Earnings summaries and quarterly performance for Allegiant Travel.

Executive leadership at Allegiant Travel.

Board of directors at Allegiant Travel.

Research analysts who have asked questions during Allegiant Travel earnings calls.

Duane Pfennigwerth

Evercore ISI

6 questions for ALGT

Scott Group

Wolfe Research

6 questions for ALGT

Andrew Didora

Bank of America

5 questions for ALGT

Christopher Stathoulopoulos

Susquehanna Financial Group

5 questions for ALGT

Conor Cunningham

Melius Research

5 questions for ALGT

Savanthi Syth

Raymond James

5 questions for ALGT

Catherine O'Brien

Goldman Sachs

4 questions for ALGT

Daniel McKenzie

Seaport Global Securities

4 questions for ALGT

Michael Linenberg

Deutsche Bank

4 questions for ALGT

Ravi Shanker

Morgan Stanley

4 questions for ALGT

Thomas Fitzgerald

TD Cowen

4 questions for ALGT

Atul Maheswari

UBS Group

3 questions for ALGT

Mike Lindenberg

Deutsche Bank

2 questions for ALGT

Atul Maheshwari

UBS Group AG

1 question for ALGT

Brandon Oglenski

Barclays

1 question for ALGT

Dan McKenzie

Seaport Global

1 question for ALGT

Jack S. Ewell

Goldman Sachs Group, Inc.

1 question for ALGT

John Godyn

Citigroup

1 question for ALGT

Josh Godin

Citigroup

1 question for ALGT

Recent press releases and 8-K filings for ALGT.

- Halper Sadeh LLC is investigating Allegiant Travel Company's (NASDAQ: ALGT) merger with Sun Country Airlines for potential violations of federal securities laws and/or breaches of fiduciary duties to shareholders.

- Upon completion of the proposed transaction, Allegiant shareholders will own approximately 67% of the combined company.

- The investigation raises concerns that insiders may receive substantial financial benefits not available to ordinary shareholders, and that the proposed transaction terms might limit superior competing offers.

- Halper Sadeh LLC may seek increased consideration, additional disclosures, or other relief and benefits on behalf of shareholders.

- Halper Sadeh LLC, an investor rights law firm, is investigating Allegiant Travel Company (NASDAQ: ALGT) for potential violations of federal securities laws and/or breaches of fiduciary duties to shareholders related to its merger with Sun Country Airlines.

- Upon completion of the proposed transaction, Allegiant shareholders are expected to own approximately 67% of the combined company.

- The firm highlights concerns that insiders may receive substantial financial benefits not available to ordinary shareholders, and that the proposed transaction terms could limit superior competing offers.

