Earnings summaries and quarterly performance for AUTONATION.

Executive leadership at AUTONATION.

Michael Manley

Chief Executive Officer

Coleman Edmunds

Executive Vice President, General Counsel and Corporate Secretary

Gianluca Camplone

Chief Operating Officer, AutoNation Parts, and Executive Vice President, Business Development

Jeff Parent

Chief Operating Officer

Thomas Szlosek

Executive Vice President and Chief Financial Officer

Board of directors at AUTONATION.

Research analysts who have asked questions during AUTONATION earnings calls.

Rajat Gupta

JPMorgan Chase & Co.

8 questions for AN

Daniela Haigian

Morgan Stanley

6 questions for AN

Jeff Lick

Stephens Inc.

6 questions for AN

Colin Langan

Wells Fargo & Company

5 questions for AN

Bret Jordan

Jefferies

4 questions for AN

Michael Ward

Citi Research

4 questions for AN

Douglas Dutton

Evercore ISI

3 questions for AN

John Murphy

Bank of America

3 questions for AN

John Babcock

Bank of America

2 questions for AN

John Saager

Evercore ISI

2 questions for AN

Bret David Jordan

Jefferies LLC

1 question for AN

David Whiston

Morningstar, Inc.

1 question for AN

Jeffrey Francis Lick

Stephens Inc.

1 question for AN

Michael Patrick Ward

Citigroup Inc.

1 question for AN

Recent press releases and 8-K filings for AN.

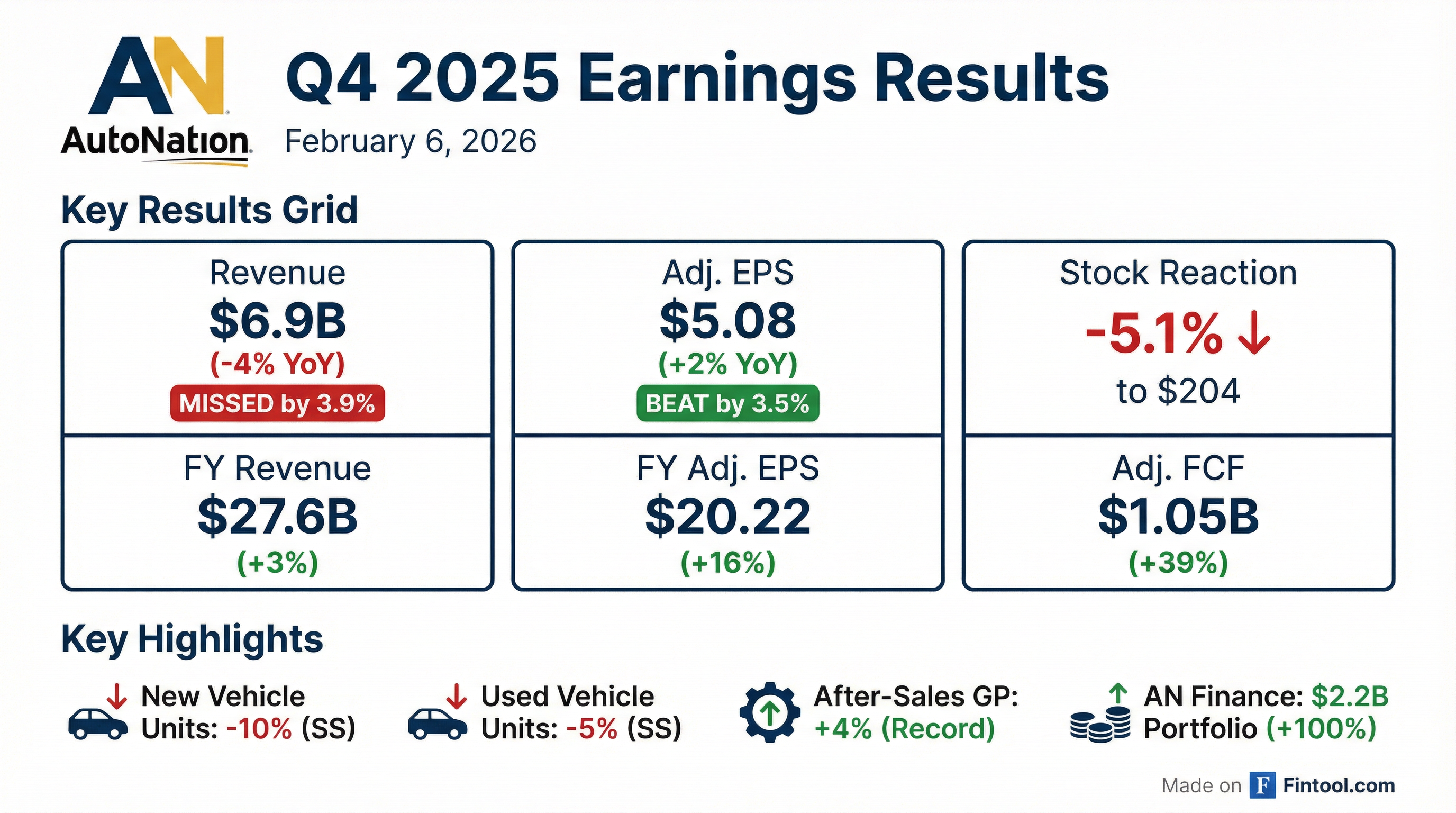

- AutoNation achieved a solid full year 2025, with revenue increasing 3% to $27.6 billion, adjusted net income up 8% to $757 million, and adjusted earnings per share growing 16%.

- In Q4 2025, total revenue was $6.9 billion, a decrease from the prior year, driven by a 9% decline in new vehicle sales revenue. However, Customer Financial Services (CFS) unit profitability grew 8% year-over-year, and after-sales delivered record revenue and gross profit.

- The company deployed over $1.5 billion in capital in 2025, including $785 million for share repurchases (reducing shares by 10%) and $460 million in M&A. Adjusted free cash flow exceeded $1 billion, up approximately 39% from 2024.

- Looking to 2026, management anticipates the overall market to be slightly down compared to 2025, while expecting new unit profitability to remain stable and after-sales to continue mid-single digit growth.

- AutoNation reported solid full-year 2025 results, with 3% revenue growth to $27.6 billion, 8% adjusted net income growth to $757 million, and a 16% increase in adjusted earnings per share to $20.22.

- Adjusted free cash flow for the full year exceeded $1 billion, reaching $1.05 billion, an increase of approximately 39% from the prior year.

- The company deployed over $1.5 billion in capital in 2025, including $785 million for share repurchases, which reduced shares in circulation by 10%, and $460 million for M&A.

- In Q4 2025, total revenue was $6.9 billion, down from $7.2 billion a year ago, driven by a 9% decline in new vehicle sales revenue and a 10% decrease in same-store new vehicle unit sales, though after-sales revenue grew 6%.

- For 2026, AutoNation expects the overall market to be slightly down, with the new car market potentially declining 2% to 5%, but anticipates continued mid-single-digit growth in after-sales gross profit.

- AutoNation reported diluted adjusted EPS of $5.08 for Q4 2025 and $20.22 for the full year 2025, representing a 16% increase year-over-year for the full year.

- The company achieved record performance in Customer Financial Services, with Gross Profit per Unit (SS) reaching $2,891 in Q4 2025, and After-Sales Gross Profit (SS) increasing 4% in Q4 2025, also a record.

- Adjusted Free Cash Flow for FY 2025 was $1.05 billion, up 39%, and $1.6 billion was deployed in capital, including $785 million in share repurchases.

- The AN Finance portfolio grew 100% to $2.2 billion and achieved $10 million in profitability for its third full year in 2025.

- AutoNation reported Q4 2025 adjusted EPS of $5.08, a 2% increase year-over-year, and full-year 2025 adjusted EPS of $20.22, up 16% from 2024, with full-year revenue increasing 3% to $27.6 billion. Adjusted free cash flow for the full year was up 39% from 2024, exceeding $1 billion.

