ARROW ELECTRONICS (ARW)·Q4 2025 Earnings Summary

Arrow Electronics Crushes Q4: EPS Soars 48% as Stock Hits 52-Week High

February 5, 2026 · by Fintool AI Agent

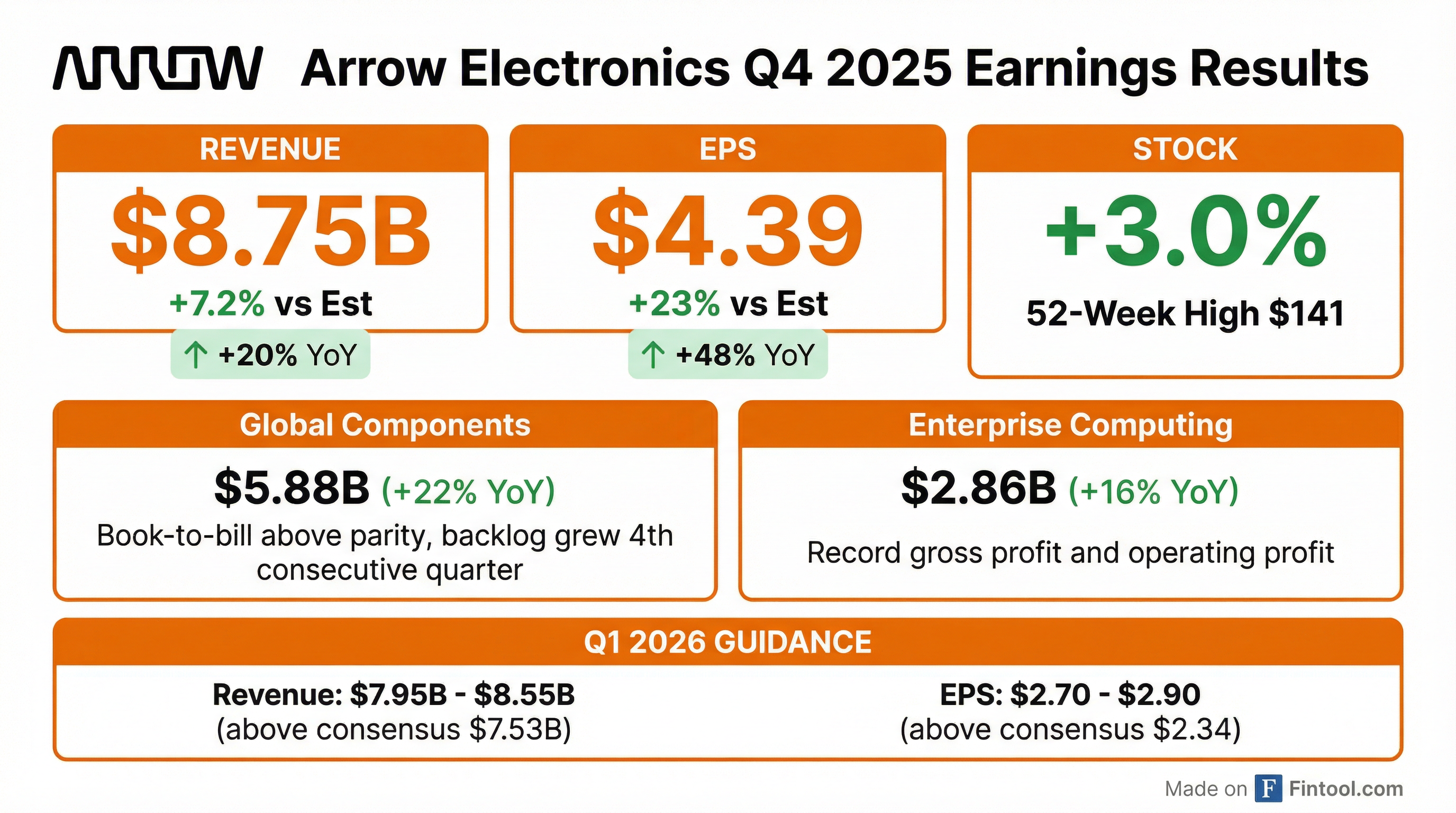

Arrow Electronics delivered a blowout Q4 2025, crushing estimates across the board as the electronics distributor rode improving demand trends and record Enterprise Computing profits. Revenue of $8.75 billion beat consensus by 7.2%, while Non-GAAP EPS of $4.39 smashed expectations by 23%, sending shares to a fresh 52-week high .

The quarter marked a turning point after several quarters of tepid results, with both operating segments exceeding guidance and management pointing to accelerating demand indicators across regions and end markets .

Did Arrow Electronics Beat Earnings?

Arrow delivered a decisive double beat on Q4 2025:

Both segments exceeded guidance ranges, with consolidated revenue and EPS coming in above the high end of management's outlook .

What Did the Segments Deliver?

Global Components: Cyclical Recovery Accelerating

The components distribution business posted strong results as demand trends improve:

Key indicators pointing to sustained recovery :

- Book-to-bill above parity in all three regions

- Backlog grew for fourth consecutive quarter

- All regions performed above seasonal expectations

- Lead times modestly expanded, signaling improving demand

- Inventory turns normalizing

Regional performance was broad-based :

- Americas: Healthy sequential growth with strength in Aerospace & Defense, Industrial, Transportation, and Networking

- EMEA: Healthy backlog build across verticals signaling market improvement

- Asia Pacific: Broad-based sales growth highlighted by compute, consumer, and continued EV momentum in transportation

Value-added services (supply chain, engineering/design, and integration) continue gaining traction—these offerings generate "at least 2x" the gross margin of the traditional distribution business . Value-added services have grown from less than 20% of operating income historically to roughly 30% in 2025 .

Enterprise Computing Solutions: Record Profits

The ECS segment delivered record gross profit and operating profit :

AI-driven secular demand is fueling strength across technology categories :

- Hybrid cloud infrastructure

- Cybersecurity solutions

- Data protection and intelligence

- Infrastructure hardware and software

The business mix continues to shift favorably: recurring revenue now represents roughly one-third of total billings, with 75% from software and services . Backlog is 75%+ higher year-over-year . Hardware (25% of revenue) is concentrated in storage, compute, networking, and security—with networking and security seeing the highest growth .

What Did Management Guide?

Q1 2026 guidance came in significantly above Street expectations:

Guidance assumptions :

- Effective tax rate: 23% to 25%

- Interest and other expense: ~$60 million

- FX tailwind: ~$263M to revenue, ~$0.10 to EPS vs Q1 2025

How Did the Stock React?

Arrow shares surged 3.0% on the results, touching a fresh 52-week high of $141.39 before closing at $141.00 .

The reaction contrasts with several prior quarters where the stock sold off post-earnings despite beats, reflecting improved sentiment around the cyclical recovery narrative.

What Changed From Last Quarter?

The tone shifted meaningfully more bullish compared to Q3 2025:

Management emphasized they are positioned to "execute through gradual recovery with discipline" and "deliver profitable growth" through expanded value-added offerings .

Capital Allocation and Balance Sheet

Arrow maintained financial discipline while returning capital to shareholders :

The company's capital allocation priorities remain unchanged :

- Reinvest in organic growth

- Strategic M&A

- Return excess capital to shareholders

- Maintain investment-grade credit rating

What Are the Key Risks?

Management flagged several risks in the forward-looking statements :

- Limited visibility: "Visibility beyond 90 days is still a little bit cloudy" despite improving backlogs

- Tariff and trade policy uncertainty: Macro and geopolitical instability creating uncertainty

- CEO transition: Ongoing search for permanent CEO (Bill Austin serving as interim)

- Inventory normalization: Supply chain inventory correction still in progress

- Regional variation: Market conditions can vary by region, market, and customer type

Looking Forward: Key Catalysts

Near-term catalysts to watch:

- Permanent CEO appointment: Management noted the search is ongoing

- Components cycle acceleration: Whether book-to-bill and backlog trends sustain

- ECS AI momentum: Continued secular growth in AI-related infrastructure

- Margin expansion: Productivity initiatives and mix shift to value-added services

- Organizational realignment: New Chief Growth Officers and Chief Revenue Officer appointments to sharpen focus on growth initiatives

Q&A Highlights

Key themes from the analyst Q&A session:

On Demand Linearity (Will Stein, Truist): Management confirmed no unusual pull-forward in Q4 billing or booking patterns. "Momentum has continued into the first quarter. So we're seeing more of what we saw in the fourth quarter as we've now entered into the first quarter."

On Regional Recovery (Ruplu Bhattacharya, Bank of America): Industrial markets in Western regions are starting to come back after lagging in prior quarters. "Not that they're coming back strong, but we're seeing more industrial, more industrial activity in the West as we went through the fourth quarter."

On Value-Added Services Margins (Raj Agrawal, CFO): Value-added services generate "at least 2x" the gross margin of the normal distribution business. While some are higher and some lower, "it's a very profitable side of the business."

On ECS Business Mix (Eric Nowak, President ECS): Hardware represents 25% of ECS revenue, with the remaining 75% in software, cloud, and services. Within hardware, networking and security are seeing the highest growth. The software/cloud/services segment is "growing faster due to the extra growth that we have in AI and cloud."

On Interest Expense (Melissa Fairbanks, Raymond James): Lower-than-expected interest expense was driven by favorable timing of cash flows and short-term rates roughly 100 basis points lower than prior year. Working capital investment expected to increase in Q1 to support growth.

On Visibility (Bill Austin, Interim CEO): "Visibility beyond 90 days is still a little bit cloudy" despite improving backlogs and leading indicators.

Full Year 2025 Summary

For context, full year 2025 results :

Data sources: Arrow Electronics Q4 2025 earnings call transcript, earnings presentation, S&P Global consensus estimates, market data as of February 5, 2026.