Corporate

Amphenol Chairman Martin Loeffler Retires After 52 Years: CEO Norwitt Named Successor

Feb 5

You're signed outSign in or to get full access.

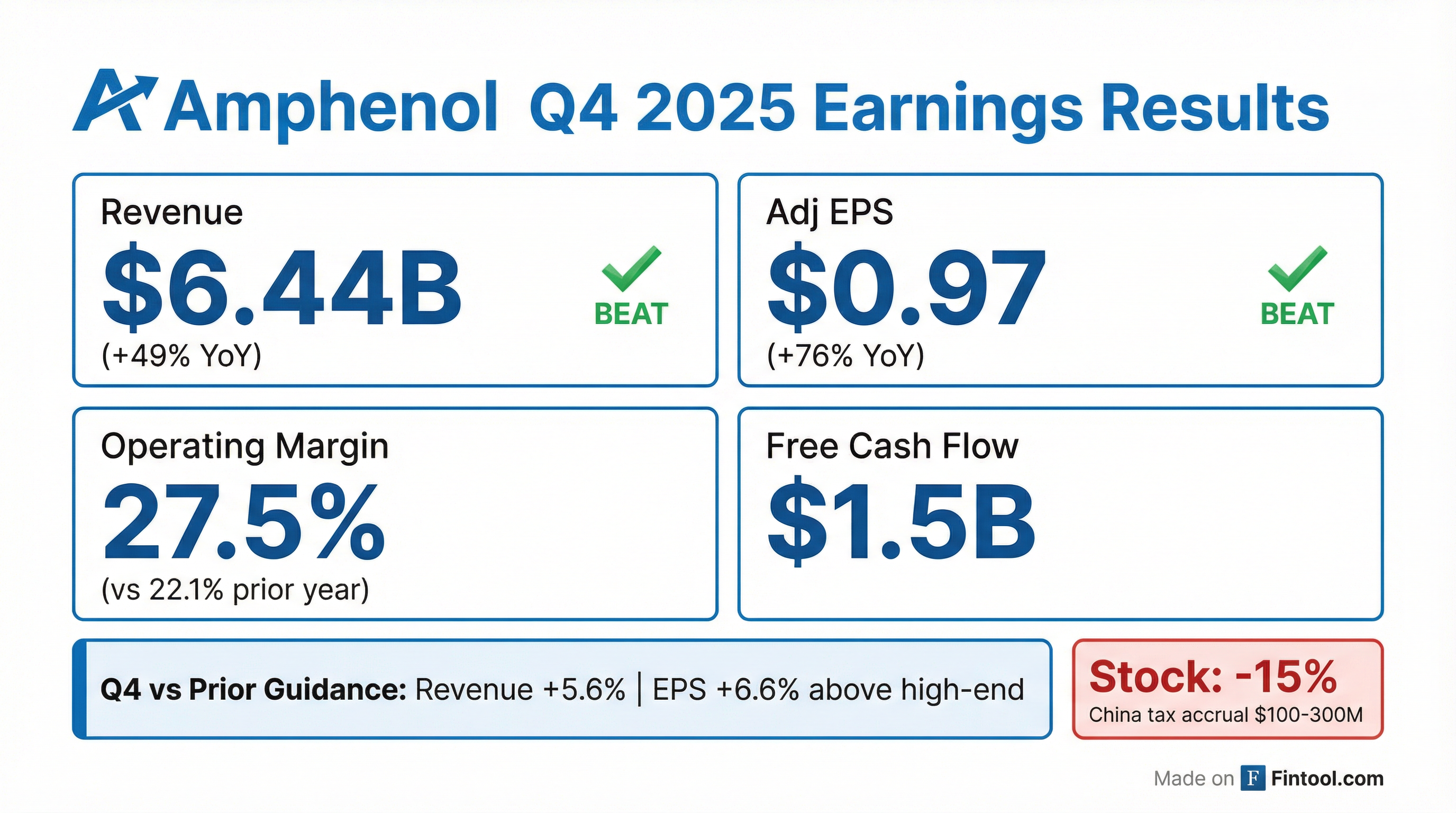

View earnings summary and analysis

View earnings summary and analysis

View earnings summary and analysis

View earnings summary and analysis

View earnings summary and analysis

Research analysts covering AMPHENOL CORP /DE/.