Earnings summaries and quarterly performance for Arthur J. Gallagher &.

Executive leadership at Arthur J. Gallagher &.

Board of directors at Arthur J. Gallagher &.

Chris Miskel

Director

David Johnson

Lead Independent Director

Deborah Caplan

Director

John Coldman

Director

Norman Rosenthal

Director

Ralph Nicoletti

Director

Richard Harries

Director

Sherry Barrat

Director

Teresa Clarke

Director

Research analysts who have asked questions during Arthur J. Gallagher & earnings calls.

David Motemaden

Evercore ISI

8 questions for AJG

Elyse Greenspan

Wells Fargo

8 questions for AJG

Katie Sakys

Autonomous Research

8 questions for AJG

Mark Hughes

Truist Securities

8 questions for AJG

Andrew Andersen

Jefferies

6 questions for AJG

Andrew Kligerman

TD Cowen

6 questions for AJG

C. Gregory Peters

Raymond James

5 questions for AJG

Michael Zaremski

BMO Capital Markets

5 questions for AJG

Meyer Shields

Keefe, Bruyette & Woods

4 questions for AJG

Alex Scott

Barclays PLC

3 questions for AJG

Rob Cox

Goldman Sachs

3 questions for AJG

Ryan Tunis

Cantor Fitzgerald

3 questions for AJG

Charlie Lederer

BMO Capital Markets

2 questions for AJG

Gregory Peters

Raymond James Financial, Inc.

2 questions for AJG

Jing Li

Keefe, Bruyette & Woods (KBW)

2 questions for AJG

Paul Newsom

Piper Sandler

2 questions for AJG

Robert Cox

The Goldman Sachs Group, Inc.

2 questions for AJG

Tracy Benguigui

Wolfe Research

2 questions for AJG

Cave Montazeri

Deutsche Bank

1 question for AJG

Charles Peters

Raymond James

1 question for AJG

Dean Criscitiello

Keefe, Bruyette & Woods

1 question for AJG

Grace Carter

BofA Securities

1 question for AJG

Jing Hong

KBW

1 question for AJG

Mike Zaremski

BMO Capital Markets

1 question for AJG

Taylor Scott

BofA Securities

1 question for AJG

Recent press releases and 8-K filings for AJG.

- Arthur J. Gallagher & Co. announced the acquisition of Bremen, Germany-based Krose GmbH & Co KG, with terms undisclosed.

- Krose, founded in 1920, offers commercial insurance and reinsurance solutions across property, casualty, cyber, marine, D&O and alternative risk programs.

- The Krose team will integrate into Gallagher’s European brokerage operations, bolstering its presence in Germany and wider Europe.

- This transaction enhances Gallagher’s global network, which spans approximately 130 countries via owned offices and correspondent brokers.

- Arthur J. Gallagher & Co. acquired Hunt Financial Group, comprising Hunt Benefits & Associates and Tenaglia & Associates; terms undisclosed

- Hunt Financial Group operates in Charlotte, NC, and Mount Pleasant, SC, providing consultative benefits solutions to banking industry clients

- Founders Tim Hunt and Tom Tenaglia and their team will remain in place under Luke Kaplan, U.S. Financial and Retirement Services Managing Director

- The acquisition expands Gallagher’s niche expertise within its employee benefits consulting operations

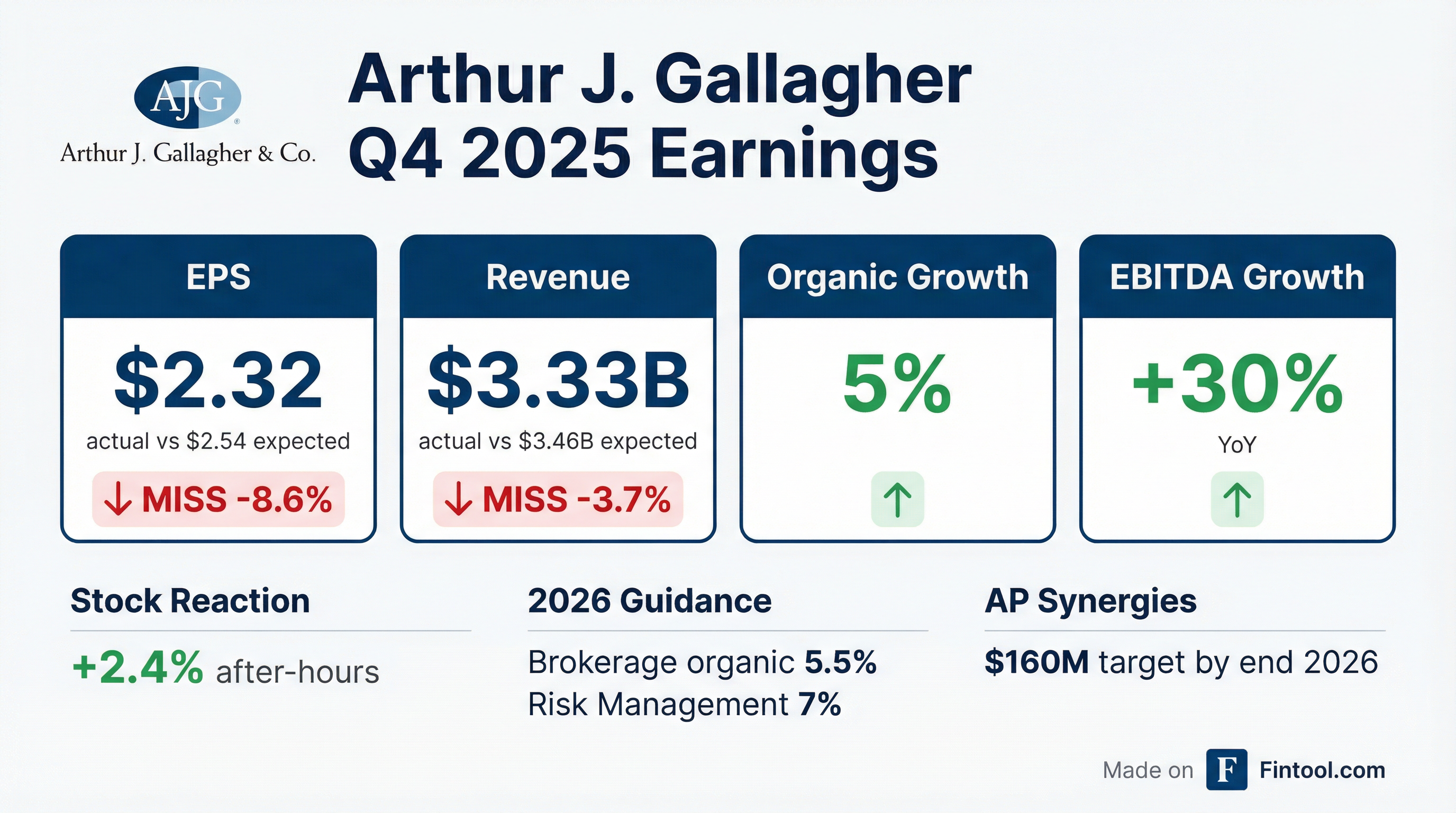

- Gallagher delivered >30% Q4 revenue growth with 5% organic growth, as brokerage segment revenue rose 38% and adjusted EBITDA margin reached 32.2% (+50 bps underlying).

- Full-year 2025 combined brokerage and risk management achieved 21% revenue growth (6% organic), 26% adjusted EBITDA growth, margin expansion of 70 bps to 35%, and $3.5 billion in acquired annualized revenue.

- Q4 risk management segment grew revenue 13% (7% organic) with a 21.6% adjusted EBITDA margin; 2026 guidance calls for ~7% organic growth and margins in the 21%-22% range.

- Completed 7 acquisitions in Q4 adding $145 million of annualized revenue; full-year 2025 M&A drove >$3.5 billion acquired revenue and the pipeline includes 40+ term sheets (~$350 million).

- 2026 outlook: brokerage organic growth of ~5.5%, underlying margin expansion of 40-60 bps, and M&A integration on track to deliver planned synergies.

- Q4 2025 adjusted EBITDAC margin was 32.2% in the brokerage segment and 21.6% in the risk management segment.

- Foreign currency translation had a $14 million tailwind to Q4 brokerage revenues and a $(2) million headwind to risk management revenues.

- Integration costs in Q4 2025 amounted to $0.12 per share, and foreign currency contributed $0.01 per share to EPS.

