Earnings summaries and quarterly performance for APi Group.

Executive leadership at APi Group.

Board of directors at APi Group.

Research analysts who have asked questions during APi Group earnings calls.

Joshua Chan

UBS Group AG

6 questions for APG

Kathryn Thompson

Thompson Research Group

6 questions for APG

Jonathan Tanwanteng

CJS Securities

5 questions for APG

Andrew J. Wittmann

Robert W. Baird & Co.

4 questions for APG

Jasper Bibb

Truist Securities

4 questions for APG

Stephanie Moore

Jefferies

4 questions for APG

Andrew Kaplowitz

Citigroup

3 questions for APG

Julian Mitchell

Barclays Investment Bank

3 questions for APG

Timothy Mulrooney

William Blair & Company

3 questions for APG

Andy Kaplowitz

Citigroup Inc.

2 questions for APG

Andy Wittman

Robert W. Baird & Co.

2 questions for APG

Tomohiko Sano

JPMorgan Chase & Co.

2 questions for APG

C. Stephen Tusa

JPMorgan Chase & Co.

1 question for APG

David Paige

RBC Capital Markets

1 question for APG

David Paige Papadogonas

RBC Capital Markets

1 question for APG

Ethan

JPMorgan Chase & Co.

1 question for APG

Harold Antor

Jefferies Financial Group Inc.

1 question for APG

Jack Cauchi

Barclays PLC

1 question for APG

Kenyon Pelletier

Barclays

1 question for APG

Recent press releases and 8-K filings for APG.

- APi Group has grown from $4 billion to pushing $8 billion under CEO Russ Becker, with Q4 2025 marking the best quarter for year-over-year margin expansion, and further margin improvement is expected in the specialty business throughout 2026.

- The company's strategy prioritizes an "inspection-first mindset" for growth, with data centers contributing 8% of revenue in 2025 and projected to reach 10% in 2026.

- APi Group is committed to $250 million in annual bolt-on M&A, recently acquiring CertaSite (approx. $90 million in revenue, 90%+ inspection and service work), and is optimizing branches to achieve a minimum 20% margin, with median North American margins at 17% and international at 13% as of last May, expecting a 100 basis point improvement this year.

- The company is investing in technology, viewing AI as an opportunity, and has established an AI team to develop tools for field leaders, alongside deploying a new business system in a pilot company in the first half of 2026.

- APi Group reported strong momentum in Q4 2025, similar to Q3, with year-over-year margin expansion making it their best quarter of the year, and expects normal seasonality for 2026 with a strong backlog.

- Key growth drivers include critical infrastructure, healthcare, and life sciences, with data centers accounting for 8% of revenue in 2025 and projected to reach 10% in 2026.

- The company is focused on branch optimization, aiming for a minimum of 20% margin for all branches, up from a median of 17% in North America and 13% internationally (as of May 2025), with an expected 100 basis point improvement in the median over 2026.

- APi Group maintains a strategy of $250 million in bolt-on M&A annually, recently acquiring CertaSite (approx. $90 million in revenue with 90%+ inspection and service work), and is pursuing opportunities to grow its elevator service platform to over $1 billion in revenue.

- The company is investing in AI and technology enablement, with an AI team focused on improving field efficiency and a new business system implementation underway, expected to pilot in the first half of 2026.

- APi Group reported Q4 2025 as its best quarter of the year for year-over-year margin expansion, with margins improving sequentially from Q2 to Q4, and expects normal seasonality and continued margin improvement in Specialty Services throughout 2026.

- The company's strategic focus remains on its inspection-first business model, with data centers contributing 8% of revenue in 2025 and projected to reach 10% in 2026. They see boundless opportunity for inspection growth, holding less than 5% market share in the largest US metropolitan areas.

- APi is actively pursuing branch optimization, aiming for all branches to achieve a minimum of 20% margin, up from the current median of 17% in North America and 13% internationally. They anticipate improving the median margin by approximately 100 basis points this year.

- The M&A pipeline is robust, with a commitment to $250 million in bolt-on M&A annually, typically at 5x-7x multiples. A recent strategic acquisition was CertaSite, a ~$90 million revenue company with over 90% inspection and service revenue. The company also aims to grow its elevator service business to over $1 billion in revenue.

- APi is investing in AI and new business systems, viewing AI as an opportunity to enhance efficiency for field leaders and potentially automate design processes. A new system is being piloted in H1 2026, which will provide clean data to further enable AI capabilities.

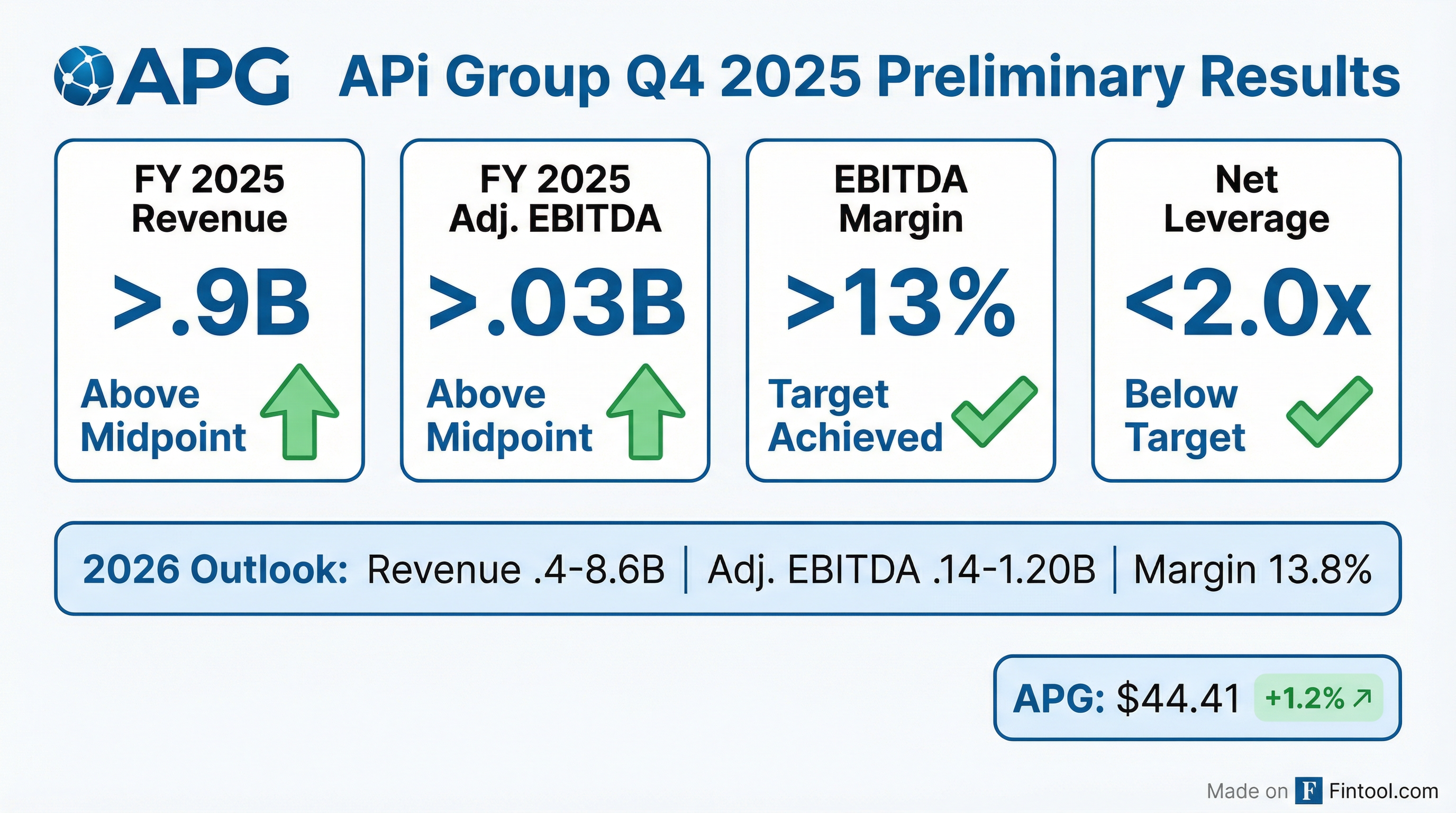

- APi Group expects 2025 net revenues and adjusted EBITDA to exceed the midpoint of prior guidance, with adjusted EBITDA margins above the 13% target and adjusted free cash flow conversion in line with the 80% target.

