ASHLAND (ASH)·Q1 2026 Earnings Summary

Ashland Q1 FY2026: EPS Beat But Revenue Misses as Calvert City Outage Weighs

February 3, 2026 · by Fintool AI Agent

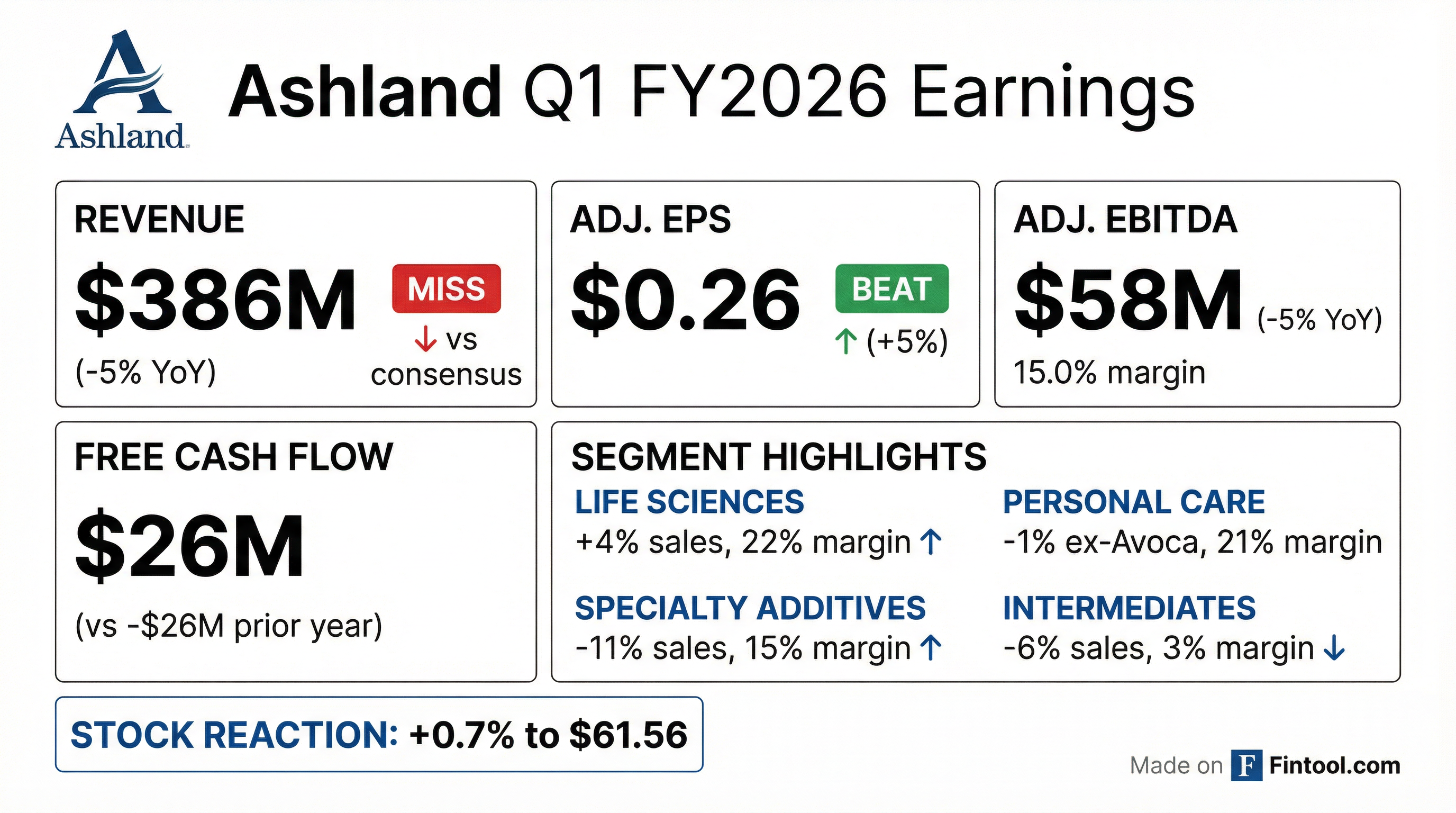

Ashland delivered a mixed Q1 FY2026 with adjusted EPS of $0.26 beating consensus by 5%, while revenue of $386M missed by 4% and adjusted EBITDA of $58M came in 5% light. The specialty chemicals company narrowed its full-year EBITDA guidance to $400-420M from $400-430M, citing ~$11M of temporary impacts from Calvert City startup delays and weather disruptions—all isolated to Q2. The stock traded up 0.7% to $61.56 on the results.

Did Ashland Beat Earnings?

Mixed results: EPS beat but revenue and EBITDA missed consensus.

Values retrieved from S&P Global

The revenue miss was driven primarily by continued weakness in Specialty Additives (-11% YoY) and the Avoca divestiture impact (-$10M or 2%). Excluding Avoca, organic sales declined 3% YoY with pricing down 2% reflecting prior-year carryover adjustments.

The EPS beat came despite significant headwinds, with cost actions, favorable mix, and lower SG&A driving better-than-expected profitability. The Calvert City outage negatively impacted Adjusted EBITDA by approximately $10M in the quarter.

What Did Management Guide?

Ashland narrowed EBITDA guidance to $400-420M from $400-430M:

The guidance reduction reflects ~$11M of temporary impacts from the Calvert City startup delay and weather-related disruptions, all isolated to Q2. Management emphasized these impacts are expected to be recoverable over time but timing remains uncertain.

CEO Guillermo Novo stated: "The only change to our guidance is the narrowing of the adjusted EBITDA range, reflecting temporary weather impacts and the extended Calvert City repair work isolated to the second quarter. All other elements of our outlook remain unchanged."

Key FY26 planning assumptions remain intact:

- Life Sciences and Personal Care demand expected to remain resilient

- ~$30M cost savings under the $90M manufacturing optimization program

- Raw material costs assumed stable to favorable

- Tariff-related uncertainty elevated but no material incremental impacts assumed

How Did Each Segment Perform?

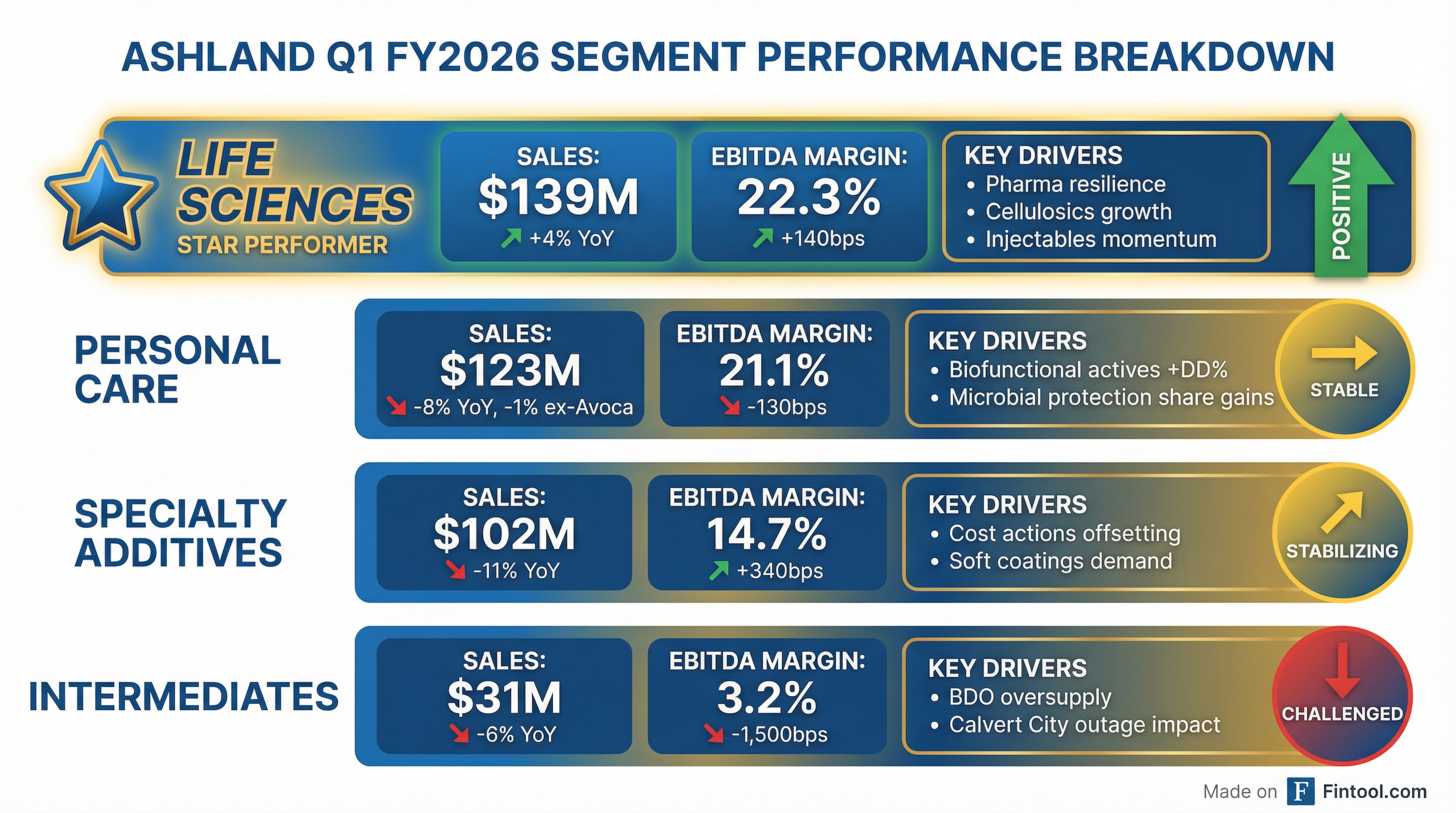

Life Sciences: The Star Performer

Life Sciences delivered 4% YoY sales growth to $139M with EBITDA margin expanding 140bps to 22.3%—the standout segment this quarter.

Pharma achieved low-single-digit growth marking its third consecutive quarter of YoY volume gains, driven by:

- Robust demand for high-value cellulosic excipients

- Strong progress in injectables and tablet coatings

- Meaningful contributions from low-nitrite cellulosics and high-purity excipients

Personal Care: Stable Ex-Avoca

Personal Care sales declined 8% to $123M, but excluding the Avoca divestiture, sales were down only 1%.

Highlights included double-digit growth in biofunctional actives and continued share gains in microbial protection. Weakness in Care Ingredients reflected customer-specific production outages and softer North America demand.

Specialty Additives: Cost Actions Shine

Despite sales down 11% to $102M amid soft coatings and construction demand, Specialty Additives delivered EBITDA margin expansion of 340bps to 14.7%.

The segment faced headwinds from coatings weakness in China, elevated competitive intensity in MEAI, and softer North America demand. However, HEC network consolidation and cost actions more than offset lower volumes.

Intermediates: Trough Conditions

Intermediates continues to struggle with sales down 6% to $31M and EBITDA margin collapsing 1,500bps to just 3.2%.

BDO oversupply continues to pressure pricing across the value chain, compounded by upstream impacts from the Calvert City outage.

How Did the Stock React?

Ashland shares rose +0.7% to $61.56 following the Q1 results, trading near its 50-day moving average of $59.14.

Values retrieved from S&P Global

The muted reaction suggests the market was largely prepared for the mixed results and guidance narrowing. The stock has recovered significantly from its 52-week low of $45.21, trading about 9% below its 52-week high.

What Changed From Last Quarter?

Improving trends:

- Cash flow generation: Ongoing FCF of $26M vs -$26M in Q1 FY25

- Life Sciences volumes: Third consecutive quarter of YoY gains

- Cost actions: Restructuring benefits flowing through to margins

- Early Q2 sales trends "encouraging" per management

New concerns:

- Calvert City outage extended, now impacting Q2 by ~$11M

- Specialty Additives demand weaker than expected (-11% vs prior -5% trends)

- BDO oversupply showing no signs of abating

Management credibility: The Q1 EPS beat continues a pattern of operational execution despite top-line pressure. However, this is the fourth consecutive quarter of revenue misses, raising questions about demand forecasting accuracy.

Values retrieved from S&P Global

What Did Management Say About GLP-1 Opportunity?

Management highlighted oral GLP-1 and oral biologics as a "significant opportunity" for Ashland during Q&A, a notable growth catalyst:

- VP&D portfolio especially relevant for oral GLP-1 formulations given high-volume/high-throughput requirements

- Aquarius Genesis high-solids coatings positioned for tablet coating demand

- Multiple active projects with major pharma players in this space

- 80+ emerging opportunities identified in the pipeline

- Sodium caprate launch planned for summer — a formulation enhancer with multiple customer sample requests already

Alessandra Faccin, Life Sciences President: "Both the oral GLP-1 and oral biologics present a significant opportunity for Ashland. Our VP&D portfolio is of particular interest, as well as our new innovation programs."

What's Happening in China? CEO On-the-Ground Perspective

CEO Guillermo Novo joined the call from Shanghai, providing firsthand color on Chinese market conditions:

- Bottoming out: "I don't expect this is gonna improve quickly... but we're bottoming out. There's a limit to how much you can lose."

- Government stimulus: "A lot of actions by the government to stimulate, to reenergize the property market, but reality is it's gonna take a while"

- Strategic pivot: Nanjing plant now being repositioned as a global export hub serving Middle East and Africa markets

- Product innovation: Team developing products "made for the China market" with both cost-effective and higher-performance offerings

- Comps easing: "China comps expected to ease in the second half following the second quarter"

Global trade focus: When asked about tariff risks, management identified Europe as the key watch area with pressure for the industry to take protective actions, though no specific decisions have been made.

Q&A Highlights: Customer Outages and Recovery

Management clarified the Personal Care customer outages were not demand-related and are fully resolved:

- Cause: Unplanned customer-side plant outages (not Ashland supply issues)

- Duration: Multi-week, with one extending almost two months

- Status: All customers back online before Q1 close

- Recovery: "We do expect to recover most of it in Q2 and through the balance of the year"

On the $11M Q2 temporary impacts, management provided additional detail:

- ~Two-thirds absorption-related (recoverable but timing dependent on restart)

- ~One-third incremental costs (energy, repairs from weather events)

- VP&D recovery can only begin once Calvert City reaches normal operating rates (expected late Q2)

- HEC recovery depends on seasonal demand lift, with visibility firming in March

CEO Novo on capital allocation: "Cash is king in a lot of these times of uncertainty, so we're gonna be a little bit more prudent."

Key Risks and Concerns

-

Calvert City uncertainty: The $10M Q1 impact and $11M Q2 impact from the outage represent meaningful headwinds. While customer supply remains uninterrupted, the extended repair timeline introduces execution risk.

-

China coatings exposure: Specialty Additives faces "elevated competitive intensity" from Chinese exports and weak domestic demand. Management flagged "Chinese overcapacity & exports" as an explicit risk, though CEO Novo noted the business is "bottoming out."

-

Europe trade policy: Management identified Europe as the area of most focus regarding potential protective trade actions, though no specific impacts are assumed in guidance.

-

Balance sheet leverage: Net debt of $1.08B represents 2.7x leverage, though the maturity schedule is manageable with no significant refinancing until January 2028.

Forward Catalysts

Near-term (1-3 months):

- Q2 FY26 results (late April/early May) - Will show full Calvert City impact and whether "encouraging" early trends hold

- Progress on $30M FY26 cost savings target

- Contract renewals completion in Middle East, Africa, and India (April)

Medium-term (3-12 months):

- Sodium caprate launch (summer 2026) — GLP-1 formulation enhancer with multiple customer requests

- Innovation pipeline commercialization ($15M incremental sales target, $6M achieved in Q1)

- Globalize platform expansion ($20M target, $3M achieved in Q1)

- Oral GLP-1/biologics opportunity with 80+ identified pipeline projects

- Potential coatings recovery as housing/construction activity improves

Bottom Line

Ashland delivered a mixed Q1 that showcased strong operational execution against a challenging demand backdrop. The EPS beat demonstrated disciplined cost management, but persistent revenue misses and the Calvert City headwinds limited upside. Life Sciences remains the crown jewel with 22%+ margins and consistent volume growth, while Specialty Additives and Intermediates face structural headwinds that may take several quarters to resolve.

The most notable new development from the call was management's bullish commentary on the oral GLP-1 and biologics opportunity, with 80+ identified pipeline projects and a sodium caprate launch planned for summer 2026. This positions Life Sciences for potential upside beyond base case assumptions.

The guidance narrowing was modest ($10M off the top end) and isolated to Q2 temporary impacts, suggesting the underlying FY26 trajectory remains intact. With CEO Novo calling from Shanghai and emphasizing that China is "bottoming out," plus a clear balance sheet priority ("cash is king"), the company appears to be managing through near-term headwinds while positioning for eventual recovery. Investors appear cautiously positioned heading into a potentially challenging Q2 before the expected H2 acceleration.

View full transcript | Company overview | Prior quarter: Q4 FY2025