ALASKA AIR GROUP (ALK)·Q4 2025 Earnings Summary

Alaska Air Q4 2025 Earnings: EPS Beat, $10 Target Reaffirmed

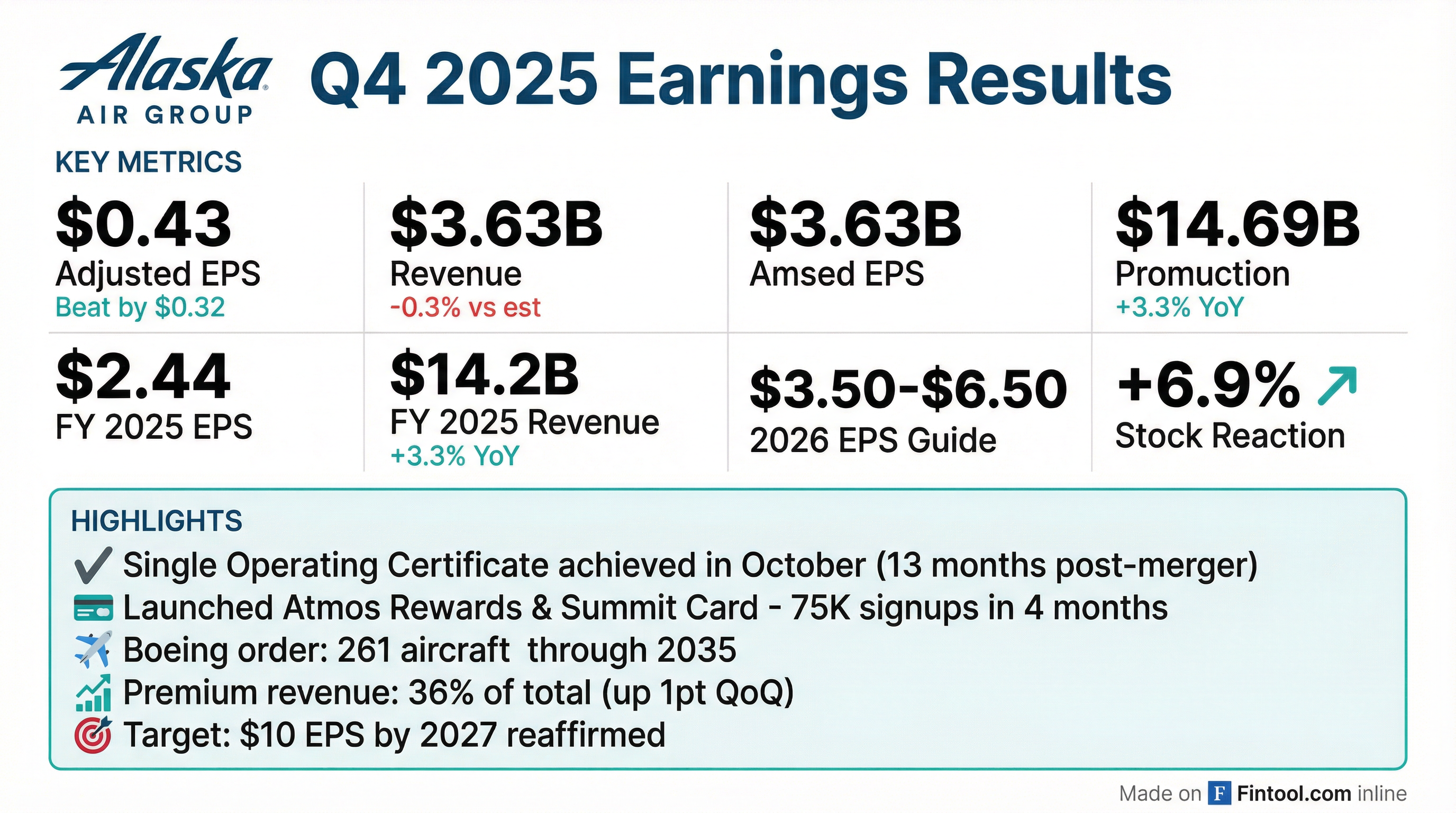

Alaska Air Group delivered a strong Q4 2025, handily beating EPS estimates on better-than-expected cost performance while reaffirming its ambitious $10 EPS target for 2027. The stock surged nearly 7% as management highlighted accelerating merger synergies and robust booking trends entering 2026.

Did Alaska Air Beat Earnings?

Yes — EPS crushed estimates, revenue was a slight miss:

The massive EPS beat came from stronger cost management in Q4 and lower-than-expected fuel prices in December as West Coast refining margins normalized. The company had previously guided Q4 adjusted EPS of ~$0.10 in early December.

Full Year 2025 Results:

Beat/Miss History (Last 8 Quarters)

Values from S&P Global

How Did the Stock React?

ALK surged 6.9% on earnings day, closing at $51.27 vs. prior close of $48.86.

The positive reaction reflects:

- EPS beat magnitude — $0.43 vs. $0.11 consensus

- Reaffirmed $10 EPS target — management maintained 2027 goal

- Strong booking momentum — "several of the highest booking days in Air Group's history" in January

- Managed corporate strength — held managed corporate revenue up 20% YoY for Q1

What Did Management Guide?

2026 EPS guidance of $3.50-$6.50 implies meaningful earnings expansion from 2025's $2.44.

What Drives the High vs. Low End?

CFO Shane Tackett explained the unusually wide guidance range:

High End ($6.50):

- Current demand trends hold through the year

- Fuel prices stabilize with normalized refining margins

- Full execution on synergies and initiatives

Low End ($3.50):

- Macroeconomic step-back similar to 2025

- Fuel price spike (+$0.20/gallon = -$1.50 EPS)

- Industry capacity outpaces demand growth

"All of the things that are in our control, synergies, initiatives, running a great operation, lapping some things that happened to us last year, we're going to execute really, really well on. We're confident about that." — Shane Tackett, CFO

The Path to $10 EPS by 2027

Management reaffirmed the $10 EPS target laid out at their December 2024 Investor Day:

The thesis hinges on: (1) executing the remaining ~$700M of synergies, (2) macro demand returning to 2024 levels, and (3) fuel normalizing.

What Changed From Last Quarter?

Integration Milestones Achieved

The Hawaiian Airlines merger (closed September 2024) hit major milestones in Q4:

Premium & Loyalty Strength

Premium revenue trends accelerated:

The new Atmos Summit Card is generating 2x the spend of the base card, with nearly 60% of new signups coming from outside the Pacific Northwest.

International Expansion

Alaska is positioning Seattle as a "world-class global hub":

Corporate share on Tokyo/Seoul routes is "about to cross over our fair market share" — a key proof point for the international strategy.

Key Management Quotes

On demand momentum:

"We've seen several of the highest booking days in Air Group's history the last few weeks." — Andrew Harrison, EVP & CCO

On $10 EPS commitment:

"I am as convicted and as committed as ever to $10 of EPS to that goal... We're in month 13 of a three-year plan. Way too early for us to be saying we can't achieve this." — Shane Tackett, CFO

On West Coast fuel volatility:

"We really need the West Coast refineries, particularly in California, to stabilize. They just are not up and operating consistently enough." — Shane Tackett, CFO

On systems integration confidence:

"All major guest-facing commercial systems, whether it's loyalty and all the rest of it, are all single and in place now. So that's why we're very confident that our guest experiences in 2026 will be materially smoother and more seamless than they were in 2025." — Andrew Harrison, EVP & CCO

Capital Allocation

Management expects to continue share repurchases in 2026 "to at least offset dilution."

Risks & Headwinds

-

West Coast Fuel Volatility — 50% of fuel exposed to West Coast refining margins, which have been "the most volatile in my 23 years at the company" per Tackett

-

IT Outages — Two painful outages in 2025 impacted operations and financials; corrective investments underway

-

Macro Sensitivity — Q1 seasonality remains a headwind; company is the "most seasonal airline" in the industry

-

Boeing Delivery Delays — MAX 10 certification delays limiting 2026 growth; only 6 737 deliveries expected

-

Integration Execution — Final PSS cutover in April 2026 carries operational risk

Looking Ahead

Key catalysts for 2026:

- April 2026: Unified passenger service system cutover

- Spring 2026: London, Rome, Iceland routes launch

- H1 2026: All 737 premium seat retrofits complete (1.3M incremental premium seats)

- YE 2026: 50% of fleet equipped with Starlink Wi-Fi

- Ongoing: Dynamic pricing rollout, O&D revenue management system development (2027)

The setup for Alaska Air is improving: bookings are accelerating, merger synergies are ahead of plan, and the international expansion is gaining traction. The wide guidance range appropriately reflects macro uncertainty, but management's conviction in the $10 EPS target remains strong.

Related Research: