Allegiant Travel (ALGT)·Q4 2025 Earnings Summary

Allegiant Soars on Record Q4 Revenue, Sun Country Acquisition, and >$8 EPS Guidance

February 4, 2026 · by Fintool AI Agent

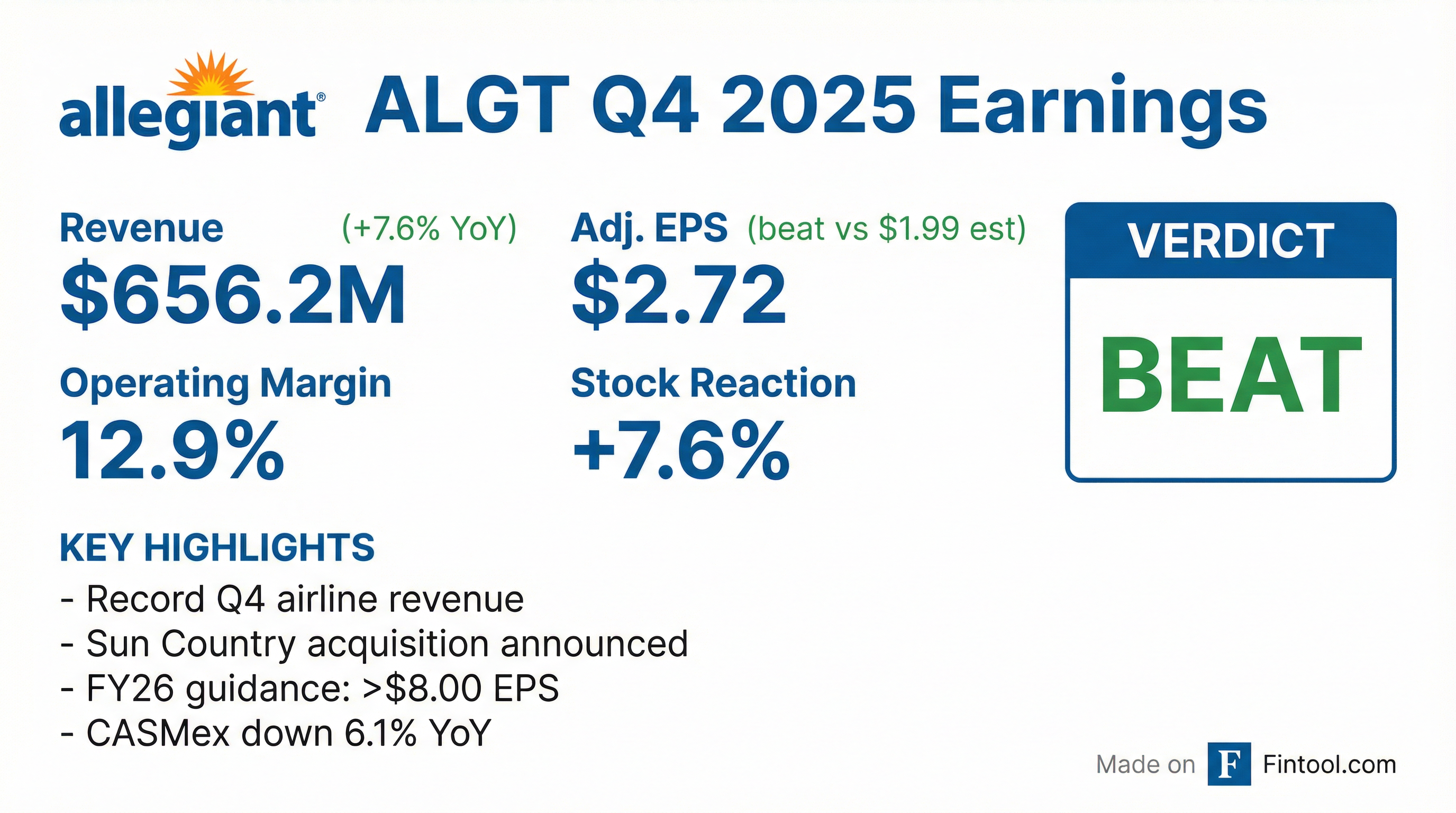

Allegiant Travel Company delivered a strong finish to 2025, posting record fourth-quarter airline revenue of $656.2 million while guiding to adjusted EPS above $8.00 for FY26—a 58% increase and well above Street expectations. The stock surged 7.6% on the news, closing at $99.86 and hitting a 52-week high.

The quarter was marked by three key developments: (1) record Q4 revenue and margin execution, (2) the transformational Sun Country Airlines acquisition announcement, and (3) aggressive guidance that positions Allegiant for significant earnings growth in 2026.

Did Allegiant Beat Earnings?

Revenue: Beat by 1.5% — Airline-only revenue of $656.2 million exceeded consensus of $646.4 million, up 7.6% year-over-year.

EPS: GAAP miss, adjusted beat — GAAP diluted EPS of $1.73 missed consensus of $1.99 (-13%), but adjusted airline-only diluted EPS of $2.72 significantly exceeded expectations, reflecting continued Sunseeker drag in GAAP results.

*Adjusted airline-only EPS beat expectations materially; stock reaction confirms market focus on adjusted results.

Key operating metrics also impressed:

- TRASM declined just 2.6% despite 10.5% capacity growth

- CASMex (unit costs ex-fuel) down 3.4% YoY to 8.01¢

- Load factor improved to 81.2%, up 1.0pt YoY

- Controllable completion factor of 99.9%—best in industry

What Did Management Guide?

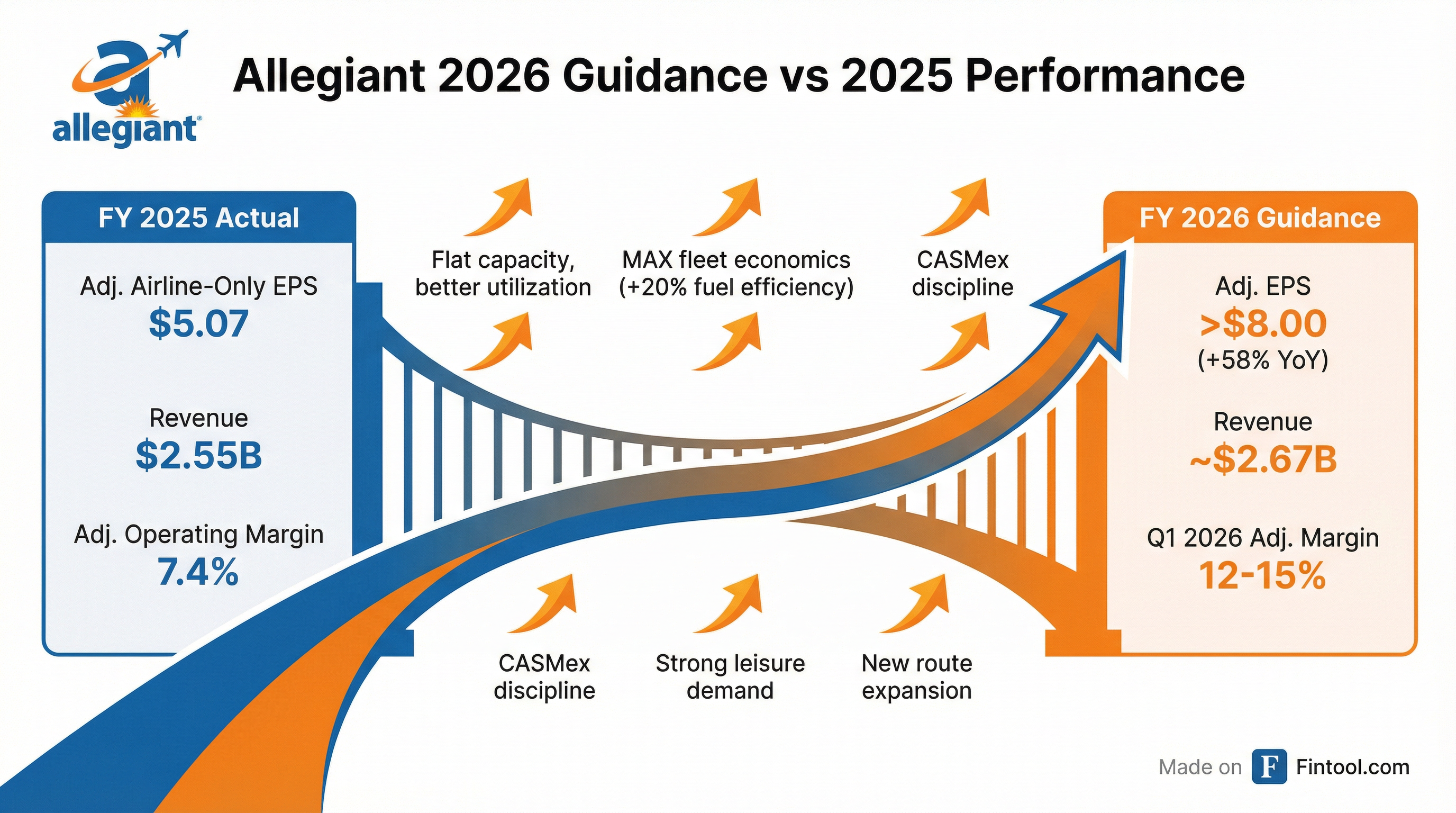

Allegiant issued aggressive 2026 guidance that exceeded Street expectations across the board:

Q1 2026 Guidance

Capacity shape: Q2 will see slightly more capacity decline than Q1 (Easter pull-forward), with growth ramping in Q3 and accelerating in Q4 as MAX deliveries come online. Three MAX aircraft are experiencing modest delivery delays, impacting early summer capacity.

Full-Year 2026 Guidance

Important: Management emphasized the $8+ guide is "conservative" and does not assume January's exceptional demand trends continue through summer. CFO BJ noted they are "not plugging a full recovery" of the 5-point RASM decline seen in 2025, leaving clear upside if leisure demand strengthens.

The $8+ EPS guide represents 58% growth over FY25's $5.07 adjusted airline-only EPS, driven by:

- Flat capacity with better unit economics — No fleet growth in 2026, focusing on optimization

- MAX aircraft contribution — 737 MAX delivers ~20% fuel burn advantage vs A320 on peak days with similar utilization, and 10% better economics on off-peak days while flying 30% more hours

- Cost discipline — CASMex down 6.1% in FY25, infrastructure scaled; aircraft utilization stepped up from low 6s (hours/day) in 2024 to 7+ in 2025

- Allegiant Extra and commercial initiatives — Contributing meaningfully to results

How Did the Stock React?

ALGT shares surged 7.6% to close at $99.86 on earnings day, hitting a new 52-week high of $100.40 intraday. After-hours trading pushed shares above $100.90.

The strong reaction reflects:

- Guidance beat — >$8.00 EPS vs $7.31 consensus (9% above)

- Sun Country acquisition optionality — Strategic catalyst for long-term value

- Margin trajectory — Q1 2026 midpoint of 13.5% implies 4+ point YoY improvement

- Balance sheet improvement — Net leverage at 2.3x, down from 4.1x in Q3 2024

What Changed From Last Quarter?

Demand Acceleration

December demand accelerated sharply, driving a nearly 6-point sequential improvement in year-over-year unit revenue versus Q3. Holiday unit revenue strengthened and spilled into January.

Sun Country Acquisition

The headline announcement was the definitive merger agreement to acquire Sun Country Airlines, announced in January 2026.

CEO Gregory Anderson called it "an important step toward building the leading leisure carrier in the U.S."

Key deal rationale:

- Cultural alignment and similar fleet types

- Minimal network overlap — complementary routes

- Shared technology stack — reduces integration risk

- Synergy capture without disrupting operations

Balance Sheet Strengthening

Allegiant made $224.3 million in voluntary debt prepayments during Q4, reducing total debt to $1.8 billion from $2.1 billion at Q3 end. Net debt fell to $961 million with $1.1 billion in liquidity.

Sunseeker Exit Completed

The sale of Sunseeker Resort closed in 2025, with minimal operating impact in Q4. Special charges of $(6.8)M net recovery on Sunseeker actually benefited results.

Key Management Quotes

"We closed out 2025 with meaningful momentum, and I'm extremely proud of how the team executed. We delivered a 12.9 percent adjusted airline-only operating margin in the fourth quarter, exceeding our initial guidance, despite the impact of the government shutdown."

— Gregory Anderson, CEO

"As we enter 2026, the positive trends continue. We're seeing strong demand to start the year and expect a 13.5 percent adjusted operating margin in the first quarter, representing more than a four-point improvement over the prior year."

— Gregory Anderson, CEO

"Team Allegiant's performance truly stands out. In 2025, we led the industry with a controllable completion factor of 99.9 percent."

— Gregory Anderson, CEO

Full-Year 2025 Summary

Full-year 2025 was impacted by:

- Sunseeker special charges of $94.2 million

- Airline special charges of $43.5 million (restructuring, accelerated depreciation, acquisition costs)

- CBA ratification bonuses in prior year

Fleet and Capital Allocation

Fleet Plan

The fleet remains flat at 123 aircraft, but mix shifts toward higher-gauge MAX aircraft. Nine A320s retiring, nine 737 MAX deliveries expected.

2026 Capital Expenditure Guidance

Risks and Concerns

-

Sun Country integration execution — Management acknowledged diversion of attention and potential for integration costs to exceed expectations

-

Boeing delivery risk — Regulatory reviews and production limits on Boeing could impact aircraft delivery schedule

-

Fuel volatility — Q1 2026 assumes $2.60/gallon; FY26 assumes ~$2.50/gallon

-

Labor costs — CBA ratification bonuses in prior periods; ongoing labor negotiations across industry

-

Macro sensitivity — Leisure travel demand correlated with consumer health and economic conditions

Q&A Highlights

The earnings call Q&A revealed several key insights not covered in prepared remarks:

January Demand: "Exceptional"

Drew Wells (Chief Commercial Officer) described January demand as "exceptional," with website visitation beating even 2025's strong start:

"What's coming through the front door, we would have loved to have in 2025 too when we were talking about how strong it was to start the year, and we're beating that."

— Drew Wells, CCO

Management noted the strength is manifesting in both bookings volume and pricing power—"a nice change of pace" after two years of yield pressure.

Sun Country: HSR Filing Timeline

When asked about regulatory timing, CEO Greg Anderson confirmed:

"We expect to file both [the proxy and HSR filing] within the coming weeks."

— Gregory Anderson, CEO

On financing the $200M+ cash consideration, BJ (CFO) noted plans to potentially refinance the 2027 bond maturity while "taking a little bit more out" for the merger. If timing doesn't align, there's $1B+ in unencumbered aircraft to tap.

Vegas Struggles Continue

Drew Wells acknowledged that Las Vegas remains challenging, with LVCBA visitation down ~7.5% YoY, though convention attendance held flat. The destination has shifted to being "event-driven and holiday-driven" rather than the "year-round rockstar reliable that it once was."

Potential Competitor Liquidation

Asked directly about a potential ULCC liquidation (likely Spirit), management was measured:

"We don't view our success here at Allegiant as being dependent on what other carriers in our sector may or may not do. We believe we're just uniquely positioned here at Allegiant."

— Gregory Anderson, CEO

Drew Wells noted ALGT recently secured additional space at Fort Lauderdale and has "some slack left in our schedule" to deploy if opportunity arises.

Credit Card Program Momentum

The co-brand credit card is accelerating, with 600,000+ cardholders now enrolled. New card acquisitions have been up double-digits YoY for five consecutive months. Management sees potential to grow card revenue from ~5% of revenue today toward 8-10% longer-term.

MAX Options: 80 Aircraft in Play

Management confirmed 80 737 MAX options are available, with decisions on exercise needed in 2H 2026 for 2028 deliveries. CEO Anderson called potential exercise "accretive to our standalone business" and "much, much more powerful" in a combined fleet scenario with Sun Country.

Forward Catalysts

- Sun Country shareholder/regulatory approvals — HSR filing expected "within coming weeks"; close targeted for 2H 2026

- Q1 2026 earnings — Will test 12-15% margin guidance

- MAX fleet expansion — Nine deliveries through 2026 improving unit economics

- Allegiant Extra rollout — Premium seating product ramping

- Network expansion — 36 new routes launching in 1H 2026 (17 in February alone)

- Bond refinancing — 2027 maturity may be addressed opportunistically in 2026

- Investor Day — Expected late 2026, post-merger close

The Bottom Line

Allegiant delivered a strong Q4 that exceeded expectations on revenue and margins while guiding to 58% EPS growth in 2026. The Sun Country acquisition adds a transformational element to the story, though execution risk remains. With the stock hitting 52-week highs on 7.6% gains, the market is clearly buying the turnaround thesis. At ~12x FY26 guided EPS, ALGT offers leverage to leisure travel recovery with improving unit economics and a strengthening balance sheet.

Data sources: Company 8-K filing dated February 4, 2026; S&P Global estimates.