Earnings summaries and quarterly performance for ARROW ELECTRONICS.

Executive leadership at ARROW ELECTRONICS.

William Austen

Interim President and Chief Executive Officer

Brandon Brewbaker

Vice President, Chief Accounting Officer and Corporate FP&A

Carine Jean-Claude

Senior Vice President, Chief Legal and Compliance Officer, and Secretary

Eric Nowak

President, Global Enterprise Computing Solutions

Gretchen Zech

Senior Vice President, Chief Governance, Sustainability, and Human Resources Officer

Rajesh Agrawal

Senior Vice President, Chief Financial Officer

Richard Marano

President, Global Components

Board of directors at ARROW ELECTRONICS.

Research analysts who have asked questions during ARROW ELECTRONICS earnings calls.

William Stein

Truist Securities

6 questions for ARW

Ruplu Bhattacharya

Bank of America

5 questions for ARW

Joseph Quatrochi

Wells Fargo Securities, LLC

3 questions for ARW

Melissa Dailey Fairbanks

Raymond James Financial, Inc.

2 questions for ARW

Melissa Fairbanks

Raymond James

2 questions for ARW

Joe Quatrochi

Wells Fargo

1 question for ARW

Joseph Lehman

Bank of America

1 question for ARW

Matthew Sheerin

Stifel

1 question for ARW

Toshiya Hari

Goldman Sachs Group, Inc.

1 question for ARW

Recent press releases and 8-K filings for ARW.

