Earnings summaries and quarterly performance for ALASKA AIR GROUP.

Executive leadership at ALASKA AIR GROUP.

Board of directors at ALASKA AIR GROUP.

Research analysts who have asked questions during ALASKA AIR GROUP earnings calls.

Andrew Didora

Bank of America

6 questions for ALK

Conor Cunningham

Melius Research

6 questions for ALK

Duane Pfennigwerth

Evercore ISI

6 questions for ALK

Jamie Baker

JPMorgan Chase & Co.

6 questions for ALK

Scott Group

Wolfe Research

6 questions for ALK

Catherine O'Brien

Goldman Sachs

5 questions for ALK

Ravi Shanker

Morgan Stanley

5 questions for ALK

Brandon Oglenski

Barclays

4 questions for ALK

Thomas Fitzgerald

TD Cowen

4 questions for ALK

Daniel McKenzie

Seaport Global Securities

3 questions for ALK

Michael Linenberg

Deutsche Bank

3 questions for ALK

Savanthi Syth

Raymond James

3 questions for ALK

Atul Maheswari

UBS Group

2 questions for ALK

Thomas Wadewitz

UBS

2 questions for ALK

Tom Fitzgerald

TD Cowen

2 questions for ALK

Christopher Stathoulopoulos

Susquehanna Financial Group

1 question for ALK

John Dorsett

Barclays

1 question for ALK

Ravi Shankar

Morgan Stanley

1 question for ALK

Shannon Doherty

Deutsche Bank

1 question for ALK

Stephen Trent

Citigroup Inc.

1 question for ALK

Recent press releases and 8-K filings for ALK.

- ALK reported full-year 2025 revenue of DKK 6,312 million, representing 15% growth, and an EBIT margin of 26%.

- Q4 2025 revenue increased by 17% to DKK 1,733 million, with EBIT growing 88% to DKK 387 million.

- The company expects sustained high organic revenue growth of 11-15% and an EBIT margin of approximately 25% for 2026.

- The Board of Directors recommends dividend payments for 2025 of DKK 355 million, or DKK 1.6 per share, corresponding to approximately 30% of net profit after tax.

- Growth in 2025 was primarily driven by Tablet sales increasing by 17% and Anaphylaxis & other products sales increasing by 34%.

- Ben Brookman has been promoted to Vice President of Real Estate and Airport Affairs at Alaska Airlines.

- In this role, Brookman will lead the strategy for airport access, infrastructure, and corporate real estate for both the Alaska and Hawaiian brands.

- This promotion supports Alaska's strategic vision, which includes investing over $3 billion in hub airports and expanding its network to more than 140 destinations, including 29 international markets.

- Alaska Airlines is adding new international destinations, with flights available for booking to Rome, London Heathrow, Reykjavik, Tokyo Narita, and Seoul Incheon.

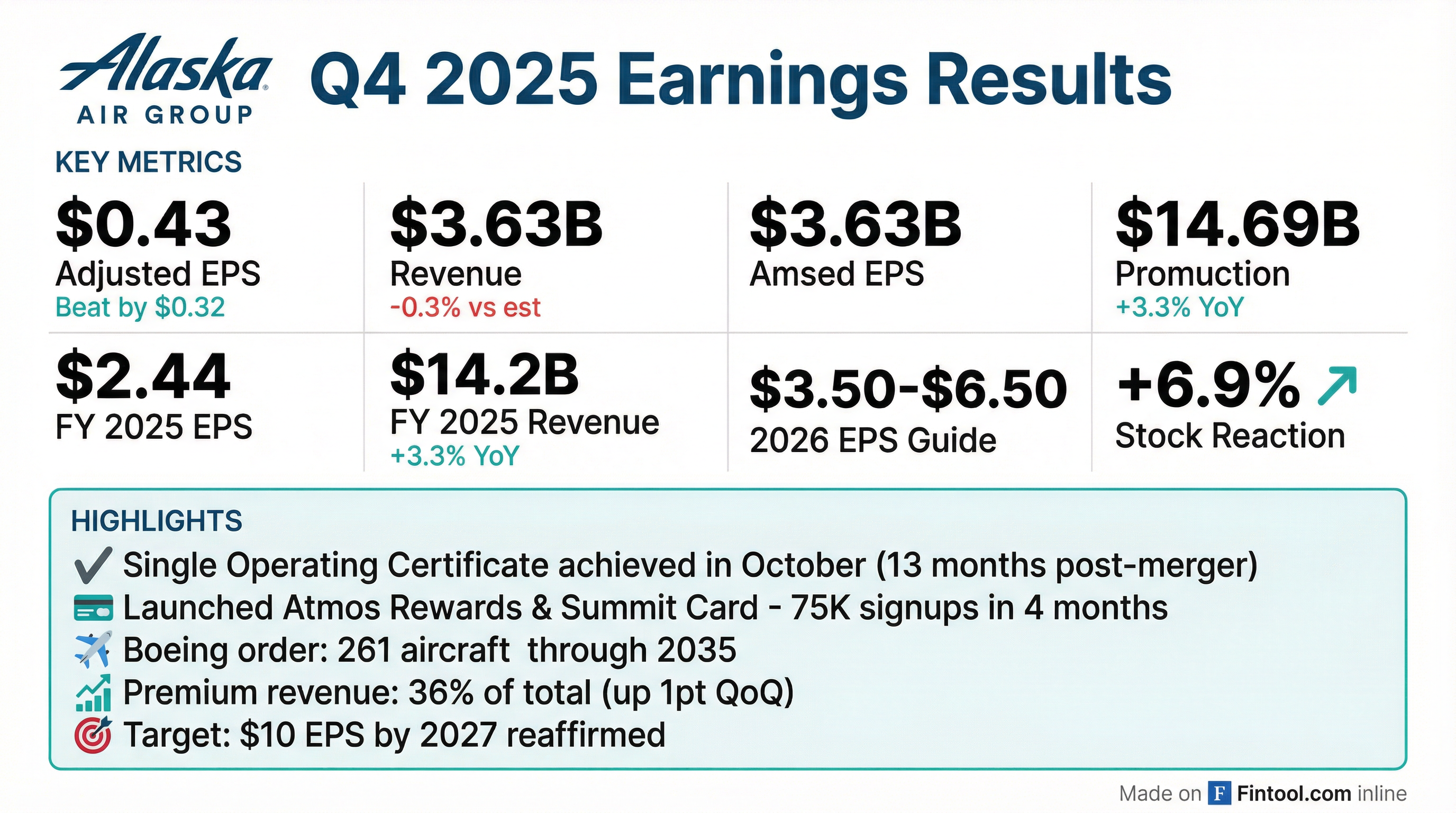

- Alaska Air Group reported adjusted EPS of $0.43 for Q4 2025 and $2.44 for the full year 2025, with total revenues reaching $14.2 billion, an increase of 3.3% year-over-year.

- For 2026, the company expects full-year adjusted EPS to be in the range of $3.50-$6.50, while reaffirming its commitment to achieving $10 of earnings per share by 2027.

- Key operational milestones in 2025 included synergies finishing ahead of plan, the launch of the unified loyalty program Atmos Rewards, and achieving a single operating certificate 13 months post-merger. The combined passenger service system cutover is scheduled for April 2026.

- The company repurchased $570 million of its stock in 2025, reducing the diluted share count to 117 million, and ended the year with $3 billion in total liquidity.

- Demand trends are strong, particularly in premium cabins, which saw revenues increase 7.1% in Q4 2025, and managed corporate travel, which was up 9% in Q4 2025. The company is expanding its international network and expects to realize $800 million in incremental revenue by 2027 from Alaska Accelerate.

- Alaska Air Group reported Q4 2025 adjusted EPS of $0.43 and full-year adjusted EPS of $2.44, both ahead of revised guidance.

- For the full year 2025, total revenues reached $14.2 billion, up 3.3% year-over-year, and the company generated $1.2 billion of operating cash flow.

- The company provided 2026 full-year adjusted EPS guidance of $3.50-$6.50, with a projected Q1 2026 adjusted EPS loss of $1.50-$0.50, and expects to generate positive free cash flow in 2026.

- ALK repurchased $570 million of its stock in 2025, reducing diluted share count to 117 million shares, and remains committed to its goal of $10 of earnings per share by 2027.

- Key 2025 achievements included synergies finishing ahead of plan, the launch of the Atmos Rewards loyalty program, and achieving a single operating certificate in October, 13 months post-merger.

- Alaska Air Group (ALK) reported adjusted EPS of $0.43 for Q4 2025 and $2.44 for the full year 2025. Total revenues reached $3.6 billion in Q4 2025 and $14.2 billion for the full year.

- The company provided 2026 full-year earnings per share guidance in the range of $3.50-$6.50 , with full-year capacity projected to increase between 2%-3%.

- ALK repurchased $570 million of its stock in 2025 and reaffirmed its commitment to achieving $10 of earnings per share by 2027 through its Alaska Accelerate plan.

- Key revenue drivers in Q4 2025 included premium revenues, which represented 36% of total revenue , loyalty revenues up 12% year-over-year , and managed corporate revenues up 9%.

- Alaska Air Group reported Q4 2025 GAAP net income of $21 million ($0.18 per share) and adjusted net income of $50 million ($0.43 per share). For the full year 2025, GAAP net income was $100 million ($0.83 per share) and adjusted net income was $293 million ($2.44 per share), with an adjusted pretax margin of 2.8%.

- The company repurchased 0.7 million shares for approximately $30 million in Q4 2025, bringing total repurchases for 2025 to 11.3 million shares for $570 million.

- For Q1 2026, adjusted earnings per share are guided to be ($1.50) to ($0.50), and for the full year 2026, adjusted earnings per share are expected to range from $3.50 to $6.50, with capital expenditures projected at ~$1.4 to $1.5 billion.

- Operationally, Alaska and Hawaiian achieved a single operating certificate, and the company announced its largest fleet order in January 2026, including 105 737-10 aircraft and 5 787 aircraft.

- Alaska Air Group reported Q4 2025 adjusted earnings per share of $0.43, exceeding expectations, and generated $1.2 billion in operating cash flow for the full year 2025.

- The company provided Q1 2026 adjusted earnings per share guidance of ($1.50) to ($0.50) and full-year 2026 adjusted earnings per share guidance of $3.50 to $6.50.

- A significant integration milestone was achieved with a single operating certificate for Hawaiian Airlines and Alaska Airlines in Q4 2025.

- Alaska announced its largest fleet order in history in January 2026, including 105 737-10 and 5 787 aircraft, with plans to expand its fleet to 475 aircraft by 2030.

- In Q4 2025, the company repurchased 0.7 million shares of common stock for approximately $30 million, contributing to $570 million in total repurchases for 2025.

- Alaska Air Group reported fourth-quarter revenue of $3.63 billion, with GAAP EPS of $0.18 and adjusted EPS of $0.43.

- The company is planning capacity growth of 2–3% and $1.4–$1.5 billion in capital expenditures for fiscal 2026.

- Early-year demand indicators are encouraging, with strong January bookings and managed corporate revenues growing about 20% year-over-year.

- The Alaska–Hawaiian integration is advancing, and new international routes are launching in spring 2026, with the company expanding international sales channels and language support.

- Wall Street analysts have raised price targets and maintained positive ratings, citing a constructive fundamental backdrop.

- Alkane Resources produced 43,663 AuEq oz during the quarter from 1 October to 31 December 2025, comprised of 42,767 Au oz and 267 Sb t.

- The company's cash, bullion, and listed investment balance increased by A$55 million to A$246 million at 31 December 2025, after paying $11 million in FY25 income tax.

- Sales for the quarter included 42,709 Au oz and 409 Sb t.

- FY2026 Group Guidance for production of 160,000 to 175,000 AuEq oz at an AISC of A$2,600 - $2,900 per AuEq oz remains unchanged.

- Alaska Air Group announced its largest fleet order in the airline's history on December 31, 2025, which includes 105 new 737-10 aircraft and 5 new 787 aircraft from Boeing, along with an option for 35 additional 737-10 aircraft.

- This order extends the aircraft delivery stream through 2035 and increases Alaska's total orderbook with Boeing to 245 aircraft.

- The new aircraft support the "Alaska Accelerate" strategic plan, enabling expansion to more international destinations, with the five additional 787 widebody aircraft expected to facilitate flights to at least 12 long-haul international destinations from Seattle by 2030.

- The company projects its fleet will grow from a current 413 aircraft to more than 475 aircraft by 2030 and more than 550 aircraft by 2035.

Fintool News

In-depth analysis and coverage of ALASKA AIR GROUP.

Quarterly earnings call transcripts for ALASKA AIR GROUP.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more