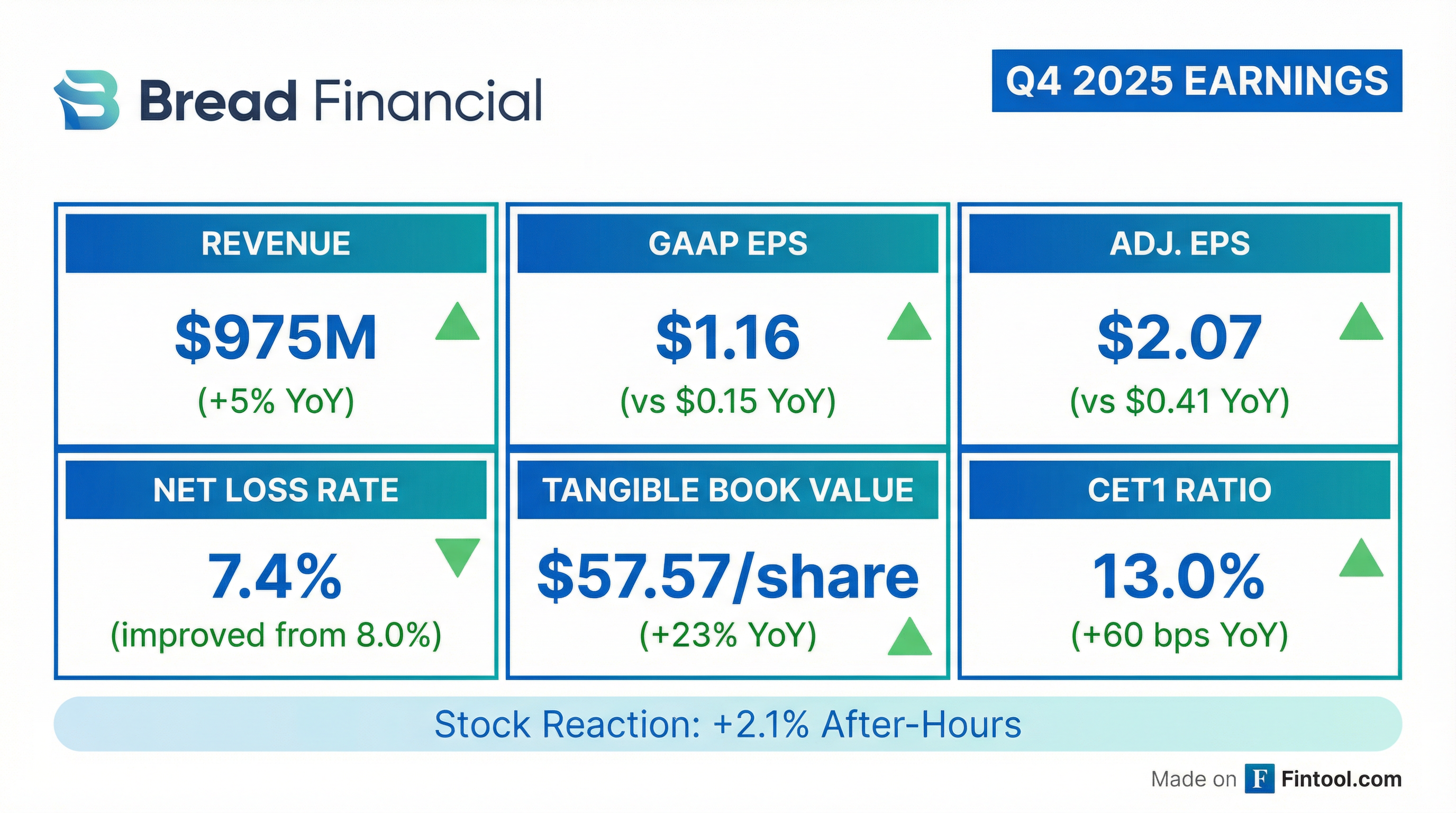

Earnings summaries and quarterly performance for BREAD FINANCIAL HOLDINGS.

Executive leadership at BREAD FINANCIAL HOLDINGS.

Ralph Andretta

President and Chief Executive Officer

Allegra Driscoll

Executive Vice President, Chief Technology Officer

Bryan Campbell

Senior Vice President, Chief Accounting Officer

Joseph Motes

Executive Vice President, Chief Administrative Officer, General Counsel and Secretary

Perry Beberman

Executive Vice President, Chief Financial Officer

Tammy McConnaughey

Executive Vice President, Chief Credit Risk and Operations Officer

Valerie Greer

Executive Vice President, Chief Commercial Officer

Board of directors at BREAD FINANCIAL HOLDINGS.

Research analysts who have asked questions during BREAD FINANCIAL HOLDINGS earnings calls.

Jeffrey Adelson

Morgan Stanley

8 questions for BFH

Mihir Bhatia

Bank of America

8 questions for BFH

Sanjay Sakhrani

Keefe, Bruyette & Woods (KBW)

8 questions for BFH

Moshe Orenbuch

TD Cowen

7 questions for BFH

Vincent Caintic

Stephens Inc.

7 questions for BFH

John Pancari

Evercore ISI

5 questions for BFH

Bill Carcache

Wolfe Research, LLC

4 questions for BFH

Dominick Gabriele

Compass Point Research & Trading, LLC

3 questions for BFH

Reggie Smith

JPMorgan Chase & Co.

3 questions for BFH

Terry Ma

Barclays

3 questions for BFH

John Hecht

Jefferies

2 questions for BFH

Reginald Smith

JPMorgan Chase & Co.

2 questions for BFH

Richie Smith

JPMorgan Chase & Co.

2 questions for BFH

David Rochester

Compass Point

1 question for BFH

Jon Arfstrom

RBC Capital Markets

1 question for BFH

Ryan Shelley

Bank of America

1 question for BFH

Recent press releases and 8-K filings for BFH.

- Bread Financial Holdings, Inc. announced a $600 million increase to its existing share repurchase authorization.

- As of December 31, 2025, the company had $240 million remaining on its open share repurchase authorization, and made an additional $75 million in repurchases during 2026.

- Following the increase, the company's total share repurchase authorization is now $765 million, with no expiration date.

- Bread Financial's Board of Directors has approved a $600 million increase to the Company’s existing share repurchase authorization.

- This increase brings the Company's total share repurchase authorization to $765 million, with no expiration date.

- Prior to this announcement, $165 million of share repurchase capacity was available, considering $75 million in repurchases made during 2026 to date.

- Bread Financial's CFO, Perry Beberman, stated that the company serves "Middle America" (near prime to prime customers) and observes a resilient consumer who has adjusted to inflation, expecting continued improvement in credit quality and spend resumption throughout 2026. The 2026 outlook anticipates continued improvement in credit losses, despite a seasonal spike expected in February to near 8%.

- The company anticipates low single-digit average loan growth for 2026, with January showing flat year-over-year growth, driven by new partner launches and future announcements. Net interest margin is expected to be flat to slightly up in 2026 due to pricing changes implemented in 2024 and 2025, which are expected to run their course by 2027.

- Bread Financial is targeting mid-20s Return on Tangible Common Equity (ROTCE), supported by efficiency gains, aiming for a 6% loss rate range, and optimizing its capital stack, including issuing up to $300 million of preferred stock.

- Capital priorities include supporting profitable growth, investing in the company, paying down debt (reduced from $900 million to $500 million), and returning capital to shareholders, with $240 million in share authorizations outstanding and a target CET1 ratio of 13%-14%.

- The company applied in December to merge its two legacy banks into the Utah Bank to enhance funding flexibility and risk management. Bread Financial also leverages AI with over 200 machine learning models and 60 initiatives in flight to drive efficiency and improve customer service.

- Bread Financial anticipates low single-digit average loan growth for 2026, building on flat year-over-year growth in January 2026, driven by new partner launches and an improving credit mix.

- The company expects continued improvement in credit quality in 2026, targeting a 6% loss rate range for its mid-20s Return on Tangible Common Equity (ROTC) goal, despite an expected seasonal spike in February losses near 8%.

- Net interest margin is projected to be flat to slightly up in 2026, supported by prior pricing adjustments that are expected to fully integrate by 2027.

- Bread Financial plans for positive operating leverage in 2026 through revenue growth and ongoing operational excellence initiatives, while also leveraging AI with over 60 initiatives in flight.

- The company submitted an application in December 2025 to merge its two banks for enhanced funding flexibility and intends to continue share buybacks with $240 million in outstanding authorizations, maintaining CET1 targets in the 13%-14% range.

- Bread Financial is cautiously optimistic for 2026, anticipating a return to growth mode for the business, continued credit improvement, and positive operating leverage.

- The company expects low single-digit average loan growth for the full year, primarily driven by new partner launches including Raymour & Flanigan, Cricket Wireless, and Vivint, along with future unannounced partnerships.

- Management forecasts continued improvement in credit losses throughout 2026, supported by gradual improvement in the existing portfolio and lower loss rates from new vintages. The net interest margin is guided to be flat to slightly up due to pricing changes implemented in 2024 and early 2025.

- Bread Financial plans to maintain capital targets in the 13%-14% CET1 range and has $240 million in share authorizations outstanding for returning excess capital to shareholders. An application was submitted in December to merge its two legacy banks into the Utah Bank to enhance funding flexibility.

- Financial Outlook: Bread Financial reported strong January results with flat loan growth and good loss and delinquency performance, though February losses are expected to increase seasonally. The company anticipates low single-digit loan growth for 2026, supported by new partners and improving credit quality, and guides for a flat to slightly up Net Interest Margin (NIM) due to ongoing pricing changes.

- Credit & Reserves: The company aims to reduce its loss rate from the current 7% to a long-term target of around 6% through responsible underwriting, balancing profitability with credit risk. The long-term reserve rate is projected to gradually decrease to approximately 10%, influenced by credit quality and the macro outlook.

- Strategic Diversification: Bread Financial has expanded its product offerings beyond private label credit cards to include co-brand, direct-to-consumer, and buy now, pay later options, serving diverse retail verticals. This strategy enhances consumer reach and partner relationships, with the company actively pursuing new programs and larger portfolio opportunities.

- Funding Initiatives: In 2025, the company refinanced $900 million in senior notes at 9.75% to $500 million at 6.75%, issued $400 million in subordinated notes, and $75 million in preferred stock. Bread Financial plans to continue growing its direct-to-consumer deposits, which were $8.5 billion at year-end 2025, aiming to reach 50% of total funding.

- January 2026 results showed strong performance in losses and delinquency, with loan growth flat, marking an inflection point. The company projects low single-digit loan growth for the full year 2026.

- Non-interest expenses for Q1 2026 are expected to be slightly down from $500 million in Q4 2025. Management aims to reduce the loss rate from 7%+ to approximately 6% , with a long-term reserve rate target of around 10%.

- In 2025, the company refinanced $900 million in senior notes to $500 million at 6.75%, issued $400 million in subordinated notes, and $75 million in preferred stock. For 2026, they plan to grow direct-to-consumer deposits (exited 2025 at $8.5 billion) towards a 50% funding target, and expect Net Interest Margin (NIM) to be flat to slightly up.

- Strategic initiatives include continued investment in technology, digital, and AI, with an ongoing tech transformation to migrate to the cloud.

- For January 2026, Bread Financial reported flat loan growth and pleasing losses and delinquency. However, February losses are expected to increase seasonally to approximately 8%. The company anticipates low single-digit loan growth for 2026 and projects Net Interest Margin (NIM) to be flat to slightly up.

- The company is targeting a long-term loss rate of around 6% and expects the long-term reserve rate to be approximately 10%.

- In 2025, Bread Financial significantly improved its funding structure by refinancing $900 million of senior notes at 9.75% down to $500 million at 6.75%, issuing $400 million in subordinated notes, and $75 million in preferred stock. Direct-to-consumer deposits grew to $8.5 billion by the end of 2025, with a goal to reach 50% of total funding.

- Bread Financial has diversified its product portfolio beyond private label cards to include co-brand, direct-to-consumer, and buy now, pay later options, serving a "Middle America" customer base with newer vintages averaging $94,000 in income.

- Bread Financial Holdings, Inc. reported a net principal loss rate of 7.1% for January 2026, an improvement from 7.8% in January 2025.

- The company's delinquency rate as of January 31, 2026, was 5.9%, down from 6.1% as of January 31, 2025.

- End-of-period credit card and other loans stood at $18,386 million as of January 31, 2026, a slight increase from $18,366 million as of January 31, 2025.

- Bread Financial reported a net principal loss rate of 7.1% for the month ended January 31, 2026, an improvement from 7.8% for the same period in 2025.

- The company's delinquency rate decreased to 5.9% as of January 31, 2026, compared to 6.1% as of January 31, 2025.

- Net principal losses for the month ended January 31, 2026, were $111 million, down from $123 million in January 2025.

- End-of-period credit card and other loans were $18,386 million as of January 31, 2026, a slight increase from $18,366 million as of January 31, 2025.

Quarterly earnings call transcripts for BREAD FINANCIAL HOLDINGS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more