Earnings summaries and quarterly performance for AGILYSYS.

Executive leadership at AGILYSYS.

Ramesh Srinivasan

President and Chief Executive Officer

Dave Wood

Senior Vice President and Chief Financial Officer

Joe Youssef

Senior Vice President of Sales and Chief Commercial Officer

Kyle Badger

Senior Vice President, General Counsel and Secretary

Sethuram Shivashankar

Senior Vice President, Chief Technology Officer and Chief Information Officer

Board of directors at AGILYSYS.

Research analysts who have asked questions during AGILYSYS earnings calls.

Brian Schwartz

Oppenheimer & Co.

8 questions for AGYS

George Sutton

Craig-Hallum

7 questions for AGYS

Nehal Chokshi

Northland Capital Markets

7 questions for AGYS

Mayank Tandon

Needham & Company, LLC

6 questions for AGYS

Matthew VanVliet

BTIG, LLC

4 questions for AGYS

Stephen Sheldon

William Blair & Company

3 questions for AGYS

Allan Verkhovski

Scotiabank

2 questions for AGYS

Matthew Filek

William Blair

2 questions for AGYS

Matt Vanvliet

Cantor Fitzgerald

2 questions for AGYS

Logan W Lillehaug

Craig-Hallum Capital Group LLC

1 question for AGYS

Matt Flick

William Blair & Company, L.L.C.

1 question for AGYS

Sam Salvas

Needham & Company

1 question for AGYS

Sam Valves

Needham & Company, LLC

1 question for AGYS

Stephen Hardy Sheldon

William Blair & Company L.L.C.

1 question for AGYS

Stephen Sheldon

William Blair

1 question for AGYS

Recent press releases and 8-K filings for AGYS.

- AGILYSYS, INC. raised its FY26 annual guidance in January CY26, with revenue now projected between $315M and $318M (up from $308M-$312M) and subscription revenue growth expected at 27% year over year (up from 25%).

- For the trailing twelve months ended December 31, 2025, the company reported revenue of $310.6M, Adjusted EBITDA of $61.0M, and diluted earnings per share of $1.07.

- The company maintains a strong balance sheet with $81.5M in cash and $20.3M in debt as of December 31, 2025.

- AGILYSYS is 100% hospitality-focused, offering industry-leading solutions globally, with 91% of its revenue from North America for the trailing twelve months ended December 31, 2025.

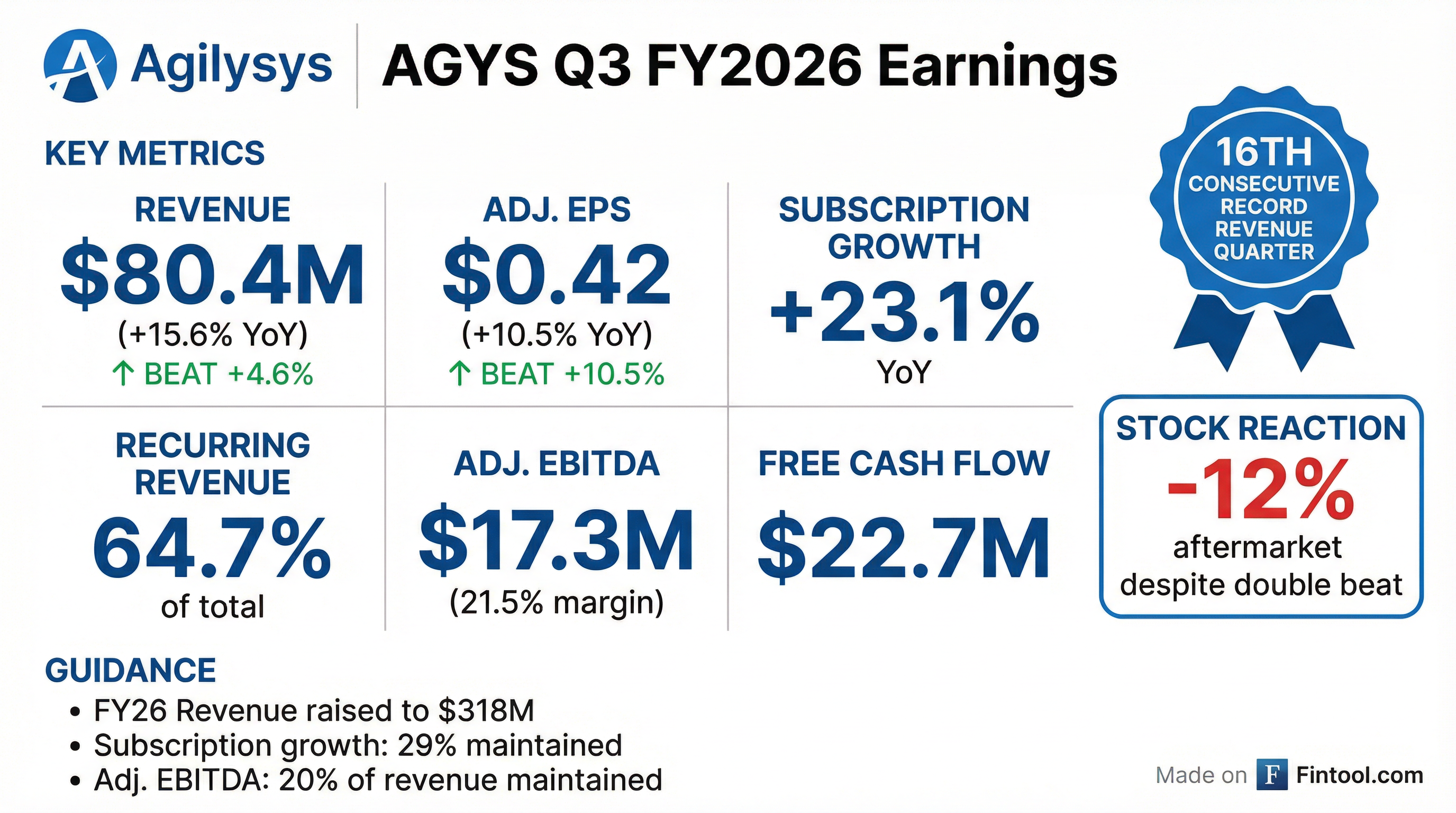

- Fiscal 2026 Q3 revenue reached a record $80.4 million, representing a 15.6% increase over the comparable prior year quarter and marking the 16th consecutive record revenue quarter.

- Recurring revenue for Q3 2026 was a record $52 million, up 17.2% year-over-year, comprising 64.7% of total revenue, while subscription revenue grew 23.1% to a record $34.9 million.

- The company raised its fiscal 2026 full-year revenue guidance to $318 million and maintained its subscription revenue growth guidance at 29% and Adjusted EBITDA expectation at 20% of revenue.

- Q3 fiscal 2026 was the second best Q3 sales quarter, with 1,616 new customers added (excluding Book4Time), all fully subscription-based, and the Hotels, Resorts, and Cruise Ships (HRC) vertical achieved its best Q3 sales quarter on record.

- Agilysys reported record Q3 fiscal 2026 revenue of $80.4 million, a 15.6% increase year-over-year, marking the 16th consecutive record revenue quarter.

- Recurring revenue grew 17.2% to $52 million, representing 64.7% of total revenue, with subscription revenue up 23.1% to $34.9 million.

- The company raised its fiscal 2026 full-year revenue guidance to $318 million and maintained its subscription revenue growth expectation at 29% and Adjusted EBITDA at 20% of revenue.

- Q3 fiscal 2026 was the second best Q3 sales quarter, with the Hotels, Resorts, and Cruise Ships (HRC) vertical achieving its best Q3 sales quarter on record.

- Agilysys added 1,616 new subscription-based customers in Q3 2026, and PMS and POS subscription revenues grew 30% and 20% year-over-year, respectively.

