ALEXANDRIA REAL ESTATE EQUITIES (ARE)·Q4 2025 Earnings Summary

Alexandria Slashes Dividend 45% as Life Science REIT Faces Fifth Year of Biotech Bear Market

January 27, 2026 · by Fintool AI Agent

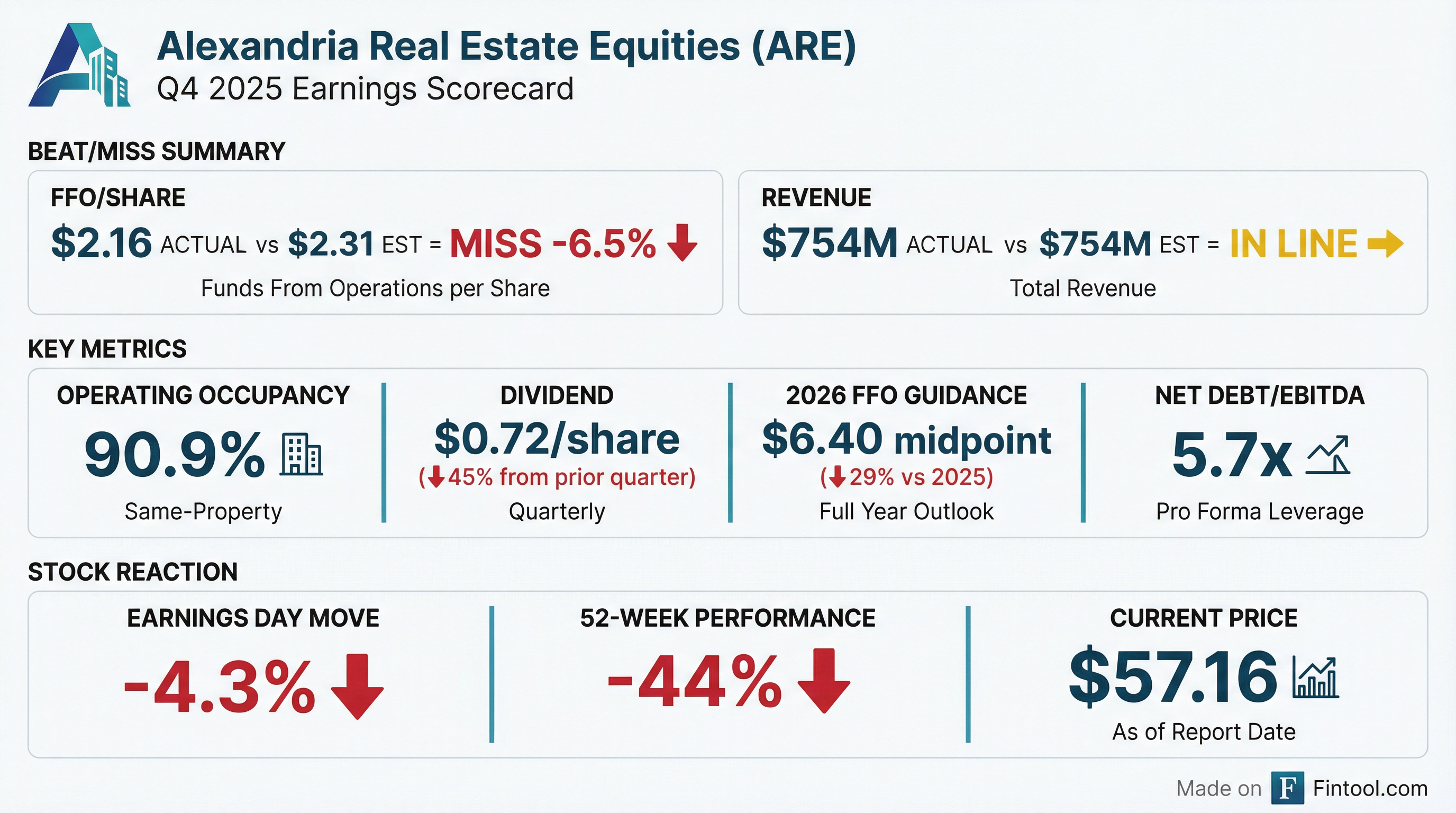

Alexandria Real Estate Equities (NYSE: ARE) reported Q4 2025 results that underscored the prolonged stress in life science real estate markets, but delivered a critical update on the earnings call: management sees a 2-3 year recovery timeline for core markets, not the 4-5 years some investors feared .

The company posted FFO per share of $2.16, at the midpoint of prior guidance, while reiterating the 45% dividend cut and 2026 FFO guidance of $6.25-$6.55 announced at December's investor day .

Shares initially fell 3.9% on results day but recovered 2.4% the following session as investors digested the Q&A commentary, leaving ARE up ~20% year-to-date .

Did Alexandria Beat Earnings?

FFO per share: At guidance midpoint. Alexandria reported FFO per share as adjusted of $2.16, hitting the midpoint of prior company guidance. Management noted full-year 2025 FFO of $9.01 "represents the midpoint of our prior guidance" .

Revenue: In line. Total revenues of $754.4 million were essentially flat versus consensus .

Net loss: $(6.35) per share. The GAAP loss reflects $1.45 billion in Alexandria's share of real estate impairments during Q4 2025, with approximately 90% previously announced in the December 3rd 8-K .

Impairment context: 50%-60% of Q4 impairments related to land, with the two largest comprising 37% of total — 88 Bluxome Street (SoMa, San Francisco) and Gateway campus (South San Francisco JV) .

Why Did Alexandria Cut the Dividend?

The headline-grabbing move: Alexandria slashed its quarterly dividend from $1.32 to $0.72 per share — a 45% reduction .

Management framed this as a proactive measure to:

- Preserve $410 million annually for balance sheet flexibility

- Support the 2026 capital plan amid reduced cash flow

- Maintain leverage targets (5.6x-6.2x net debt/EBITDA)

The decision reflects the severity of the operating environment. Even at the reduced payout, the dividend yield sits at 5.9% and the payout ratio dropped to 33% of FFO — providing a meaningful cushion .

Key Context: This is the first dividend reduction in Alexandria's history as a public company. The move signals management's concern about the duration of the current downturn.

What Did Management Guide?

2026 FFO guidance: $6.25 to $6.55 per share (midpoint $6.40), representing a 29% decline from 2025's $9.01 .

The guidance incorporates several headwinds:

Occupancy guidance: 87.7% to 89.3% by year-end 2026 — down from 90.9% currently .

Same-property NOI: Expected to decline 7.5% to 9.5% in 2026 .

What Changed From Last Quarter?

Several factors deteriorated since Q3 2025:

1. Accelerated Dispositions

Alexandria completed $1.47 billion of dispositions in Q4 2025 alone — the highest quarterly total in company history . Key sales included:

- 409/499 Illinois Street (Mission Bay): Sold to UCSF for $767M at 40% occupancy

- Gateway Boulevard portfolio (South San Francisco): Exited 1.1M RSF JV for $600M

- ARE Nautilus (San Diego): Sold non-core campus for $192M at 76% occupancy

2. Massive Impairment Charges

The $1.72 billion Q4 impairment brings full-year 2025 impairments to $2.2 billion — nearly 10x the $223 million recorded in 2024 .

3. Early Lease Termination

A 170,618 RSF lease at 259 East Grand Avenue in South San Francisco was terminated early (originally expiring early 2027). While the space is re-leased, occupancy won't commence until 2H26 .

4. Dividend Reset

The 45% dividend cut was not telegraphed in Q3, representing a significant shift in capital allocation strategy.

How Did the Stock React?

Initial reaction (Jan 26): -3.9% (from $59.69 to $57.16)

Next-day recovery (Jan 27): +2.4% (to $58.53)

The stock showed resilience following the initial selloff, suggesting the market viewed the guidance reiteration from December's investor day as largely priced in . The earnings call tone, emphasizing disciplined execution and "North Star" focus on the 2026 plan, may have provided reassurance .

As management noted on the call, the stock is up approximately 20% year-to-date, which CEO Joel Marcus attributed to a combination of value-driven investors recognizing quality assets generating quality cash flows and interest in the life science industry's long-term potential .

Q&A Highlights: What Analysts Asked

The earnings call Q&A revealed several important insights not covered in the press release:

Market Recovery Timeline

Peter Moglia provided critical context on recovery expectations :

"2-3 years for our core markets, maybe even less depending on trends. 4-5 years for tertiary areas that really didn't ever need to be lab markets."

Specifically:

- Cambridge, Watertown, Seaport (Greater Boston core): 2-3 year recovery

- Somerville, Alewife (Greater Boston tertiary): 4-5 years

- Resolution path for tertiary: "Not going to get resolved through lab demand. It's going to get resolved by changing use"

Public Biotech: The Missing Piece

Management repeatedly emphasized that public biotech companies — historically the "mainstay of this industry" — are notably absent from the leasing pipeline :

- Q4 leasing pie chart showed "a notable, very small amount of leasing for public biotech"

- Why it matters: Public biotech typically drives 50,000-150,000 RSF lease requirements — the middle of the demand barbell

- The blocker: Lack of available secondary offerings and no "real, robust, open IPO market"

- XBI disconnect: While XBI outperformed in 2025, gains were driven by commercial/near-commercial stage companies "which don't typically drive lab space needs"

Free Rent: The Primary Leasing Tool

Peter Moglia was candid about market dynamics :

"Free rent is the tool that we're using... As long as we continue to have availability in the mid-20s to low-30s in the major markets, free rent is going to be the tool that people need to use in order to execute on deals."

Key points:

- TIs stable for renewals/releases (space already built out)

- TIs elevated for shell space (full build-out or spec build required)

- Rental rates stable, which preserves value — "When you start taking rents down, then you're starting to destruct value"

Cap Rates and Core Asset Value

When asked about disposition cap rates, Peter Moglia noted :

- Non-core assets: Mid-6s to mid-9s depending on market, leasing status, and WALT

- Core assets: "We do think our top end properties should have a five-handle"

- Execution plans: 1-2 core asset JV transactions could provide NAV discovery in 2026

- No outright core sales: "We are not planning on selling any core assets outright unless there's a special situation"

Disposition Buyer Pool

The 2025 buyer mix was diverse :

- Investment funds (private capital, long-term hold): 12%-15% of inventory

- Residential conversions: Significant and expected to continue — 55% of available land has residential zoning potential

- No shortage of buyers: "There has not been a problem getting assets sold. The biggest issue is just the yields that these buyers are looking for"

FFO Trajectory Confirmation

CFO Marc Binda confirmed Q4 2026 FFO guidance of $1.40-$1.60 represents the trough for the year :

- Earnings trajectory: Decline through mid-2026, stabilize in 2H26

- Q1 2026 leverage: Could temporarily spike 1-1.5x higher (6.7x-7.2x) due to lower quarterly EBITDA

- 2027 outlook: Q4 2026 FFO "is a good run rate to think about as a base"

Positive Signal: Greater Boston Tours

Peter Moglia shared encouraging data :

"Greater Boston region did see an 11% increase in tenants in the market, and that was really the first time we've seen an increase in a number of quarters."

What's Driving the Challenges?

Alexandria's struggles reflect broader forces in the life science real estate market:

The Biotech Bear Market

Management explicitly called out 2025 as the fifth consecutive year of a broad-based biotech bear market . Contributing factors include:

- NIH funding uncertainty: Proposed 40% ($18B) cut to NIH funding

- FDA leadership turnover: Multiple commissioners and directors departed or were replaced

- Tariff threats: 100% tariff threat on branded medicines unless pharma builds US manufacturing

- IRA drug pricing impact: 26 medicines dropped since Inflation Reduction Act

- Capital markets drought: SVB reported lowest life science venture funding since 2016

A Glimmer of Hope: NIH Indirect Cost Cap Blocked

A federal appeals court in January 2026 upheld an injunction blocking the proposed 15% cap on NIH indirect grant funding — a significant positive for biomedical institutions and their real estate needs .

The Fenway Pivot: Office Over Lab

Alexandria decided to lease 401 Park in The Fenway as office rather than converting to lab space . The rationale:

- Building has existing long-term leases with major LMA (Longwood Medical Area) institutions

- Increased demand for office space in the area

- Lab availability elsewhere in Fenway means no need to create more lab supply

- This is "more building and sub-market specific as opposed to something much broader"

Four Development Projects Under Review

Management disclosed they are "evaluating the go-forward business strategy" for four projects currently under construction with "significant remaining capital needs" . Key decisions have milestones in May 2026 on average. If projects are paused or sold, interest capitalization would cease — potentially accelerating deleveraging.

Key Operating Metrics

Leasing activity: 1.2 million RSF in Q4 2025 — "the highest quarter in the last year" and up 14% over the prior four-quarter average . Key highlights:

- Vacant space leased: 393,000 RSF — "almost double the quarterly average over the last five quarters"

- New tenancy: "A significant amount of that leasing was absolutely new tenants actually coming into our portfolio"

- Geographic diversity: Leasing across Cambridge, Seattle, San Francisco — "diversity across the regions is healthy"

- Signed but not commenced: ~900,000 RSF of leases signed, expected to commence in Q3 2026 on average, generating $52M incremental annual rent

Rental rate changes: Renewals and re-leasing decreased 9.9% (5.2% cash basis) in Q4 due to two large deals in Canada and Sorrento Mesa . Full-year 2025 was +7.0% (+3.5% cash) .

Balance Sheet Position

Alexandria maintains investment-grade credit (BBB+/Baa1) with significant liquidity, though elevated leverage remains a concern:

The company repaid $300 million of unsecured notes in January 2026 and targets $1.1B-$2.3B of debt reduction in 2026 .

Notable Wins Amid the Pain

AstraZeneca Lease Extension

Alexandria executed a lease through 2041 with AstraZeneca for 171,239 RSF at 700 Quince Orchard Road in Maryland. This brings AstraZeneca's total footprint across Alexandria markets to over 600,000 RSF .

AstraZeneca has committed to invest $50 billion in U.S.-based manufacturing and R&D by 2030, supporting the onshoring trend that could benefit Alexandria long-term .

G&A Cost Control

General and administrative expenses fell to 5.6% of NOI — the lowest level in ten years and approximately half the S&P 500 REIT average of 11.3% .

Cumulative G&A savings of $76 million are expected for 2025-2026 combined versus 2024 levels .

Top 20 Tenant Profile

Alexandria's tenant base remains high-quality, with 84% of top 20 tenant revenue from investment-grade or publicly traded large cap companies .

Tenant mix by category: Multinational Pharma (24%), Life Science Products/Services (18%), Public Biotech - Approved/Marketed (12%), Advanced Technologies (11%), and Government Institutions (10%) .

Forward Catalysts and Risks

Potential Positives

- Disposition proceeds: $2.1B-$3.7B of additional sales targeted in 2026 could accelerate deleveraging

- Development deliveries: $97M of incremental NOI expected by 4Q26 from projects 86% leased

- NIH funding clarity: Court injunction blocking indirect cost cap provides stability

- Onshoring tailwinds: Pharma manufacturing investment (AstraZeneca's $50B commitment)

Key Risks

- Occupancy erosion: 1.2M RSF of key expirations in 2026 with 6-24 month downtime expected

- Tenant wind-downs: $20-25M of rent at risk from potential failures

- Continued biotech weakness: Venture funding at 2016 lows, biotech layoffs up 16% YoY

- Leverage elevation: Net debt/EBITDA could temporarily spike to 6.7x-7.2x in Q1 2026

The Bottom Line

Alexandria's Q4 2025 results confirm the company is in full defensive mode. The 45% dividend cut, $2.2 billion of impairments, and 29% FFO guidance reduction reflect a management team preparing for a prolonged downturn — but one with a clear end in sight.

The key insight from the earnings call: Management sees a 2-3 year recovery timeline for core markets where Alexandria is concentrated, not the 4-5 years some feared . The longer recovery applies only to tertiary areas where Alexandria has minimal exposure.

Three reasons for cautious optimism:

- Stock up ~20% YTD suggests value investors are finding the bottom

- Greater Boston tours up 11% — first increase in several quarters

- Q4 2026 ($1.40-$1.60) represents trough FFO, with 2H26 stabilization expected

Three reasons for caution:

- Public biotech demand still absent — the historical driver of 50-150K RSF leases

- Free rent is the primary leasing tool — margin pressure continues

- Q1 2026 leverage could spike to 6.7x-7.2x temporarily

With the stock trading at ~9x forward FFO (based on $6.40 midpoint) and a 4.9% dividend yield (at the new $0.72 rate), the risk/reward has improved — but recovery requires the IPO window to reopen and capital to flow back to earlier-stage biotech.

As Joel Marcus framed it: "If one believes in this industry, 50 years after Genentech was founded... we've only addressed 10% of diseases. 90% are left" .

Earnings call held January 27, 2026.

For the full earnings press release and supplemental information, visit Alexandria Investor Relations .