AGILYSYS (AGYS)·Q3 2026 Earnings Summary

Agilysys Posts 16th Consecutive Record Quarter, Stock Drops 12% Aftermarket

January 26, 2026 · by Fintool AI Agent

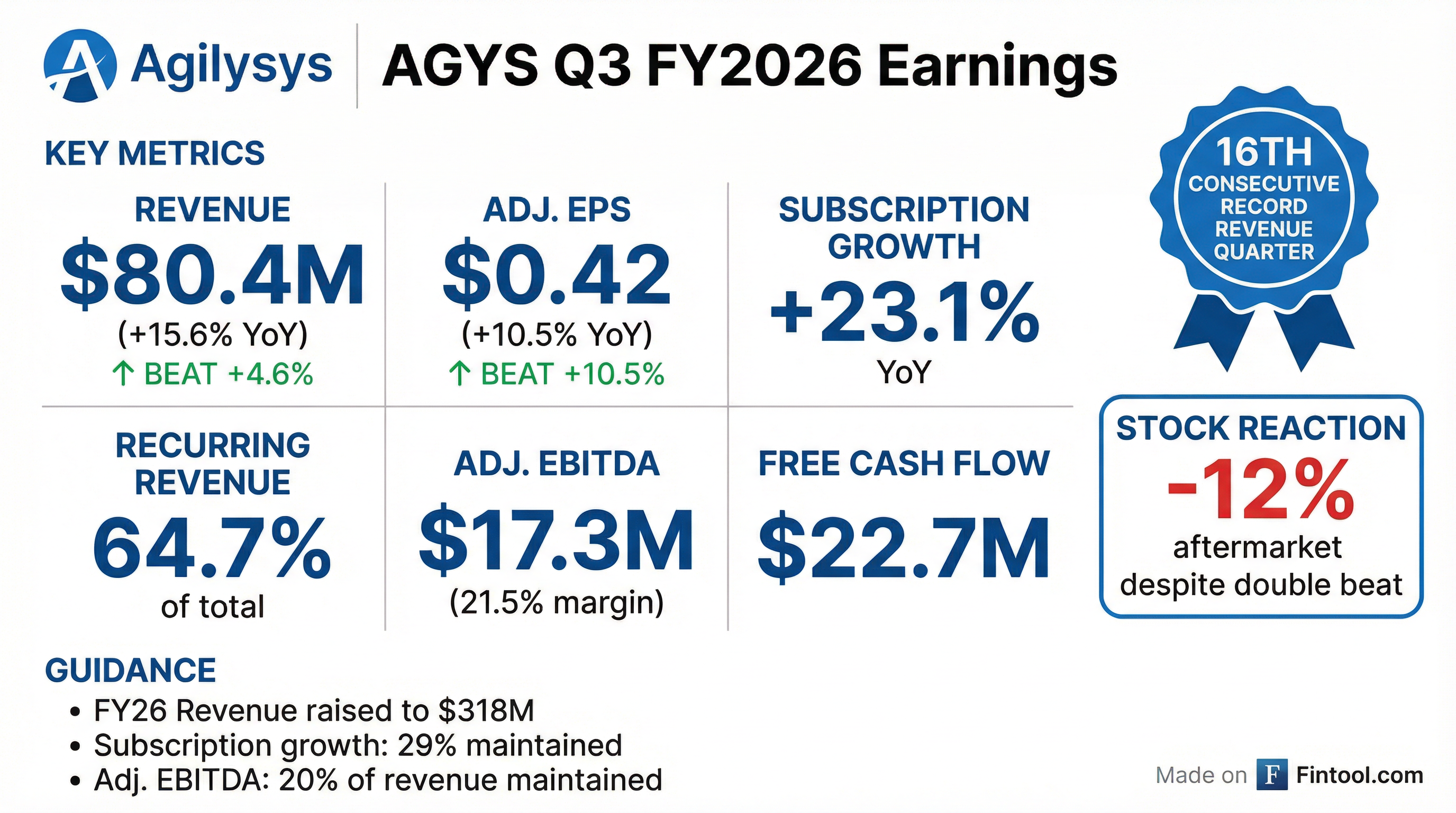

Agilysys (NASDAQ: AGYS), the hospitality software provider, delivered its 16th consecutive record revenue quarter with Q3 FY2026 results that topped Wall Street estimates on both the top and bottom lines. However, shares plunged approximately 12% in aftermarket trading to $99.51 despite the strong results, wiping out the day's 5.5% gain.

Did Agilysys Beat Earnings?

Yes — Agilysys beat on both revenue and EPS.

*Values retrieved from S&P Global

Revenue grew 15.6% year-over-year from $69.6M in Q3 FY2025, driven primarily by subscription revenue growth of 23.1%. Recurring revenue (subscription + maintenance) reached a record $52.0M, representing 64.7% of total revenue — the highest percentage level reached so far.

What Changed From Last Quarter?

Key deltas vs Q2 FY2026:

Record implementation quarter — Despite Q3 holiday season challenges, this was the best quarter on record for subscription ARR installed, 40% higher than the comparable period last year.

Best December sales month ever — Global sales recovered strongly after a gaming slowdown in October-November.

Debt-free balance sheet — The company paid down its $24M credit revolver, leaving it with zero debt and $81.5M in cash.

What Did Management Guide?

Agilysys raised full-year FY2026 revenue guidance while maintaining profitability targets:

FY27 outlook teased — CEO Ramesh Srinivasan stated: "It is highly likely that the next couple of fiscal years will turn out to be the most exciting ones in our history, with increased top and bottom-line growth expectations." He confirmed FY27 profitability "should definitely be higher" than FY26's 20% Adjusted EBITDA.

How Did the Stock React?

Down ~12% aftermarket — Despite beating estimates and raising guidance, AGYS shares fell from $113.55 (regular session close) to $99.51 in aftermarket trading.

The aftermarket decline may reflect:

- Gaming segment concerns — October-November sales slowdown in casino vertical

- Gross margin compression — 62.5% vs 63.0% in the year-ago quarter

- Q4 subscription deceleration — Implied ~20% growth vs 23% this quarter due to Book4Time comps

- Profit-taking — Stock had rallied significantly heading into earnings

Marriott PMS Project Update

The flagship Marriott property management system project reached a significant milestone:

"The pilot phase went off very successfully. Our products worked very well... I've been in enterprise software for close to three decades now, and this is one of the best, most collaborative projects that I've seen managed by a customer." — CEO Ramesh Srinivasan

Key developments:

- Pilot property implementations completed successfully across U.S. and Canada

- Now entering implementation waves phase, which will "keep increasing in size and scope during coming months"

- Project remains excluded from sales, backlog, and subscription revenue guidance

- Most costs and infrastructure are "well provided for" — no margin headwind expected

Q&A Highlights

Gaming Vertical Slowdown

Analyst Mayank Tandon (Needham) pressed on October-November weakness in casino gaming sales:

"Casino gaming, our strongest sales vertical for several years now, witnessed a relative sales slowdown during the months of October and November... but recovered well during the month of December." — CEO

Management declined to speculate on causes, noting December "came roaring back" and January is "back to normal levels." Not all postponed deals were recovered in December — some will close in coming months.

International Sales Dynamics

Q3 international sales were "somewhat lackluster," but cumulative year-to-date is already close to the second-best full year ever with one quarter remaining.

