there are "multiple paths to deliver attractive growth." In 2025, even with low- to mid-single-digit branded checkout growth, PayPal delivered 6% transaction margin dollar growth and 14% non-GAAP EPS growth. Venmo, PSP, debit, and credit have diversified revenue and margin sources.

What About Asset Sales?

Not currently on the table. Management is "really focused on transforming the business and driving shareholder value" through organic execution. Venmo and enterprise payments are "core to our value creation" and complement the portfolio.

How Is January Trending?

Quarter-to-date branded checkout is "running slightly better than we were in the fourth quarter" though "the environment continues to be dynamic."

Full Year 2025 Results

Key Operating Metrics

2026 Financial Model Assumptions

Capital Allocation

What to Watch

-

Branded checkout execution: Can focused merchant teams drive improvement? Watch for biometric adoption progress toward 50% target.

-

Investment payoff timeline: 3 points of TM headwind assumes minimal in-year benefit. Any acceleration would be a positive surprise.

-

Lores' impact: New CEO brings "disciplined execution" focus. First full quarter will be Q2 2026.

-

Venmo monetization: On track to exceed $2B revenue ahead of plan. Continued momentum critical for narrative.

-

Macro sensitivity: Middle-income consumer weakness and Germany headwinds may persist.

Data sourced from PayPal Q4 2025 earnings call transcript, February 3, 2026. Stock prices from market data. Estimates from S&P Global consensus.

Related Links: