Earnings summaries and quarterly performance for Ares Management.

Executive leadership at Ares Management.

Michael J Arougheti

Chief Executive Officer

Antony P. Ressler

Executive Chairman

Bennett Rosenthal

Chairman of Private Equity Group

Blair Jacobson

Co-President

David B. Kaplan

Co-Founder

Jarrod Phillips

Chief Financial Officer

Naseem Sagati Aghili

General Counsel and Corporate Secretary

R. Kipp deVeer

Co-President

Board of directors at Ares Management.

Research analysts who have asked questions during Ares Management earnings calls.

Michael Cyprys

Morgan Stanley

8 questions for ARES

Alexander Blostein

Goldman Sachs

7 questions for ARES

Brian McKenna

Citizens JMP Securities

7 questions for ARES

Kenneth Worthington

JPMorgan Chase & Co.

7 questions for ARES

Brennan Hawken

UBS Group AG

6 questions for ARES

Craig Siegenthaler

Bank of America

6 questions for ARES

Brian Bedell

Deutsche Bank

5 questions for ARES

Patrick Davitt

Autonomous Research

5 questions for ARES

Steven Chubak

Wolfe Research

5 questions for ARES

William Katz

TD Cowen

5 questions for ARES

Ben Budish

Barclays PLC

4 questions for ARES

Benjamin Budish

Barclays PLC

4 questions for ARES

Bill Katz

TD Securities

4 questions for ARES

Kyle Voigt

Keefe, Bruyette & Woods

4 questions for ARES

Michael Brown

Wells Fargo Securities

3 questions for ARES

Alex Blostein

Goldman Sachs Group, Inc.

2 questions for ARES

Ken Worthington

JPMorgan

2 questions for ARES

Mike Brown

UBS

2 questions for ARES

Craig Seigenthaler

Bank of America Securities

1 question for ARES

Recent press releases and 8-K filings for ARES.

- Ares Management Corporation has priced its second European Direct Lending CLO, Ares European Direct Lending CLO II (EDL CLO II), at over 300 million euros.

- The EDL CLO II is a diversified CLO composed entirely of directly originated and actively managed loans.

- These loans are sourced from over 70 medium-sized companies predominantly in Western Europe and operating in resilient sectors.

- The instrument focuses on senior secured floating-rate loans and will be rated by S&P and KBRA.

- Ares Management Corporation has priced its second European Direct Lending CLO, Ares European Direct Lending CLO II (EDL CLO II), at over 300 million Euros.

- The EDL CLO II is a diversified CLO consisting of directly originated and actively managed loans from over 70 middle-market companies predominantly based in Western Europe, focusing on senior secured floating rate loans.

- Ares' European direct lending strategy manages over $84 billion in assets as of December 31, 2025, and the firm has issued 108 CLOs since 1999, with 72 currently active.

- Ares Management Corporation (NYSE: ARES) has priced its second European direct lending collateralized loan obligation (CLO), Ares European Direct Lending CLO II (EDL CLO II), at over €300 million.

- EDL CLO II is a diversified CLO composed of directly originated and actively managed loans issued by over 70 mid-sized companies primarily in Western Europe.

- The CLO is weighted towards senior-secured, floating-rate loans and will be rated by S&P and KBRA.

- Ares Management Corporation has priced its second European Direct Lending CLO II (EDL CLO II) at over 300 million euros.

- The EDL CLO II is a diversified CLO composed exclusively of directly originated and actively managed loans to over 70 medium-sized companies, primarily in Western Europe.

- This instrument is weighted towards senior secured floating rate loans and is considered one of the first multi-currency CLOs for European medium-sized companies.

- This marks the company's second European direct lending CLO priced in less than 12 months.

- Ares Management Corporation announced on February 19, 2026, the pricing of its second European Direct Lending Collateralized Loan Obligation (EDL CLO II) at over €300 million.

- The EDL CLO II is a diversified CLO comprised entirely of directly originated and actively managed senior-secured floating rate loans from over 70 middle-market companies predominantly based in Western Europe.

- This is Ares' second European Direct Lending CLO priced in less than 12 months, building on its nearly 20 years of corporate direct lending experience in Europe.

- As of December 31, 2025, Ares' European Direct Lending strategy managed over $84 billion in assets, and its global CLO portfolio, which includes 72 active CLOs, represented over $39 billion of the nearly $407 billion managed across the Ares Credit Group.

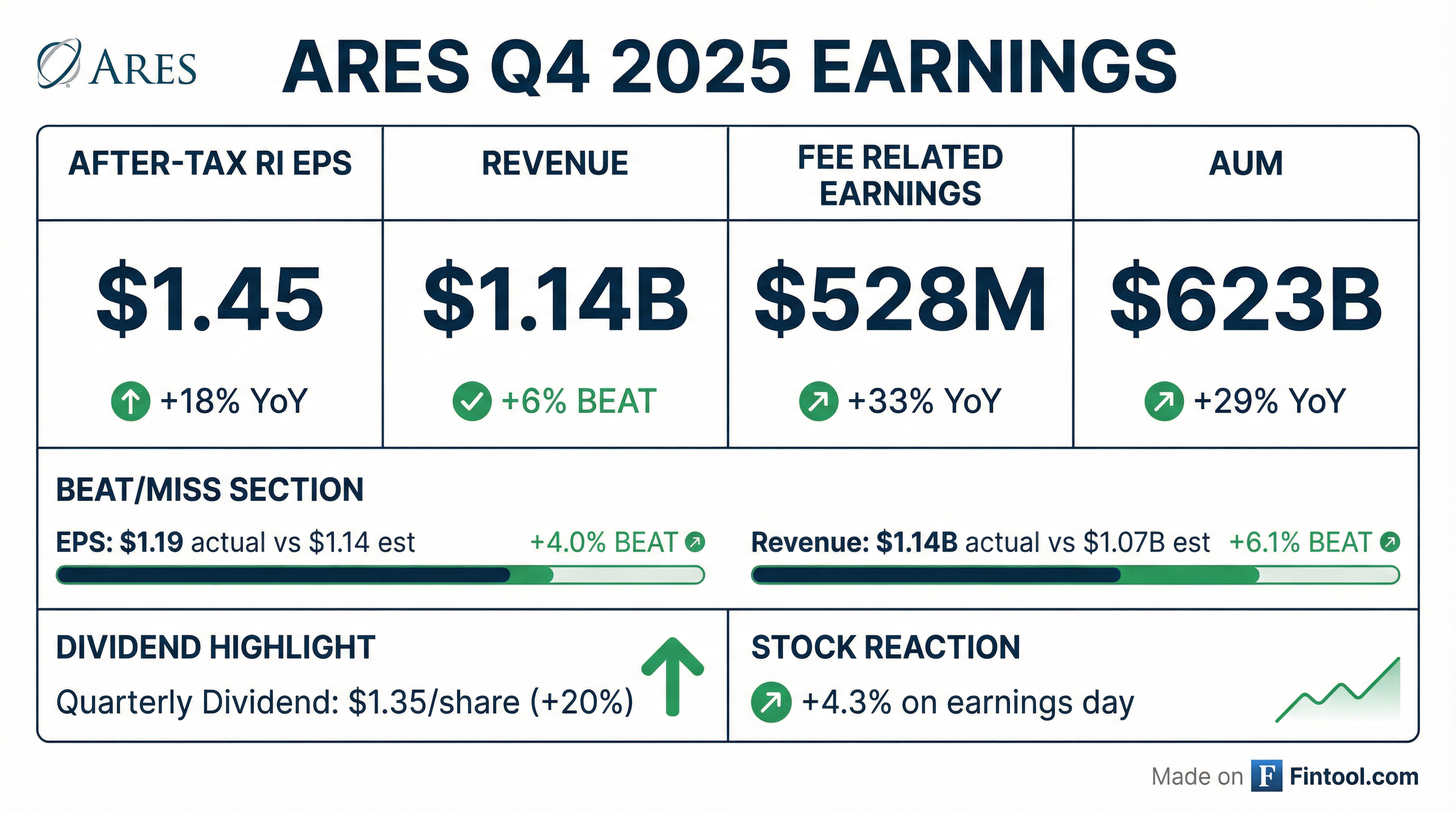

- Ares Management is constructive on the 2026 deal environment, reporting a record $46 billion of capital deployed in Q4 and a record high pipeline as of the end of January.

- The company reaffirmed its financial targets, expecting Fee Related Earnings (FRE) to grow 16%-20%+ per year and Realized Income (RI) to grow 20%+ per year, and announced a 20% increase in its Q1 dividend.

- Strategic priorities include expanding its digital infrastructure business (with a $2.4 billion Japanese data center fund and a $6 billion equity pipeline), growing in Japan, and developing a vertically integrated real estate approach.

- Ares attributes its private credit outperformance to an origination-led strategy with high asset selectivity (investing in only 3%-5% of transactions), scale, and deep industry expertise.

- The company is actively employing AI tools for efficiency gains across its operations, which contributed to the slowest organic headcount growth in over a decade in 2025.

- Ares Management's AUM has tripled to $600 billion in the last five years, with a record $46 billion of capital deployed in Q4 and a record high pipeline as of January for the first half of 2026, indicating a constructive deal environment.

- The company reaffirmed its guidance for 16%-20%+ annual FRE growth and 20%+ annual RI growth, and raised its wealth targets. The Q1 dividend was increased by 20%.

- Strategic growth initiatives include expanding its digital infrastructure business, which saw a $2.4 billion Japanese data center fund close in its first year and has a $6 billion equity pipeline for data centers, alongside diversification in the Japanese market and a vertically integrated real estate approach.

- Ares is leveraging AI to drive efficiencies and better investment outcomes, contributing to the slowest organic headcount growth in over 10 years in 2025.

- The firm's private credit business is characterized by an origination-led strategy and over $150 billion in dry powder, positioning it to capitalize on market dislocations.

- Ares Management's top strategic priorities include continued expansion in its digital infrastructure business, which recently closed a $2.4 billion Japanese data center fund and has a pipeline requiring an additional $6 billion of equity. Other key priorities are expanding its presence in Japan, developing a vertically integrated real estate approach, and enhancing margins through technology and organizational redesign.

- The company reaffirmed its financial guidance, projecting organic Fee Related Earnings (FRE) growth of 16%-20%+ per year and Realized Income (RI) growth of 20%+ per year. Additionally, Ares raised its wealth AUM target to $125 billion and increased its Q1 dividend by 20%.

- Ares is actively implementing AI across its operations, utilizing an acquired venture firm, Bootstrap Labs, to drive efficiencies and improve investment outcomes. This has led to 2025 being the slowest year of organic headcount growth in over 10 years, reflecting productivity gains from AI applications in areas such as NDA negotiation and compliance.

- Ares maintains a robust position in the private credit market, holding over $150 billion in dry powder to capitalize on market dislocations. The company emphasizes a symbiotic relationship with banks, where increased bank activity in investment-grade lending can benefit Ares' wholesale lending operations.

- Ares Management arranged a $2.4 billion debt facility for Vantage Data Centers, committing approximately $1.6 billion and funding about $330 million at closing.

- The capital will refinance existing indebtedness and support the development, construction, and operation of Vantage’s North America portfolio, which includes 17 hyperscale campuses.

- A portion of the financing may help build infrastructure tied to Oracle’s partnership with OpenAI, underscoring the AI demand driving the deal.

- Ares is seeking to raise more than $8 billion of equity in the near term to support additional data center investments.

- Ares Management Corporation achieved a record year in 2025, with total AUM exceeding $622 billion and $113 billion in total fundraising, capped by $36 billion in the fourth quarter.

- The company reported record financial results for 2025, including $3.7 billion in management fees and $1.8 billion in realized income, representing year-over-year increases of 25% and 26%, respectively. Fee-related earnings (FRE) grew 30% for the full year.

- Strategic initiatives, such as the GCP acquisition and significant growth in the wealth management business (AUM up 69% to $66 billion), contributed to AUM expansion and diversification.

- Ares expects 2026 fundraising to be as good or better than 2025's record, with anticipated $350 million in European-style net realized performance income (more than double 2025 levels) and FRE margins at the high end of the 0-150 basis points annual target range.

- The company also announced a 20% increase in its Q1 dividend to $1.35.

Fintool News

In-depth analysis and coverage of Ares Management.

Quarterly earnings call transcripts for Ares Management.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more