APPLIED INDUSTRIAL TECHNOLOGIES (AIT)·Q2 2026 Earnings Summary

Applied Industrial Technologies Q2 FY26: EPS Beat, But Stock Drops 8% as Investors Weigh LIFO Headwinds

January 27, 2026 · by Fintool AI Agent

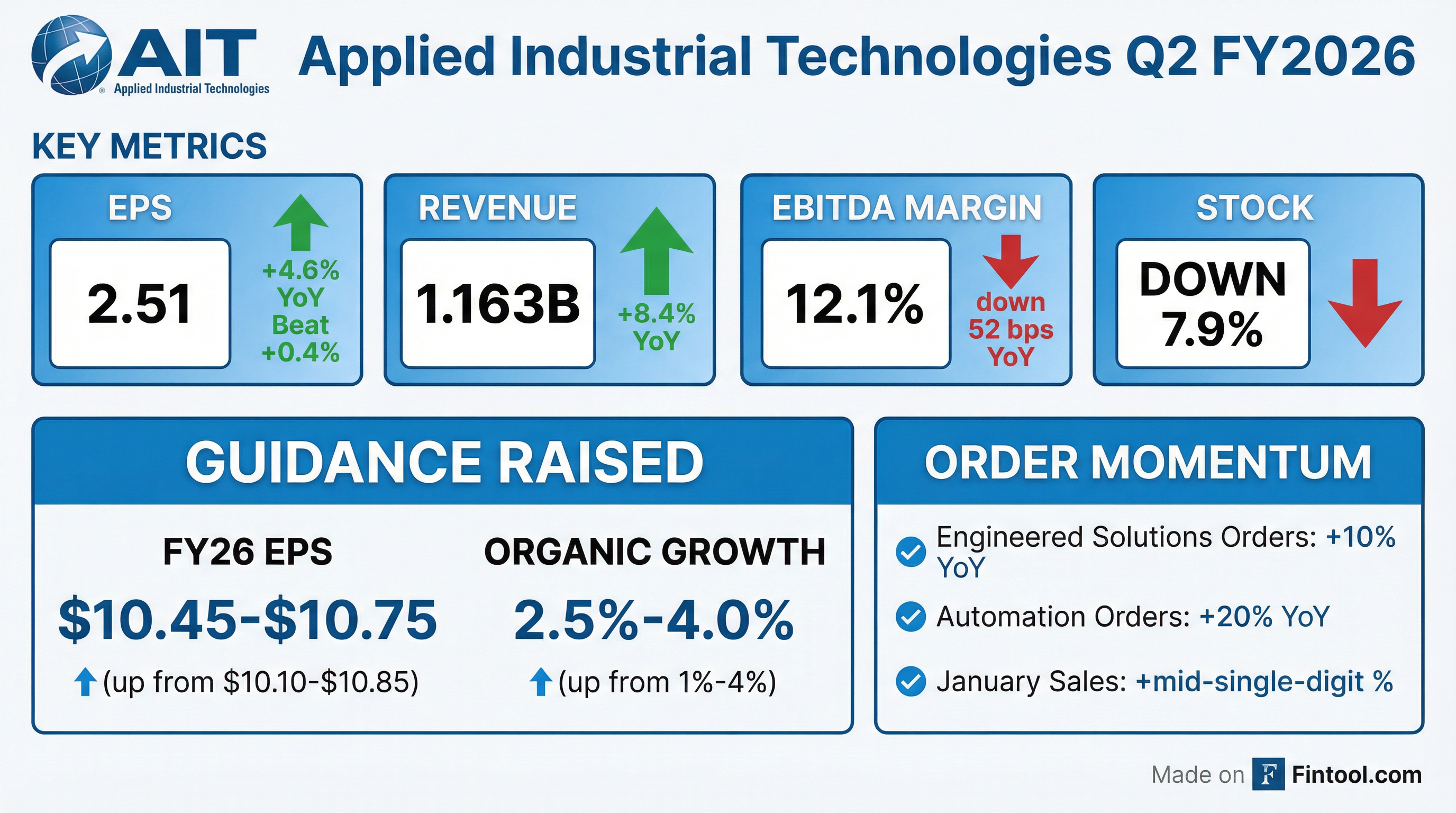

Applied Industrial Technologies delivered a solid Q2 FY2026 with EPS of $2.51 (up 4.6% YoY) and revenue of $1.163B (up 8.4% YoY), modestly beating Street expectations despite a challenging December. Management struck a constructive tone, citing accelerating order momentum—automation orders surged 20% YoY—and raised the low end of FY26 guidance. However, the stock dropped nearly 8% as investors focused on elevated LIFO expense and margin headwinds that overshadowed the guidance raise.

Did Applied Industrial Technologies Beat Earnings?

AIT's Q2 results essentially matched Wall Street expectations—EPS came in slightly ahead while revenue was a hair below consensus:

The quarter included a $6.9 million pre-tax LIFO expense headwind—$2-3 million above management's expectations—and softer-than-normal December sales activity. CEO Neil Schrimsher noted that December weakness was "not indicative of the underlying sales trend," citing mid-week holiday timing and seasonal plant shutdowns.

YoY Performance:

Gross margin declined 19 bps to 30.4%, entirely attributable to a 54 bps YoY headwind from higher LIFO expense. Excluding LIFO, gross margins were up 34 bps YoY to 31%, reflecting strong channel execution and pricing actions.

What Did Management Guide?

Management tightened FY26 guidance toward the high end, signaling growing confidence in second-half momentum:

Key assumptions for the second half:

- Low-to-mid single digit percent YoY organic sales growth

- Q3 pricing contribution ~250 bps, moderating to ~200 bps in Q4

- LIFO expense of $7-8 million per quarter

- Higher net interest expense after interest rate swap matures January-end

For Q3 FY26, management expects organic sales up low-to-mid single digits YoY, gross margin down 10-30 bps sequentially, and EBITDA margin of 12.2%-12.4%.