- Key growth drivers included Customer Financial Services (CFS) with Q4 unit profitability up 8% and full-year total profit up 8%, and after-sales revenue growing 6% in Q4. AN Finance also saw a significant improvement, moving from a $9 million operating loss in 2024 to a $10 million operating profit in 2025.

- New vehicle sales revenue declined approximately 9% in Q4 2025, with unit sales down 9% (or 10% on a same-store basis), primarily due to a 60% reduction in EV volume. Used vehicle retail unit sales also decreased 5% on a same-store basis in Q4.

- In 2025, the company deployed over $1.5 billion in capital, including $785 million for share repurchases (reducing share count by 10% year-over-year) and $460 million for M&A.

- Looking to 2026, AutoNation expects the overall market to be slightly down, with the new car market potentially decreasing 2% to 5% due to affordability pressures, while after-sales is projected to continue mid-single digit growth.

- AutoNation reported Q4 2025 revenue of $6.9 billion, a 4% decrease compared to the same period a year ago, while full year 2025 revenue increased 3% to $27.6 billion.

- Adjusted Diluted EPS was $5.08 for Q4 2025 and $20.22 for the full year 2025, representing a 16% increase from the prior year's adjusted EPS.

- The company generated Adjusted Free Cash Flow greater than $1 billion for the full year 2025 and executed $785 million in share repurchases, resulting in a 10% share reduction in 2025.

- Operational highlights include record Q4 After-Sales gross profit with 4% same-store growth and record quarterly and full year Customer Financial Services (CFS) profit per unit.

- AutoNation reported Q4 2025 revenue of $6.9 billion, a 4% decrease compared to the same period a year ago, with Diluted EPS of $4.70 and Adjusted Diluted EPS of $5.08.

- For the full year 2025, revenue increased by 3% to $27.6 billion, with Diluted EPS of $17.04 and Adjusted Diluted EPS of $20.22.

- The company achieved record Q4 After-Sales gross profit and record quarterly Customer Financial Services profit per unit, and the AutoNation Finance portfolio grew to $2.2 billion.

- AutoNation generated $1.05 billion in adjusted free cash flow for the full year 2025 and repurchased $785 million in shares, representing a 10% share reduction.

- On January 21, 2026, TrueCar completed its $227 million take-private acquisition by Fair Holdings, Inc., led by TrueCar Founder Scott Painter.

- AutoNation (NYSE: AN) is identified as one of the strategic partners in the acquiring group, alongside entities such as PenFed Credit Union and Zurich North America.

- As a result of the transaction, TrueCar will no longer be publicly traded, and its stock will be delisted from NASDAQ.

- Scott Painter will return as Chief Executive Officer of TrueCar, with a mandate to refocus the business on profitability.

- AutoNation, Inc. acquired Jerry's Toyota from Jerry's Automotive Group in Baltimore, Maryland, with the transaction taking effect on December 8, 2025.

- This acquisition is projected to add approximately $123 million in annual revenue and 2,600 retail new and used vehicle annual unit sales.

- The new dealership, renamed AutoNation Toyota White Marsh, is AutoNation's 20th Toyota store nationwide and its first Toyota dealership in Maryland, increasing its presence in the state to 18 locations.

- AutoNation, Inc. has acquired Jerry's Toyota, a flagship Toyota dealership that has served the Mid-Atlantic region for over 40 years.

- This transaction represents AutoNation's first Toyota acquisition in over a decade and is intended to reinforce its continued expansion and leadership in the Mid-Atlantic market.

- The Dave Cantin Group (DCG) advised the seller, Jerry's Toyota, on this deal, which also served as a multi-generational succession planning milestone for the Stautberg family.

- AutoNation, Inc. closed the sale of $600 million aggregate principal amount of 4.450% Senior Notes due 2029 on November 14, 2025.

- The notes were issued at 99.846% of the aggregate principal amount, representing a yield to maturity of 4.499%.

- Interest on the notes will be paid semi-annually on January 15 and July 15 of each year, commencing July 15, 2026.

- The notes are not guaranteed by any subsidiaries of the company and are structurally subordinated to all existing and future liabilities of its subsidiaries.

Quarterly earnings call transcripts for AUTONATION.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more