Earnings summaries and quarterly performance for APPLIED INDUSTRIAL TECHNOLOGIES.

Executive leadership at APPLIED INDUSTRIAL TECHNOLOGIES.

Neil A. Schrimsher

President & Chief Executive Officer

David K. Wells

Vice President – Chief Financial Officer & Treasurer

Jason W. Vasquez

Vice President – Sales & Marketing, U.S. Service Centers

Jon S. Ploetz

Vice President – General Counsel & Secretary

Kurt W. Loring

Vice President – Chief Human Resources Officer

Richard M. Wagner

Chief Accounting Officer & Controller (Principal Accounting Officer)

Warren E. Hoffner

Vice President, General Manager – Fluid Power & Flow Control

Board of directors at APPLIED INDUSTRIAL TECHNOLOGIES.

Research analysts who have asked questions during APPLIED INDUSTRIAL TECHNOLOGIES earnings calls.

David Manthey

Robert W. Baird & Co. Incorporated

8 questions for AIT

Sabrina Abrams

Bank of America

8 questions for AIT

Kenneth Newman

KeyBanc Capital Markets

6 questions for AIT

Christopher Dankert

Loop Capital Markets

5 questions for AIT

Christopher Glynn

Oppenheimer & Co. Inc.

5 questions for AIT

Brett Linzey

Mizuho Securities

4 questions for AIT

Patrick Schuchard

Oppenheimer & Co. Inc.

3 questions for AIT

Chris Dankert

Loop Capital

2 questions for AIT

Ken Newman

KeyBanc

2 questions for AIT

Peter Costa

Mizuho Financial Group

2 questions for AIT

Sam Darkatsh

Raymond James & Associates, Inc.

2 questions for AIT

Aaron Reed

Northcoast Research

1 question for AIT

Peter Cost

Mizuho Securities

1 question for AIT

Recent press releases and 8-K filings for AIT.