How Did the Stock React?

AIT shares dropped 7.9% to $259.19 following the earnings release, despite the guidance raise. The selloff reflects investor concern over:

Why the selloff? The $10 million increase in full-year LIFO guidance ($24-26M vs. prior $14-18M) weighed on sentiment, as did the margin compression narrative. CFO Dave Wells explained that LIFO expense "doesn't necessarily travel in exact tandem with pricing" because it's influenced by purchasing mix—this quarter had heavier concentration of parts not purchased for 2-3 years, attracting more LIFO expense.

What Changed From Last Quarter?

Several notable shifts emerged versus Q1 FY26:

Positive developments:

- Order momentum accelerating — Engineered Solutions orders up >10% YoY (strongest in 4 years), with book-to-bill above 1 for 3 of last 4 quarters

- Automation surging — Orders up 20% YoY, driven by reshoring and labor constraints

- January trending well — Organic sales up mid-single-digit % YoY month-to-date

- Guidance raised — Low end of all key metrics lifted

- Capital returns — 11% dividend increase and $143M in buybacks YTD

Ongoing challenges:

- LIFO headwinds persist — Now expected at $24-26M for FY26 (vs. $14-18M prior)

- December weakness — Muted seasonal activity reduced reported organic growth

- Mixed end-markets — 15 of top 30 verticals growing vs. 16 in Q1

Order Momentum: The Key Bright Spot

The Q&A revealed strong order detail across all Engineered Solutions verticals—the strongest performance in four years:

CEO Schrimsher highlighted that book-to-bill was above 1 during the quarter, providing visibility into continued growth.

Automation tailwinds: Management sees structural drivers accelerating automation adoption—labor constraints, reshoring activity, and heightened focus on quality and safety. "How can they drive their efficiencies and productivity where collaborative or mobile robots will help? They're looking at quality control or quality and inspection where vision systems can help."