- The company forecasts full year 2025 organic revenue growth above 4% with potential for further margin expansion.

- Arthur J. Gallagher & Co. delivered >30% Q4 revenue growth, including 5% organic growth; adjusted EBITDA rose 30%, with brokerage segment revenue up 38% (organic 5%) and adjusted EBITDA margin of 32.2% (+50 bps).

- Q4 global property casualty renewal premiums rose in low-single digits overall, with –5% in property, +5% in casualty (+7% US casualty) and +3% ex-property.

- Gallagher Bassett (risk management) posted 13% Q4 revenue growth (organic 7%) and a 21.6% adjusted EBITDA margin; 2026 organic growth is guided to ~7% and margins to 21–22%.

- Completed 7 acquisitions in Q4 with $145 M of annualized revenue; full-year 2025 acquisitions totaled >$3.5 B; M&A pipeline includes ~40 term sheets (~$350 M); AssuredPartners integration targets $160 M of run-rate synergies by end-2026 (up to $260–280 M by early-2028).

- 2026 outlook includes brokerage organic growth of ~5.5%, underlying margin expansion of 40–60 bps, cash taxes ~10% of EBITDA, and $10 B of M&A funding capacity over two years.

- Brokerage segment delivered 5% organic growth in Q4, while Gallagher Bassett risk management saw 13% revenue growth including 7% organic growth in the quarter.

- The company guides full-year 2026 organic growth at ~5.5% for Brokerage and ~7% for Risk Management.

- In Q4, AJG completed 7 acquisitions adding $145 million of annualized revenue; full-year 2025 acquired revenue exceeded $3.5 billion, and the M&A pipeline comprises over 40 term sheets (~$350 million).

- Underlying Brokerage adjusted EBITDA margin expanded ~50 bps in Q4; AJG forecasts 40–60 bps of margin expansion in 2026. Gallagher Bassett posted a 21.6% adjusted EBITDA margin in Q4 with 2026 outlook of 21–22%.

- Q4 2025 revenues before reimbursements were $3.586 billion, up from $2.679 billion in Q4 2024.

- Q4 2025 net earnings were $154 million (diluted EPS $0.58), versus $258 million (EPS $1.12) in Q4 2024; on an adjusted basis, Q4 net earnings were $620 million (EPS $2.38).

- Full year 2025 revenues before reimbursements totaled $13.778 billion, compared with $11.401 billion in 2024; reported net earnings were $1.503 billion (EPS $5.74).

- Full year 2025 adjusted net earnings were $2.793 billion (adjusted EPS $10.69), up from $2.279 billion (EPS $10.10) in 2024.

- Q4 revenues of $3.586 billion, up over 30% year-on-year, with 5% organic growth, net earnings margin of 10.2% and adjusted EBITDAC margin of 30.8% in the quarter.

- Full-year 2025 revenues reached $13.778 billion, a 21% increase (6% organic), with net earnings of $1.503 billion and adjusted net earnings of $2.793 billion; adjusted EBITDAC grew 26%.

- Completed 33 acquisitions during 2025, adding over $3.5 billion in estimated annualized revenue, marking the 20th consecutive quarter of double-digit top-line growth.

- Company enters 2026 with strong momentum under its organic and M&A-driven growth strategy.

- Board declares quarterly cash dividend of $0.70 per share, a $0.05 increase over the prior quarter

- Dividend payable March 20, 2026, to shareholders of record as of March 6, 2026

- Global insurance brokerage and risk management firm headquartered in Rolling Meadows, Illinois, with operations in approximately 130 countries

- Gallagher pursues a two-pronged growth strategy of organic sales and M&A “to buy brains”, targeting a negligible share of the $4 trillion global non-life P&C premium market where it currently touches ~$200 billion of premium.

- Integration of AssuredPartners (11,000 employees) is on track: 90% of offices visited, 500 in-person meetings held, with economics driving >20% revenue growth in 2026 and $160 million of run-rate synergies by end-2026.

- Organic growth guidance: 5% in 4Q 2025 and 6% for full-year 2026 across global segments, including 5% in Americas P&C and 6% in Specialty.

- Continued investment in data and analytics—Gallagher Drive now ingests $31 billion of premium data—to power the Core 360 advisory platform and enhance client benchmarking and retention.

Quarterly earnings call transcripts for Arthur J. Gallagher &.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more