Earnings summaries and quarterly performance for AMPHENOL CORP /DE/.

Executive leadership at AMPHENOL CORP /DE/.

R. Adam Norwitt

President and Chief Executive Officer

Craig A. Lampo

Senior Vice President and Chief Financial Officer

David Silverman

Senior Vice President, Human Resources

Lance E. D’Amico

Senior Vice President, Secretary and General Counsel

Luc Walter

President, Harsh Environment Solutions Division

Michael R. Ivas

Principal Accounting Officer

Peter J. Straub

President, Interconnect and Sensor Systems Division

William J. Doherty

President, Communications Solutions Division

Board of directors at AMPHENOL CORP /DE/.

Research analysts who have asked questions during AMPHENOL CORP /DE/ earnings calls.

Amit Daryanani

Evercore

8 questions for APH

Andrew Buscaglia

BNP Paribas

8 questions for APH

Luke Junk

Robert W. Baird & Co.

8 questions for APH

Mark Delaney

The Goldman Sachs Group, Inc.

8 questions for APH

Scott Graham

Seaport Research Partners

8 questions for APH

Wamsi Mohan

Bank of America Merrill Lynch

8 questions for APH

Asiya Merchant

Citigroup Global Markets Inc.

7 questions for APH

Guy Hardwick

Freedom Capital Markets

7 questions for APH

William Stein

Truist Securities

7 questions for APH

Joseph Giordano

TD Cowen

6 questions for APH

Samik Chatterjee

JPMorgan Chase & Co.

6 questions for APH

Steven Fox

Fox Research

6 questions for APH

Joseph Spak

UBS Group AG

5 questions for APH

Saree Boroditsky

Jefferies

3 questions for APH

Asiya Merchant

Citigroup

2 questions for APH

Steve Fox

Fox Advisors

2 questions for APH

Joe Spak

UBS Group AG

1 question for APH

Michael

TD Cowen

1 question for APH

Recent press releases and 8-K filings for APH.

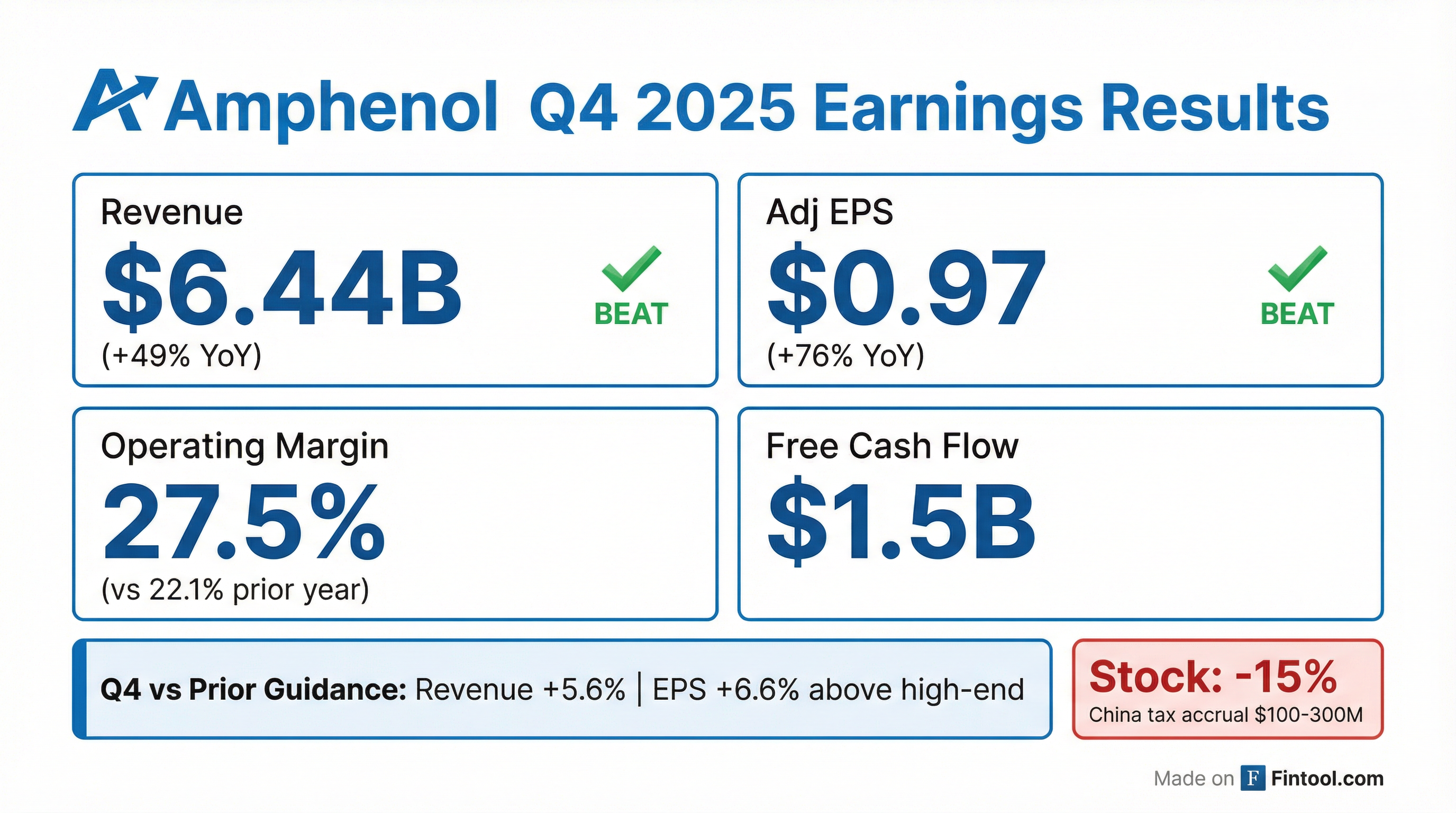

- Fourth quarter record sales of $6.439 billion, up 49% YoY in USD (37% organically); full year 2025 sales of $23.1 billion, up 52% USD (38% organically).

- Q4 GAAP operating margin 26.8% and adjusted 27.5%; GAAP diluted EPS $0.97 and adjusted EPS $0.93.

- Record Q4 orders of $8.431 billion, up 68% YoY and 38% sequentially, driven by AI-related data center demand; full year orders $25.4 billion, book-to-bill 1.1×.

- Q1 2026 guidance: sales $6.9–$7.0 billion (+43%–45% YoY) and adjusted EPS $0.91–$0.93, including $900 million sales and $0.02 EPS accretion from the CommScope acquisition.

- Completed Trexon and CCS acquisitions; expects CommScope to add $4.1 billion in 2026 sales and $0.15 to adjusted EPS.

- In Q4 2025, sales reached $6.439 billion, up 49% in USD (+48% local, +37% organically).

- The company booked a record $8.431 billion in orders, up 68% YoY and 38% sequentially.

- Q4 adjusted operating margin was 27.5%, a 510 bp increase YoY, driven by robust volume leveraging.

- Adjusted EPS was $0.97, up 76% from Q4 2024.

- Amphenol closed the CCS acquisition in January (pro forma net leverage ~1.8×) and guided Q1 2026 sales of $6.9 billion–$7.0 billion (+43–45% YoY) and EPS of $0.91–$0.93 (+44–48% YoY).

- Amphenol delivered record Q4 sales of $6.439 B, up 49% YoY, and FY2025 sales of $23.1 B, up 52% YoY.

- Q4 GAAP EPS was $0.97 and adjusted EPS was $0.93, up 58% and 76% YoY respectively; FY2025 record adjusted EPS reached $3.34, up 77%.

- Q4 orders hit a record $8.431 B, up 38% sequentially, driving an FY2025 book-to-bill of 1.1×; full-year orders rose 51% to $25.4 B.

- Segment performance: Communication Solutions sales of $3.4 B (+78% YoY) with 32.5% margin; Harsh Environment Solutions +31% YoY with 27.6% margin; Interconnect & Sensor Systems sales of $1.4 B (+21%) with 20.1% margin.

- Closed the $4 B+ CCS (CommScope) acquisition in January 2026, funded via bond proceeds and term loans; Q1 2026 guidance calls for $6.9 B–$7.0 B sales and $0.91–$0.93 EPS including $0.02 from CommScope.

- Reported record Q4 net sales of $6.4 B (up 49% YoY) and full-year net sales of $23.1 B (up 52% YoY); GAAP diluted EPS was $0.93 for Q4 (+58%) and $3.34 for FY (+74%), with adjusted EPS at $0.97 and $3.34, respectively.

- Generated operating cash flow of $1.7 B in Q4 and $5.4 B for 2025, with free cash flow of $1.5 B and $4.4 B, respectively.

- Completed the Trexon acquisition in November and closed the CommScope CCS business in January 2026; CCS is expected to add approximately $4.1 B in 2026 sales and $0.15 to 2026 adjusted EPS.

- Returned nearly $1.5 B to shareholders in 2025 through share repurchases ($171 M) and dividends ($202 M).

- Issued Q1 2026 guidance for sales of $6.90–$7.00 B (up 43–45%) and adjusted EPS of $0.91–$0.93 (up 44–48%), including $900 M in sales and $0.02 EPS accretion from the CCS business.

- Amphenol achieved record Q4 2025 sales of $6.4 billion (↑49% YoY) and GAAP diluted EPS of $0.93 (↑58%; Adjusted EPS $0.97, ↑76%).

- Full-year 2025 sales reached $23.1 billion (↑52% YoY; 38% organic), with GAAP and Adjusted diluted EPS of $3.34 (↑74% and ↑77%), operating margin of 25.4% GAAP (26.2% adjusted), operating cash flow of $5.4 billion, and free cash flow of $4.4 billion.

- Completed the Trexon acquisition in Q4, marking the fifth acquisition of 2025.

- Returned nearly $1.5 billion to shareholders via share repurchases and dividends.

- Amphenol, following its CCS Acquisition from Vistance Networks, launched a mandatory open offer under SEBI (SAST) Regulations to acquire up to 1,196,000 equity shares (26.00% of voting share capital) of ADC India Communications Limited.

- The offer price is INR 1,233.59 per share (≈US$13.68), with total cash consideration of INR 1,475,373,640 (≈US$16.36 million) assuming full acceptance.

- The Open Offer is unconditional on minimum acceptance and uses a conversion rate of US$ 1 = INR 90.2016 as of January 14, 2026.

- On January 9, 2026, Amphenol acquired CommScope’s Connectivity and Cable Solutions (CCS) business for approximately $10.5 billion in cash, subject to customary post-closing adjustments.

- The CCS unit is expected to generate $4.1 billion in full-year 2026 sales and be $0.15 accretive to Amphenol’s 2026 diluted EPS, excluding acquisition-related expenses.

- The acquisition adds significant fiber optic interconnect capabilities for IT/datacom and communications networks, as well as industrial interconnect products for building infrastructure.

- Approximately 20,000 CCS employees will join Amphenol, and the business will be integrated into its Communications Solutions segment.

- Amphenol Corp. finalized its purchase of CommScope’s Connectivity and Cable Solutions (CCS) business, integrating about 20,000 employees into the company.

- The acquisition expands Amphenol’s fiber-optic interconnect and industrial connectivity portfolio within its Communications Solutions segment.

- Amphenol projects $4.1 billion in full-year 2026 sales from the CCS business.

- The transaction is expected to be $0.15 accretive to Amphenol’s 2026 diluted EPS, excluding acquisition-related expenses.

- Amphenol priced $7.5 billion aggregate principal amount of senior notes across seven tranches: $500 million floating-rate due 2027; $750 million of 3.800% due 2027; $750 million of 3.900% due 2028; $1.0 billion of 4.125% due 2030; $1.25 billion of 4.400% due 2033; $1.6 billion of 4.625% due 2036; and $1.65 billion of 5.300% due 2055.

- The notes were issued under the indenture dated March 16, 2023 and registered pursuant to a Form S-3, with a final prospectus supplement filed October 27, 2025.

- Special counsel opined that, upon execution, authentication and delivery, the notes will constitute valid, binding obligations of the company.

- Amphenol Corp. (NYSE: APH) completed its acquisition of Trexon from Audax Private Equity for $1 billion in cash.

- Trexon is expected to be accretive to earnings in the first year post-closing and will be integrated into Amphenol’s Harsh Environment Solutions segment.

- CEO R. Adam Norwitt emphasized the enhanced technology solutions from combining Trexon’s high-reliability cable assembly products with Amphenol’s interconnect offerings.

Fintool News

In-depth analysis and coverage of AMPHENOL CORP /DE/.

Quarterly earnings call transcripts for AMPHENOL CORP /DE/.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more