Earnings summaries and quarterly performance for ARES CAPITAL.

Executive leadership at ARES CAPITAL.

Kort Schnabel

Chief Executive Officer

Jana Markowicz

Chief Operating Officer

Jim Miller

President

Joshua Bloomstein

General Counsel, Vice President and Secretary

Kipp deVeer

Executive Vice President

Lisa Morgan

Chief Compliance Officer

Michael Arougheti

Executive Vice President

Paul Cho

Chief Accounting Officer

Scott C. Lem

Chief Financial Officer and Treasurer

Board of directors at ARES CAPITAL.

Ann Torre Bates

Director

Daniel G. Kelly, Jr.

Director

Eric B. Siegel

Lead Independent Director

Mary Beth Henson

Director

Michael K. Parks

Director

Michael L. Smith

Co-Chairperson of the Board

Mitchell Goldstein

Co-Chairperson of the Board

Steven B. McKeever

Director

Research analysts who have asked questions during ARES CAPITAL earnings calls.

Casey Alexander

Compass Point Research & Trading, LLC

8 questions for ARCC

Kenneth Lee

RBC Capital Markets

8 questions for ARCC

Robert Dodd

Raymond James

8 questions for ARCC

Finian O'Shea

Wells Fargo Securities

7 questions for ARCC

Melissa Wedel

JPMorgan Chase & Co.

6 questions for ARCC

Paul Johnson

Keefe, Bruyette & Woods

6 questions for ARCC

Arren Cyganovich

Truist

5 questions for ARCC

Brian McKenna

Citizens JMP Securities

5 questions for ARCC

John Hecht

Jefferies

5 questions for ARCC

Doug Harter

UBS Group AG

4 questions for ARCC

Sean-Paul Adams

Not Provided in Transcript

4 questions for ARCC

Derek Hewett

Bank of America

3 questions for ARCC

Douglas Harter

UBS

3 questions for ARCC

Mark Hughes

Truist Securities

3 questions for ARCC

Ethan Kaye

Lucid Capital Markets

1 question for ARCC

Finian O'Shea

Wells Fargo

1 question for ARCC

Recent press releases and 8-K filings for ARCC.

- On February 25, 2026, Ares Capital Corporation's wholly owned subsidiary, Ares Capital JB Funding LLC, entered into Amendment No. 13 to its Loan and Servicing Agreement, also known as the SMBC Funding Facility.

- The amendment increased commitments under the SMBC Funding Facility from $1.1 billion to $1.6 billion.

- The interest rate charged on the facility was adjusted downwards, with the applicable spread over SOFR decreasing from 1.80% to 1.75% and over a "base rate" from 0.80% to 0.75%.

- The "accordion" feature, which allows for an increase in the overall size of the facility, was raised from a maximum of $1.3 billion to $2.5 billion.