- The company anticipates a net leverage ratio significantly below 2.0x for year-end 2025, well below its 2.5 – 3.0x target.

- For 2026, APi Group forecasts net revenues between $8,400 million and $8,600 million and adjusted EBITDA between $1,140 million and $1,200 million, implying a 13.8% adjusted EBITDA margin at the midpoint.

- APi Group anticipates 2025 net revenues and adjusted EBITDA to exceed the midpoint of prior guidance, with net revenues comfortably above $7,825 to $7,925 million and adjusted EBITDA above $1,015 to $1,045 million. The company also expects adjusted EBITDA margins above its 13% target and a net leverage ratio significantly below 2.0x for 2025.

- For 2026, APi Group projects net revenues between $8,400 to $8,600 million and adjusted EBITDA ranging from $1,140 to $1,200 million, implying a 13.8% adjusted EBITDA margin at the midpoint.

- Further details on 2025 performance and the 2026 outlook will be provided during the earnings call on February 25, 2026.

- APi Group Corporation completed its acquisition of CertaSite on February 2, 2026.

- CertaSite is an inspection-first provider of comprehensive fire and life safety services in the Midwest region.

- The acquisition is expected to be accretive to APi's "10/16/60+" shareholder value creation framework and complement its position as a premier provider of safety services.

- APi's President and CEO, Russ Becker, stated that the company begins 2026 with a strong balance sheet and a robust M&A pipeline.

- Aware Super has acquired a 31.3% stake in the European Outlet Mall Venture (EOMV) platform from Allianz accounts managed by PIMCO.

- The EOMV platform, valued at approximately €2.6bn, comprises four outlet centers across the Netherlands, Austria, and Italy, totaling 163,523 sqm of retail space and attracting roughly 24.6 million annual visits.

- This investment represents one of Aware Super's largest moves into European property, aiming for geographic diversification and a selective re-entry into retail, citing the outlet mall sector's defensive performance and resilience through economic cycles.

- Aware Super joins Dutch pension manager APG and a French institutional investor as partners in the EOMV platform.

- On December 31, 2025, APi Group Corporation's Board of Directors approved a stock dividend of 15,212,810 shares of common stock.

- This dividend was issued to holders of the 4,000,000 outstanding shares of Series A preferred stock.

- The dividend was triggered because the volume weighted average share price over the last ten trading days of 2025 was $38.8096, exceeding the previously established threshold.

- The common stock dividend was issued on January 2, 2026, resulting in approximately 431,128,083 shares of Common Stock outstanding.

- APi Group Corporation announced an agreement to acquire CertaSite, an inspection-first provider of fire and life safety services.

- The acquisition is expected to close in the first quarter of 2026, financed with cash on hand, and is anticipated to be accretive to APi's long-term financial targets.

- CertaSite is projected to deliver approximately $90 million in revenue for full-year 2025.

- APi updated its full-year 2025 financial guidance, expecting net revenues and adjusted EBITDA to be at or above the midpoint of the previously provided ranges of $7,875 million and $1,030 million, respectively.

- The company also expects its net leverage ratio to be below 2.0x by year-end 2025.

- APi Group has entered into an agreement to acquire CertaSite, an inspection-first provider of fire and life safety services, with the transaction expected to close in the first quarter of 2026.

- CertaSite is projected to deliver $90 million in revenue for full year 2025 and is anticipated to be accretive to APi's long-term financial targets.

- For 2025, APi expects its net revenues and adjusted EBITDA to be at or above the midpoint of its guidance, which is $7,875 million for net revenues and $1,030 million for adjusted EBITDA.

- The company also anticipates its net leverage ratio will be below 2.0x by year-end.

Fintool News

In-depth analysis and coverage of APi Group.

Quarterly earnings call transcripts for APi Group.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more