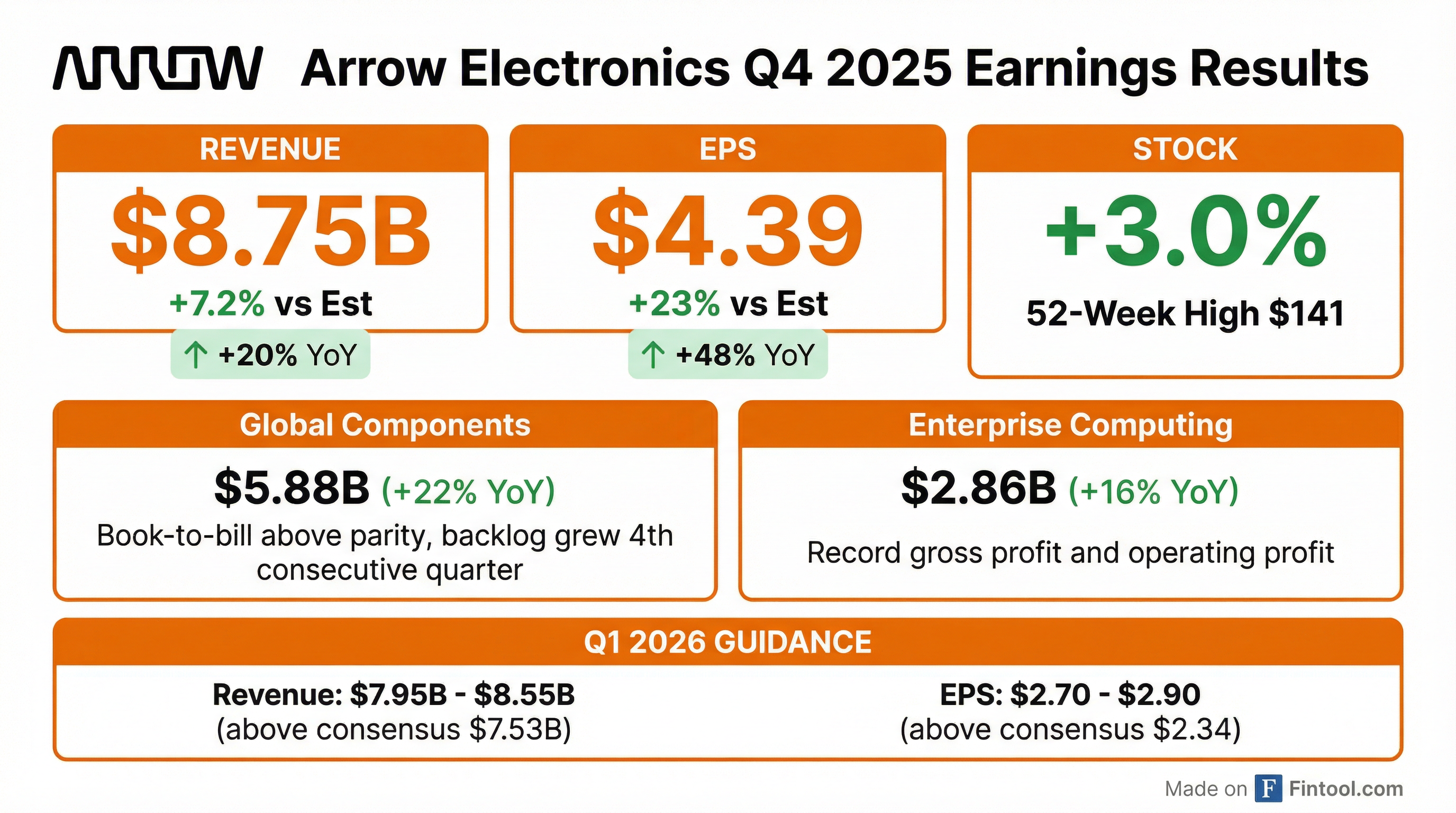

- Arrow Electronics reported strong Q4 2025 revenue of $8.7 billion, an increase of 20% year-over-year, and non-GAAP diluted EPS of $4.39, up 48% year-over-year, both exceeding expectations. For the full year 2025, consolidated revenue was $30.9 billion, up 10% year-over-year, with non-GAAP diluted EPS of $11.02, up 4%.

- The company's strategic shift towards higher-margin value-added offerings is showing results, with these services accounting for roughly 30% of total company operating income in 2025, up from less than 20% historically.

- Leading indicators continue to improve, with book-to-bill ratios above parity in all three regions and backlog increasing for four consecutive quarters, signaling the early stages of a gradual cyclical upturn.

- For Q1 2026, Arrow expects sales between $7.95 billion and $8.55 billion and non-GAAP diluted EPS between $2.70 and $2.90.

- Arrow repurchased $50 million in stock during Q4 2025, contributing to a total of $150 million in share repurchases for the full year 2025.

- Arrow Electronics reported strong Q4 2025 financial results, with revenue increasing 20% year-over-year to $8.7 billion and non-GAAP diluted EPS rising 48% year-over-year to $4.39, both exceeding expectations. For the full year 2025, consolidated revenue was $30.9 billion, up 10% from the prior year, with non-GAAP diluted EPS of $11.02.

- The company issued Q1 2026 guidance, expecting sales between $7.95 billion and $8.55 billion (midpoint up 21% year-over-year) and non-GAAP diluted EPS between $2.70 and $2.90.

- Arrow observed a gradual market recovery with improving leading indicators such as book-to-bill ratios and backlog, and is strategically focusing on higher-margin value-added services, which accounted for approximately 30% of total operating income in 2025.

- The company repurchased $50 million in stock during Q4 2025, bringing the total share repurchases for the full year 2025 to $150 million.

- Arrow Electronics reported consolidated sales of $8.7 billion for Q4 2025, an increase of 20% year-over-year, and Non-GAAP diluted earnings per share of $4.39, representing a 48% increase year-over-year.

- Both consolidated revenue and earnings per share exceeded the high end of guidance for Q4 2025.

- The company generated $200 million in operating cash flow and repurchased $50 million in shares during the fourth quarter of 2025.

- For Q1 2026, Arrow Electronics provided guidance projecting consolidated sales between $7.95 billion and $8.55 billion and Non-GAAP diluted earnings per share between $2.70 and $2.90.

- An ongoing CEO search was noted as a forward-looking item.

- Arrow Electronics reported fourth-quarter 2025 sales of $8.7 billion, a 20% increase year-over-year, with diluted earnings per share of $3.75 and non-GAAP diluted earnings per share of $4.39.

- For the full year 2025, sales reached $30.9 billion, up 10% year-over-year, with diluted earnings per share of $10.93 and non-GAAP diluted earnings per share of $11.02.

- Foreign currency changes positively impacted Q4 2025 sales by $232 million and diluted EPS by $0.23, and full-year 2025 sales by $399 million and diluted EPS by $0.31.

- The company provided a first-quarter 2026 outlook, projecting consolidated sales between $7.95 billion and $8.55 billion, diluted earnings per share from $2.13 to $2.33, and non-GAAP diluted earnings per share from $2.70 to $2.90.

- Arrow Electronics reported fourth-quarter 2025 sales of $8.7 billion, an increase of 20% year-over-year, with diluted earnings per share of $3.75 and non-GAAP diluted earnings per share of $4.39.

- For the full-year 2025, the company achieved sales of $30.9 billion, up 10% from the prior year, and reported diluted earnings per share of $10.93 and non-GAAP diluted earnings per share of $11.02.

- The company's performance was driven by disciplined execution and meaningful momentum across both Global Components and ECS segments, supported by improving leading indicators and strong performance in value-added offerings, cloud, AI, and datacenter activity.

- For the first quarter of 2026, Arrow Electronics anticipates consolidated sales between $7.95 billion and $8.55 billion, and non-GAAP diluted earnings per share ranging from $2.70 to $2.90.

- In the fourth quarter of 2025, Arrow generated $200 million of cash flow from operations and repurchased $50 million of shares.

- Interim CEO Bill Austen highlighted Arrow Electronics' strategic focus on higher-margin value-added services, which are projected to contribute approximately 30% of total company operating income in 2025, up from less than 20% historically.

- The company operates in a distribution total addressable market exceeding $250 billion, with its core distribution business growing 6-10% annually, and is diversified across Global Components (70% of revenue) and Enterprise Computing Solutions (30% of revenue).

- For fiscal year 2025, Arrow expects nearly $21 billion in Global Component sales and over $9 billion in ECS revenue with approximately $20 billion in billings.

- Arrow maintains a focused capital allocation strategy, having returned approximately $3.5 billion to shareholders through share repurchases since 2020 and generated about $3.1 billion in free cash flow over the last five years.

- Arrow Electronics is executing a strategic shift towards higher-margin value-added services, which are projected to contribute 30% of total operating income in 2025, an increase from less than 20% historically.

- The company's business model is diversified across Global Components (approximately 70% of total revenue) and Enterprise Component Solutions (ECS) (approximately 30% of total revenue), with ECS expected to deliver over $9 billion in revenue and approximately $20 billion in billings for full year 2025.

- Arrow's capital allocation strategy prioritizes reinvesting in organic growth, pursuing disciplined M&A, and returning excess capital to shareholders, having repurchased approximately $3.5 billion in shares since 2020.

- The company is benefiting from secular growth trends in cloud and AI, particularly in AI infrastructure build-out, and is observing early signs of gradual recovery in its Global Components business, including book-to-bill ratios above parity.

- Interim President and CEO Bill Austen presented Arrow's investment thesis, highlighting its leading position in large markets, differentiated capabilities, diversified business model, and focused capital allocation strategy.

- The company is experiencing a gradual cyclical recovery in its Global Components business, with improving book-to-bill ratios, and is benefiting from secular growth trends in cloud and AI across both its components and Enterprise IT Solutions (ECS) segments.

- Arrow is strategically shifting towards higher-margin value-added services, which are projected to contribute approximately 30% of total operating income in 2025, an increase from less than 20% historically.

- For fiscal year 2025, the Global Components business is expected to achieve nearly $21 billion in sales, and the ECS business anticipates over $9 billion in revenue and approximately $20 billion in billings. The company has also returned approximately $3.5 billion to shareholders through share repurchases since 2020.

- Bill Alston, President and interim CEO of Arrow Electronics, is leading the company while a search for a permanent CEO with operational expertise is underway. The company's strategy is focused on margining up the business by driving profitable growth, shifting from a sole focus on cost reduction.

- Arrow is expanding into higher-margin service offerings, including Arrow Intelligence Solutions (high mix, low volume appliances) and Supply Chain Services (fee-based model for managing customer supply chains), both of which yield margins in excess of 2X the semiconductor business. These services are integrated into Global Components and contribute to the profit line.

- The global components business is experiencing a gradual recovery, with book-to-bill above parity in all regions. Asia-Pacific volumes are strong, EMEA shows green shoots in industrials, and North America's industrial markets are gradually recovering.

- The ECS (Enterprise Computing Solutions) business is a key differentiator, with its market anticipated to grow 10-15% over the next five years. Arrow is implementing a "beyond distribution" fee-based model in ECS to upsize margins.

- Arrow's capital allocation priorities remain organic growth, M&A, and returning capital to shareholders through share buybacks. The M&A strategy focuses on strategic, margin-accretive acquisitions (e.g., in the IP&E space) rather than just adding bulk.

- Interim CEO Bill Alston is leading the search for a permanent CEO, with a focus on candidates possessing operational expertise.

- Arrow Electronics is strategically shifting its focus from cost-cutting to driving higher-margin growth through expanded services, including Arrow Intelligence Solutions, engineering services, and supply chain services, which offer margins 2X that of the semiconductor business. The company is also pushing its ECS "beyond distribution" software selling model to upsize margins.

- The company reports a gradual recovery in global components, with book-to-bill ratios above parity across all regions. While Asia-Pacific volumes are strong, EMEA is seeing "green shoots" in industrials, and North America's mass markets are returning.

- Management aims to restore pre-pandemic margin levels and maintains capital allocation priorities of organic growth, accretive M&A (particularly in IP&E), and share buybacks.

Fintool News

In-depth analysis and coverage of ARROW ELECTRONICS.

Quarterly earnings call transcripts for ARROW ELECTRONICS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more