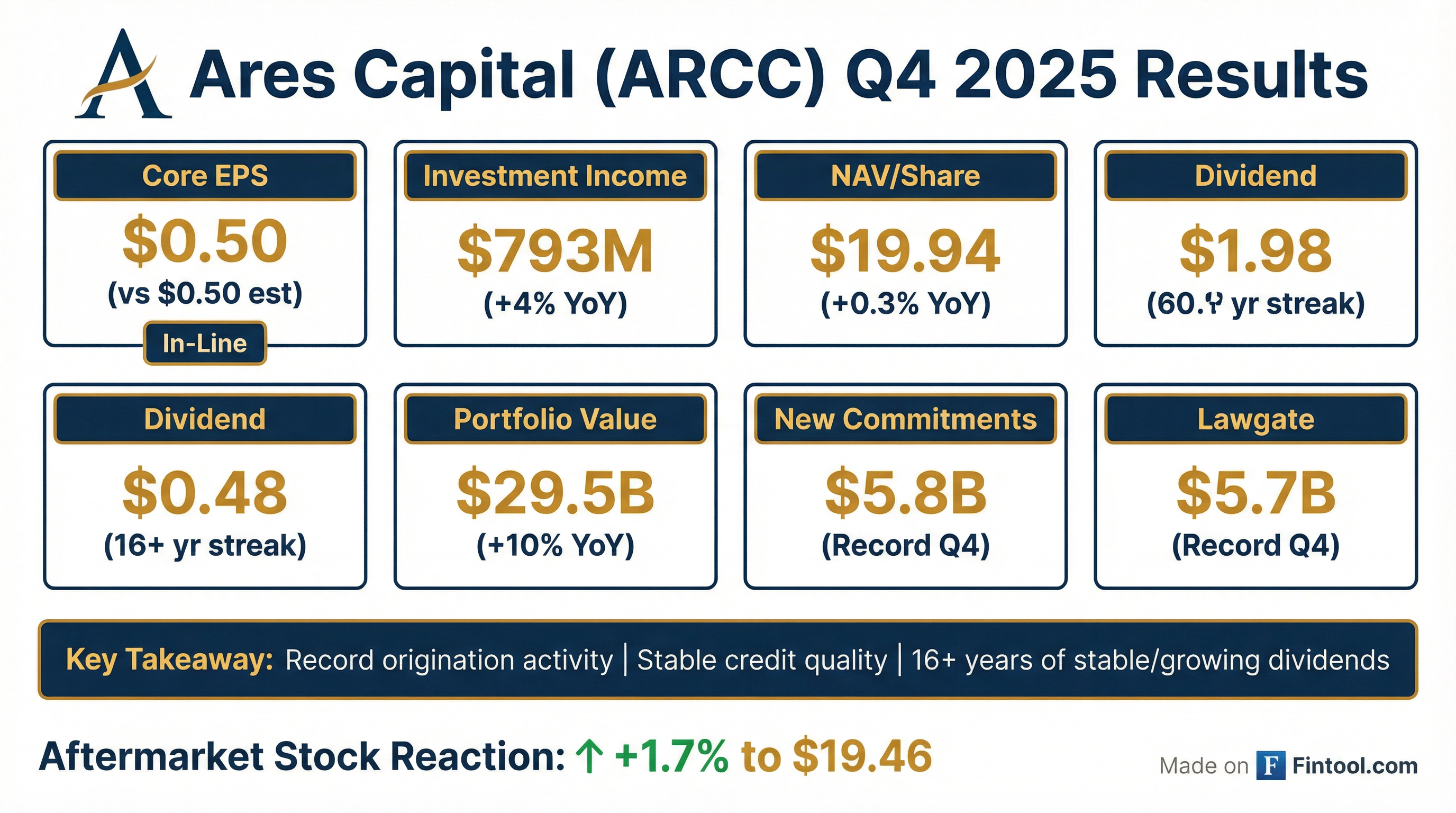

- Ares Capital Corporation (ARCC) reported core earnings per share of $0.50 for Q4 2025 and $2.01 for the full year 2025, fully covering its dividends, and announced a Q1 2026 dividend of $0.48 per share. The company also has $988 million, or $1.03 per share, in spillover income available for distribution to stockholders in 2026.

- ARCC achieved record gross originations of $15.8 billion in 2025 and $5.8 billion in Q4 2025, leading to a total portfolio at fair value of $29.5 billion at year-end 2025. The company added over 100 new borrowers during the year.

- The portfolio demonstrated robust credit quality with weighted average organic EBITDA growth of borrowers more than three times GDP in 2025, an improved average interest coverage ratio of 2.2 times, and stable non-accruals. The balance sheet remains strong with a debt-to-equity ratio of 1.08 times at Q4 2025, well below the target of 1.25 times, and over $6 billion in liquidity.

- For Q4 2025, Ares Capital reported Core EPS of $0.50 and GAAP Net Income Per Share of $0.41. Full-year 2025 figures were Core EPS of $2.01 and GAAP Net Income Per Share of $1.86.

- The company declared a regular dividend of $0.48 per share for Q4 2025. Ares Capital also anticipates carrying forward approximately $988 million or $1.38 per share in excess taxable income from 2025 for distribution to stockholders in 2026. Net Asset Value Per Share was $19.94 as of December 31, 2025.

- As of December 31, 2025, the portfolio was valued at $29.5 billion, comprising 603 portfolio companies. First Lien Senior Secured Loans represented the largest asset class at 61%.

- Key credit statistics for Q4 2025 showed a Portfolio Weighted Average Net Leverage Multiple of 5.6x and a Weighted Average Interest Coverage Ratio of 2.0x. The portfolio maintained strong credit quality with 79% by fair value graded as Grade 1.

- Ares Capital Corporation (ARCC) reported core earnings per share of $0.50 for Q4 2025 and $2.01 for the full year 2025, fully covering dividends and driving an ROE in excess of 10% for both periods.

- The company achieved record gross originations of $15.8 billion in new commitments during 2025 and added more than 100 new borrowers to its portfolio, which reached a record $29.5 billion at fair value by year-end.

- ARCC's portfolio quality remains strong, with non-accruals at cost ending 2025 in line with prior periods, an improved average interest coverage ratio of 2.2 times, and average portfolio leverage decreasing by approximately a quarter turn of EBITDA from the prior year.

- The company recorded record new gross debt commitments of $4.5 billion in 2025, including $2.4 billion in unsecured notes, and maintains a strong liquidity position of over $6 billion.

- ARCC's software portfolio strategy focuses on foundational infrastructure software, companies with proprietary data, and those serving regulated end markets to be highly resistant to technology and obsolescence risks, including AI disruption.

- ARCC reported Q4 2025 core earnings per share of $0.50 and full-year 2025 core earnings per share of $2.01, both fully covering dividends and contributing to an ROE exceeding 10% for the quarter and year. The company maintains a strong dividend outlook, supported by over 2 quarters of spillover income.

- The company achieved record new investment commitments of $15.8 billion for the full year 2025, including $5.8 billion in Q4 2025, which was up 50% from Q4 2024. This led to a record total portfolio at fair value of $29.5 billion by year-end 2025, diversified across 603 borrowers.

- Credit quality remained stable, with non-accruals at cost at 1.8% and at fair value at 1.2% at the end of Q4 2025. ARCC also set a new record for gross debt commitments in 2025 at $4.5 billion and expanded credit facilities by $1.4 billion.

- ARCC's software portfolio, its largest industry category, is positioned for resilience against AI-related disruption, characterized by investments in foundational infrastructure software, companies with proprietary data, and those serving regulated markets, with an average EBITDA of $350 million and an average loan-to-value of 37%.

- Ares Capital Corporation reported Q4 2025 GAAP net income per share of $0.41 and Core EPS of $0.50, with full-year 2025 GAAP net income per share at $1.86 and Core EPS at $2.01. The company declared a first quarter 2026 dividend of $0.48 per share.

- As of December 31, 2025, portfolio investments at fair value reached $29,485 million, driven by Q4 2025 gross commitments of $5,825 million. Loans on non-accrual status represented 1.8% of total investments at amortized cost.

- The company's balance sheet as of December 31, 2025, showed total assets of $31,235 million, stockholders' equity of $14,318 million, and a net asset value per share of $19.94. The debt/equity ratio stood at 1.12x.

- In January 2026, Ares Capital issued $750 million in unsecured notes and repaid $1,150 million in unsecured notes. The share repurchase program was extended to February 15, 2027, authorizing repurchases of up to $1.0 billion.

- Ares Capital Corporation issued $750,000,000 aggregate principal amount of 5.250% Notes due 2031.

- The Notes will mature on April 12, 2031, and bear interest at a rate of 5.250% per year, payable semiannually on April 12 and October 12, commencing April 12, 2026.

- The net proceeds from this offering are expected to be used to repay certain outstanding indebtedness under its credit facilities, with the Company retaining the option to reborrow for general corporate purposes, including investing in portfolio companies.

- In connection with the issuance, the Company entered into an interest rate swap for a notional amount of $750,000,000 to convert the fixed interest rate of 5.250% to a floating rate based on one-month SOFR + 1.7217%, maturing on April 12, 2031.

- Ares Capital Corporation (Nasdaq: ARCC) announced it has priced an underwritten public offering of $750 million in aggregate principal amount of notes.

- The notes are 5.250% unsecured notes due 2031.

- The notes will mature on April 12, 2031, and may be redeemed in whole or in part at Ares Capital’s option at any time at par plus a “make-whole” premium, if applicable.

- Ares Capital Corporation (ARCC) has priced an underwritten public offering of $750 million in aggregate principal amount of 5.250% unsecured notes due 2031.

- The notes will mature on April 12, 2031, and the offering is expected to close on January 12, 2026.

- Ares Capital plans to use the net proceeds from this offering to repay certain outstanding indebtedness under its debt facilities.

- ARES CAPITAL CORPORATION (ARCC) filed an 8-K on December 9, 2025, outlining detailed definitions and criteria related to its investment activities and debt instruments.

- The document specifies "Eligibility Criteria" and "Portfolio Criteria" for investments, including a minimum of 96% for Senior Secured Loans and Eligible Investments, and a maximum of 4% for Second Lien Loans (including First-Lien Last-Out Loans).

- Investment limits include a maximum of 5% for Fixed Rate Underlying Assets and a maximum of 17.5% for Underlying Assets with a Standard & Poor's Rating or Fitch Rating at or below "CCC+".

- The company defines "ESG Prohibited Obligation" to exclude investments in obligors whose principal business is derived from activities such as controversial weapons, thermal coal, oil from oil sands, tobacco, pornography, child labor, and human trafficking.

- A "Weighted Average Life Test" is detailed, requiring the Weighted Average Life to be no higher than specified levels, starting at 8.00 for the Closing Date and decreasing to 0.00 by January 2034 and thereafter.

Quarterly earnings call transcripts for ARES CAPITAL.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more