Segment Performance

Service Center Segment (64% of revenue)

U.S. service center sales grew 4%+ YoY, with strength in both national and local accounts. Growth was strongest in metals, aggregates, mining, utilities, and machinery verticals, offset by declines in lumber, chemicals, and oil & gas.

Engineered Solutions Segment (36% of revenue)

Organic sales were up just 0.5%, with acquisitions (Hydradyne) driving the headline growth. Importantly, January segment organic sales are trending up high single digits YoY.

Hydradyne: One-Year Anniversary Update

AIT marked the one-year anniversary of its Hydradyne acquisition at year-end December. CEO Schrimsher provided a detailed update on the integration:

"We've made tremendous progress in leveraging complementary solutions, harmonizing technical capabilities and systems, and driving operational efficiencies across the combined operating platforms."

The acquisition is now being cross-sold to AIT's legacy southeastern customer base and is capturing growth in fluid power mobile systems and data center thermal management.

Growth Catalysts: Semiconductor & Data Center

Management expressed optimism about emerging technology tailwinds:

Semiconductor (15% of Engineered Solutions):

- Receiving "positive demand signals" from semiconductor customer base

- Multi-year upcycle emerging for wafer fab equipment

- Recent investments in engineering, systems, and production capacity to capture demand

Data Center:

- Expertise in thermal management, robotics, and fluid conveyance

- New business tied to broader data center build-out

- Hydradyne capabilities aligned with thermal management needs

"We believe our technology vertical could provide a nice tailwind to our organic growth in coming quarters."

Q&A Highlights

On incremental margins: CFO Dave Wells noted that at mid-single-digit organic growth, the company can achieve mid-to-high-teens incremental EBITDA margins. "At the midpoint of the guidance, we would assume that the fourth quarter gets to a mid-teen incremental margin on EBITDA at that 4% or so type of organic growth."

On SD&A leverage: Organic constant currency SD&A growth was below organic revenue growth, demonstrating cost discipline. However, merit increases effective January 1 and lapping Hydradyne will close that gap somewhat in Q3.

On tariffs: Management believes most supplier price increases for 2026 are now in place, with Q3 pricing contribution similar to Q2 (~250 bps) before moderating to ~200 bps in Q4. On tariffs specifically: "Perhaps the tariff environment is going to stay moderated at its current level right now as we look out over the rest of the fiscal year."

On capital allocation: Priorities remain: 1) organic growth investment, 2) M&A, 3) dividend growth, 4) opportunistic buybacks. About 700,000 shares remain on the current authorization. Management noted an active M&A pipeline with "potential for greater activity as we look out over 12-18 months."

Capital Allocation Highlights

Management continues executing on capital deployment:

- Dividend increase: 11% raise to the quarterly dividend (following 24% last year)

- Share repurchases: $143M in buybacks during H1 FY26; 700K shares left on authorization

- M&A: Announced Thompson Industrial Supply acquisition (~$20M annual sales)

- Net leverage: 0.3x — significant capacity for deals

Thompson Industrial Supply Acquisition

AIT announced the acquisition of Thompson Industrial Supply, a bolt-on expanding Southern California presence:

Key Management Quotes

On December weakness and January rebound:

"While monthly sales trends have been choppy for most of the year, we do not view December's weakness as indicative of the underlying sales trend developing across the business."

On margin execution amid LIFO headwinds:

"As in prior periods of increasing LIFO expense, our teams responded with a focus on internal initiatives, effective management of product inflation, and strong channel execution."

On second-half outlook:

"We remain prudent with our guidance as we look for greater consistency in sales trajectories... Importantly, sentiment from both our customers and our sales teams continues to be directionally positive, and our business funnels are expanding."

Historical Beat/Miss Trend

AIT has demonstrated remarkable consistency, beating EPS estimates for nine consecutive quarters:

Values retrieved from S&P Global

This analysis was generated by Fintool AI Agent based on Applied Industrial Technologies' Q2 FY2026 earnings call transcript and supplemental materials released January 27, 2026. For the full earnings materials, see AIT Documents.