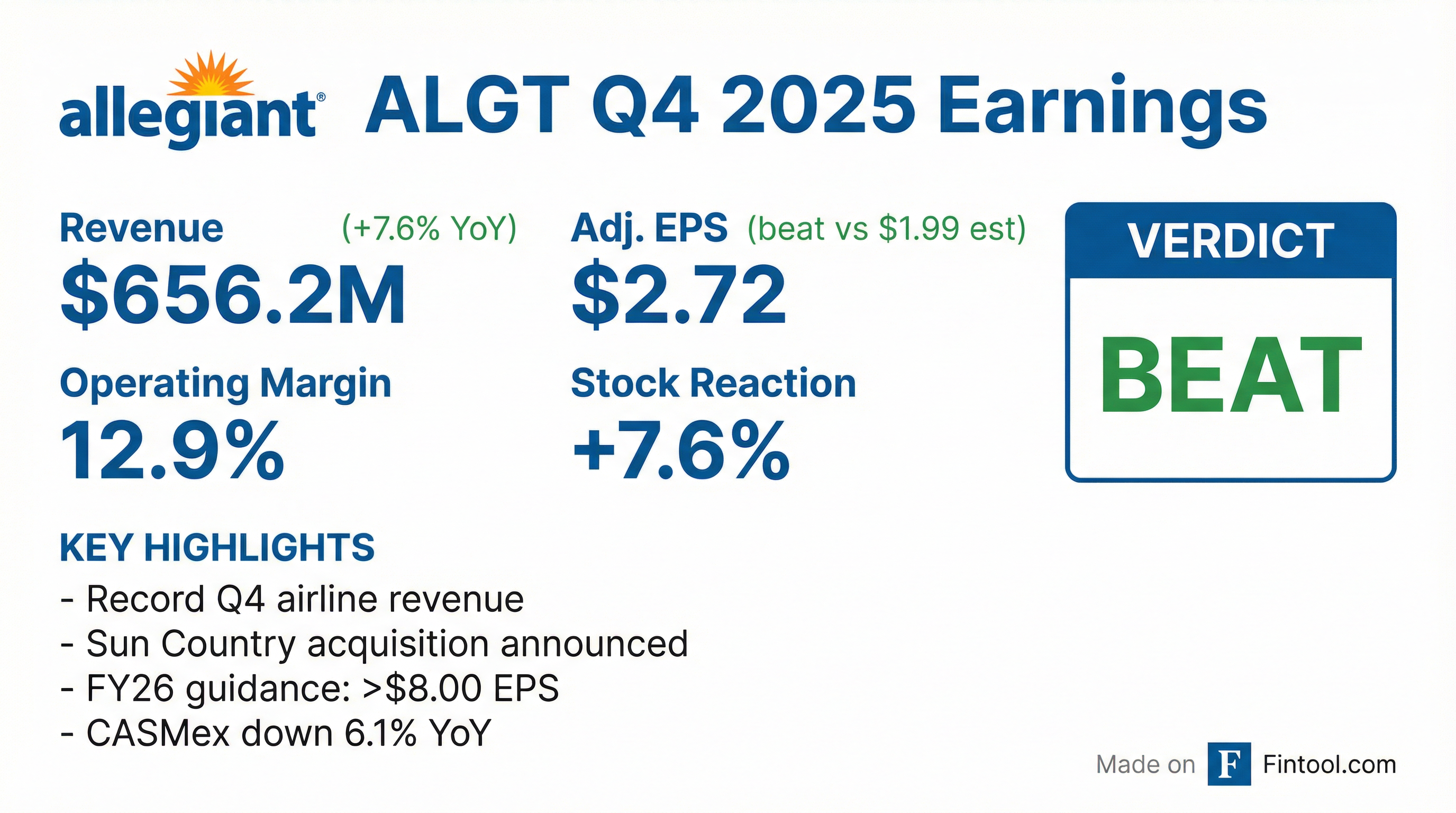

- Allegiant Travel Company reported a Q4 2025 adjusted operating margin of 12.9% and record total airline revenue of $656 million, marking a 7.6% increase year-over-year.

- For the full year 2025, total airline revenue surpassed $2.5 billion, growing 4.3% from 2024, with unit costs falling more than 6% and net leverage reduced to 2.3 turns.

- The company projects full-year 2026 adjusted EPS of more than $8 per share, an approximate 60% increase year-over-year, and anticipates a 13.5% adjusted operating margin for Q1 2026.

- Strategic initiatives include the planned acquisition of Sun Country, expected to close in the second half of 2026, and the successful integration of MAX aircraft, which demonstrate 20% better economics on peak days compared to A320s.

- Full-year 2026 capacity is expected to be down 0.5% year-over-year, with capital expenditures estimated at approximately $750 million.

- Allegiant Travel reported a strong finish to 2025, with a Q4 2025 adjusted airline-only operating margin of 12.9% and full-year 2025 airline revenue exceeding $2.5 billion, marking a record for the company.

- The company provided a positive outlook for 2026, projecting a first-quarter operating margin of 12.0% to 15.0% and full-year earnings per share greater than $8.00, excluding special charges.

- Allegiant significantly improved its balance sheet, reducing net leverage to 2.3x by the end of 2025 and maintaining $1.1 billion in available liquidity. The company plans no fleet growth in 2026, focusing on integrating the 737 MAX fleet which offers a ~20% fuel burn advantage.

- Allegiant Travel Company reported strong Q4 2025 financial results, with total airline revenue of $656 million, up 7.6% year-over-year, and an adjusted operating margin of 12.9%. Airline-only earnings per share reached $2.72, exceeding the guided midpoint of $2.

- For the full year 2025, total airline revenue exceeded $2.5 billion, a 4.3% increase from 2024, and unit costs fell more than 6%, contributing to a strengthened financial position with net leverage reduced to 2.3x.

- The company provided a positive outlook for 2026, guiding to adjusted EPS of more than $8 per share, an approximate 60% increase year-over-year, and expects a 13.5% adjusted operating margin in Q1 2026.

- Strategic initiatives include the successful integration of MAX aircraft, delivering approximately a 20% fuel burn advantage, and the planned acquisition of Sun Country, expected to close in the second half of 2026.

- Allegiant Travel Company reported a 12.9% adjusted operating margin for Q4 2025 and $2.72 airline-only EPS, with full-year 2025 airline-only EPS reaching $5.07. Total airline revenue for Q4 2025 was $656 million, up 7.6% year-over-year, and exceeded $2.5 billion for the full year.

- For Q1 2026, the company expects an adjusted operating margin of 13.5% and EPS of approximately $3. Full-year 2026 adjusted EPS is guided to be more than $8 per share, representing an approximate 60% increase year-over-year.

- Key achievements in 2025 included a more than 6% reduction in unit costs, successful integration of MAX aircraft providing a 20% fuel burn advantage, and a strengthened balance sheet with net leverage reduced to 2.3 turns.

- The company plans for a flat year-over-year fleet count in 2026, taking delivery of 11 737 MAX aircraft and retiring 9 A320 family aircraft, and expects full-year 2026 capital expenditures of approximately $750 million. Allegiant also has an agreement to acquire Sun Country, expected to close in the second half of 2026.

- Allegiant Travel Company reported GAAP diluted earnings per share of $1.73 for the fourth quarter of 2025 and a GAAP diluted loss per share of $(2.48) for the full-year 2025.

- Adjusted diluted earnings per share was $2.72 for Q4 2025 (airline-only) and $3.80 for full-year 2025 (consolidated).

- Total operating revenue increased by 4.5% year-over-year to $656.2 million in Q4 2025 and by 3.7% year-over-year to $2,606.6 million for full-year 2025.

- The company projects full-year 2026 adjusted earnings per share of more than $8 and an adjusted operating margin of 12.0% to 15.0% for Q1 2026.

- In January 2026, Allegiant announced a definitive merger agreement to acquire Sun Country Airlines.

- Allegiant Travel Company reported Q4 2025 GAAP diluted earnings per share of $1.73 and adjusted airline-only diluted earnings per share of $2.72. For the full year 2025, the company posted a GAAP diluted loss per share of $(2.48) and adjusted diluted earnings per share of $3.80.

- Total operating revenue reached $656.2 million in Q4 2025 and $2,606.6 million for the full year 2025.

- The company achieved a 12.9 percent adjusted airline-only operating margin in Q4 2025 and reduced full-year unit costs by more than six percent.

- Allegiant ended 2025 with $1.1 billion in available liquidity, including $838.5 million in cash and investments, and reduced total debt to just under $1.8 billion, improving net leverage to 2.3x.

- For Q1 2026, the company anticipates an adjusted operating margin of 12.0% to 15.0% and adjusted earnings per share of $2.50 to $3.50. Full-year 2026 guidance projects adjusted earnings per share of more than $8, representing a 60 percent year-over-year increase, and the company announced an agreement to acquire Sun Country Airlines.

- Allegiant Travel Company reported that Full Year 2025 scheduled service passengers increased by 10.5% to 18,518,653 and available seat miles (ASMs) grew by 12.9% to 20,679,905 thousand compared to Full Year 2024.

- For the fourth quarter of 2025, scheduled service passengers increased by 13.3% to 4,447,973 and ASMs grew by 10.5% to 4,976,428 thousand year-over-year.

- The scheduled service load factor for Full Year 2025 was 82.0%, a 1.6 percentage point decrease from Full Year 2024, while the fourth quarter 2025 load factor improved by 1.0 percentage point to 81.2% compared to the prior year.

- The estimated average system fuel cost per gallon for Full Year 2025 was $2.55, and for the fourth quarter 2025 it was $2.61.

- Allegiant will acquire Sun Country in a cash and stock transaction, valuing Sun Country at approximately $1.5 billion, inclusive of $400 million of net debt, or a fully diluted equity value of $1.1 billion.

- The acquisition implies a value of $18.89 per Sun Country share, representing a 19.8% premium over its January 9 closing share price of $15.77. Sun Country shareholders will receive 0.1557 shares of Allegiant stock plus $4.10 in cash per share, and will own approximately 33% of the combined company.

- The transaction is expected to generate $140 million in annual synergies and be accretive to Allegiant's EPS in the first full year post-closing.

- The deal is anticipated to close in the second half of 2026, subject to customary closing conditions, including regulatory and shareholder approvals. Greg Anderson will continue as CEO, and Sun Country's CEO, Jude Bricker, will join the combined company's board and serve as an advisor.

Fintool News

In-depth analysis and coverage of Allegiant Travel.

Quarterly earnings call transcripts for Allegiant Travel.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more