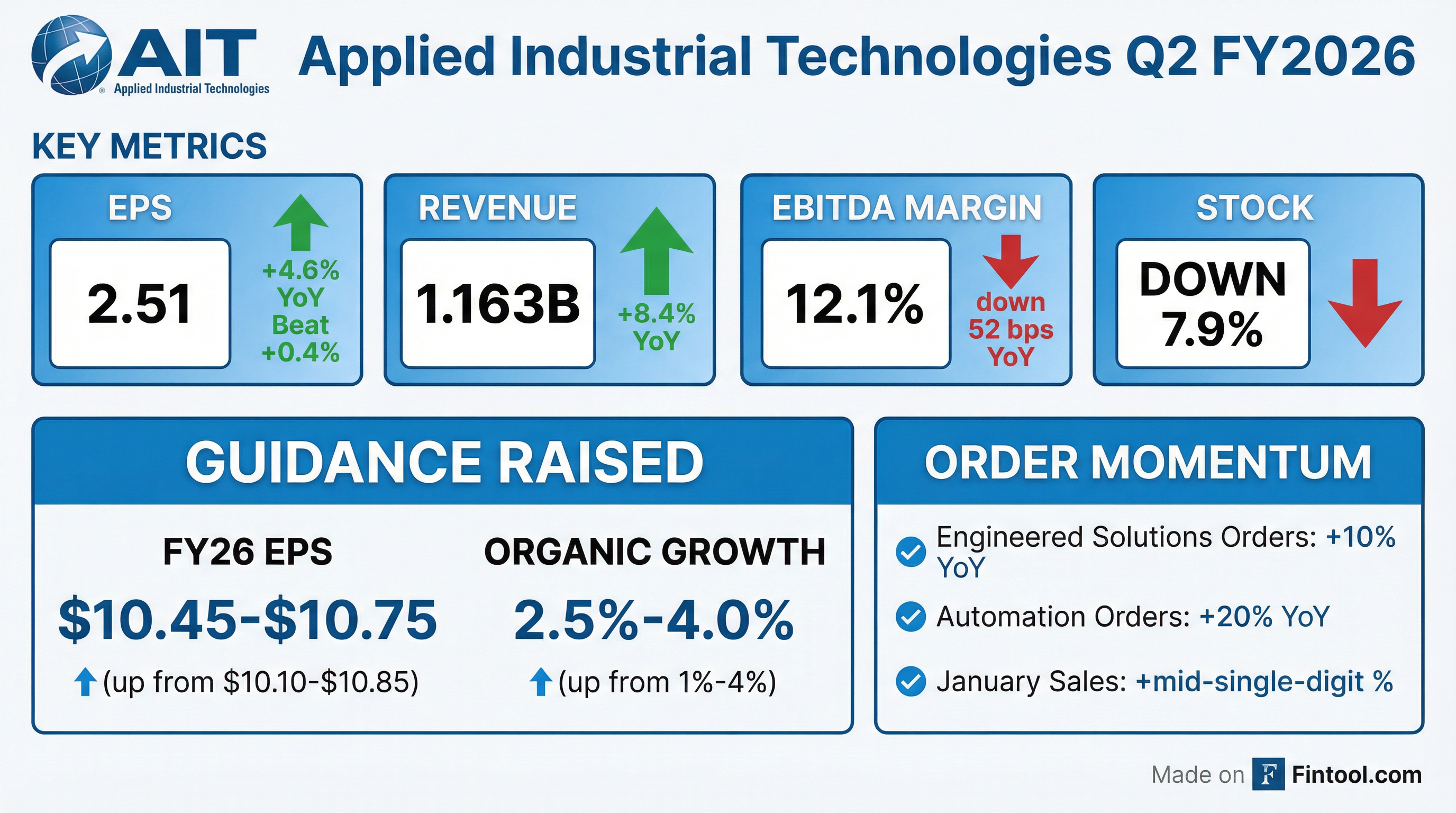

- AIT reported Q2 2026 consolidated sales growth of 8.4% year-over-year, with organic growth of 2.2%. Early Q3 2026 organic sales in January are trending up by a mid-single-digit percentage.

- The company updated its full-year fiscal 2026 EPS guidance to $10.45-$10.75 and raised its sales growth outlook to 5.5%-7%, with organic sales growth now projected at 2.5%-4%. This guidance includes an increased LIFO expense assumption of $24-$26 million.

- AIT announced an 11% increase in its quarterly dividend and repurchased over 346,000 shares for $90 million in Q2 2026.

- The Engineered Solutions segment saw orders increase over 10% year-over-year, and Automation orders were up 20% year-over-year in Q2 2026. The company also acquired Thompson Industrial Supply, adding $20 million in expected annual sales.

- Applied Industrial Technologies reported Q2 2026 consolidated sales growth of 8.4% year-over-year, with organic sales up 2.2%, and EPS increasing 4.6% to $2.51.

- The company updated its full-year fiscal 2026 guidance, raising EPS to $10.45-$10.75 and organic sales growth to 2.5%-4%.

- LIFO expense was $6.9 million in Q2 2026, significantly higher than the prior year, leading to an increased full-year LIFO expense guidance of $24-$26 million.

- AIT announced an 11% increase in its quarterly dividend, deployed over $140 million on share repurchases in the first half of fiscal 2026, and acquired Thompson Industrial Supply.

- The company noted strengthening sales trends, with January organic sales trending up mid-single digits, and strong order growth in its Engineered Solutions segment (up 10%) and Automation (up 20%) in Q2.

- AIT reported Q2 2026 sales of $1,163 million, an 8.4% increase year-over-year, with organic sales up 2.2%. Net Income was $95.3 million, and EPS increased 4.6% year-over-year to $2.51.

- EBITDA for Q2 2026 was $140.4 million, up 3.9% compared to the prior year, resulting in an EBITDA margin of 12.1%. The gross margin of 30.4% included a 54 basis points year-over-year headwind from higher LIFO expense.

- The company tightened its Fiscal Year 2026 guidance, raising the low end for total sales growth to 5.5%-7.0% (from 4%-7%) and organic sales growth to 2.5%-4.0% (from 1%-4%). Diluted EPS guidance was also tightened to $10.45-$10.75 (from $10.10-$10.85).

- AIT deployed $194 million in capital year-to-date fiscal 2026 , which included $143 million in share repurchases during F1H26 and an 11% increase in its quarterly dividend. Management noted that demand is trending positively with order momentum remaining strong across both segments.

- For Q2 2026, Applied Industrial Technologies reported a 8.4% increase in consolidated sales year-over-year, with organic sales up 2.2%, and reported earnings per share (EPS) grew 4.6% to $2.51.

- The company updated its full-year fiscal 2026 guidance, projecting EPS in the range of $10.45-$10.75 and organic sales growth of 2.5%-4%.

- Applied Industrial Technologies announced an 11% increase in its quarterly dividend and deployed over $140 million on share repurchases during the first half of fiscal 2026.

- Early fiscal Q3 2026 organic sales are trending up by a mid-single-digit % year-over-year, with Engineered Solutions segment orders increasing over 10% in Q2 2026.

- Applied Industrial Technologies reported fiscal 2026 second quarter net sales of $1.2 billion, an 8.4% increase year-over-year (or 2.2% on an organic basis), and diluted earnings per share of $2.51, up 4.6% year-over-year.

- The company adjusted its fiscal 2026 EPS guidance to a range of $10.45 to $10.75 (from $10.10 to $10.85) and sales growth to 5.5% to 7.0% (from 4.0% to 7.0%).

- The quarterly dividend was increased by 11% to $0.51 per share.

- Applied Industrial Technologies announced the acquisition of Thompson Industrial Supply Inc., which is expected to generate approximately $20 million in annual sales.

- AIT reported strong Q1 2026 financial results, with sales increasing 9.2% year-over-year to $1,200 million and Earnings Per Share (EPS) growing 11.4% to $2.63.

- The company achieved 3.0% organic sales growth in Q1 2026, its strongest in two years, primarily driven by the Service Center segment which saw sales increase over 4% year-over-year.

- EBITDA grew 13.4% year-over-year to $146.3 million, with the EBITDA margin expanding by 46 basis points to 12.2%.

- AIT increased its Fiscal Year 2026 diluted EPS guidance from $10.00-$10.75 to $10.10-$10.85, reflecting the strong Q1 performance and a lower diluted share count assumption, while reiterating its sales and EBITDA margin outlook.

- The company maintained a strong financial position, generating $112.0 million in free cash flow and reporting a net leverage ratio of 0.27x as of September 30, 2025.

- Applied Industrial Technologies (AIT) reported a strong Q1 2026, with EBITDA growing 13% and EPS growing 11% over the prior year, surpassing expectations.

- Consolidated sales increased 9.2% year-over-year, driven by 3% organic sales growth. The Service Center segment achieved 4.4% organic sales growth, while the Engineered Solutions segment experienced a 0.4% organic sales decrease.

- The company raised its full-year fiscal 2026 EPS guidance to $10.10-$10.85 from $10.00-$10.75, while maintaining sales growth guidance of 4%-7% (1%-4% organic) and EBITDA margins of 12.2%-12.5%.

- The Hydradyne acquisition's EBITDA contribution increased 20% sequentially in Q1 2026, on track for its first-year guidance of $260 million in sales and $30 million in EBITDA.

- AIT repurchased approximately 204,000 shares for $53 million in Q1 2026 and plans continued share buybacks and M&A activity for the remainder of fiscal 2026.

- Applied Industrial Technologies (AIT) reported strong Q1 2026 results, with EBITDA growing 13% and EPS increasing 11% over the prior year, surpassing expectations.

- Consolidated sales for Q1 2026 rose 9.2% year-over-year, including 6.3 points from acquisitions and 3% organic growth.

- EBITDA margins expanded to 12.2%, a 46 basis point increase from the prior year, exceeding the high end of Q1 guidance.

- The company raised its full-year fiscal 2026 EPS guidance to a range of $10.10 to $10.85 (from $10.00-$10.75), while maintaining sales growth guidance of 4% to 7% (1% to 4% organic) and EBITDA margin guidance of 12.2% to 12.5%.

- During Q1 2026, AIT repurchased approximately 204,000 shares for $53 million.

- AIT reported strong Q1 2026 results, with consolidated sales increasing 9.2% and organic sales up 3% over the prior year.

- EBITDA grew 13% and EPS increased 11.4% to $2.63 in Q1 2026, with EBITDA margins expanding to 12.2%.

- The company raised its full-year fiscal 2026 EPS guidance to a range of $10.10 to $10.85 (from $10 to $10.75), while maintaining sales and EBITDA margin guidance.

- AIT repurchased approximately 204,000 shares for $53 million in Q1 2026 and continues to prioritize M&A for fiscal 2026.

- The service center segment achieved 4.4% organic sales growth, while the engineered solutions segment had a slight organic sales decrease of 0.4%.

- Applied Industrial Technologies reported net sales of $1.2 billion for the first quarter of fiscal 2026, an increase of 9.2% year-over-year, with 3.0% organic growth.

- Net income for Q1 2026 was $100.8 million, or $2.63 per diluted share, representing an 11.4% year-over-year increase.

- EBITDA for the quarter was $146.3 million, up 13.4% year-over-year, with an EBITDA margin of 12.2%.

- The company is increasing its fiscal 2026 EPS guidance to a range of $10.10 to $10.85 (from the prior $10.00 to $10.75), while reiterating sales and EBITDA margin guidance.

- A quarterly cash dividend of $0.46 per common share was declared, payable on November 28, 2025.

Quarterly earnings call transcripts for APPLIED INDUSTRIAL TECHNOLOGIES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more