ALIGN TECHNOLOGY (ALGN)·Q4 2025 Earnings Summary

Align Technology Q4 2025: Record Revenue, EPS Beat by 11% as Clear Aligner Volumes Surge

February 4, 2026 · by Fintool AI Agent

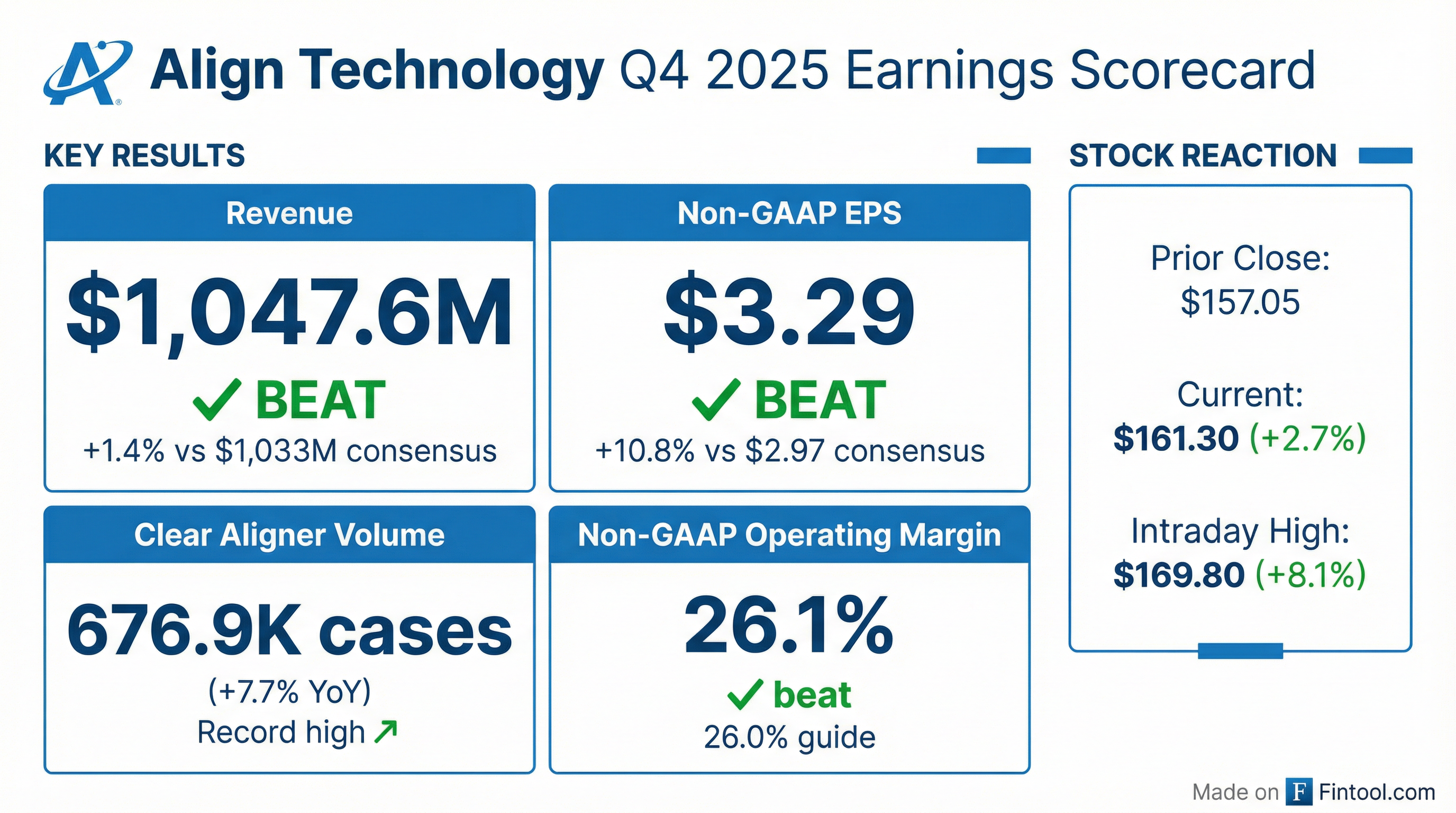

Align Technology (NASDAQ: ALGN) delivered a strong Q4 2025, posting record quarterly revenues of $1,047.6 million and non-GAAP EPS of $3.29, beating consensus estimates on both metrics. The quarter was marked by record Clear Aligner volumes of 677K cases (+7.7% YoY), the highest non-GAAP operating margin since 2021, and strong momentum across DSO partners and international markets. The stock closed up 2.7% following the announcement, after reaching an intraday high of $169.80 (+8.1% from prior close).

Did Align Technology Beat Earnings?

Yes — Align beat on both revenue and EPS, exceeding the high end of its own Q4 guidance:

This marks Align's sixth consecutive EPS beat over the past 8 quarters. The strong performance was driven by record Clear Aligner volumes, double-digit growth from DSO partners, and better-than-expected Systems and Services revenues from continued iTero Lumina scanner adoption.

What Changed From Last Quarter?

Several notable improvements from Q3 2025:

The Q4 improvement reflects:

- Reduced restructuring charges — Lower restructuring costs vs Q3

- Seasonal strength — Q4 typically sees higher Systems and Services demand (+10.3% sequentially)

- DSO outperformance — Double-digit growth from DSO partners in North America and EMEA

- Geographic mix improvement — Double-digit growth in EMEA, Latin America, and APAC

What Did Management Guide?

Q1 2026 Guidance

Full Year 2026 Guidance

CFO John Morici noted: "Our confidence is grounded in the actions we're taking to actively manage the business and drive growth through our core strategic priorities — expanding international adoption, increasing orthodontic utilization particularly among teens and kids, accelerating GP engagement including restorative dentistry, and strengthening consumer demand conversion with greater emphasis on local, last-mile marketing."

On the 2026 outlook methodology, Morici added: "We're not expecting the markets to be anything different... It's about us driving that active conversion approach, some of it on the products and portfolio, some of it is in terms of how we go to market, some of the last-mile efforts to help customers drive that conversion."

How Did the Stock React?

The positive reaction breaks a streak of negative post-earnings moves. Over the prior 7 quarters, ALGN stock has consistently sold off after earnings despite mostly beating estimates:

The positive Q4 2025 reaction suggests the market is more constructive on the FY2026 outlook and margin improvement trajectory.

Key Business Metrics

Clear Aligner Performance

Volume growth was driven by:

- Adults: +8.0% YoY — best growth since 2021

- Teens and kids: +7.0% YoY — 230K case starts in Q4

- EMEA: Double-digit YoY growth, record Q4 levels

- Latin America: Double-digit YoY growth, record shipments, 1M+ patients milestone

- APAC: Double-digit YoY growth, record Q4 for China, India, Korea

- DSP touch-up cases: 136K+ for FY2025, +36% YoY

Systems and Services (iTero Scanners)

Management noted exocad delivered sequential and YoY revenue growth in Q4. The exocad ART (Advanced Restorative Treatment) platform continues piloting in Europe with broader rollout planned for 2026.

Full Year 2025 Milestones

The company achieved several major milestones during FY2025:

- 22+ million Invisalign patients treated to date

- 6.5+ million teens and growing kids treated

- 936,000 teens and kids started treatment in FY25 (+7.8% YoY)

- 296,000+ active Invisalign-trained doctors

- 1 million+ patients treated in Latin America, UK, and Iberia (milestones reached in Q4)

- FY25 Non-GAAP operating margin: 22.7%, above outlook

Margins and Profitability

CFO Morici on margin drivers: "When we have some of this lower-stage product, it's more profitable. The margin rate is higher... You're also seeing many of the effects of some of the productivity improvements that we have. We talked about upgrading some of the equipment and seeing early stages of that benefit."

Management committed to 100 bps non-GAAP operating margin improvement in FY2026, with Morici noting: "We've made structural changes to improve productivity. We want to be mindful of getting that adoption, growing our business, and that volume helps."

Capital Allocation

The company completed its $200M accelerated repurchase program (announced August 2025) in January 2026. FY2026 capex is guided at $125M-$150M, primarily for technology upgrades and manufacturing capacity.

Q&A Highlights

DSO Momentum: "Triple-Digit Growth" in Top EMEA Accounts

Analysts focused heavily on DSO (Dental Service Organization) performance. CFO John Morici confirmed DSOs now represent ~25% of volume globally. CEO Joe Hogan highlighted the partnership advantage:

"We are a natural partner because we can scale on so many dimensions with them... We can scale treatment planning. We have local distribution. There's a broader product portfolio. Some of these DSOs had worked with competitive suppliers, and when they look at us, they understand that we can scale."

Key DSO metrics:

- Top 10 Americas DSOs: Double-digit YoY growth, retention up double-digits

- Top 10 EMEA DSOs: Triple-digit YoY growth

- North America DSOs: Double-digit YoY growth led by adults

Adult Segment: Best Growth Since 2021

An analyst noted the +8% adult growth was the best in years. Hogan attributed it to:

- DSO adoption driving GP channel conversion

- Financial credit partnerships (HFD) helping affordability

- "Scan every patient" workflow driving visualization and conversion

North America Retail: "More Stability"

When pressed on retail dynamics, Hogan offered cautious optimism:

"The word I'd use is more stability there. We're standing on a better platform. The team's been executing better. I wouldn't call the economic situation in the United States better in any way — I'd just say the team's more focused, our portfolio's a little broader, and obviously the DSOs are helping a lot."

NoAA Product Rollout Timeline

The "No Additional Aligners" (NoAA) product offering, which allows upfront revenue recognition, will be mostly fully rolled out by end of Q2 2026:

"It's kind of a different profile, what we have in the United States versus what we have in Europe and what we're doing in APAC... By the end of the first quarter, end of the second quarter of this year, we'll have that pretty much lined out by geography."

Morici noted NoAA is not dilutive to ASP since there's no revenue deferral for refinements.

China VBP: "No Impact" in Guidance

On China's Volume-Based Procurement concerns, Hogan was clear the guidance assumes no VBP impact:

"We're 85% private. We're primarily in one or two cities... We've pretty much taken a status quo look at our business in China as we go into the year... Right now, we're not expecting any major disruption."

Direct Fabrication: Margin Accretion in 2H 2027+

The 3D-printed aligner transition timeline:

- 2026: Limited market release (margin dilutive while scaling)

- 2027: Scale to millions of units

- 2H 2027 / 2028: Expect margin accretion

2026 ASP Guidance

CFO Morici guided ASPs down 1%-2% YoY for FY2026 due to:

- Country mix (growth in lower-list-price markets like LatAm, Turkey, India)

- Product mix (non-comprehensive vs comprehensive)

Risks and Concerns

Tariff Exposure: Management noted "we do not expect a material change to our operations as a consequence of the latest U.S. tariff actions" and referenced prior disclosures.

North America Demand: While international markets showed strength, North America showed only "stability" rather than growth. CEO Hogan acknowledged consumer sentiment remains pressured.

Revenue per Case Compression: Clear Aligner ASP expected down 1%-2% in FY2026 due to geographic and product mix shifts.

Q1 2026 Seasonality: Guided Q1 non-GAAP operating margin of ~19.5% is 660 bps below Q4, reflecting typical first-quarter seasonality.

Recent Announcements

Key developments during Q4 2025 and early 2026:

- $200M Buyback Completed: Accelerated repurchase program announced Aug 2025 completed in Jan 2026

- ClinCheck Live Plan: AI-driven planning generates doctor-ready plans in ~15 minutes

- Invisalign Prefab Attachments: Direct 3D printed accessory successfully treated 1,000+ patients with positive feedback

- Palate Expander APAC Launch: First FDA-cleared removable palate expander adoption began in APAC

- HFD Partnership Growth: Healthcare financing platform driving incremental treatment adoption

Forward Catalysts

- NoAA Full Rollout (Q1-Q2 2026) — No Additional Aligners product offering rolling out globally by mid-2026

- Direct Fabrication Launch (2026) — Limited market release of 3D-printed Invisalign First retainers and prefab attachments

- FY2026 Margin Expansion — 100 bps non-GAAP operating margin improvement to 23.7% guided

- DSO Expansion — Continued double/triple-digit growth with strategic DSO partners globally

- exocad ART Rollout — Advanced Restorative Treatment platform broader European rollout in 2026

Related Resources: