Earnings summaries and quarterly performance for ALEXANDRIA REAL ESTATE EQUITIES.

Executive leadership at ALEXANDRIA REAL ESTATE EQUITIES.

Peter M. Moglia

Chief Executive Officer and Chief Investment Officer

Andres R. Gavinet

Chief Accounting Officer

Daniel J. Ryan

Co-President and Regional Market Director – San Diego

Gary D. Dean

Executive Vice President – Real Estate Legal Affairs

Hunter L. Kass

Co-President and Regional Market Director – Greater Boston

Jackie B. Clem

General Counsel and Secretary

Joel S. Marcus

Executive Chairman and Founder

John Hart Cole

Executive Vice President – Capital Markets/Strategic Operations and Co-Regional Market Director – Seattle

Joseph Hakman

Co-Chief Operating Officer and Chief Strategic Transactions Officer

Kristina A. Fukuzaki-Carlson

Executive Vice President – Business Operations

Lawrence J. Diamond

Co-Chief Operating Officer and Regional Market Director – Maryland

Madeleine T. Alsbrook

Executive Vice President – Talent Management

Marc E. Binda

Chief Financial Officer and Treasurer

Orraparn C. Lee

Executive Vice President – Accounting

Board of directors at ALEXANDRIA REAL ESTATE EQUITIES.

Research analysts who have asked questions during ALEXANDRIA REAL ESTATE EQUITIES earnings calls.

Michael Carroll

RBC Capital Markets

7 questions for ARE

Vikram Malhotra

Mizuho Financial Group, Inc.

7 questions for ARE

Dylan Burzinski

Green Street Advisors, LLC

6 questions for ARE

Farrell Granath

Bank of America

6 questions for ARE

James Kammert

Evercore ISI

6 questions for ARE

Anthony Paolone

JPMorgan Chase & Co.

5 questions for ARE

Richard Anderson

Wedbush Securities

5 questions for ARE

John Kim

BMO Capital Markets

4 questions for ARE

Nick Joseph

Citigroup Inc.

4 questions for ARE

Omotayo Okusanya

Deutsche Bank AG

4 questions for ARE

Peter Abramowitz

Jefferies

3 questions for ARE

Wesley Golladay

Robert W. Baird & Co.

3 questions for ARE

Jamie Feldman

Wells Fargo & Company

2 questions for ARE

Jim Kammert

Evercore

2 questions for ARE

Mason P. Guell

Baird

2 questions for ARE

Nicholas Joseph

Citigroup

2 questions for ARE

Ray Zhong

JPMorgan Chase & Co.

2 questions for ARE

Rich Anderson

Cantor Fitzgerald

2 questions for ARE

Ronald Kamdem

Morgan Stanley

2 questions for ARE

Tayo Okusanya

M Science

2 questions for ARE

Georgi Dinkov

Mizuho

1 question for ARE

James Feldman

Wells Fargo

1 question for ARE

Joshua Dennerlein

BofA Securities

1 question for ARE

Michael Griffin

Citigroup Inc.

1 question for ARE

Nick

Virtue Capital

1 question for ARE

Thomas Catherwood

BTIG

1 question for ARE

William Catherwood

BTIG

1 question for ARE

Recent press releases and 8-K filings for ARE.

- On February 25, 2026, Alexandria Real Estate Equities, Inc. completed a registered public offering of $750 million aggregate principal amount of 5.25% Senior Notes due 2036 under an indenture dated February 13, 2025, as supplemented on the same date by Supplemental Indenture No. 2.

- The Notes bear interest at 5.25% per annum, payable semi-annually on March 15 and September 15 (first payment September 15, 2026), and mature on March 15, 2036; they are unsecured senior obligations, fully and unconditionally guaranteed on a senior basis by Alexandria Real Estate Equities, L.P., and rank equally with the Company’s existing and future unsecured senior debt.

- The Company may redeem the Notes at any time before December 15, 2035 at a redemption price equal to par plus accrued interest and a make-whole amount, and thereafter at par plus accrued interest; the indenture also includes customary covenants limiting mergers, asset sales and incurrence of additional debt, and standard events of default.

- On February 10, 2026, Alexandria Real Estate Equities, Inc. and its subsidiary entered into an underwriting agreement for $750 million of 5.25% Senior Notes due 2036, fully guaranteed by Alexandria Real Estate Equities, L.P.

- The notes were priced at 99.679% of par with a 5.291% yield to maturity, and are expected to close on or about February 25, 2026, subject to customary conditions

- Net proceeds will be used to repay commercial paper borrowings incurred to repurchase or redeem $952,202,784.40 of outstanding senior unsecured notes under a previously announced tender offer

- The offering is made under an effective Form S-3 shelf registration, and the notes will be unsecured obligations of the company

- Alexandria priced a $750 million offering of 5.25% senior notes due 2036 at 99.679% of par, yielding 5.291% to maturity.

- The unsecured notes, fully guaranteed by an indirect 100% owned subsidiary, are expected to close on or about February 25, 2026.

- Net proceeds will repay part of the commercial paper used to repurchase approximately $952.2 million of outstanding senior notes and may be invested short-term or used for general corporate purposes pending deployment.

- Alexandria Real Estate Equities launched cash tender offers to purchase up to $952.2 million aggregate principal of its 3.000% Senior Notes due 2051, 3.550% Senior Notes due 2052 and 4.000% Senior Notes due 2050.

- Each offer includes a $50 early tender premium per $1,000 of notes, resulting in total considerations of $656.22, $726.53 and $790.86 per $1,000 for the 2051, 2052 and 2050 Notes, respectively.

- Alexandria received tenders equal to the maximum—$497.602 million of 2051 Notes, $524.594 million of 2052 Notes and $309.199 million of 2050 Notes—which it expects to accept and settle on February 12, 2026.

- Alexandria Real Estate Equities is commencing an underwritten public offering of senior notes, which will be unsecured obligations of the Company and fully guaranteed by its indirectly 100% owned subsidiary.

- The offering is being led by Citigroup, BofA Securities, J.P. Morgan, Scotia Capital and TD Securities as joint book-running managers.

- Net proceeds are intended to repay commercial paper borrowings incurred in connection with a cash tender offer for certain outstanding senior unsecured notes; pending such use, proceeds may be invested in high-quality short-term securities or used for general corporate purposes.

- The issuance is not conditioned on the completion of the tender offer or any specific amount of notes tendered.

- Alexandria Real Estate Equities increased its aggregate maximum tender amount to accept all valid tenders for its 3.000% Senior Notes due 2051, 3.550% Senior Notes due 2052, and 4.000% Senior Notes due 2050.

- As of the Feb. 9, 2026 Early Tender Date, the company received tenders totaling $497.602 million (2051 Notes), $524.594 million (2052 Notes) and $309.199 million (2050 Notes).

- With tenders equaling the maximum amount, Alexandria does not expect to accept late tenders and will return any received after the early date; the Total Consideration will be set on Feb. 10, 2026.

- Alexandria Real Estate Equities launched cash tender offers to repurchase up to $800 million aggregate principal of its 3.000% Senior Notes due 2051, 3.550% Senior Notes due 2052 and 4.000% Senior Notes due 2050, with acceptance priority levels determining purchase order.

- Holders tendering by the 5:00 p.m. ET February 9, 2026 early date receive a $50 early tender premium per $1,000 plus accrued interest and a fixed spread of 75–80 bps over the reference U.S. Treasury; those tendering by the 5:00 p.m. ET February 25, 2026 expiration date receive the same less the early premium.

- Settlement is expected on February 12, 2026 for early tenders and February 27, 2026 for later tenders, and the offers are conditioned on the company raising at least $500 million in other financing transactions.

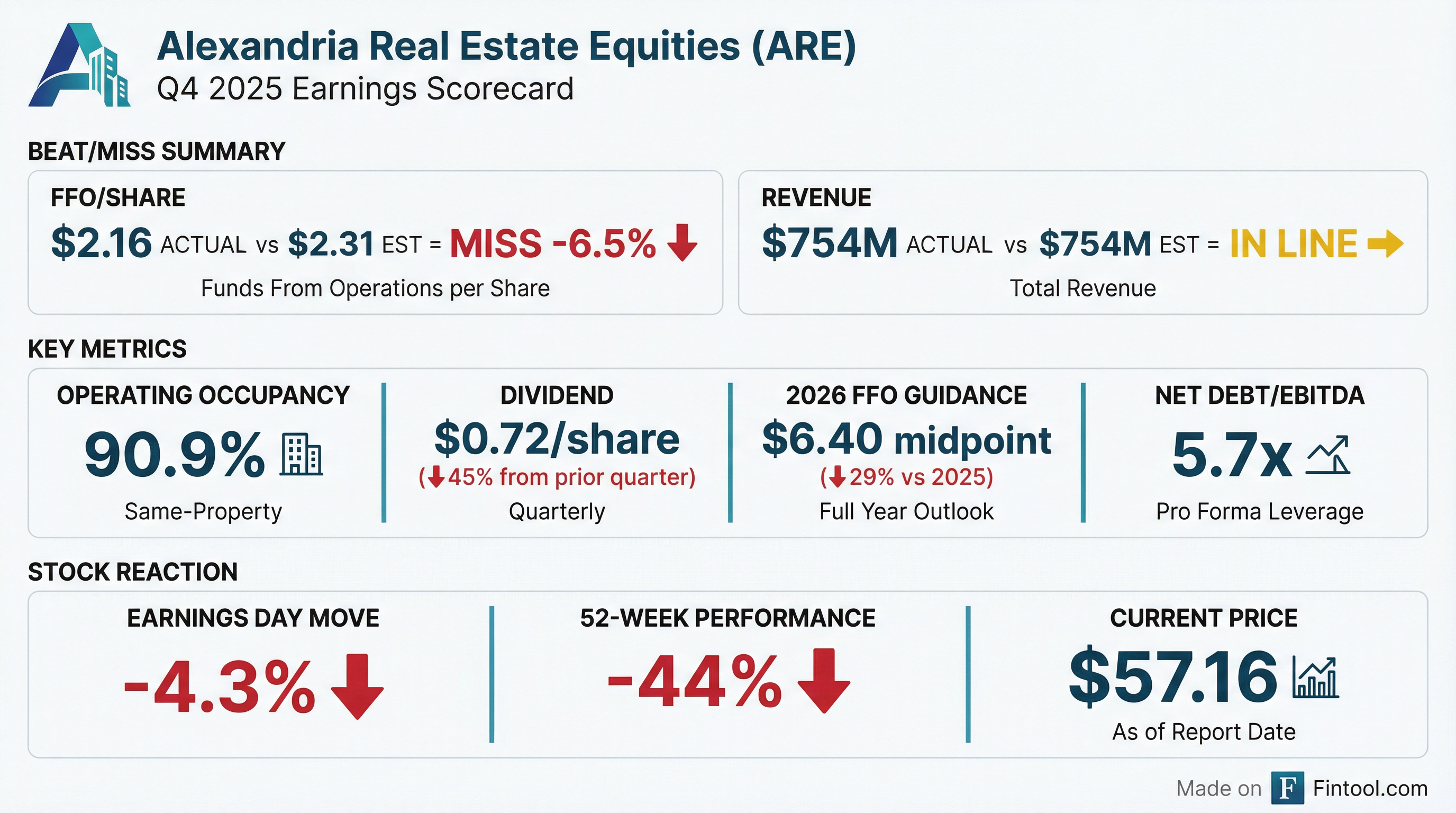

- FFO per share (diluted, as adjusted) of $2.16 in Q4 and $9.01 for FY 2025, meeting prior guidance midpoints.

- Completed $1.5 billion of dispositions across 26 transactions and 1.2 million sq ft of leasing in Q4—the highest quarterly leasing volume in the past year—and ended 2025 with 90.9% occupancy, up 30 bps QoQ.

- Signed 900,000 sq ft of leases (~2.5% of portfolio) set to commence in Q3 2026, generating $52 million of annual rent; 78% of annual rental revenue from Mega Campuses, which outperform market occupancy by 19%.

- 2026 outlook includes an expected occupancy dip in Q1 followed by recovery in H2, with year-end occupancy guidance of 87.7%–89.3% and same-property NOI projected to decline 8.5% at midpoint.

- Strategic plan calls for $2.9 billion of dispositions (65%–75% non-core assets and land), $250 million of capitalized interest (down 24%), and partial reversal of 2025 G&A savings.

- Alexandria Real Estate Equities reported FFO per share diluted as adjusted of $2.16 for Q4 and $9.01 for FY2025, meeting the midpoint of prior guidance.

- The company completed $1.5 billion of dispositions across 26 transactions and achieved 1.2 million sq ft of leasing volume, driving year-end occupancy to 90.9%.

- Management reaffirmed 2026 guidance for year-end occupancy of 87.7%–89.3% and same-property NOI expected down 8.5% at midpoint, with an anticipated occupancy dip in Q1 and recovery in H2.

- The board authorized a $500 million reload of the common share repurchase program, though no buybacks are assumed in 2026 guidance.

- Completed $1.5 billion of dispositions across 26 transactions and leased 1.2 million sq ft in Q4, driving FFO per share of $2.16 for 4Q25 and $9.01 for the full year (midpoint of guidance).

- Portfolio occupancy rose to 90.9% at year-end, up 30 bps quarter-over-quarter; nearly 900,000 sq ft of leases signed to commence in Q3 2026, adding $52 million in annualized revenue; year-end 2026 occupancy forecast: 87.7%–89.3%.

- Same-property net operating income declined 6.0% (1.7% on a cash basis) in Q4 and 3.5% (0.9% cash) for 2025; reaffirmed 2026 same-property NOI guidance of down 8.5% at midpoint.

- Maintained $5.3 billion of liquidity with net debt to annualized EBITDA at 5.7x and 12-year average debt maturity; non-income-producing assets reduced from 20% to 17% of gross assets in 2025, with further decline expected.

- Recognized $1.45 billion of impairments (90% previously announced) on non-core land and development projects; sold Gateway campus and to divest 88 Bluxome Street in coming quarters; board authorized a $500 million share repurchase program (not assumed in 2026 guidance).

Quarterly earnings call transcripts for ALEXANDRIA REAL ESTATE EQUITIES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more