ARES CAPITAL (ARCC)·Q4 2025 Earnings Summary

Ares Capital Posts Record Q4 Originations, Maintains $0.48 Dividend

February 4, 2026 · by Fintool AI Agent

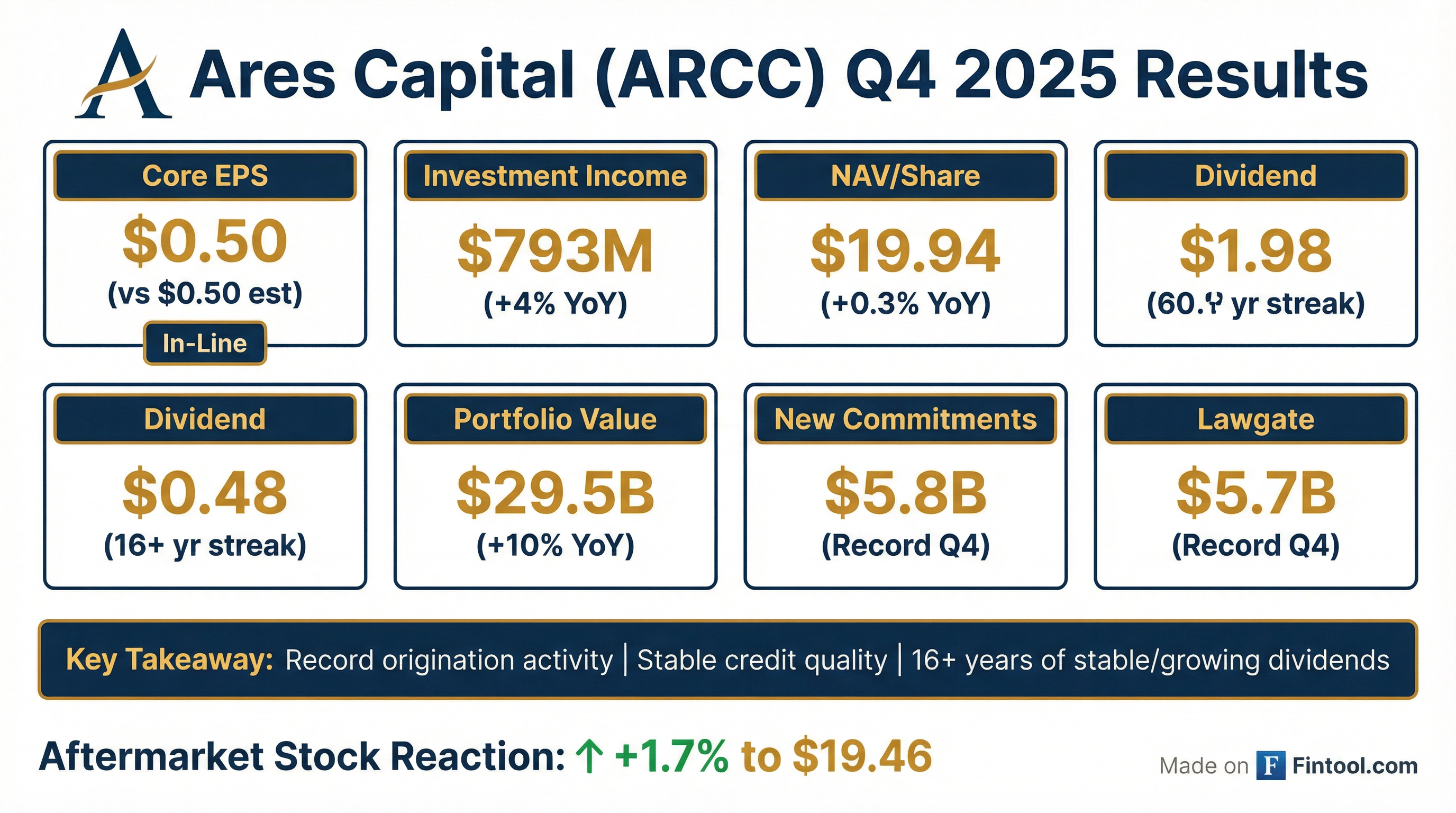

Ares Capital (NASDAQ: ARCC), the largest publicly traded business development company (BDC) by market capitalization, reported Q4 2025 results that showcased record origination activity and stable credit quality. Core EPS of $0.50 came in essentially in-line with consensus, while total investment income exceeded expectations by 2%. The company declared a Q1 2026 dividend of $0.48 per share, continuing its 16+ year streak of stable or growing quarterly dividends.

Did Ares Capital Beat Earnings?

Ares Capital's Q4 2025 results were mixed but solid:

The company reported GAAP net income of $293M ($0.41/share), which was lower than the $0.55/share reported in Q4 2024 primarily due to net realized losses of $155M in the quarter. However, Core EPS of $0.50 — which excludes realized and unrealized gains/losses — remained stable and covered the $0.48 quarterly dividend.

Full-Year 2025 Summary:

- GAAP Net Income: $1.86/share (vs. $2.44 in FY2024)

- Core EPS: $2.01 (vs. $2.33 in FY2024)

- Dividends Declared: $1.92/share (fully covered by Core EPS)

How Did the Stock React?

ARCC shares were trading at $19.46 in aftermarket trading, up approximately +1.7% from the regular session close of $19.13. The muted positive reaction reflects the solid operational performance offset by expected compression in net investment income as interest rates have declined from peak levels.

During Q4 2025, the stock traded in a range of $18.90 (low) to $21.03 (high), closing the quarter at $20.23. The current price represents a slight discount to NAV of $19.94 per share.

What Made This Quarter Stand Out?

Record Origination Activity: Ares Capital made $5.8B in new investment commitments during Q4 2025 — a record quarter — bringing full-year 2025 gross commitments to $15.8B, exceeding the prior year's $15.1B.

CEO Kort Schnabel highlighted the strong performance:

"2025 was another good year for our company. We generated strong financial results, supported by our stable credit quality and growing portfolio. Our core earnings per share of $0.50 for the fourth quarter and $2.01 for the full year, fully covered our dividends and drove an ROE in excess of 10% for both the fourth quarter and the full year."

Key Full-Year 2025 Achievements:

- Record $15.8B in gross originations (24% increase in opportunities reviewed vs prior year)

- Added 100+ new borrowers — a new company record

- Non-sponsored originations grew more than 50%

- Top 10 incumbent transactions: more than doubled share of overall financing

- Equity co-investments: 25%+ average IRR on exits, 3x average return on initial investment

Key Q4 2025 Operating Highlights:

Portfolio Composition (as of Dec 31, 2025):

The portfolio remains conservatively positioned with 72% in floating rate investments and 61% in first lien senior secured loans.

What's the Dividend Story?

Ares Capital declared a Q1 2026 dividend of $0.48 per share, payable March 31, 2026 to stockholders of record as of March 13, 2026.

CFO Scott Lem emphasized the dividend track record:

"As an illustration of our leading track record through different interest rate and credit cycles, through year-end 2025, we have now paid a stable or growing level of regular quarter dividends for over 16 consecutive years."

At the aftermarket price of $19.46, the $1.92 annual dividend represents a forward yield of approximately 9.9%.

Taxable Income Spillover: Ares Capital estimates it will carry forward excess taxable income of approximately $988M (or $1.03 per share) from 2025, available for distribution to stockholders in 2026. This represents more than 2 quarters of spillover income, providing additional dividend coverage flexibility.

How's the Credit Quality?

Credit quality remained stable despite the challenging rate environment:

Non-accruals at cost of 1.8% remain well below ARCC's 2.8% historical average since the global financial crisis, and significantly below the BDC industry historical average of 3.8% over the same period.

Portfolio Company Credit Statistics:

The modest uptick in non-accruals at fair value remains well within historical norms for the direct lending industry. The company exited $4.7B of investment commitments in Q4, with 89% being first lien senior secured loans.

What's the Balance Sheet Position?

Ares Capital ended the quarter with a strong liquidity position:

The leverage increase to 1.12x reflects the strong origination activity and remains comfortably within BDC regulatory limits.

Debt Maturity Schedule:

The weighted average stated interest rate on total debt is 4.86% with a weighted average remaining maturity of 4.18 years. Approximately 61% of debt is floating rate (at SOFR + spread) and 39% is fixed rate.

What Happened After the Quarter?

Recent Developments (January 1 - January 29, 2026):

New Investment Activity:

- Made approximately $1.4B in new investment commitments

- 90% in first lien senior secured loans, 5% in IHAM subordinated loan, 3% preferred equity, 2% other equity

- 94% floating rate, 2% fixed rate, 4% non-income producing

- Weighted average yield on new investments at amortized cost: 8.5% (debt: 9.0%)

Investment Exits:

- Exited approximately $709M of investment commitments

- 89% first lien, 9% second lien, 1% SDLP certificates, 1% other equity

- Weighted average yield on exits at amortized cost: 10.0% (debt: 10.1%)

- Realized net gains of ~$16M

Investment Backlog: $2.2B in approved deals as of January 29, 2026 — more than 17% greater than the $1.9B backlog reported at January 28, 2025 (89% first lien senior secured loans).

What Changed From Last Quarter?

The sequential stability in Core EPS and net investment income demonstrates earnings resilience despite the ~80bps compression in weighted average yields as floating rate loans repriced lower with Fed rate cuts.

What Did Management Say About Software and AI Risk?

The Q&A session was dominated by questions about AI disruption risk to ARCC's software lending book. CEO Kort Schnabel provided an extensive defense of their software portfolio positioning:

"We feel very good about our software book... The number one risk that we identified in the software space was technology risk and obsolescence risk. So we said to ourselves, if we're going to have a thesis in this space and build a book, we really wanna make sure that every single software company we put in the portfolio is highly resistant to technology risk."

Software Portfolio Characteristics:

ARCC's Software Investment Thesis:

-

Foundational Infrastructure Software — Target software that sits at center of tech stack, powers core business systems, and is "the last type of software a company would look to switch out"

-

Data Moats — Companies that collect and own proprietary data built over years of serving customers. "AI is not a database. AI doesn't house data. It can't replicate proprietary data."

-

Regulated End Markets — Healthcare, financial services, and other industries where "the need for accuracy and auditing of information is really high, and the penalties for lack of compliance can be severe."

-

Diversified Customer Bases — Avoiding binary outcomes by investing in software companies with diverse customers

Schnabel emphasized the structural protection of being a senior lender:

"We are lenders to these companies with maturity dates. We're sitting at the top of the capital structure. We have all the assets as collateral, including intellectual property. So there's lots of ways that we can look to recover our principal if things do start to get disrupted."

Areas of Caution: Management noted they are being disciplined on new transactions involving single-function software apps on the edges of the tech stack, and software that creates or delivers content, which AI excels at.

Q&A Highlights

On Dividend Sustainability Despite Rate Cuts:

"We believe ARCC is in a good position to maintain its dividend despite market expectations for further declines in short-term interest rates... We have more than 2 quarters of spillover income, which provides an additional cushion to help support dividend stability."

On Competitive Positioning:

"In contrast to managers that have concentrated their fundraising in retail-oriented products, we believe managers such as Ares, with both significant institutional and retail sources of capital, possess a more stable base of committed dry powder."

On Spread Outlook:

Regarding whether software market disruption could widen spreads:

"If there's very high-quality software companies that meet the standards I described earlier, I would venture a guess that the cost of capital for those companies probably has gone up a bit, and I think we might be excited to provide that type of financing to the very best of those companies."

On Share Repurchases:

"We have purchased shares back in the past. So it's not something that we're not unwilling to do. And it's always on the table and something that we're looking at and discussing with our board based on where the stock is trading."

On Retail Flow Dynamics:

"It's really in the last month or two, max, that we've seen those flows change... the money's not flying into those funds like it was before, but it's still remaining pretty stable... if it stays like that, I expect it to change things, and that could absolutely be a catalyst for spread widening."

What Should Investors Watch?

Forward Catalysts:

- Q1 2026 Earnings Call — Scheduled for late April/early May 2026

- Fed Rate Path — ARCC's floating rate portfolio (72% of assets) will see continued yield compression if rates fall further

- Credit Cycle — Non-accruals have been stable but warrant monitoring in a potential recession

- Origination Pace — The $2.2B investment backlog suggests continued strong deal flow

Key Risks:

- Q1 2026 Rate Timing: CFO noted the Q4 rate decline will create ~$0.01/share earnings headwind in Q1 2026 due to contractual rate reset timing

- Retail Flow Dynamics: Non-traded BDC flows have slowed in the past 1-2 months, though ARCC's diversified capital base (institutional + retail) provides insulation

- Potential credit deterioration in middle-market borrowers

- Spread compression in a competitive direct lending market

Ares Capital hosted its Q4 2025 earnings conference call on February 4, 2026. An archived replay is available on the Investor Resources section of their website through March 4, 2026.

Related Links: