AUTONATION (AN)·Q4 2025 Earnings Summary

AutoNation Beats EPS But Revenue Misses as Vehicle Volume Slides — Stock Falls 5%

February 6, 2026 · by Fintool AI Agent

AutoNation reported Q4 2025 results before the market open on February 6, 2026, delivering a mixed quarter that sent shares tumbling. While adjusted EPS of $5.08 beat consensus by 3.5%, revenue of $6.93 billion missed expectations by 3.9% as new vehicle unit sales declined 10% year-over-year on a same-store basis. The stock fell 5.1% to $204.02 on the news.

For the full year, AutoNation posted stronger results with revenue up 3%, adjusted net income up 8%, and adjusted EPS surging 16% to $20.22 — driven significantly by a 10% reduction in shares outstanding through aggressive buybacks.

Did AutoNation Beat Earnings?

AutoNation delivered a split decision in Q4 2025:

The EPS beat was driven by disciplined SG&A management (67.3% of gross profit for the full year) and continued improvement in Customer Financial Services profitability. However, the revenue miss reflected challenging vehicle unit volumes — new retail units declined 10% YoY on a same-store basis (64,841 vs 71,434), while used vehicle units fell 5% (62,926 vs 64,829).

This marks AutoNation's sixth consecutive EPS beat over the past eight quarters, though Q2-Q3 2024 saw misses. The company has demonstrated consistent ability to exceed Street earnings expectations through margin discipline and capital allocation, even as vehicle volumes remain challenged.

What Drove the Q4 Performance?

New Vehicles: Volume Pressure, Margin Stabilization

New vehicle retail units of 64,841 were down 10% YoY, though gross profit per unit improved sequentially to ~$2,400 from Q3, driven by improvements in Domestic and Premium Luxury segments. Full-year new vehicle volume was up 2%, and management noted market share improved quarter-over-quarter. Vehicle supply stood at 45 days (vs 47 in September).

The EV Collapse: The biggest driver of the 10% unit decline was a dramatic pullback in electrified powertrains. CEO Mike Manley revealed that EV/BEV mix dropped from 30% in Q4 2024 to just 20% in Q4 2025 — a 60% decline in battery electric vehicle volume. This was exacerbated by reduced OEM dealer-facing incentives, particularly for hybrids and EVs:

"The largest drop, by the way, was dealers, OEM dealer support for hybrid and battery electric vehicles, as you can imagine." — Mike Manley, CEO

Used Vehicles: Improving Mix, Acquisition Challenges

Used vehicle retail units of 62,926 declined 5% YoY, with gross profit per unit of $1,438 (vs $1,538 in Q4 2024). Importantly, the used-to-new ratio improved to 97% in Q4 2025 vs 91% in Q4 2024, indicating a more balanced mix. Full-year used volume was up 1% and gross profit increased 5%.

Management highlighted a mix imbalance: AutoNation outperformed in $40,000+ vehicles but underperformed in the sub-$20,000 segment due to quality standards. The company is now focused on expanding into the sub-$30,000 price band:

"We're looking very carefully at how we can achieve a slightly different balance in terms of price segments of our used vehicles... that's a very, very competitive marketplace. And this is where we've got to leverage our scale and our reach." — Mike Manley, CEO

Over 90% of used vehicle sourcing comes from internal channels — trade-ins, We Buy Your Car, loaner conversions, and lease returns — providing cost advantages.

Customer Financial Services: Record Performance

CFS delivered record results with gross profit per unit of $2,891, up 7% YoY in Q4 and 6% for the full year. This represents continued strength in F&I penetration as customers finance at higher rates.

After-Sales: The Highlight

After-Sales delivered record Q4 and full-year gross profit, with revenue of $1.22B (up 6% YoY) and gross margin of 48.3%. Customer pay, the largest channel, grew 8% on a same-store basis and 11% total. Franchise technician headcount grew 3%, reflecting improved retention. Full-year margin expanded to 48.7% from 47.9%.

AutoNation Finance: A Growing Profit Engine

AutoNation Finance achieved its first full-year profit of $10 million in 2025, up from a $9 million loss in 2024. Key metrics:

Q4 market share reached approximately 14%. A second ABS transaction of ~$750M closed in January 2026 at a blended rate of 4.25% with an advance rate of 98.7% — improvements from the Q2 2025 offering. On a pro forma basis, portfolio funding status exceeds 90%.

CFO Tom Szlosek provided forward guidance on profitability: "$6 million we achieved in the fourth quarter... that's probably a decent starting point as you look on a quarterly basis through 2026."

Management emphasized discipline in the "buy box" — AN Finance targets used vehicles and new vehicles that don't qualify for subsidized OEM captive financing, rather than competing directly with manufacturer programs.

How Did AutoNation Allocate Capital?

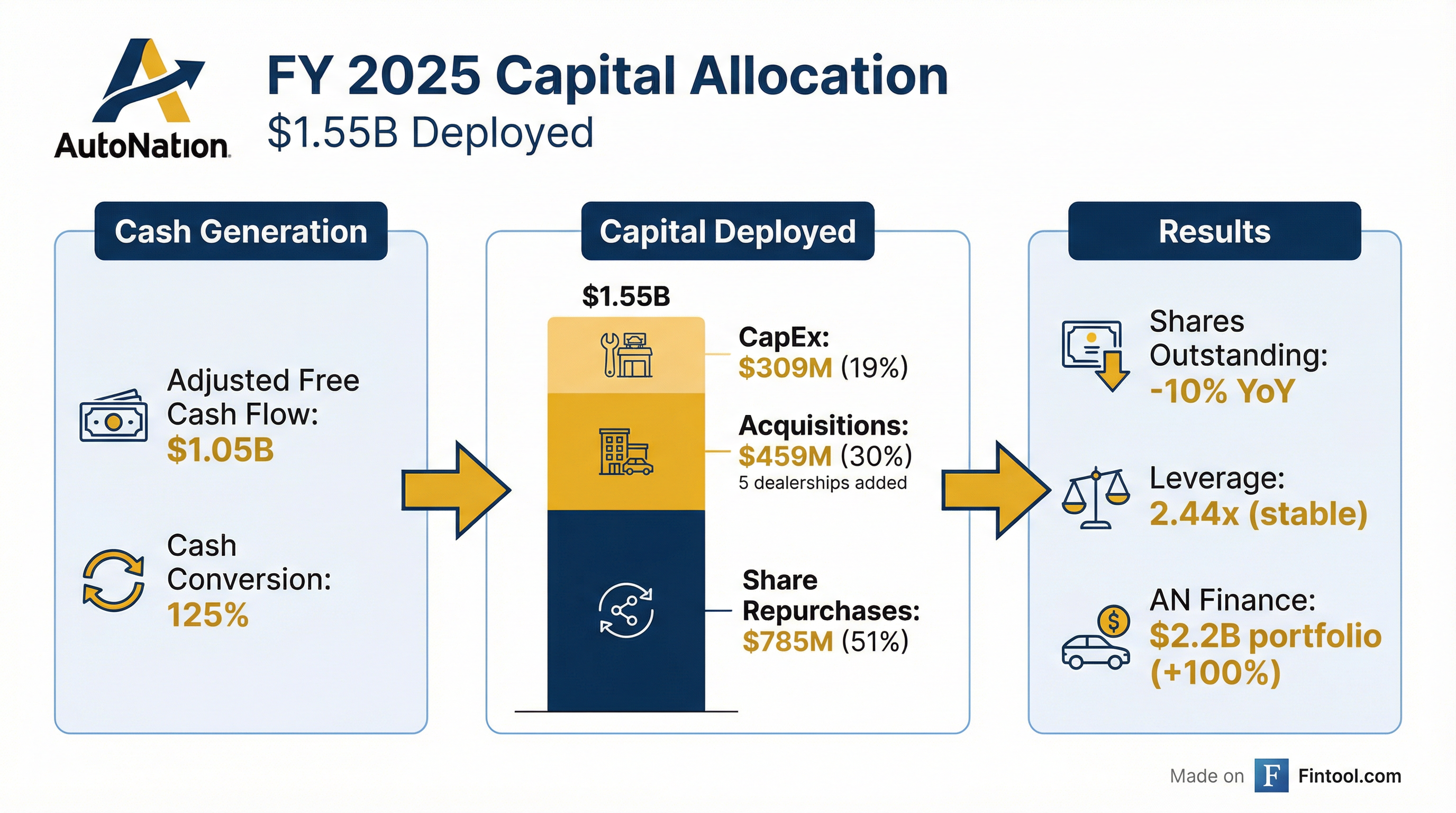

AutoNation deployed $1.55 billion in capital during 2025, funded by record adjusted free cash flow of $1.05 billion (up 39% YoY) with a 125% cash conversion rate.

Shares outstanding decreased by 10%+ from year-end 2024, driving EPS growth even as absolute net income grew more modestly. Leverage remained stable at 2.44x, below the midpoint of the targeted range. The Board recently approved a new $1.0 billion share repurchase program.

How Did the Stock React?

AutoNation shares fell 5.1% to $204.02 following the earnings release, despite the EPS beat. The stock opened at $213.40 and traded as low as $204.02 during the session.

The negative reaction likely reflects:

- Revenue miss — Street was expecting $7.2B, got $6.9B

- Volume declines — New vehicle units down 10% is concerning for top-line growth

- Tariff uncertainty — Management mentioned potential tariff-related impacts in forward-looking statements

Despite the selloff, shares remain up significantly from the 52-week low of $148.33, and the stock trades at a discount to the $243.67 average analyst price target.

What Did Management Guide for 2026?

Management provided qualitative guidance for 2026, with more color on the earnings call:

- New Vehicles: Unit sales in line with market, expected to be down 2%-5% for the industry. GPU stabilizing near 2H 2025 levels "at least for the coming few months"

- Used Vehicles: Market constrained with some improvement YoY; increased focus on sub-$30K price segment

- Customer Financial Services: Sustained performance expected, with focus on monthly payment sensitivity

- AN Finance: Portfolio scaling; Q4 profitability (~$6M/quarter) is "a decent starting point" for 2026

- After-Sales: Mid-single-digit growth expected to continue; technician headcount rising

- CapEx: 2025 levels (~$309M) are "sustainable for 2026"

- SG&A: Target remains 66%-67% of gross profit; may run slightly higher in H1 due to upper-funnel advertising investments

Industry Outlook: CEO Manley expects the new car market will be "slightly down in 2026 compared to 2025" but sees potential tailwinds from withholding tax refunds and bonus depreciation.

Affordability Pressures: Management acknowledged that monthly payments remain a key concern and expects some APR relief toward the back end of 2026. OEMs may address affordability through "decontenting" rather than significant transaction price reductions.

What Changed From Last Quarter?

*Values marked with asterisk are from S&P Global

Key improvements from Q3:

- New vehicle margin improved driven by Domestic and Premium Luxury segments

- CFS profitability per unit continued its upward trajectory

- Inventory levels tightened modestly

Key concerns:

- Volume pressure continued despite improving used-to-new mix

- Used vehicle GPU declined sequentially

Full-Year Summary: A Year of Growth

Despite Q4 volume challenges, FY 2025 was a strong year for AutoNation:

- Organic growth: Higher unit sales, higher revenue, higher After-Sales margins

- Acquisition growth: Added 5 dealerships with "great brands in key markets"

- Cash flow growth: Adjusted FCF exceeded $1 billion, up 39%

- Profit growth: Adjusted Net Income up 8%, Adjusted EPS up 16%

The outsized EPS growth vs net income growth reflects aggressive share repurchase activity — shares outstanding declined from 40.1M (weighted avg Q4 2024) to 36.6M (Q4 2025), a 9% reduction.

Q&A Highlights

Key themes from the analyst Q&A:

On the Volume vs. Margin Trade-off (J.P. Morgan): Management confirmed they consciously balanced margin protection against volume. The reduced OEM dealer incentives — especially for electrified vehicles — required careful navigation. Market share improved sequentially from Q3 despite the volume decline.

On Lease Returns (Stephens): CEO Manley expects increased lease returns to benefit the business in 2026, particularly as underwater EV residuals flow back to market. He believes OEMs have "already provided for" residual value shortfalls and expects dealers to work with manufacturers on fair pricing.

On After-Sales Sustainability (Wells Fargo): Management expects mid-single-digit growth to continue, supported by 3%+ technician headcount growth and available capacity. Gross margin may moderate due to growing wholesale parts business (which carries lower margins), but underlying workshop productivity continues improving.

On New GPU Stabilization (Evercore ISI): CFO Szlosek noted January is tracking stable vs. December, calling it "off to a good start." Management expects H1 stability to continue.

On M&A Pipeline (Barclays): The market remains "reasonably buoyant" with opportunities across all quarters. AutoNation remains selective, focused on high-quality brands in markets where they have density and can drive synergies.

Key Risks and Concerns

Based on forward-looking statements, risk factors, and earnings call commentary:

- Tariff Exposure: Management noted that 2025 saw "turbulent" dynamics with tariff announcements driving pull-forward demand in Q1-Q3. The expiration of government EV incentives also impacted volumes. OEMs are absorbing "residual tariff impact" on cost of goods sold.

- Affordability Pressures: Monthly payments have seen "significant compound growth" over six years driven by transaction prices and APRs. This remains "front of mind" for the industry.

- Volume Pressure: New vehicle units declining 10% suggests ongoing demand challenges; industry expected down 2%-5% in 2026

- Used Vehicle Acquisition Competition: Sourcing competitive across all channels; AutoNation must leverage scale advantages to compete in the sub-$30K segment

- EV Margin Normalization: Management doesn't expect BEV margins to stabilize until penetration settles at 2%-3%, which "is not going to happen in 2026"

Bottom Line

AutoNation delivered a mixed Q4 with EPS beating expectations but revenue falling short due to meaningful declines in vehicle unit volumes — driven largely by a 60% collapse in EV sales. The company's capital allocation strategy — aggressive buybacks, disciplined M&A, and AN Finance scaling — continues to drive EPS growth even as the core retail business navigates affordability headwinds and shifting powertrain preferences.

After-Sales remains a standout with record performance, and management is investing in technician capacity to sustain mid-single-digit growth. AN Finance crossed into profitability and should scale further as the $2.2B portfolio matures. For 2026, management expects the industry to be down 2%-5% but sees AutoNation well-positioned to perform in line with or better than market, with GPU stability continuing through H1.

The 5% stock decline suggests investors were disappointed by the revenue miss, but the core earnings power story — capital return, margin discipline, and diversifying profit streams — remains intact.

Data sources: AutoNation Q4 2025 Earnings Call Transcript, Q4 2025 8-K, S&P Global, MarketBeat