- Agilysys reported record fiscal Q3 2026 net revenue of $80.4 million, representing a 15.6% year-over-year increase, though it missed revenue estimates by approximately $0.2 million and EPS estimates of $0.46 by reporting $0.42.

- Subscription and maintenance revenue grew by 17.2% year-over-year in Q3 2026, reflecting an ongoing shift from perpetual licenses to subscription models.

- Wall Street reactions were mixed-to-positive, with Oppenheimer raising its price target to $140 with an Outperform rating.

- Over the past six months, there was heavy insider selling, including CFO William David III Wood selling 7,574 shares for an estimated $889,810. Conversely, significant institutional buying occurred in Q3 2025 from firms such as Rockefeller, Wellington, and BlackRock.

- Agilysys reported a record total net revenue of $80.4 million for Fiscal 2026 Q3, marking its 16th consecutive record revenue quarter, an increase of 15.6% year-over-year.

- Recurring revenue for the quarter was $52.0 million, comprising 64.7% of total net revenue, with subscription revenue growing 23.1% year-over-year.

- Net income for Fiscal 2026 Q3 was $9.9 million, or $0.35 per diluted share, and Adjusted EBITDA was $17.3 million.

- The company raised its full-year Fiscal 2026 total revenue guidance to $318 million and reiterated its Adjusted EBITDA guidance at 20% of revenue and year-over-year subscription revenue growth of 29%.

- Agilysys reported record total net revenue of $80.4 million for Fiscal 2026 Q3, an increase of 15.6% year-over-year, marking its 16th consecutive record revenue quarter.

- Subscription revenue grew by 23.1% year-over-year in Fiscal 2026 Q3, contributing to recurring revenue of $52.0 million, which was 64.7% of total net revenue.

- Net income for Fiscal 2026 Q3 was $9.9 million, or $0.35 per diluted share, while Adjusted diluted EPS reached $0.42 per share.

- The company raised its full-year Fiscal 2026 total revenue guidance to $318 million and reiterated its Adjusted EBITDA guidance at 20% of revenue and subscription revenue growth guidance at 29%.

- Agilysys, Inc. has raised its fiscal year 2026 annual revenue guidance to between $315 million and $318 million, and increased its Q1 fiscal year 2026 subscription revenue year-over-year growth guidance to 27%.

- For the trailing twelve months ended September 30, 2025, the company reported total revenue of $299.8 million and Adjusted EBITDA of $58.4 million.

- Recurring revenue represented 63% of total revenue, with subscription revenue growing 41% year-over-year for the trailing twelve months ended September 30, 2025.

- The company maintains a 100% hospitality-focused strategy, offering state-of-the-art cloud-native and on-premise solutions.

- Agilysys reported record total net revenue of $79.3 million for Fiscal 2026 Q2, marking its 15th consecutive record revenue quarter and an increase of 16.1% compared to the prior-year period.

- This growth was significantly driven by a 33.1% year-over-year increase in subscription revenue, which reached a record $51.0 million and constituted 64.3% of total net revenue.

- Net income for the Fiscal 2026 second quarter was $11.7 million, or $0.41 per diluted share.

- The company raised its full-year Fiscal 2026 total revenue guidance to a range of $315 million to $318 million and increased subscription revenue growth expectations to 29% year-over-year.

- Agilysys reported record Q2 2026 revenue of $79.3 million, a 16.1% increase year-over-year, and raised its full-year 2026 revenue guidance to $315 million to $318 million.

- The company achieved its best-ever July period of sales and the best first-half sales start in its history for fiscal year 2026, with overall sales up 17% and subscription sales up 59% in the first half compared to the prior year.

- Subscription revenue grew 33.1% year-over-year in Q2 2026, driving a 23% increase in recurring revenue, and the full-year subscription revenue growth guidance was raised to 29%.

- Agilysys continues to enhance its competitive advantage through AI-powered features under its GetSense.ai brand, which are improving product development efficiencies and enabling personalized guest experiences.

Quarterly earnings call transcripts for AGILYSYS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more