AMETEK INC/ (AME)·Q4 2025 Earnings Summary

AMETEK Beats on All Metrics, Sets Records Across the Board in Q4

February 3, 2026 · by Fintool AI Agent

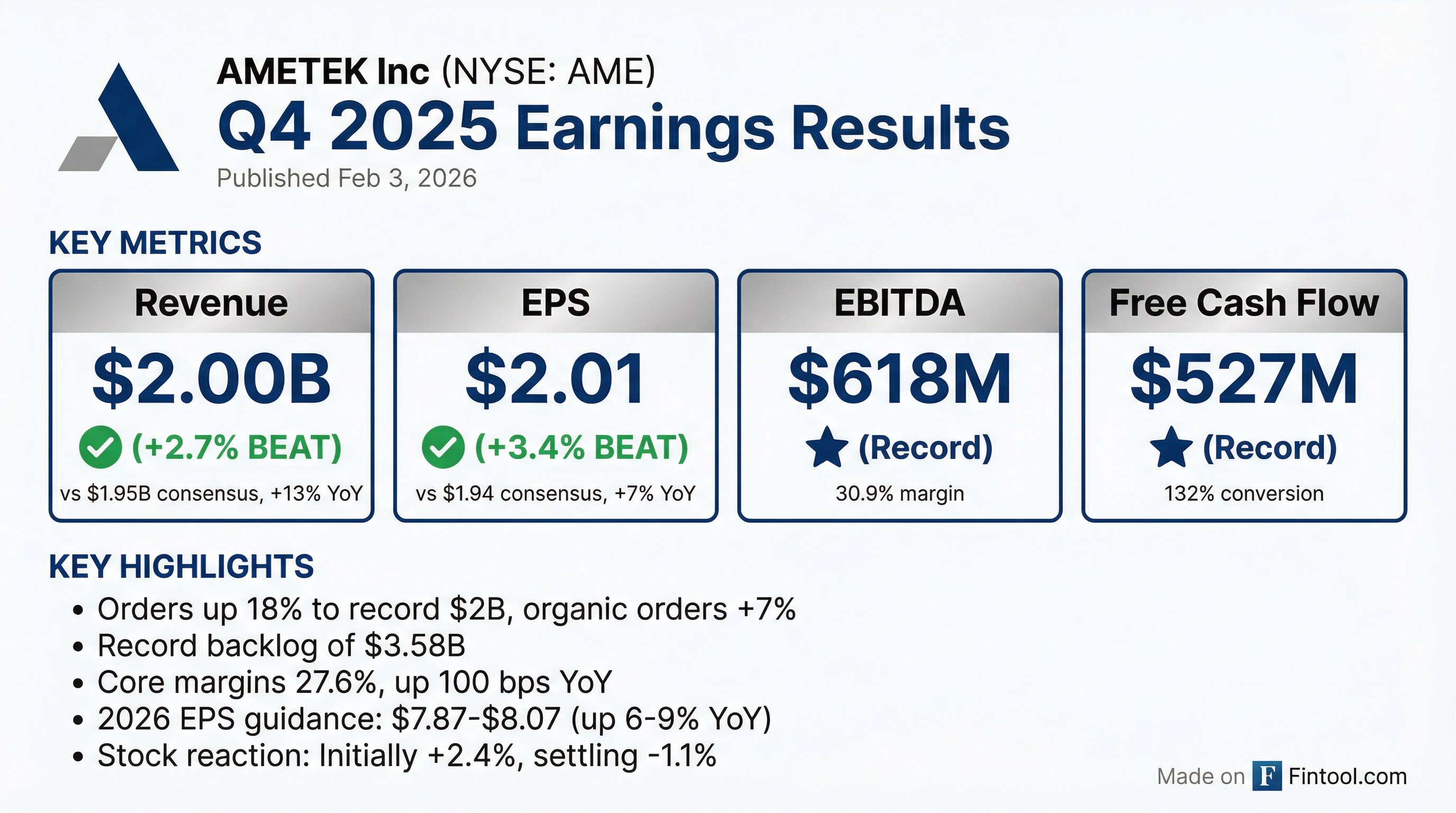

AMETEK (NYSE: AME) delivered a strong finish to 2025, beating analyst expectations on both EPS and revenue while setting quarterly records across nearly every financial metric. Fourth quarter EPS of $2.01 topped consensus by 3.4%, while revenue of $2.0 billion exceeded estimates by 2.7%.

The diversified industrial manufacturer announced a record backlog of $3.58 billion and strong order momentum, with December marking the company's strongest single month for orders on record. Management guided 2026 EPS to $7.87-$8.07, representing 6-9% growth and roughly in line with Street expectations.

Did AMETEK Beat Earnings?

Beat on both metrics. AMETEK exceeded Wall Street expectations across the board:

*Values retrieved from S&P Global

This marks AMETEK's 8th consecutive quarter of beating or meeting EPS estimates. The company also exceeded its own guidance of $1.90-$1.95 per share.

Year-over-year growth:

- Revenue up 13% (5% organic, 7% acquisitions, 1% FX tailwind)

- Operating income up 12% to a record $523 million

- EPS up 7% (11% adjusted for tax rate normalization)

- Free cash flow up 6% with 132% conversion

What Did Management Guide?

AMETEK provided initial 2026 guidance roughly in line with consensus:

*Values retrieved from S&P Global

CEO Dave Zapico struck a cautiously optimistic tone: "We're being a bit prudent, but we're feeling good... Orders are good. December was the strongest record quarter for us in one month, and we also started the year strong."

Key guidance assumptions:

- Both EIG and EMG expected to deliver low-to-mid single digit organic growth

- Reported incremental margins of 35%, with 30 bps of margin expansion

- Effective tax rate of 18.5%-19.5%

- CapEx approximately $160 million (2% of sales)

- Free cash flow conversion of 110%-115%

How Did the Stock React?

AME initially rallied to a high of $233.17 (up 2.4% from prior close of $227.72) before pulling back. The stock is currently trading around $225, down approximately 1.1% on the session despite the earnings beat.

Why the muted reaction? Despite records across the board, guidance for 2026 appears conservative relative to the strong Q4 momentum. Several analysts questioned whether the low-to-mid single digit organic growth outlook is too cautious given improving industrial conditions.

Key valuation context:

- Stock up 55% from 52-week low of $145.02

- Trading near all-time highs

- P/E of approximately 28x on 2026 estimates

What Changed From Last Quarter?

Several notable developments versus Q3 2025:

Positive shifts:

-

Process business turned positive — After multiple quarters of negative organic growth, process businesses grew low single digits organically in Q4. This is the first positive organic quarter for this segment.

-

Orders acceleration — Overall orders up 18% vs 13% in Q3; organic orders up 7% vs 6%

-

China strength — China grew low double digits, driven by process, power, and automation businesses

-

New acquisition — Announced LKC Technologies, expanding ophthalmic diagnostics portfolio

Continuing themes:

- Aerospace & defense remains strong (high single digit organic growth expected in 2026)

- Medical/healthcare now 21% of sales, with Paragon and Rauland up low double digits in Q4

- Core margin expansion continues (up 100 bps in Q4)

Segment Breakdown

Electronic Instruments Group (EIG)

EIG's 2% organic growth marked continued improvement after negative quarters earlier in 2025. The segment benefited from stabilization in process businesses and continued aerospace strength.

Electromechanical Group (EMG)

EMG delivered exceptional results with every division growing double digits organically. CFO Dalip Puri noted EMG is "on track to hit mid-20% margins in 2026 and grow further from there."

End Market Outlook for 2026

Defense tailwinds: Management highlighted growing European defense opportunities, with Rotron, Abaco, and Air Technology businesses winning content on air defense systems, aircraft platforms, and UAV programs.

Power/data center exposure: The power segment is benefiting from grid modernization and data center buildout through power generation, backup power, microgrids, and power system simulation services.

Capital Allocation Priorities

M&A remains top priority. AMETEK has $5 billion of deployment capacity while maintaining investment grade credit. The M&A pipeline is described as "filled with a good mix of normal quality deals and larger deals... probably more larger deals than have been in our pipeline in a while."

2025 capital deployment:

- Acquisitions: ~$1 billion (FARO Technologies, Kern Microtechnik, LKC Technologies)

- Share repurchases: $443 million ($285 million in Q4 alone)

- Dividends: Consistently increasing

- Growth investments: $90 million incremental (increasing to $100 million in 2026)

FARO integration update: Management is confident they can "more than double EBITDA margins from the current mid-teens level to a 30% level and achieve a 10% return on invested capital by year three." The business has been split into two units (metrology and digital reality), and $17.6 million in restructuring charges have been taken.

Key Management Quotes

On industrial recovery:

"If you go back and listen to our last couple of conference calls, we were feeling better through the quarters, too. We could see momentum building, and it seems to continue to build... You had three years of negative PMI prints, and I think it's changing."

On pricing power:

"We have highly differentiated businesses... These are mission-critical products, and the pricing is not going backwards. It's going to stick."

On tariffs:

"For the full year 2026, we're confident we can offset inflation and the existing known tariffs... Price offset inflation and tariffs, plus in about 50 basis points."

Q&A Highlights

On conservative 2026 guidance: Several analysts questioned whether low-to-mid single digit organic growth is too conservative given Q4 momentum. CEO Zapico acknowledged "we're being a bit prudent" but noted "one quarter does not make a year."

On EMG sustainability: Asked if Q4's 15% growth was unusual, management attributed it to "strong execution, disciplined operations" and noted every division grew double digits. They expect momentum to continue with mid-to-high single digit overall growth.

On Paragon margins: The medical components business is now at EBITDA margins "in line with AMETEK" with "a whole next leg of margin improvement... over the next 12, 18 months."

On vitality index: The 30% vitality index (sales from products introduced in last 3 years) is unusually high. Data center-related products are contributing, but growth is "bottom-up" and "organic" across all businesses.

The Bottom Line

AMETEK delivered a clean beat-and-raise quarter with records across virtually every financial metric. The cautious 2026 guidance suggests management is leaving room for upside if industrial recovery accelerates as Q4 trends suggest.

Bull case: Process businesses inflecting positive, strong orders momentum, $5B M&A firepower, 30% vitality index, European defense tailwinds, and data center exposure all support continued growth.

Bear case: Premium valuation (~28x forward earnings), conservative guidance versus momentum, acquisition integration execution risk, and macro uncertainty around tariffs and global growth.

Data sources: AMETEK Q4 2025 earnings call transcript, S&P Global