"We've never had this kind of a big customer in terms of multi-product ecosystem... There are multiple bigger opportunities we are working on now, but it is going to be a little bit up and down quarter-wise internationally." — CEO

AI Integration Across the Business

On AI's impact, management outlined multiple deployment areas:

Internal operations:

- Dedicated AI team with leaders focused on "AI-izing the company"

- Improving product development, quality assurance, implementation services, marketing, sales, finance, customer support, and legal

Product features:

- Natural language processing in data analysis tools

- Automatic voice recognition for spa reservations, kiosk ordering, web booking

- Intelligent room upgrades on mobile and kiosks

- Image recognition in kiosks

- AI-managed complex resort package booking (recently won innovation award)

POS Business Turnaround

The modernized point-of-sale solution, now nearly two years in field, is hitting its stride:

- POS subscription revenue growth accelerated to 20% YoY (up from mid-high teens)

- iOS, Windows, and Android support in one code base — "there are no competing systems to that"

- Expanding beyond business & industry into higher education and healthcare FSM

Reference Customer Breakthrough

Management highlighted a significant shift in customer willingness to serve as references:

"Two of our major customers currently using multiple Agilysys products... are in the process of taking on a couple of major brand flags but have turned down and refused to take on the brand's mandated PMS product, insisting that they will need to stick with Agilysys PMS." — CEO

The volume and prestige of reference customers has "expanded exponentially" as modernized solutions mature.

Implementation Efficiency Gains

AI tools are reducing implementation timelines:

- Configurations and product-to-product integrations done "much faster using AI tools"

- Services costs decreasing, improving competitive positioning

- Faster booking-to-revenue conversion (typically 1-2 quarter gap)

Segment Performance

Revenue breakdown for Q3 FY2026:

Subscription details:

- Subscription revenue was 67.0% of recurring revenue (up from 63.8% YoY)

- 17th consecutive quarter of 23%+ YoY subscription growth

- Subscription run rate doubled in last 2.5 years

- PMS-related subscription grew 30% YoY

- POS-related subscription grew 20% YoY

Sales Highlights

Q3 FY2026 sales momentum:

- Second-best Q3 sales quarter on record

- Best Q3 ever for Hotels, Resorts, and Cruise Ships (HRC) vertical

- Best December month in company history

- Calendar 2025 was best calendar sales year ever

- FSM year-to-date sales already exceed full year for each of prior two years

New customer additions:

- 1,616 new customers added (excluding Book4Time)

- 1,313 new Book4Time spa customers

- 109 instances of selling new products to existing properties (248 total new products)

- All but 2 of 120 new properties were subscription-based

Notable wins mentioned:

- Bolt Farm Treehouse (5-star luxury wellness retreat) — PMS + web booking + spa + 5 other modules

- Sands Resorts in Northern Myrtle Beach — multi-product ecosystem including PMS

- Global POS hunting license master agreement with "one of the largest hospitality corporations in the world"

- Major PMS and multi-product ecosystem deals with several casino gaming corporations

- Expansion with several Ivy League universities

Profitability Metrics

Operating leverage improving: Combined operating expenses (excl. stock comp) fell to 41.2% of revenue from 42.1% YoY.

Balance Sheet Highlights

Debt fully repaid — The company eliminated its $24M credit revolver balance during the first half of FY26.

Forward Catalysts

-

Marriott implementation waves — Rollout starting now and accelerating through calendar 2026; could unlock material subscription revenue not in current guidance

-

FY27 guidance uplift — Management teased higher profitability and "most exciting" fiscal years ahead; guidance expected mid-May

-

International deal pipeline — Working on bigger multi-product ecosystem deals than ever before internationally

-

POS market share gains — Modernized solution now competitive; expanding into healthcare and higher education

-

AI product enhancements — Innovation velocity accelerating with AI tools enabling faster development

Key Risks and Concerns

Gaming vertical volatility — October-November slowdown raises questions about cyclicality, though December recovery was strong

Q4 subscription deceleration — Implied ~20% growth due to Book4Time anniversary; core business still growing 25%+

R&D spending pressure — Customer innovation demands remain high; operating leverage in R&D still "a moving target"

International execution — Quarter-to-quarter volatility likely to continue until more consistent deal flow develops

About Agilysys

Agilysys exclusively delivers hospitality software solutions including property management systems (PMS), point-of-sale (POS), and food & beverage inventory and procurement systems. The customer base includes branded and independent hotels, multi-amenity resorts, casinos, cruise lines, corporate dining providers, higher education campus dining, stadiums, and theme parks.

Earnings call held January 26, 2026.

Related Links: